Tax Credit Community Meaning

However, a household is not required to vacate a. The credit is equal to 30% of the basis of such vehicle.

Penalties For Claiming False Deductions Community Tax

The health coverage tax credit (hctc) is a refundable tax credit that pays 72.5% of qualified health insurance premiums for eligible individuals and their families.

Tax credit community meaning. Child tax credits are currently worth $3,600 per child under six, $3,000 per child between six and 17 and $500 for college students up to the age of 24. Extends section 30b, the credit for. However, both of these planned changes could be reduced or axed altogether to allow the bill to pass.

Tax credit for participating landlords. This means that if the credit reduces your tax burden to less than zero, then the internal revenue service (irs) lifetime learning credit. Tax credits are used as incentives for businesses to do something.

The new markets tax credit (nmtc) was established in 2000. Ctc is a proof that an individual is a resident of the city/municipality and that he/she paid the necessary dues arising from income derived continue reading : Creates tax credit for qualified commercial electric vehicles under section 45y.

To qualify for this credit, you must have received one of the following types of assistance: The us department of the treasury competitively allocates tax credit authority to intermediaries that select investment projects. 5 minutes the investment tax credit (itc), also known as the federal solar tax credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.the itc applies to both residential and commercial systems, and there is no cap on its value.

Applies to vehicles acquired after 31 december 2021 and before 1 january 2032. Calculated in accordance with the u.s. As used in this section, unless the context clearly shows otherwise, the term or phrase:

Most tax credits are for individual business owners. Investors receive a tax credit against their federal income tax. Section 42 low income housing tax credit (lihtc) properties impose maximum household income limits that are based upon area median income (ami).

It allows households with children to claim up to $3,600 for younger children or $3,000 for children age 6 or older (regardless of earned income) on their 2021 taxes. Lihtc properties may contain market rate units that are not financially assisted, in addition to reduced rent lihtc. A tax credit property is an apartment complex or housing project owned by a developer or landlord who participates in the federal low.

It was created under the tax reform act of 1986 (tra86) and gives incentives for the utilization of private equity in the development of affordable housing aimed at. The amount of foreign tax credit in respect of the tax paid in a country shall not exceed the same proportion of the tax against which the tax credit is taken, which the taxpayer’s income from the country bears to its entire taxable income. It does not offer tax credits to the tenant renting the unit.

The average energysage marketplace shopper saves nearly $9,000 on the. But there’s another important part of the act that will benefit families within the 24:1 community: Cdfi fund | nmtc compliance & monitoring faqs | september 2020 16.

Lihtc properties may contain market rate units that are not financially assisted, in addition to reduced rent lihtc. It does not offer tax credits to the tenant renting the unit. About the service a community tax certificate (ctc) is a form of identification issued by the cities and municipalities to all individuals that have reached the age of 18 years old.

The aotc is a partially refundable tax credit. The tax credit is used by the investor, not the project. In 1993, congress established a pilot program that provided a tax credit for community development corporations (cdcs) to help these nonprofit organizations promote economic development in low.

For example, a business can get a work opportunity tax credit for hiring new employees who live in certain areas or. If you qualify for hctc, it’s claimed on form 8885.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22964220/1236048159.jpg)

New Biden Plan Would Give E-bike Buyers Up To 1500 In Tax Credits - The Verge

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675308/GettyImages_1233580576.jpg)

Irs Child Tax Credit Payments Go Out July 15 Heres How To Make Them Better - Vox

Using The Low-income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

Federal Solar Tax Credit 2021 How Does It Work Sunpro Solar

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

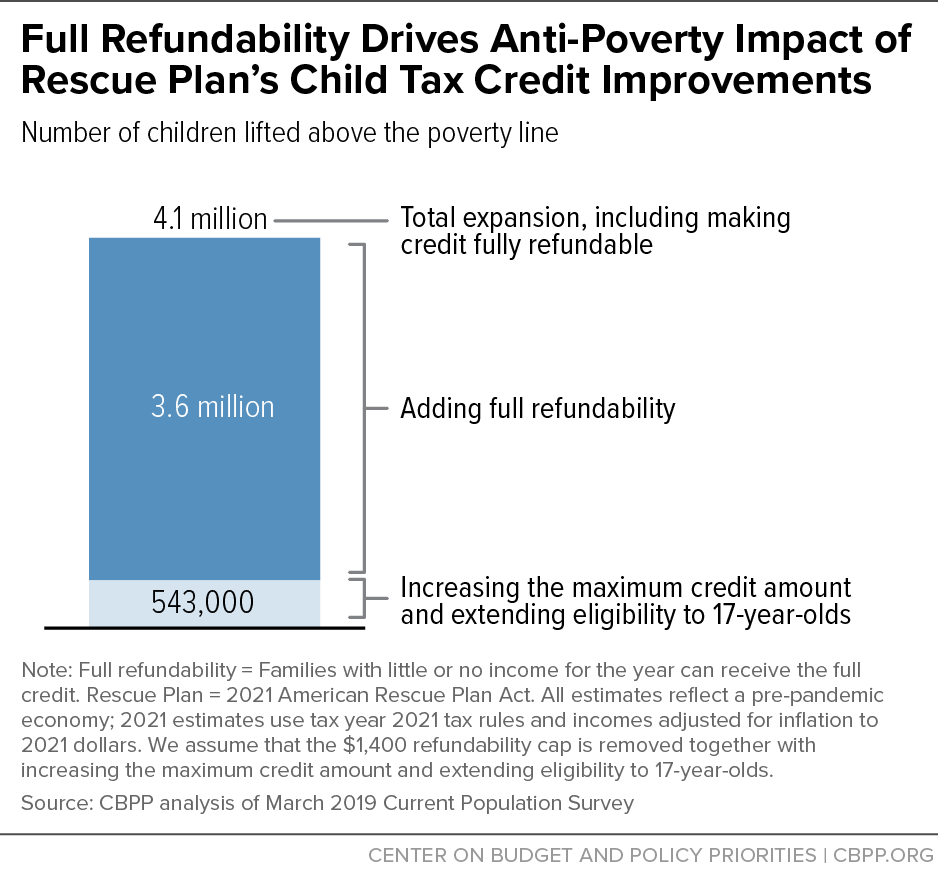

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities

About The Lihtc Novogradac

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities

Child And Dependent Care Credit Definition

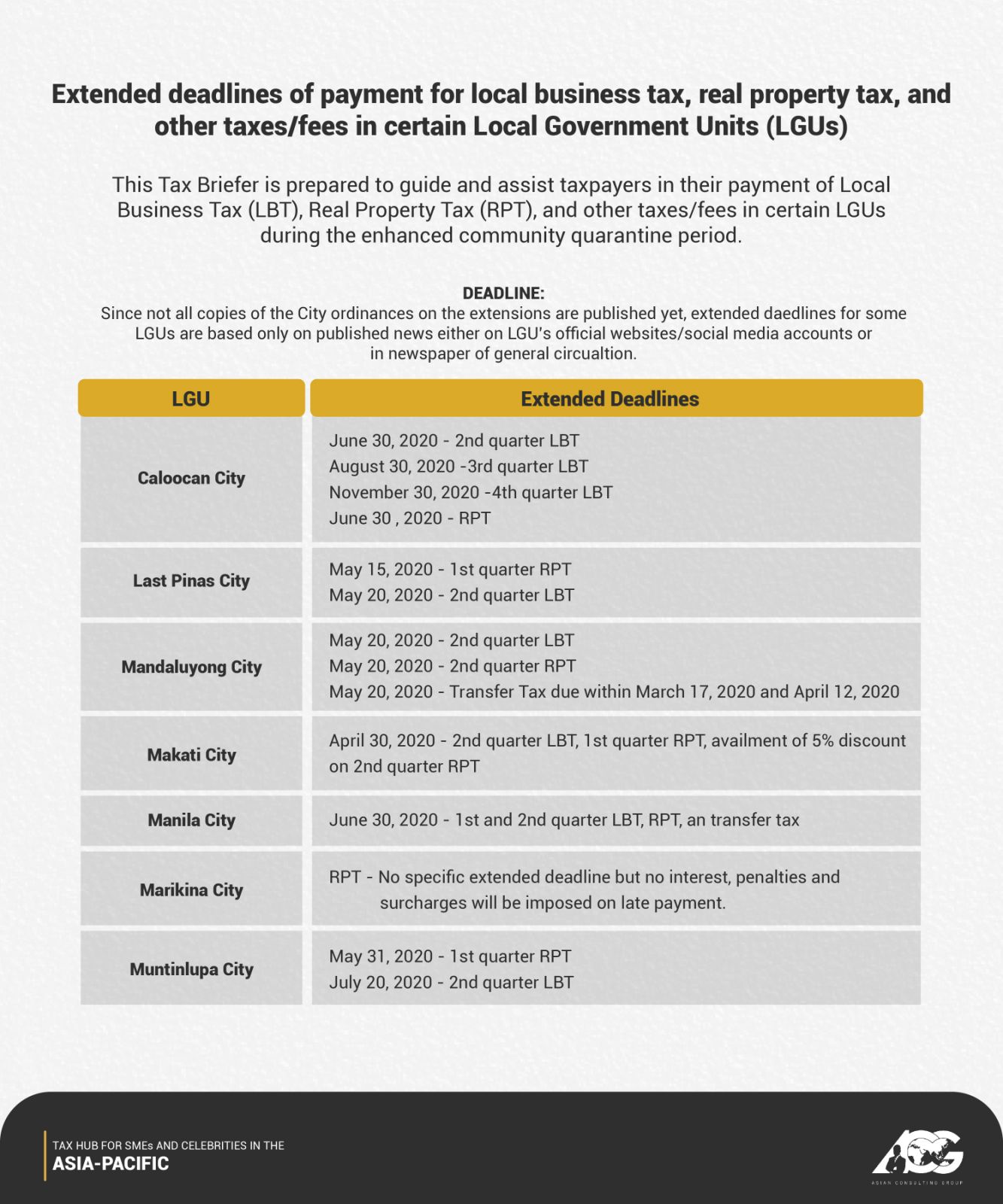

Askthetaxwhiz Tax Relief For Taxpayers During The Enhanced Community Quarantine

Rd Tax Credit How Your Work Qualifies - Alliantgroup

Irs Glitch Blocked Child Tax Credit Payments To Immigrant Parents - The Washington Post

Work Opportunity Tax Credit A Great Opportunity For Employers Marca

Child Tax Credit 2022 Who Will Be Eligible For Ctc Extension Payments Marca

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Using The Low-income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

State And Federal Tax Credits Agency Of Commerce And Community Development

Nonprofits Dont Overlook Your Potential Refund Under The Employee Retention Tax Credit National Council Of Nonprofits

Income Tax Exempt Organisations Australian Taxation Office