Interest Tax Shield Formula

Click to see full answer. (1963, formula 33.c) that, in an investment that can be financed totally by debt, the required return on the debt must be equal to the required.

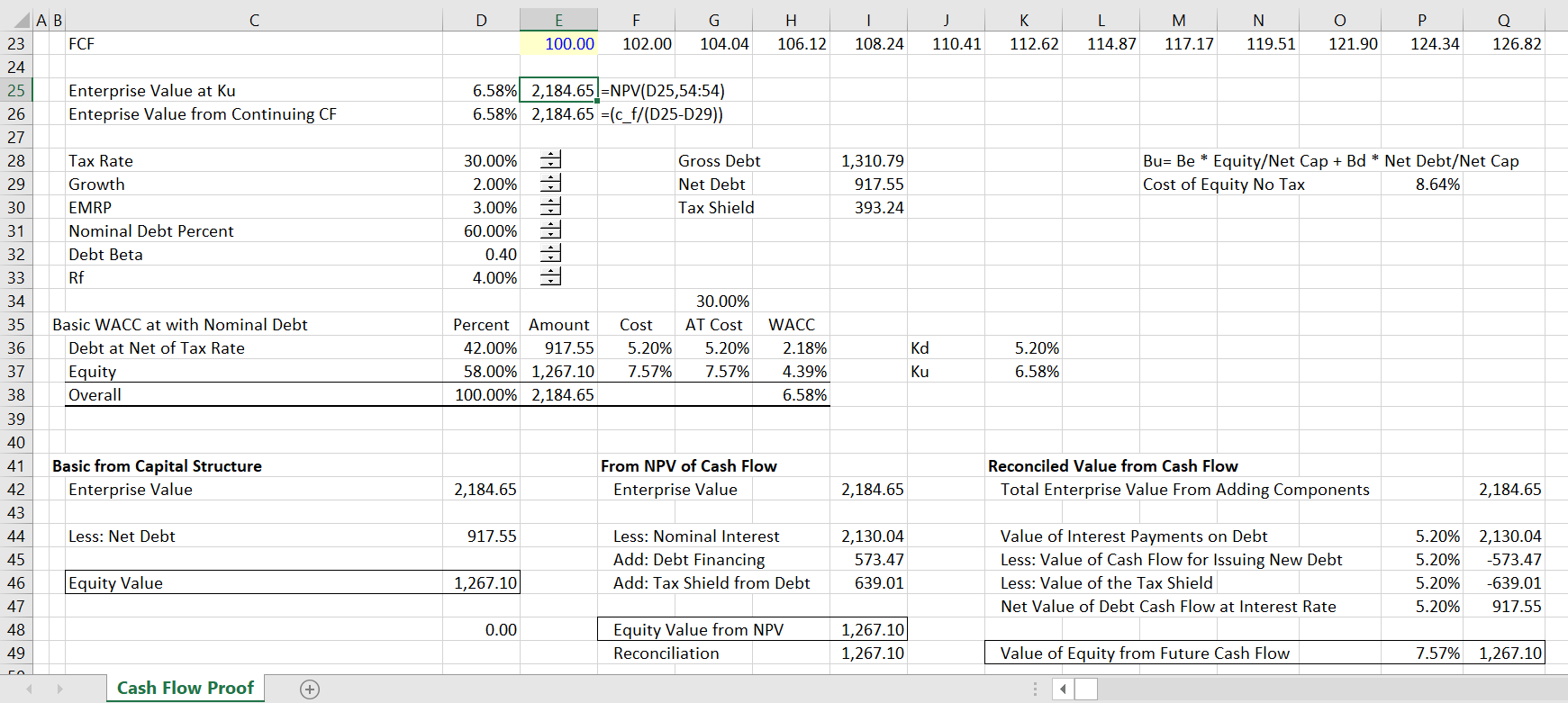

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

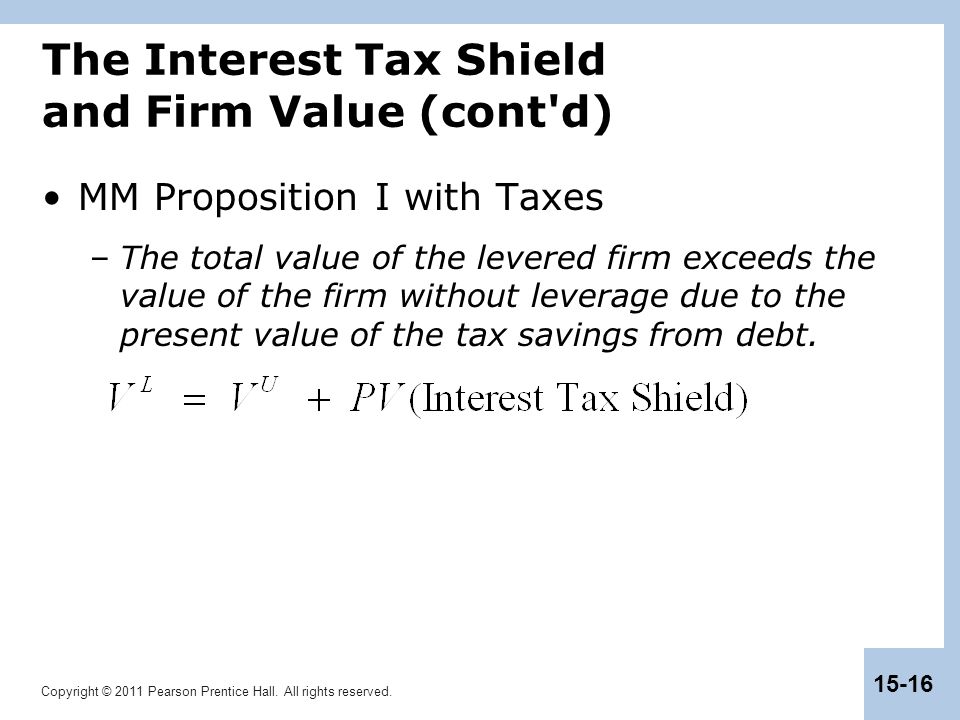

The effect of a tax shield can be determined using a formula.

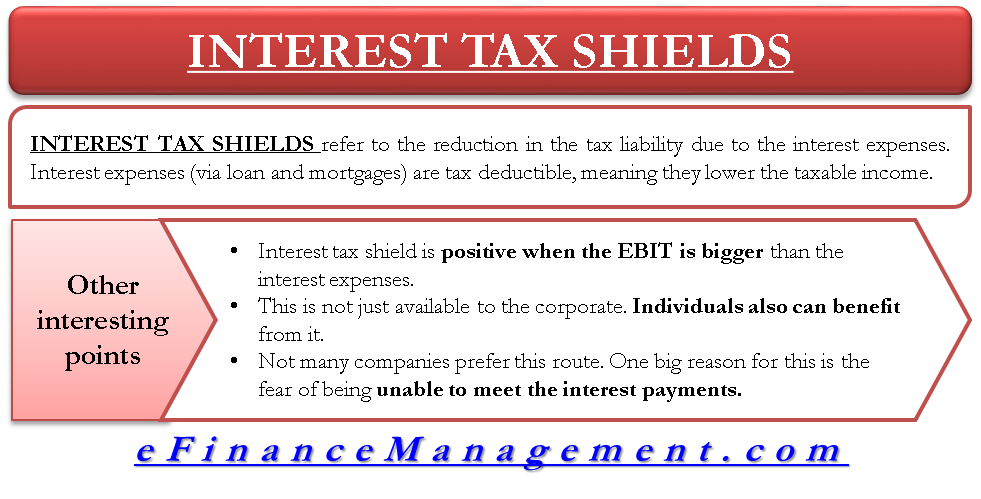

Interest tax shield formula. Interest tax shield that is discounted. Tax shield on interest expense formula is. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

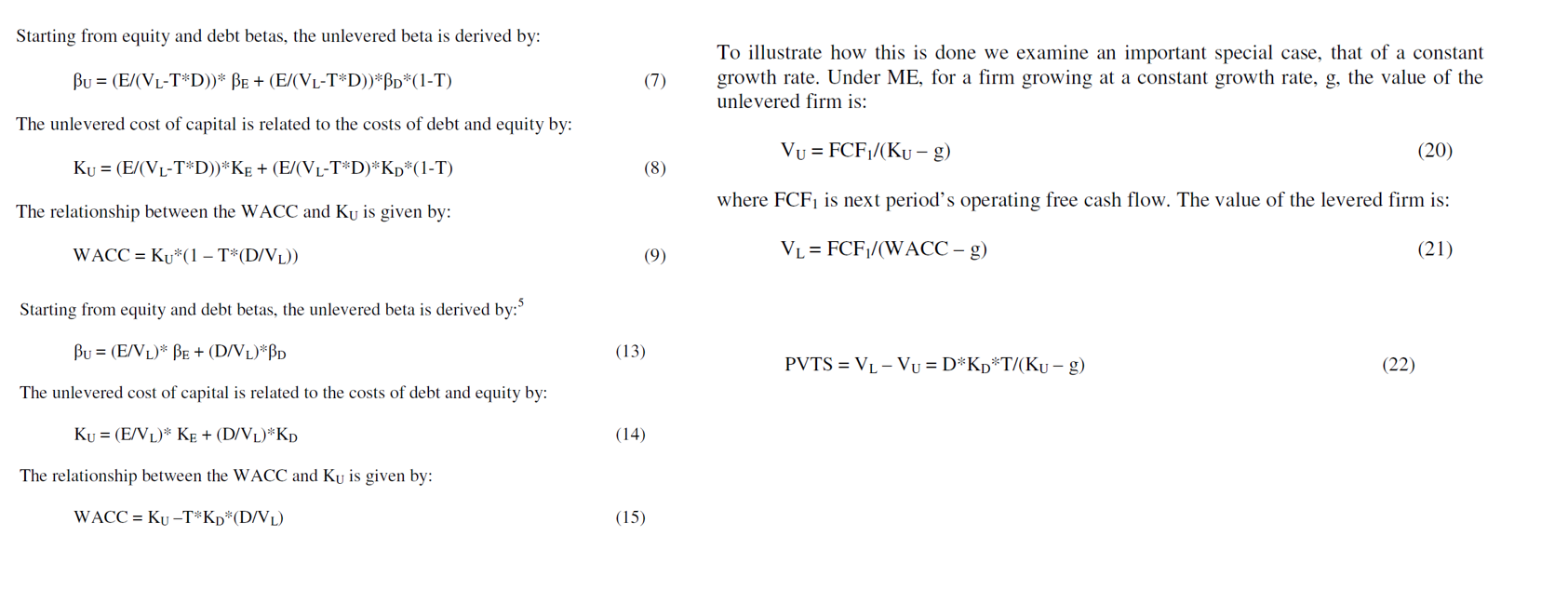

For individuals.tax rate is primarily used for interest expense and depreciation expense in the case of a company. This formula is quite popular in practise. Tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets, interest on the debts etc and is calculated by multiplying the deductible expense for the current year with the rate of taxation as applicable to the concerned person.

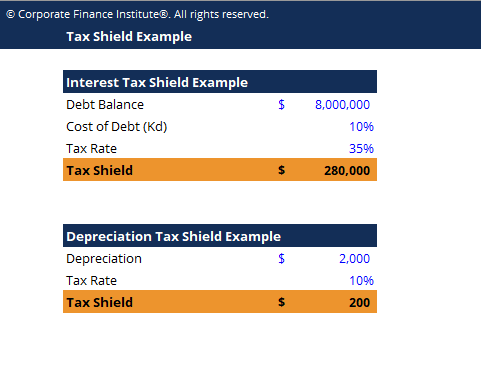

You would simply multiply the $25,000 by 35% to get $8,750 for the year 2020 and the $28,000 by 35% to get $9,800 for the year 2021. This means that the bear will have a taxable income reduced by $8,750 and $9,800 thanks to the tax shield. Interest tax shield formula = average debt * cost of debt * tax rate.

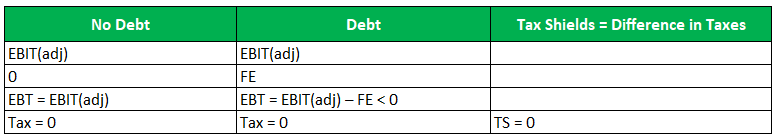

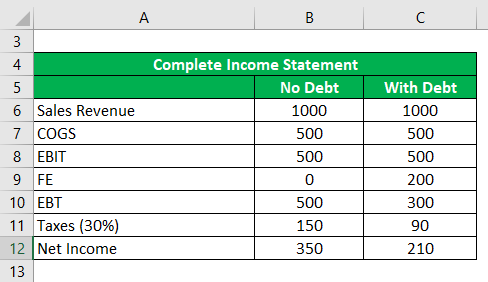

As we can see the company a paid the tax of $30 and company b paid the tax of $27. Interest tax shield = interest expense * tax rate % if we input the values from the above example in the formula, we get. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.tax shield can be claimed for a charitable contribution, medical expenditure etc.

This is usually the deduction multiplied by the tax rate. Interest tax shield = interest expense x tax rate For example, if an individual has $2000 as mortgage interest with a tax rate of 10%, then the tax shield approach will be worth $ 200.

Interest tax shield = $3. (1) the formula includes “ ” that comes from tax shield savings. The tax shield approach minimizes the.

However, students usually get confused by the absence of the ctax shield. Thus, if the tax rate is 21% and the business has $1,000 of interest expense, the tax shield value of the interest expense is $210. Interest tax shield = average debt × cost of debt × tax rate.

Businesses as well as individuals may choose to utilize this type of shield as a means of choosing how to finance different purchases and projects, simply to maximize the amount of the deduction that can be claimed. Additionally i can give you a general expression for tax shields implementation, wherein this well known wacc formula is only a special case: The difference in taxes represents the interest tax shield of company b, but we can also manually calculate it with the formula below:

Tax shield = deduction x tax rate. They think tax shield, which is [interest expenses * tax rate], should be added back to calculate fcff because most companies deduct interest expenses in calculating taxes. Interest tax shield = interest expense deduction x effective tax rate.

Interest tax shield = $4m x 21% = $840k. The value of a tax shield is calculated as the amount of the taxable expense, multiplied by the tax rate. The good news is that there is not a lot of calculations to do.

Interest tax shield formula = average debt * cost of debt * tax rate. The discount rate for the tax shield depends on the risk of the tax shield. To learn more, launch our free accounting and finance courses!

The calculation of interest tax shield can be obtained by multiplying average debt, cost of debt and tax rate as shown below. What is the interest tax shield this company is going to get by using debt? About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators.

The calculation of depreciation tax shield depreciation tax shield the depreciation tax shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. Interest tax shield formula the interest tax shield can be calculated by multiplying the interest amount by the tax rate. C = net initial investment t = corporate tax rate k = discount rate or time value of money d = maximum rate of capital cost allowance 2.

Present value of tax shield for amortizable assets present value of total tax shield from cca for a new asset acquired after november 20, 2018 𝐶𝑑𝑇1 +1.5𝑘 = ( ) (𝑑+𝑘) 1+𝑘 notation for above formula: Interest tax shield = $10*30%. And stand for debt and equity of the firm, and are the required return rates for debt and equity, is the marginal tax rate.

If the debt is risky, then we must make the distinction between the contractual return and the expected return on the debt. We find two theories that provide consistent results in a world with leverage costs, but both. The most important financing side effect is the interest tax shield (its).

Depreciation tax shield formula = depreciation expense * tax rate.

Berk Chapter 15 Debt And Taxes

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Example Template - Download Free Excel Template

Chapter 15 Debt And Taxes - Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Interest Tax Shield Formula And Calculation - Wall Street Prep

Tax Shield Formula Step By Step Calculation With Examples

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculation - Wall Street Prep

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shields Meaning Importance And More

Tax Shield Formula Step By Step Calculation With Examples