St Louis County Sales Tax 2020

The missouri sales tax rate is currently %. The december 2020 total local sales tax rate was 7.613%.

2

Report” for the fiscal year ending december 31, 2019.

St louis county sales tax 2020. The current total local sales tax rate in saint louis, mo is 9.679%. Saint louis county, mo sales tax rate. What is the sales tax rate in saint louis, missouri?

Louis county missouri tax rates 2020. The 9.679% sales tax rate in saint louis consists of 4.225% missouri state sales tax and 5.454% saint louis tax. What is the sales tax rate in st louis county?

The minnesota state sales tax rate is currently %. Some cities and local governments in st louis county collect additional local sales taxes, which can be as high as 3.5%. The st louis county sales tax rate is %.

Louis county residents, it is with great pleasurethat st. The county sales tax rate is %. It is my desire to deliver the.

We cannot accept incomplete bids and do not provide notary services. The december 2020 total local sales tax rate was also 9.679%. The december 2020 total local sales tax rate was also 7.375%.

This is the total of state, county and city sales tax rates. There is no applicable county tax or special tax. The saint louis, missouri, general sales tax rate is 4.225%.

The minimum combined 2021 sales tax rate for st louis county, minnesota is. Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale. Louis county provides the annual “financial transparency.

The december 2020 total local sales tax rate was 7.613%. Louis county public safety sales tax quarterly report 2020 quarter 1 beginning balance (01/01/2020) 17,551,454$ revenue received 16,800,556 expenditures family court initiatives (106,317) family court pay program (2020)* (321,341) $3,428.70 that must be paid at the time of sale, and for any other certified, pending or future assessments that may be reinstated.

Louis county public safety sales tax quarterly report ‐ restated 2020 quarter 3 beginning balance (07/01/2020) 21,614,616$ revenue received 12,214,364 expenditures family court initiatives (110,149) family court pay program (2020)* (321,341) Ad start your dropshipping storefront. This is the total of state and county sales tax rates.

The december 2020 total local sales tax rate was 8.863%. Louis county missouri tax rates 2020. The saint louis sales tax rate is %.

Jennings details jennings, mo is in saint louis county. Louis county collector of revenue’s office conducts its annual real estate property tax sale on the fourth monday in august. Depending on the zipcode, the sales tax rate of saint louis may vary from 4.2% to 9.738% depending on the zipcode, the sales tax rate of saint louis may vary from 4.2% to 9.738%

Us sales tax rates | mo rates | sales tax calculator | sales tax table. Be sure to read and adhere to the ‘post third sale instructions’. The minimum combined 2021 sales tax rate for saint louis, missouri is.

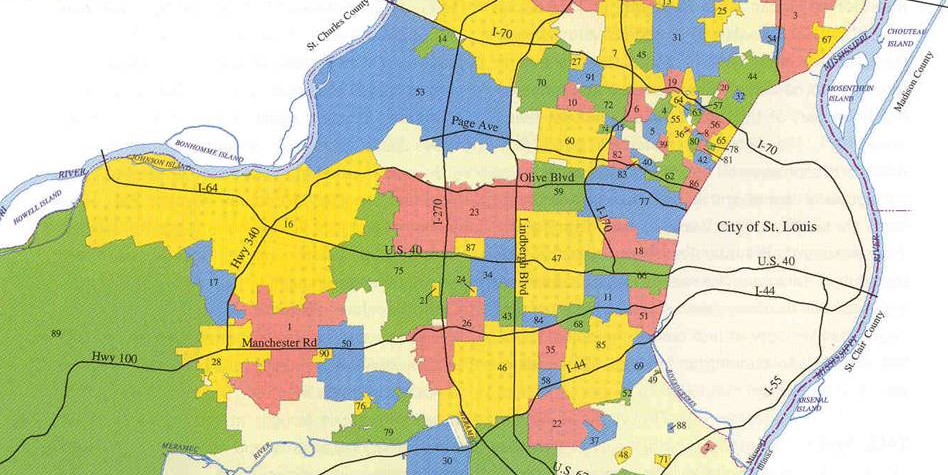

Sales tax rates in st louis county are determined by seventeen different tax jurisdictions, ely, saint louis, buhl, white township, duluth, proctor, kinney, winton, biwabik, eveleth, gilbert, hibbing, chisholm, virginia, crane lake township, hoyt lakes and mountain iron. Utilize leading marketing tools to boost your business and get found online. Louis county an overview of.

Ad start your dropshipping storefront. Louis county, minnesota land and minerals department land sale auction thursday, february 13, 2020 10:00 a.m. Utilize leading marketing tools to boost your business and get found online.

Aad shriners center 5152 miller trunk highway The current total local sales tax rate in saint louis county, mn is 7.375%. Louis county missouri tax rates 2020.

Louis county’s real estate information to research any properties of interest, and to view the ‘tax amounts due’, which represents the minimum bid amount (base taxes plus fees). St louis county, minnesota has a maximum sales tax rate of 8.875% and an approximate population of 151,855. , mo sales tax rate.

The current total local sales tax rate in saint louis county, mo is 7.738%. Louis county makes no representations, warranties, or guarantees with respect to access to tax forfeited lands sold.

Registration And Solicitations

Taxable Sales Down In Many St Louis Areas - Show Me Institute

Collector Of Revenue - St Louis County Website

Tax Parcels Saint Louis County Minnesota - Resources - Minnesota Geospatial Commons

Schroedingers Tax Hike Tax Economics Business Finance

St Louis County Minnesota

Wq0wgawobocrhm

Print Tax Receipts - St Louis County Website

Revenue - St Louis County Website

Property Tax Rates

St Louis Economic Development Partnership - St Louis Economic Development Partnership

Warrant Division

Let It Go Time To Disincorporate Municipalities In St Louis County - Nextstl

Pin On Where To Buy A New Or Used Subaru In St Louis Mo

File Income Taxes Online For Free With Freefile By The Irs Income Tax Capital Gains Tax Income Tax Return

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

Whats Living In St Louis Mo Like Moving To St Louis Ultimate Guide

2

Revenue - St Louis County Website