Nd Sales Tax Rate 2021

Find your north dakota combined state and local tax rate. All local tax changes for january 1.

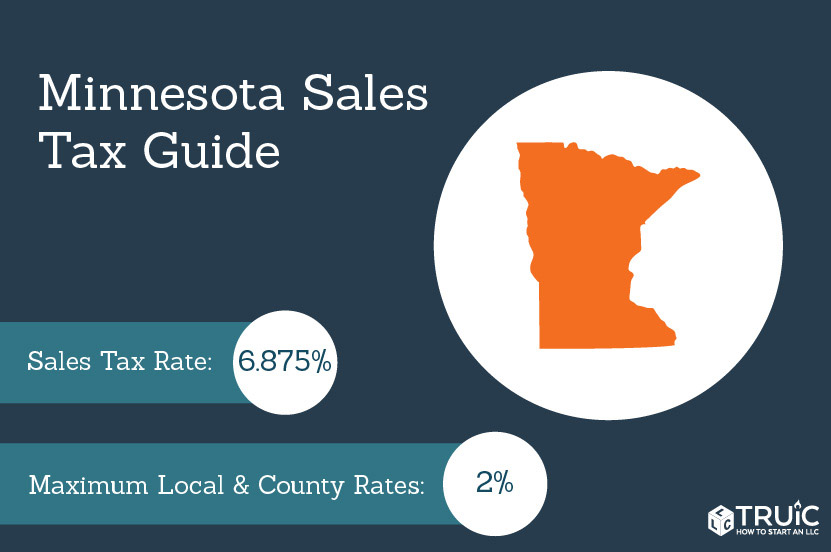

Minnesota Sales Tax - Small Business Guide Truic

, nd sales tax rate.

Nd sales tax rate 2021. This is the total of state, county and city sales tax rates. Current local taxing jurisdiction rate 7.25% sales and use tax chart:

Detailed north dakota state income tax rates and brackets are available on this page. , nd sales tax rate. Pdf sorted alphabetically by city.

To receive the sales tax rate change notifications, make sure you are subscribed to the “nd sales and special taxes” list. Gardner, nd sales tax rate. You can print a 7% sales tax table here.

The current total local sales tax rate in gardner, nd is 5.500%. 2021 local sales tax rates. Higher sales tax than 78% of north dakota localities.

The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. The county sales tax rate is %. Exact tax amount may vary for different items.

Groceries and prescription drugs are exempt from the maryland sales tax. 0.5% lower than the maximum sales tax in nd. The north dakota sales tax rate is currently %.

For tax rates in other cities, see. The tax rate for hankinson starting october 1, 2021, will be 3%. 5.60% 28 2.80% 8.40% 11 5.60% ark.

Exemptions to the north dakota sales tax will vary by state. 373 rows 2021 list of north dakota local sales tax rates. The tax rate for wyndmere starting.

2021, the city of wyndmere has adopted an ordinance to increase its city sales, use, and gross receipts tax by 1%. 4.00% 40 5.22% 9.22% 5 7.50% alaska 0.00% 46 1.76% 1.76% 46 7.50% ariz. 6.75% sales and use tax chart:

County and transit sales and use tax rates for cities and towns. You can print a 7.5% sales tax table here. Local tax rates in north dakota range from 0% to 3.5%, making the sales tax range in north dakota 5% to 8.5%.

With local taxes, the total. For tax rates in other. The nd use tax only applies to certain purchases.

The current total local sales tax rate in bismarck, nd is 7.000%. Local tax rate (a) combined rate rank max local tax rate ala. There is no applicable county tax or special tax.

, nd sales tax rate. State & local sales tax rates as of january 1, 2021 state state tax rate rank avg. The 7% sales tax rate in mohall consists of 5% north dakota state sales tax and 2% mohall tax.

2.90% 45 4.82% 7.72% 16 8.30% 7.5% sales and use tax chart: North dakota sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax.

2021 maryland state sales tax. The december 2020 total local sales tax rate was also 7.000%. 2021 north dakota state use tax.

The north dakota income tax has five tax brackets, with a maximum marginal income tax of 2.90% as of 2021. North dakota has state sales tax of 5% ,. You can print a 7% sales tax table here.

The north dakota sales tax rate is 5% as of 2021, with some cities and counties adding a local sales tax on top of the nd state sales tax. The current total local sales tax rate in argusville, nd is 5.500%. For tax rates in other cities, see north dakota sales taxes by city and county.

Menoken, nd sales tax rate. There is no applicable county tax or special tax. The maryland state sales tax rate is 6%, and the average md sales tax after local surtaxes is 6%.

The 7.5% sales tax rate in pembina consists of 5% north dakota state sales tax and 2.5% pembina tax. 6.50% 9 3.01% 9.51% 3 5.125% calif. The base state sales tax rate in north dakota is 5%.

(b) 7.25% 1 1.43% 8.68% 9 2.50% colo. Effective october 1, 2021, the city of hankinson has revised their ordinance to increase its city sales, use, and gross receipts tax by 1%. 7% sales and use tax chart:

The current total local sales tax rate in menoken, nd is 5.500%. The fargo sales tax rate is %. The minimum combined 2021 sales tax rate for fargo, north dakota is.

The north dakota use tax is a special excise tax assessed on property purchased for use in north dakota in a jurisdiction where a lower (or no) sales tax was collected on the purchase. 1% lower than the maximum sales tax in nd. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent), new york (4.52 percent), and oklahoma (4.45 percent).

, nd sales tax rate. 31 rows the state sales tax rate in north dakota is 5.000%. The 7% sales tax rate in cavalier consists of 5% north dakota state sales tax and 2% cavalier tax.

View more information about the combined state and city rates within the city limits of here: There are nine email lists to which you may subscribe. Sales tax the sales tax rate for bismarck, north dakota when combined with state and county taxes is 7 percent.

2% food sales and use tax chart There is no applicable county tax or special tax. No states saw ranking changes of more than one place since july.

Hankinson at the present time, the city of hankinson has a 2% city sales, use, and gross receipts tax.

Origin-based And Destination-based Sales Tax Rate - Taxjar

Shrinking The Delaware Tax Loophole Other Us States To Incorporate Your Business

How Is Tax Liability Calculated Common Tax Questions Answered

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

House Democrats Tax On Corporate Income Third-highest In Oecd

Sales Tax On Grocery Items - Taxjar

Us States With Highest Gas Tax 2021 Statista

Sales Tax Calculator

State Sales Tax On Groceries Ff 09202021 Tax Policy Center

North Dakota Sales Tax Rates By City County 2021

How To Charge Your Customers The Correct Sales Tax Rates

25 Percent Corporate Income Tax Rate Details Analysis

Are There Any States With No Property Tax In 2021 Free Investor Guide

State Corporate Income Tax Rates And Brackets Tax Foundation

North Dakota Income Tax Calculator - Smartasset

State-by-state Non-collecting Seller Use Tax Guide

2

Sales Tax Holidays By State Sales Tax-free Weekend Tax Foundation

States With Highest And Lowest Sales Tax Rates