New Capital Gains Tax Plan

51 rows nationwide, the combined average capital gains tax rate would amount. The new tax law also retains the 3.8% niit.

How To Pay 0 Capital Gains Taxes With A Six-figure Income

The top federal tax rate on capital gains could reach levels not seen since the 1970s under the house democrats' proposed $3.5 trillion budget.

New capital gains tax plan. 13 will be taxed at top rate of 20%; Under the current proposal, “gains realized prior to sept. The impacted assets include stocks, bonds, real estate, and art.

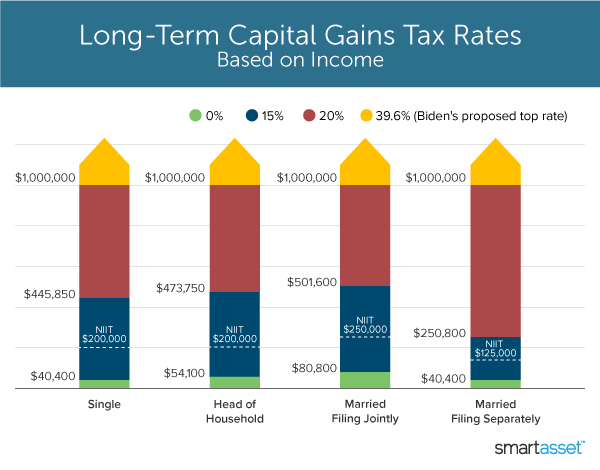

Stick to large shareholders' criteria but keep it to individuals a heated debate is happening between stock market players and members of the political community over. Understanding capital gains and the biden tax plan. Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28.

The people impacted by the tax would be able to. “ the new tax laws. This is the plan elon musk and other billionaires don’t like michael grothaus 10/26/2021 new data suggests 1 in 44 us children affected by autism

Spain approves new plusvalía capital gains tax law spain news november 09, 2021. This extra 3.8% is called the net investment income tax (niit). Capital gains taxes on collectibles.

Gains realized after that date would be taxed at a. Or 20% depending upon your income and tax filing status. House democrats unveil new tax plan 06:29.

Another would raise the capital gains tax rate to 39.6% for taxpayers. How to avoid capital gains taxes on primary residences This new capital gains tax bracket would apply only to individuals with adjusted gross income (agi) in excess of $1 million.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. Top combined capital gains tax rates would average 48 percent under biden’s tax plan. September 13, 2021, 6:48 am pdt updated on september 13, 2021, 12:17 pm.

New capital gains tax plan. Individuals with agi under the $1m threshold will continue to follow our current capital gains tax regime. Long capital gains are taxed at 0%;

The biden tax plan would raise the top marginal income tax rate to 39.6% from the current 37% level. Spain's council of ministers approved a new royal decree on monday, november 8 which will change the way that plusvalía tax is paid to each of the country's municipal governments. Capital gains tax rate set at 25% in house democrats’ plan.

Under this proposed tax, combined federal and state taxes on capital gains would average 48 percent (itself a 66 percent increase over current law), exceed 50 percent in thirteen states and the district of columbia, and reach 58.2 percent in new york city.[12] the combined average federal and state capital gains would surpass denmark, chile. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. Additionally, there has been a proposed increase to the capital gains tax, from 29% to almost 49% if including top state and federal tax.

The tax would apply to people who make more than us$ 100 million a year for three years in a row or if one makes us$ 1 billion in annual income.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isnt Everything

Whats In Bidens Capital Gains Tax Plan - Smartasset

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

What You Need To Know About Capital Gains Tax

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under The C Capital Gains Tax Capital Gain Paying Taxes

Mutual Fund Taxation Factors In 2020 Capital Gain Mutuals Funds Capital Gains Tax

Long Term Capital Gain Tax In 2021 Capital Gains Tax Capital Gain Tax

Capital Gains Tax Capital Gain Integrity

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Mutual Funds Capital Gains Taxation Rules Fy 2018-19 Ay 2019-20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

What You Need To Know About Capital Gains Taxes Now Forbes Capital Gains Tax Capital Gain Need To Know

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube In 2021 Capital Gains Tax Capital Gain Investing

How Does Capital Gains Tax Work In The Uk Capital Gains Tax Capital Gain Tax

Each Asset Class Is Tax Differently Use This To Your Advantage In Planning For Retirement Capital Gains Tax How To Plan Retirement Planning

Smart Super Strategy 4 - Manage Capital Gains Tax Capital Gains Tax Capital Gain Smart

Pin On Tax Consultant

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate Courses