Proposed Estate Tax Changes October 2021

Proposed changes the proposal would impose a 3% surcharge tax on the gross income in excess of $100,000 for a trust or estate, $2,500,000 for a married individual filing a separate return, and $5,000,000 for any other taxpayer. The bill includes several other changes that, if enacted, could affect existing estate plans.

State Corporate Income Tax Rates And Brackets Tax Foundation

On october 28, 2021, house bill h.r.

Proposed estate tax changes october 2021. You can also transfer up to that same amount to The significant changes still need to undergo rigorous negotiations in the house and senate before being sent to the president for his. The increase of the top marginal income tax rate from 37% to 39.6%;

That amount is annually adjusted for inflation—for 2021, it’s $11.7 million. Headlines indicate president biden will be signing the infrastructure investment and jobs act on monday november 15, 2021. We are constantly monitoring the situation in d.c.

Estate tax proposals increase the federal estate tax who may be affected? Then, the gift and estate tax exemption is lowered from $11.7 million to $6 million with the gift and estate tax rate increased from 40% to 45%, all effective january 1, 2022. These proposed modifications to the tax laws could impact the effectiveness of your current estate plan.

The current exemption amount from the estate tax is $11.7 million, townsend explained wednesday during schwab’s impact conference. And a reduced estate/gift tax exemption,. Posted october 27, 2021 tax alert:

The federal estate tax exemption is currently $11.7 million and the new york estate tax exemption is currently approximately $5.9 million (adjusted for inflation). The tcja doubled the gift and estate tax exemption to $10 million through 2025. The estate tax exemption and current “build back better” legislation.

5376 lowered the originally proposed $2.1 trillion tax increases to $1.85 trillion. Is $11.7 million in 2021. Recently, the house of representatives issued new draft legislative text.

The proposal in congress would cut the. Both the bernie sanders proposed legislation, and the september 13 th house of representatives ways and means committee bills, would have drastically reduced the $11,700,000 per person estate and. In september, we posted on the sweeping tax changes proposed by the ways and means committee of the house of representatives.

The september 13 tax proposal from the house ways and means committee contains many significant changes to gifting rules and estate planning that could greatly affect high net worth (hnw) individuals. Don’t worry, that’s not the bill that would have changed tax laws. Although there are many tax changes proposed in the updated version of the bill,.

Giarmarco, mullins & horton, p.c. For tax year 2021, trust or estate income over $13,050 is taxed at 37%. • taxpayers with assets over $3.5 million tax proposals under current rules for 2021, you can transfer up to $11.7 million during your lifetime or at death without paying gift or estate tax.

And will continue to provide updates on policies that are relevant to our clients. In addition to the proposed changes to trust and estate law summarized above, there are other tax law changes being proposed, including increases in the top individual income tax rates, higher capital gain tax rates for individuals at higher income levels, and larger tax bills for estates and trusts. The introduction of a 3% additional tax on high income individuals (>$5 million if married filing jointly) and trusts and estates (with income above $100,000);

Proposed changes to federal estate tax laws on september 13, the house ways and means committee made public its proposed tax plan, the revenue from which would fund president biden’s “build back better” spending package. Administration has proposed to tax capital gains when transferred by gift or at death. The taxable estate is taxed at 40%.

Following weeks of negotiations between president joe biden and congressional democrats, the white house released a retooled framework for the build back better act on october 28. The house ways and means committee released their first draft of proposed tax changes on september 14, 2021, as part of their efforts to fund the biden administration’s build back better program. Has made available for download their article, “potential changes to gift and estate tax laws in 2022”.

Under a new administration, proposed tax legislation has been introduced that could significantly impact estate tax planning. Proposed estate and tax planning changes in 2021 and 2022 on september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.” As a reminder, the federal estate tax exemption is still scheduled to drop to $5.0 million (indexed for inflation from 2018) on january 1, 2026, as that was part of the tax bill passed in 2017.

The article begins as follows: Of course, changes to the proposed bill are still being made on a daily basis, but hopefully these provisions are out for good. Recent changes in the estate and gift tax provisions updated october 19, 2021.

News october 29, 2021 at 03:06 pm share & print. On september 13, 2021, the house ways and means committee released its proposals to raise revenue, including increases to individual, trust and corporate income taxes. The build back better act was recently narrowed by president biden.

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceaseds Death Low Incomes Tax Reform Group

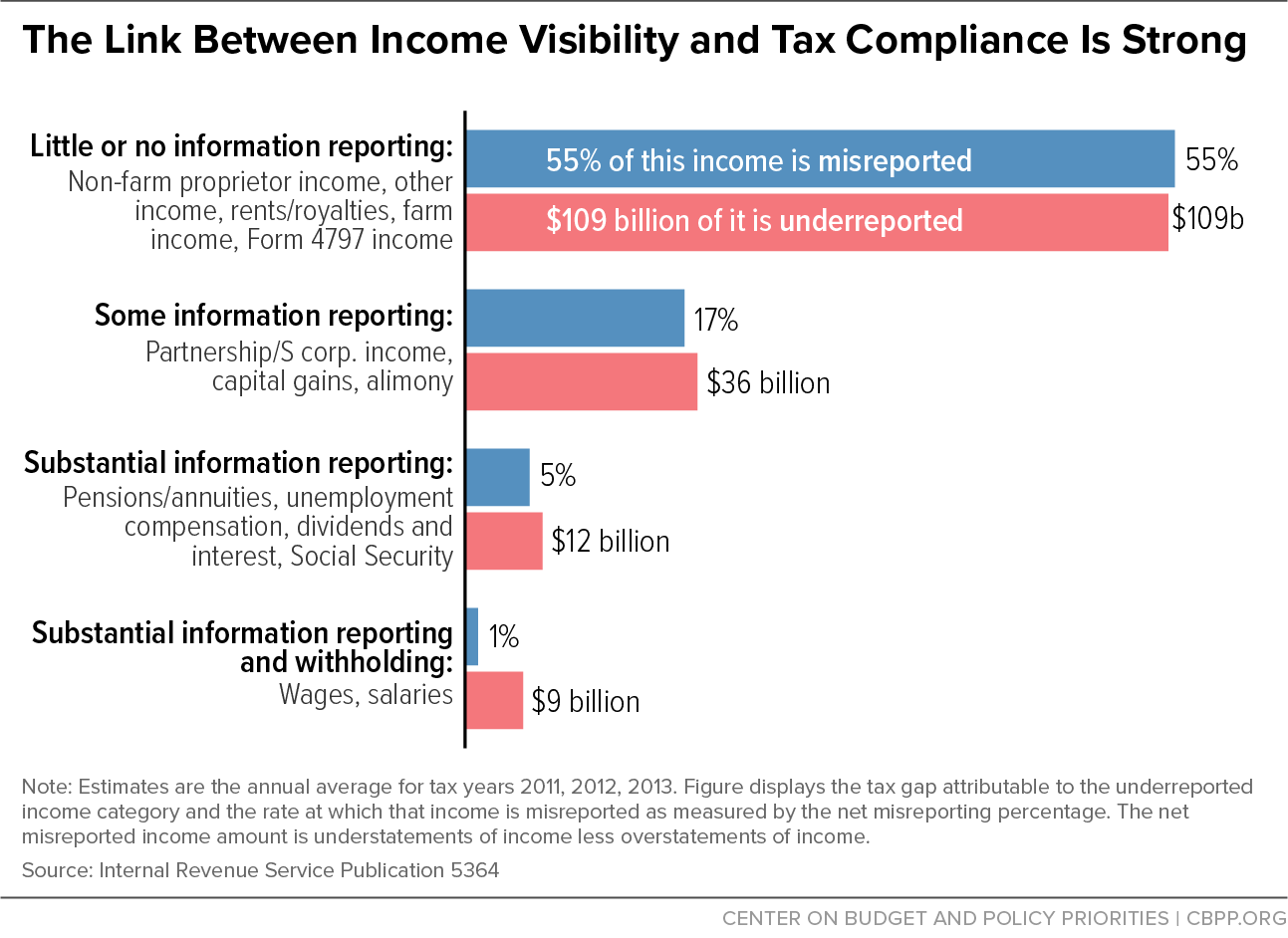

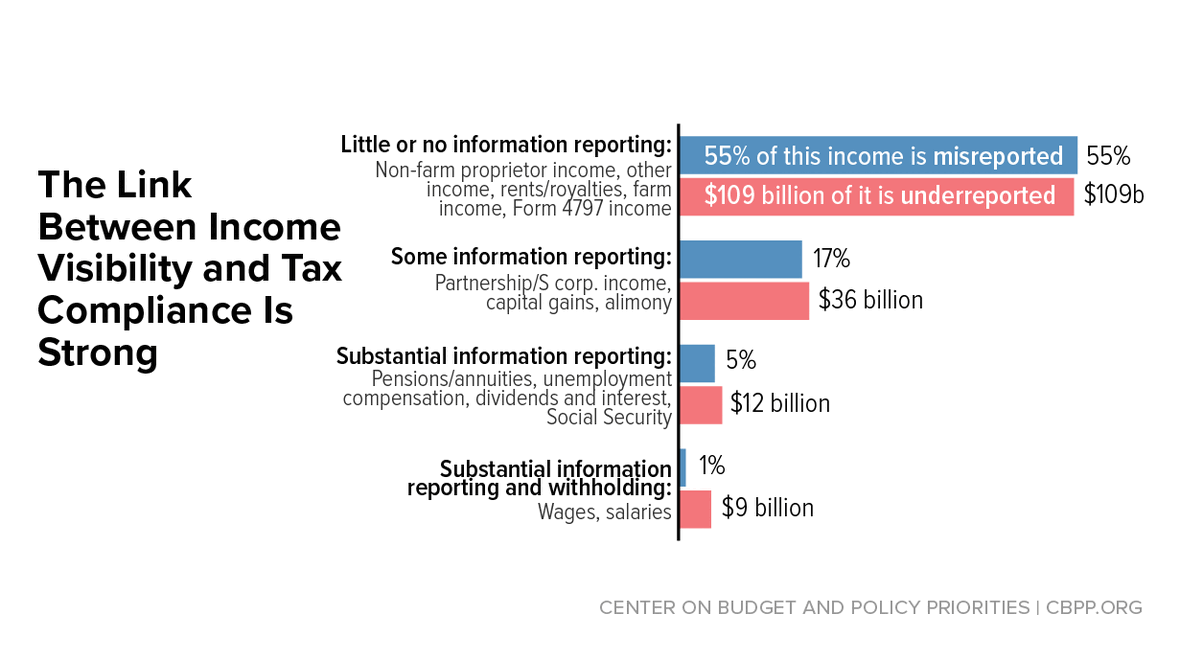

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

2

How To Prepare For Big Tax Changes

Hey President Biden - What Are You Doing On Estate Taxes

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Heres How Bidens Build Back Better Framework Would Tax The Rich

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

What Is The Stepped-up Basis And Why Does The Biden Administration Want To Eliminate It

Gift And Estate Tax Laws No Changes From Congress After All

.png?sfvrsn=1cb3b992_3)

Iras Tax Season 2021 - All You Need To Know

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2021 - All You Need To Know

The New Death Tax In The Biden Tax Proposal Major Tax Change

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Stronger Estate Tax Would Hit More Inheritances Under Democrats Plan

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp - Jdsupra