Are Political Contributions Tax Deductible Irs

“you cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. For you to deduct your charitable donations on your return, it is important to itemize the deductions.

Are Political Donations Tax Deductible

If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible.

Are political contributions tax deductible irs. On the other hand, political contributions are an exception to this rule. Businesses are cautioned to not deduct political contributions, donations or payments on their tax returns. Unlike charitable donations, which are tax deductible, donations to a political party or pac are not tax deductible.

The answer is simple, no. If you decided to donate money, or time or effort to political campaign, you might wonder whether political contributions that you make are tax deductible? The irs is very clear that money contributed to a politician or political party can't be deducted from your taxes.

Some nonprofit experts are of the opinion that a contribution to a (c) (4) organization is subject to gift tax. According to the internal service review (irs), the irs publication 529 states: Political contributions are tax deductible like.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political. Even though charitable donations can be deductible from your tax, all donations made to politics cannot. Individuals cannot deduct contributions made to political campaigns on their federal tax returns, regardless of whether they itemize or claim the standard deduction.

Are political donations tax deductible? Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate aren't deductible. Political contributions are not tax deductible, though;

The same goes for campaign contributions. Can i deduct my expenses if i volunteer for a political campaign? You can't deduct contributions made to a political candidate, a campaign committee, or a newsletter fund.

In any case, you have to pay taxes on your political donations. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal, state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer (under section 162(a) of the internal revenue code of 1954) provided such expenditure (classified as. For those who volunteer for a political candidate, campaign, or political action committee, the time you volunteer will not be considered tax deductible when filing your taxes.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible.”. Most of the time, donors have big money, and they qualify to be in a millionaire group, at least. The short answer is no, they are not.

That means with this tool, and you can search for the companies and organizations you can donate with. The simple answer to whether or not political donations are tax deductible is “no.” however, there are still ways to donate, and plenty of people have been taking advantage of. People who make political contributions often think that they count as charitable contributions.

Are political contributions tax deductible? The irs tells clear that all money or effort, time contributions to. Even so, they are not exempted from taxes on political donations, as per the us federal law.

The irsstates, “you cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. The irs explicitly says that contributions to political campaigns and candidates are not tax deductible. “political contributions deductible status” is a myth.

The irs is very clear that money contributed to a politician or political party can’t be deducted from your taxes. It depends on what type of organization you have given to. What makes political donations different?

Many donors ask our service team the same question: You can search for the organization you would like to donate to by employer identification number (ein), name or. An entity that is not a political subdivision but that performs an essential government function may not be subject to federal income tax, pursuant to code section 115(1).

This doesn’t just mean that donations made to candidates and campaigns are excluded from being tax deductible.

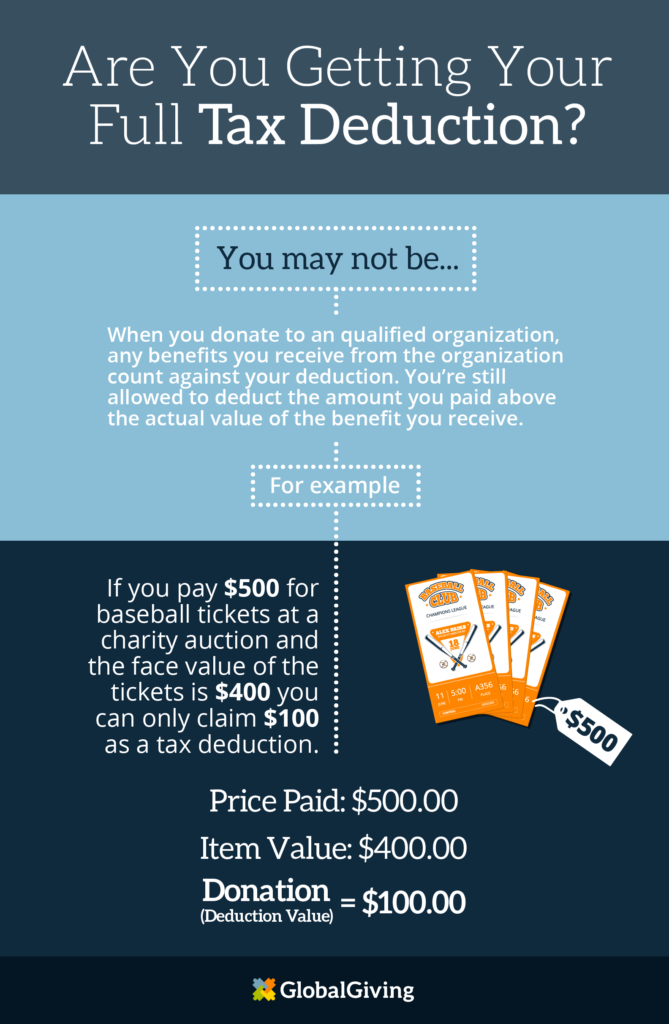

Everything You Need To Know About Your Tax-deductible Donation - Learn - Globalgiving

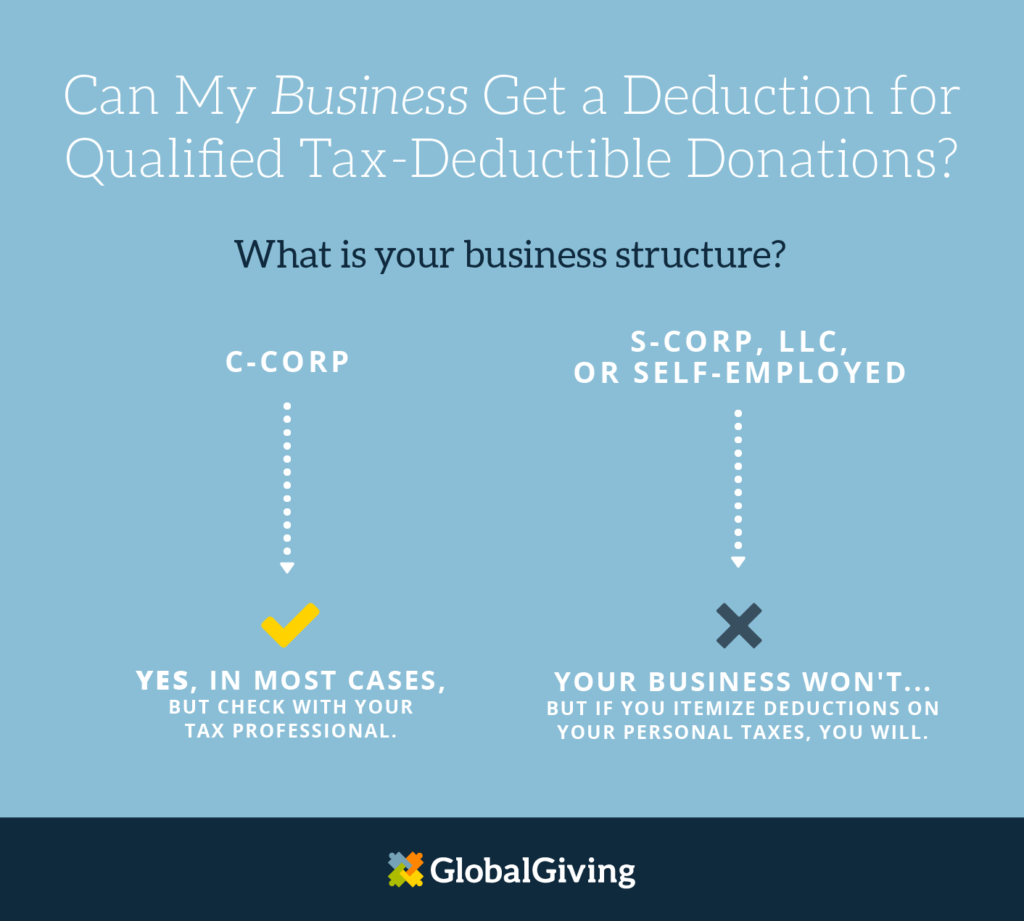

Pin On Business Taxes

Are Political Contributions Tax Deductible Hr Block

Can You Deduct Facebook Donations From Your Taxes Taxact Blog

Are Political Donations Tax Deductible Credit Karma Tax

Are Political Contributions Tax Deductible Anedot

Everything You Need To Know About Your Tax-deductible Donation - Learn - Globalgiving

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Hr Block

Deductible Or Not A Tax Guide A 1040com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

States With Tax Credits For Political Campaign Contributions Money

Are Political Contributions Tax-deductible Personal Capital

Limits And Tax Treatment Of Political Contributions - Spencer Law Firm

Are Your Political Contributions Tax Deductible Taxact Blog

Are Campaign Contributions Tax Deductible

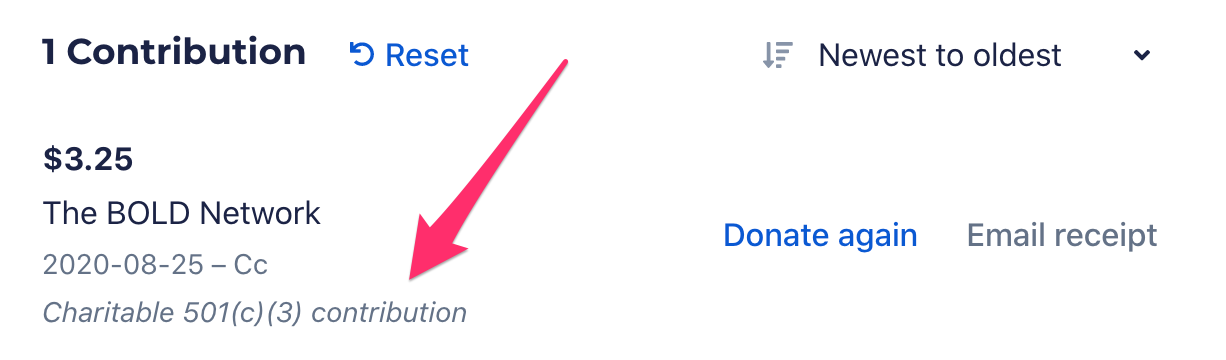

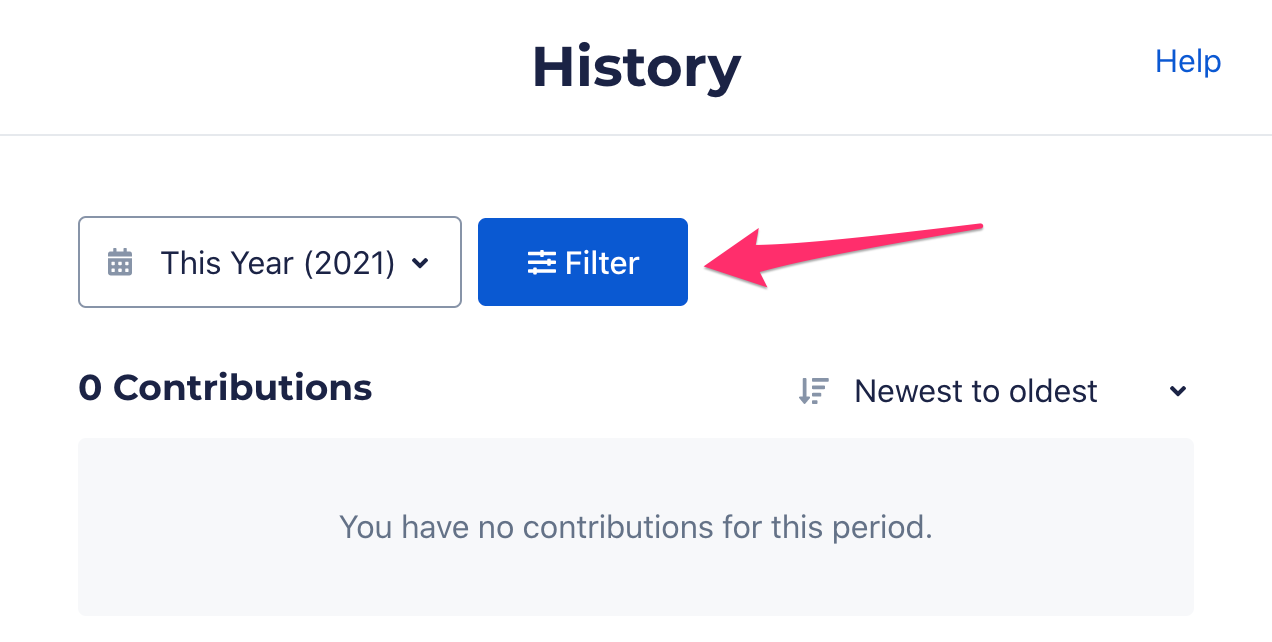

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible - Turbotax Tax Tips Videos