Indiana Excise Tax Deduction

The only vehicle registration fees that are deductible are those based on the value of the vehicle. Massachusetts—appeals court allows deduction for utility taxes paid to indiana the massachusetts appeals court reversed a decision of the appellate tax board and allowed bay state gas company (“bay state”) to deduct indiana utility receipts tax (“urt”) from its massachusetts net income for corporate excise tax purposes.

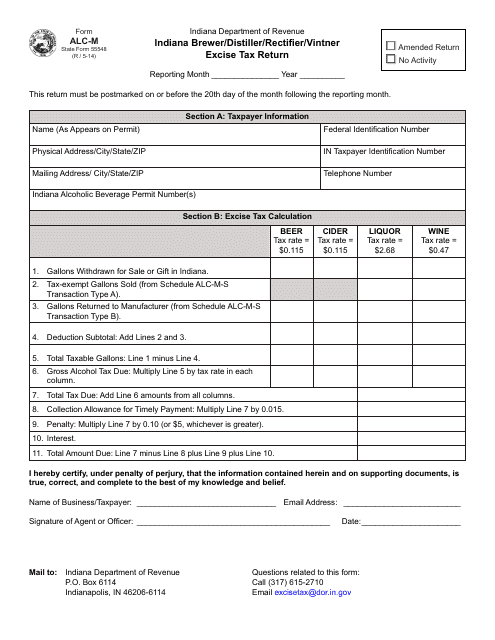

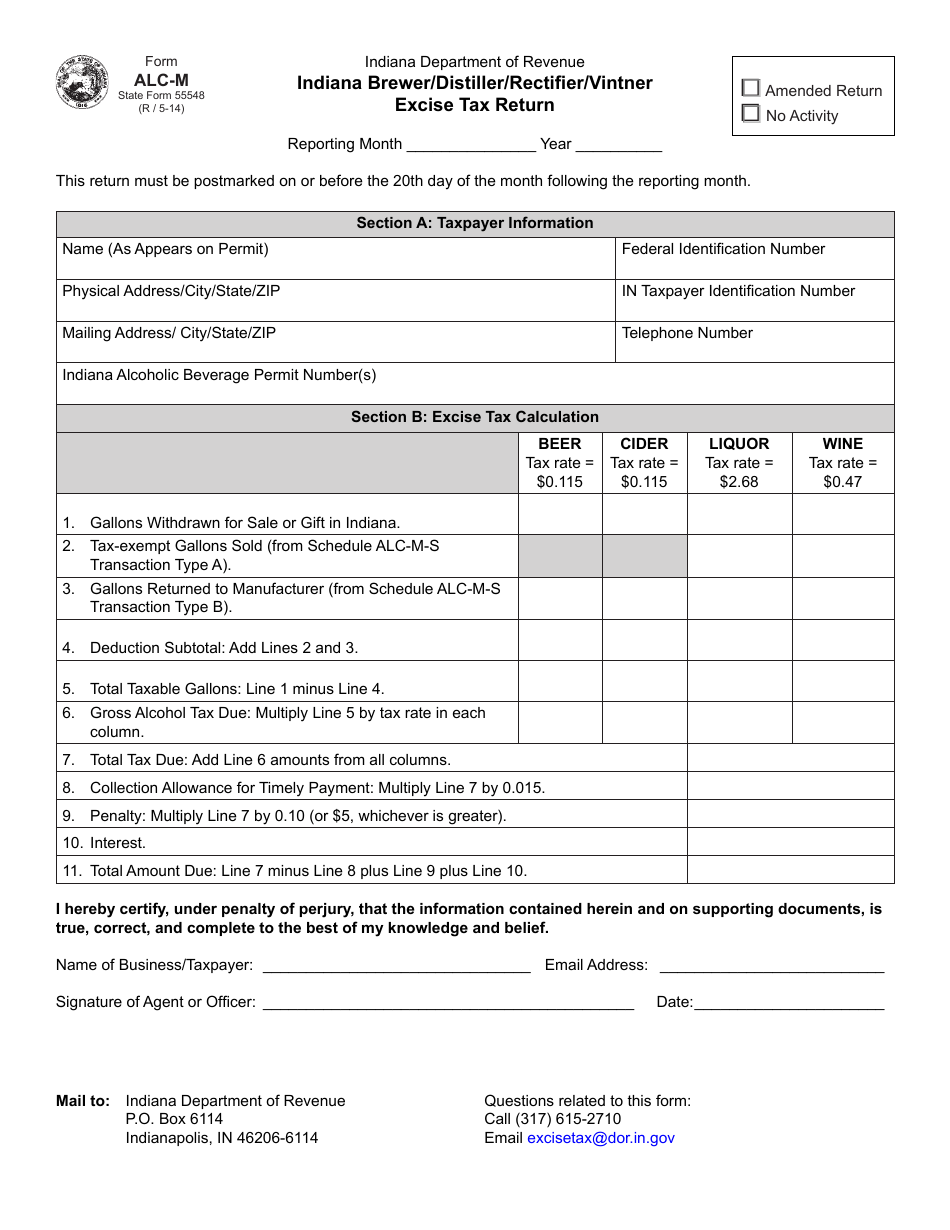

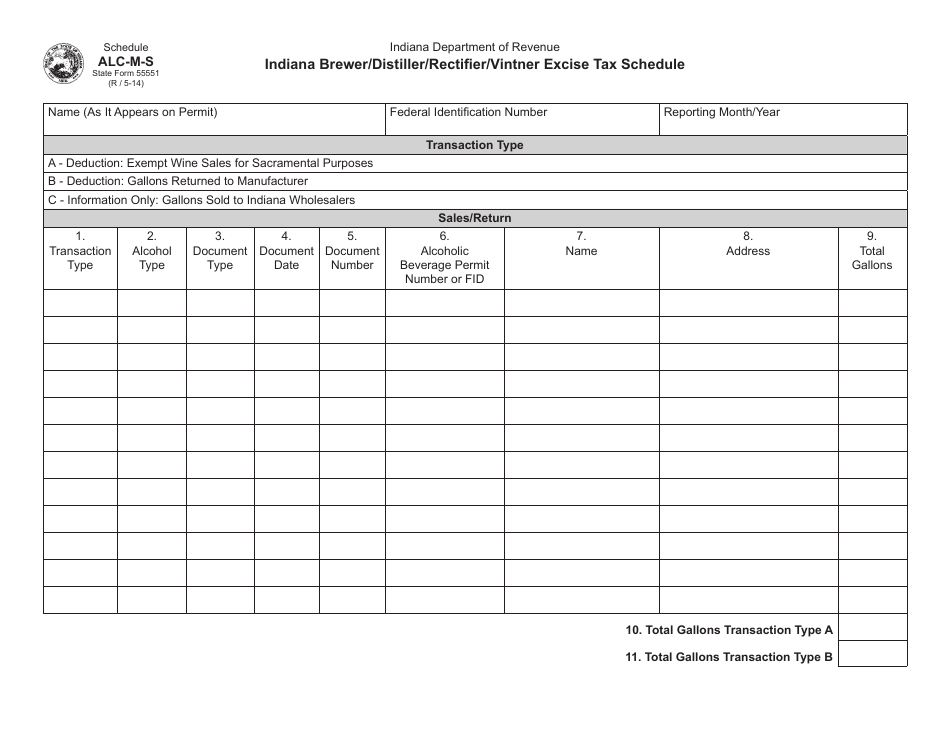

State Form 55548 Alc-m Download Fillable Pdf Or Fill Online Indiana Brewerdistillerrectifiervintner Excise Tax Return Indiana Templateroller

The sales disclosure form is not an application for the homestead, or any other relevant deductions, for an annually assessed mobile or.

Indiana excise tax deduction. A portion of indiana's vehicle registration fees are tax deductible; In other words, the value of the device. Vehicle excise tax is either a flat rate or based on the value and age of the vehicle.

It is based on the value of vehicle. Indiana imposes a flat 3.23% tax on the personal income. The amount of credit that may be claimed cannot exceed the amount of vehicle excise tax or rvet owed for the individual’s vehicle.

In 1999, a new commercial vehicle excise tax (“cvet”) was established. Your principal place of residence is the place where you have your true, fixed home and where you intend to return after being absent. When you buy a car, you have to pay indiana sales tax on the purchase, plus excise tax to register the vehicle.

Most vehicles are subject to the vehicle excise tax. The deduction will appear on the tax bill the year following the assessment date. The taxable amount can be lowered by applying several income tax deductions.the largest deductions in 2013 were a $3,000 deduction for rent paid and a deduction equal to the amount of taxes.

The excise tax amount is based on the vehicle class and age. However, if the amount shown is greater than $50.00, then only $50.00 will be charged, which is the maximum amount allowed to be assessed for county vehicle excise tax. Owners of these vehicles and trailers will now pay an excise tax in lieu of property tax.

Although trade or dealer discounts are taken off from the sales price, any manufacturer discounts are not deducted from the sales price for tax. The question of how vehicles are taxed comes up every year. You should consult your tax professional to determine whether this will apply to you.

The age of a vehicle is determined by subtracting the model year from the calendar year in which the vehicle is due to be registered. Your principal place of residence is the place where you have your true, fixed home and where you intend to. For motor vehicles, the unused portion of the veteran deduction reduces the annual excise tax in the amount of two dollars ($2.00) on each one hundred dollars ($100.00) of taxable value or major portion thereof.

Veterans or their spouse that are eligible for any of the deductions above but the assessed value of their property is less than the deduction can apply the overage toward the excise tax on up to two vehicles. The base taxable amount is equal to the adjusted gross income determined on a payers federal tax return. Veterans and their spouse can receive $2 credit to be applied toward the excise tax for every.

Excise taxes that are necessary to conduct business can usually be deducted as a business expense. Please click on the link (s) below to obtain and review information regarding the respective tax distributions for property, excise, income, financial institution and commercial vehicle excise taxes. You may be able to take a deduction of up to $2,500 of the indiana property taxes paid on your principal place of residence.

They are charged the same amount shown in the wheel tax table for the specified vehicle type and weight classification. Vehicle excise tax deduction for disabled veterans: But this amount is actually called an excise tax, and not a property tax.

This would include things like fuel tax and excise taxes paid to your city or state when you sell your home. Vehicle excise tax is an annual tax that must be paid in order to register a vehicle in indiana. The in county wheel tax is based on the type and weight of a vehicle, not the value of the vehicle.

Indiana county vehicle excise tax and wheel tax for an example of how the tax is calculated. The indiana state registration fee and the auto sales tax itself is not deductible, but all or a portion of the excise taxes you pay may be deductible on form 1040, schedule a, depending on your circumstances. Commercial vehicles subject to the excise tax are to no longer be subject to personal property taxation;

Registrant(s) name (as printed on indiana certificate of registration) mailing address (street number and name) The state charges a 7% sales tax on the total car price at the moment of registration. Please continue reading for a detailed answer;

The class of a vehicle is based on the vehicle value as. You may be eligible to take a deduction of up to $2,500 of the indiana property taxes (residential real estate taxes) paid during the year on your principal place of residence. (1) the amount of the excise tax liability for the individual's vehicle as determined under section 3 or 3.5 of this chapter, as applicable.

(d) the maximum number of motor vehicles for which an individual may claim a credit under this section is two (2). Generally speaking, true excise taxes cannot be deducted on your personal return.

How Much Does Your State Collect In Excise Taxes Per Capita 2019

Covid-19 Excise Tax Exemptions And Reductions - Mpg

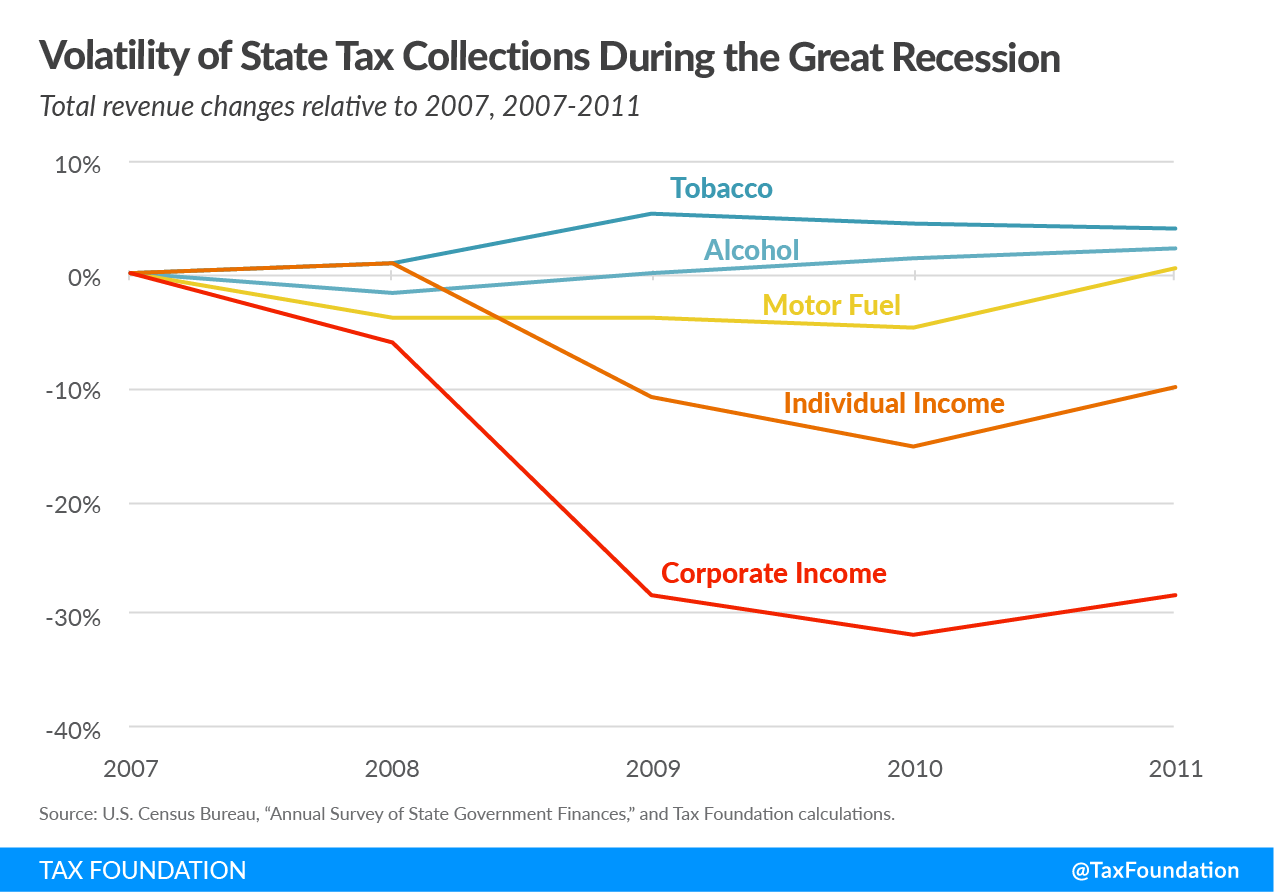

What Happens With State Excise Tax Revenues During A Pandemic

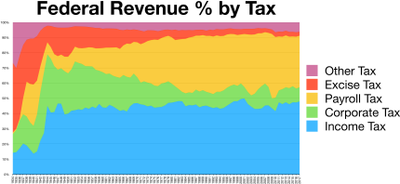

Taxation In The United States - Wikipedia

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

Tax Deduction For Vehicle Registration Fees Dmvorg

State Form 55548 Alc-m Download Fillable Pdf Or Fill Online Indiana Brewerdistillerrectifiervintner Excise Tax Return Indiana Templateroller

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

How Much Does Your State Collect In Excise Taxes Tax Foundation

How High Are Wine Taxes In Your State State Excise Tax Rates On Wine

Indiana Cigarette Tax Hike May Increase Cigarette Smuggling

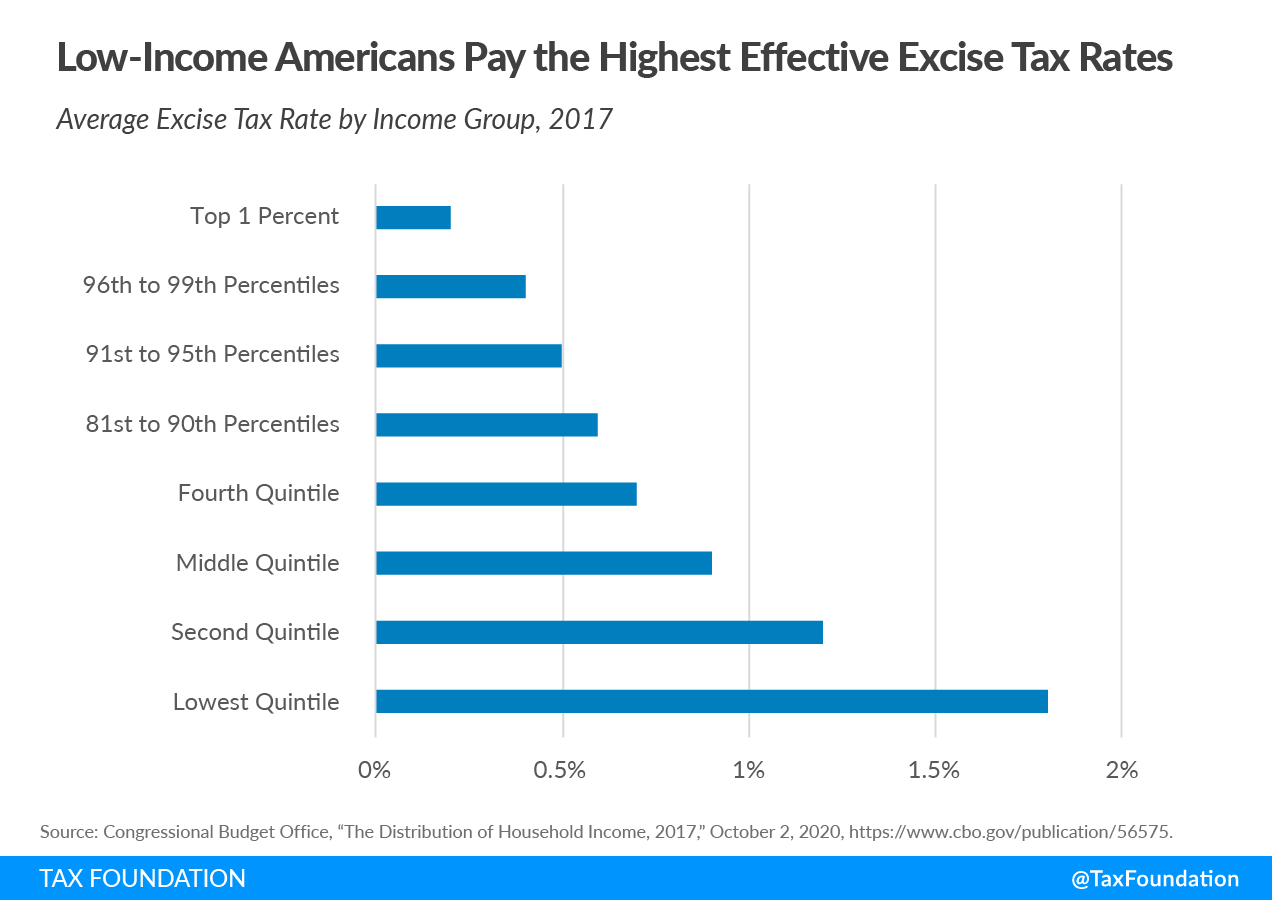

Excise Taxes Excise Tax Trends Tax Foundation

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Excise Taxes Excise Tax Trends Tax Foundation

Form Alc-m State Form 55551 Schedule Alc-m-s Download Fillable Pdf Or Fill Online Indiana Brewerdistillerrectifiervintner Excise Tax Schedule Indiana Templateroller

Excise Tax In The United States - Wikiwand

Taxation In Indiana - Wikipedia

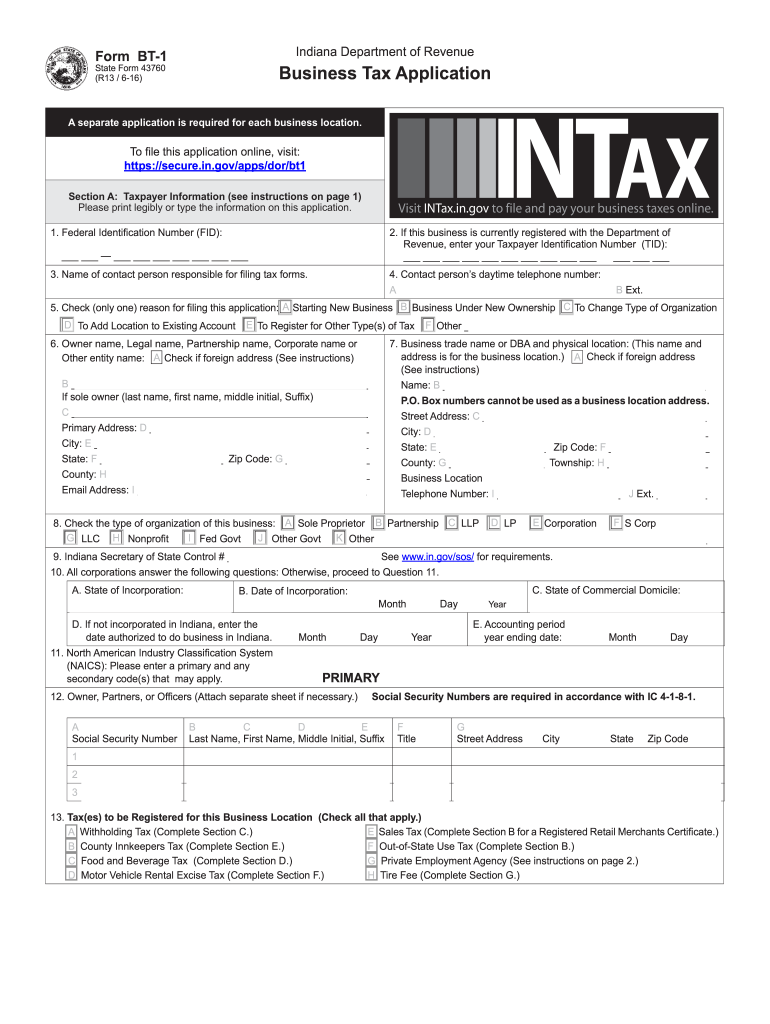

In Form Bt-1 2016 - Fill Out Tax Template Online Us Legal Forms