Tesla Tax Credit 2021 Arizona

In may 2021 the senate finance committee considered the “clean energy for america act” that suggested modifications to a number of existing programs associated. Renewable energy production tax credit.

Considering An Electric Car The Build Back Better Bill Could Save You Thousands - Cbs News

Tesla motors makes electric vehicles and, in the us, people had a federal tax credit of $7,500 for tesla.

Tesla tax credit 2021 arizona. For tesla’s bought on or after january 1, 2020, there has been no federal tax credit. Joint filers, up to $400. 2021 arizona tax credit reminder.

You can get a tax credit of 25% for any alternative fuel infrastructure project, including building an electric charging station. Please consult your tax advisor. Your tax credit may be limited to 50% of the donation.

Residential federal tax credit business federal tax credit for systems installed; If you can get them installed in 2021 you should get 22% tax credit regardless of income, not sure if credit can be carried over to the following year if your tax liability is lower. *amounts contributed for the credit between january 1, 2022 and april 15, 2022 may be used once as a tax credit on either your 2021 or 2022 arizona income tax return.

There’s also an income limit for taxpayers to receive the credit: For teslas, this isn’t a problem as the minimum is well over this threshold. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity from and after dec.

It varies based on the size of the battery but because tesla uses big batteries they qualify for the full amount of federal tax credit. You may donate up to $400 if filing singularly, and $800 if married filing jointly, and donating to a charitable tax credit organization is easy. If tesla would offer $2,000 fsd to buyers that are forgoing the tax credit, they might actually be making more money than they would have after the credit.

That is a nice bonus to add to the 26% federal solar tax credit. There's no cap on the federal tax credit and it can be claimed over multiple years if necessary. When you file your arizona taxes, you will get all of the above money back.

Special rules apply to individuals who are married filing separate. Most organizations provide a form or instructions on their website on how to donate. You can find additional information on the arizona dept of revenue state tax credit page.

A qualified energy generator is a facility that has at least 5 megawatts (or. January 1, 2020 to december 31, 2022: *to claim the first four credits listed above on your 2021 arizona tax return, contributions must be made by april 15, 2022.

In general, you must make your tax credit donations by april 15, 2021, in order for them to apply to the 2020 year. Cars need to be under $55,000. November 11, 2021 / dennis rogers / comments off on 2021 arizona tax credit reminder.

With the investment tax credit (itc), you can reduce the cost of your pv solar energy system by 26 percent.keep in mind that the itc applies only to those who buy their pv system outright (either with a cash purchase or solar loan), and that you must have enough income for the tax credit be meaningful. 1, 2021, using a qualified energy resource. With the two added, the ev credit you get is $7,500.

Every resident in arizona who installs solar panels gets a state tax credit of 25% of the total system cost, up to $1,000, to be used toward state income taxes. You do not need to itemize your taxes to take these credits. Tesla would be pocketing an extra $2,000 from each buyer for taking delivery early, money that they would more than likely not be making from those same customers after 1/1/22.

Perhaps more impressively, this level of profitability was achieved while our. Don’t forget about federal solar incentives! 31, 2010, and before jan.

Solar energy and utilities can also earn you a rebate of $300 per kilowatt up to $2,400. Rogers, cpa, cfp® it is time for the annual reminder for you to save on your state taxes by taking advantage of the arizona state tax credits. If the stimulus bill get passed with the solar tax credit extension then you will get 26% if installed by 2022.

If you plan to contribute to the mfrf, do so soon as it tends to cap out quickly. Arizona provides tax credits for seven types of donations. The id.4 is eligible for a $7,500 federal tax credit.

How do i make a tax credit donation? The third quarter of 2021 was a record quarter in many respects. The proposed eligibility requirements for the ev tax credit are simple:

The federal solar tax credit.

Going Electric Could It Save You On Your Next Car

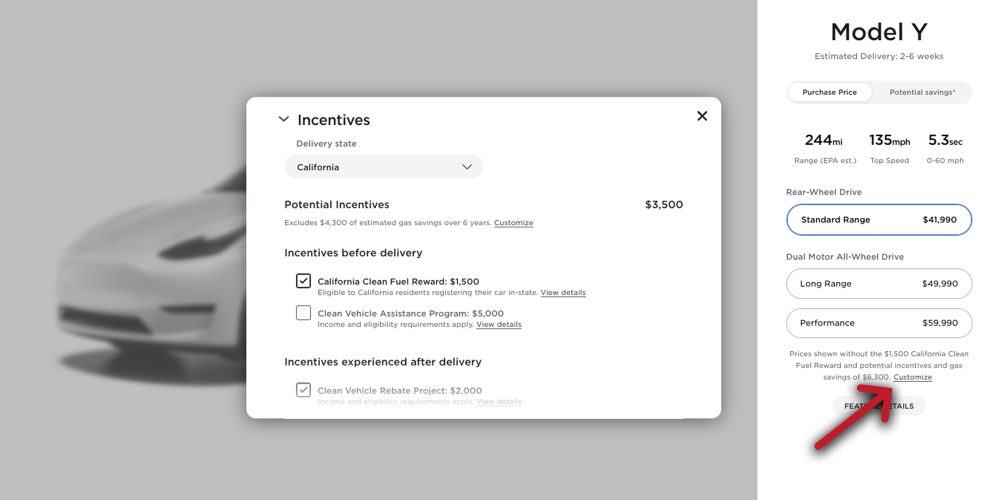

Latest On Tesla Ev Tax Credit December 2021 - Current And Upcoming In 2022

Win A Tesla Model S 75000 And Other Prizes In The Copper State Raffle Special Olympics Arizona

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

Ev Tax Credits Could Win Over Consumers But Union Spat Remains

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Win A Tesla Model S 75000 And Other Prizes In The Copper State Raffle Special Olympics Arizona

/cdn.vox-cdn.com/uploads/chorus_image/image/69866116/1231386762.0.jpg)

The Lucid Air Is The First Electric Car With A 520-mile Epa-rated Range - The Verge

Teslas 7500 Tax Credit Goes Poof But Buyers May Benefit Wired

Latest On Tesla Ev Tax Credit December 2021 - Current And Upcoming In 2022

2017 Tesla Tax Credits By State And Region - Updated Plugless

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

So How Much Would Buying A Tesla Really Cost You

Mcmaster Leads Republican Governors Against Tax Credits For Some Electric Vehicles Wbtw

Ev Start-up Lucid Begins Production Of 169000 Air Dream Edition