How To Calculate Pre Tax Benefits

Heads up, new jersey and california—you’ll have to pay state income tax on your hsa contributions. How to calculate imputed tax just like their regular pay, this imputed income is taxable income for the employee.

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

This process is referred to as giving the employee a tax break.

How to calculate pre tax benefits. Synergy = npv (net present value) + p (premium), where: Fill in each box with the total expenses you have had or will have in a given plan year, click the “calculate” button and see your savings. Tax benefits are often created as a type of incentive for promoting responsible behaviors or commercial activities.

So your family income estimate needs to be accurate and up to date. We use your family income estimate to work out how much family tax benefit and child care subsidy you get during a financial year. If pretax deductions are not included in taxable wages, subtract the benefit from gross wages before calculating state or local income tax according to the agency’s criteria.

Or here is another way we can calculate synergies in m&a: Calculate your annual fsa tax savings. Student loan, pension contributions, bonuses, company car, dividends, scottish tax and many more advanced features available in our tax calculator below.

Make your contributions as you normally would, and then come tax time, claim those contributions as tax deductions so they aren’t counted as income. Synergy benefits can come from four potential sources: After deducting the health insurance premiums, the employee’s pay is $1,700.

Why we need a family income estimate. As a rule of thumb, synergy is a business combination where 2+2 = 5. Withhold 7.65% of adjusted gross pay for medicare tax and social security tax, up to the wage limit.

Commuting expenses after taxes the amount. $1,7000 x 7.65% = $130.05 £10,000 £20,000 £30,000 £40,000 £50,000 £60,000 £70,000.

These benefits range from deductions to tax credits to exclusions and exemptions. First indicate if you are insuring just yourself or your family. Calculate your net salary and find out exactly how much tax and national insurance you should pay to hmrc based on your income.

You are responsible for calculating the estimated fair market value (fmv) of those health benefits so you can report the additional employee income to the irs, pay your business’s share of fica taxes and deduct that expense from your business income. This calculator will show you just how much you are saving in taxes by making contributions to a health savings account (hsa). Withhold the taxes for the employee based on $1,700 instead of $2,000.

The deduction is $50 per payroll, and you pay the employee a gross pay of $1,000 per biweekly pay period. It is a written plan that allows your employees to choose between receiving cash or taxable benefits, instead of certain qualified benefits for which the law provides an exclusion from wages. We’ll ask you to update your family income estimate before the start of each financial year.

The employee’s taxable income is $950 for the pay period. Take a look at the fica tax now: If pretax deductions are counted as taxable wages, subtract the benefit after deducting state or local income tax from gross earnings.

Let them know how much you'd like to contribute each pay period;

Tax Shield Formula Step By Step Calculation With Examples

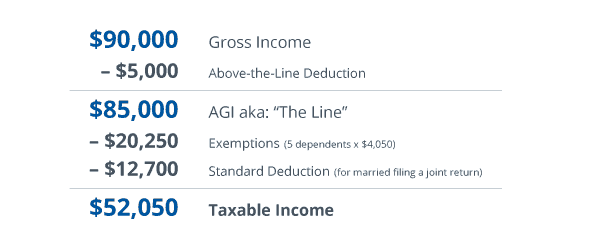

Standard Deduction - Tax Exemption And Deduction Taxact Blog

What Are Payroll Deductions Mandatory Voluntary Defined Quickbooks

Calculating Taxable Social Security Benefits - Not As Easy As 0 50 85 - Moneytree Software

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Net Operating Profit After Tax Nopat Definition And Formula - Wall Street Prep

Income Tax Calculator- Calculate Income Tax For Fy 2021-22 Online

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Deductions And Benefits On Pre-emi

Gross Vs Net Pay Whats The Difference Between Gross And Net Income Ask Gusto

Are Payroll Deductions For Health Insurance Pre-tax Details More

Pin On Accounting

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax-equivalent Yield Definition

Profit Before Tax Formula Examples How To Calculate Pbt

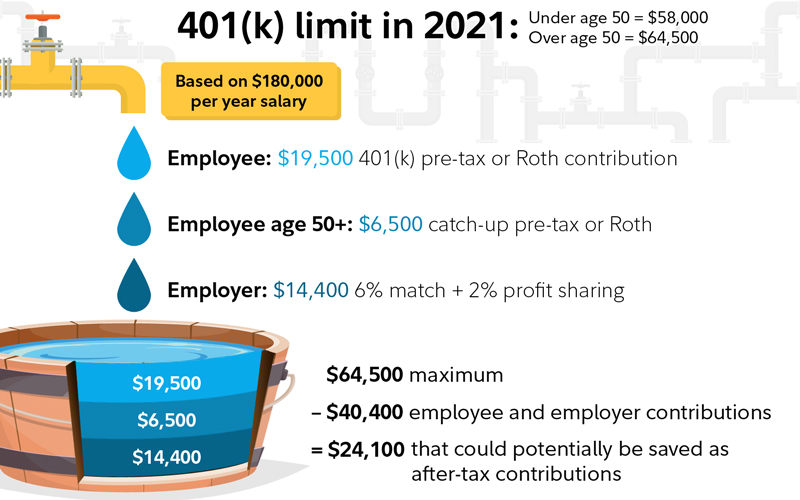

After-tax 401k Contributions Retirement Benefits Fidelity

Understanding Your Paycheck Creditcom

Pretax Income - Definition Formula And Example Significance