How Do I Pay My Personal Property Tax In Richmond Va

Just got @cityrichmondva property tax bill that's due may 1. Visit the pay online page for more information.

101 N 29th St Richmond Va 23223 Realtorcom

If the information shown is incorrect, press the return to search button and return to the pay real estate taxes online screen.

How do i pay my personal property tax in richmond va. Tax rates differ depending on where you live. Based on the type of payment(s) you want to make, you can choose to pay by these options: The fee is calculated prior to authorization, so that you may either proceed or cancel the transaction.

To pay the current personal property bill only, or to add a bill using another web application, press the checkout button. You have the option to pay by credit card or electronic check. The county offers many payment options including the internet, by telephone, by mail, in person or online banking.

Payments are processed by paymentus and a service fee is charged by the vendor. The tax rate is 1 percent charged to the consumer at the time of rental payment. Local taxes personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia.

All cities and counties in virginia administer a tax on personal property, such as automobiles, as an important and stable revenue source for municipal services ranging from police and fire protection to street maintenance and solid waste collection.the personal property tax is assessed on all vehicles (cars, buses, mobile homes, trailers, motor homes,. Click on the online services tab at the top of the website. You can also safely and securely view your bill online, consolidate your tax bills into one online account, set up notifications and reminders to be sent to your email or mobile phone, schedule payments, create an online wallet, and pay with one click using credit/debit or your checking account.

It is important accurate payment information be provided, which includes the. Taxpayers can pay online through paymentus. Press 3 for “property tax and all other payments”

Interest at a rate of 10% per annum is added beginning the 1st day of the month following the original due date. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. The treasurer collects fees for personal property tax, real estate tax, and motor vehicle license fees.

Payment of the personal property tax is normally due each year by october 5 (see tax bill for due date). There is a convenience fee for these transactions. Select the tax, bill payment option which is the 6 th option.

Steps to view/print property tax payment information: Vehicles titled out of state, but garaged in virginia. Online tax payments can be made 24 hours a day in the online payment portal.

You can make personal property and real estate tax payments by phone. Select the information requested from the pull down menus. The tax account number (located in the upper right corner of each tax statement) is all that is needed to make a payment online.

Taxable in school locality, unless personal property tax has been paid in home locality: Be it property taxes, utility bills, tickets or permits and licenses, you can find them all on papergov. The county accepts visa, mastercard, american express, discover card and electronic checks.

Henrico county now offers paperless personal property and real estate tax bills! Use the links to access the proper payment site. Directly from your bank account (direct debit) ach credit initiated from your bank account;

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts (excluding the rental of vehicles licensed by the state) from rental of personal property for 92 consecutive days or less. You will need information from your bill such as the account number to use this service. Pay personal property taxes online in city of richmond seamlessly with papergov.

Personal property taxes are billed once a year with a december 5 th due date. Use the map below to find your city or county's website to look up rates, due dates,. Click on the link for personal property/mvlt and real estate.

Median annual property tax payment average effective property tax rate; Your tax account number, which is located in the upper right corner of each tax statement. Paying online incurs 2.5% fee so snail mail it is.

If payment is late, a 10% late payment penalty is assessed on the unpaid original tax balance. There are no processing fees. If you have questions about personal property tax or real estate tax, contact your local tax office.

416 N 27th St Richmond Va 23223 - Realtorcom

9300 Ramsgate Ln Richmond Va 23236 - Realtorcom

5901 River Rd Richmond Va 23226 - Realtorcom

Hippodrome Theatre In Richmond Va - Cinema Treasures

1207 Greycourt Ave Richmond Va 23227 - Realtorcom

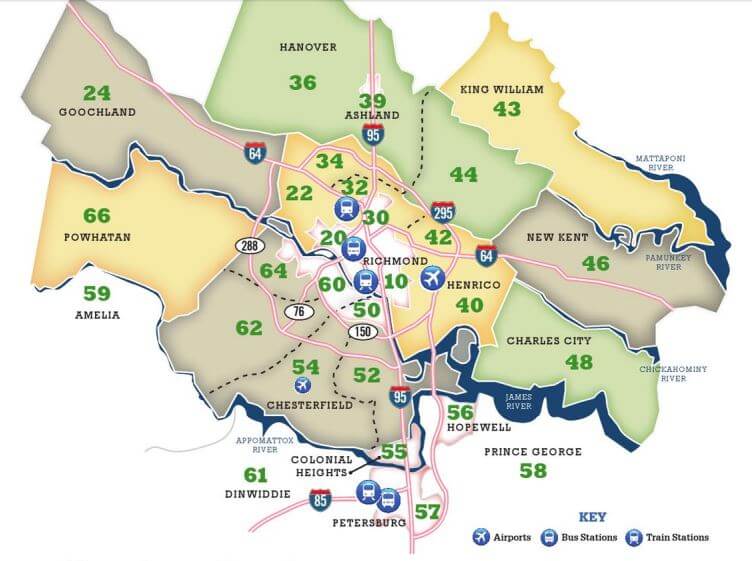

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

1839 Monument Ave Richmond Va 23220 - Realtorcom

1623 Floyd Ave Richmond Va 23220 - Realtorcom

5901 River Rd Richmond Va 23226 - Realtorcom

Hotel John Marshall - Wikipedia

301 Virginia St Unit 1405 Richmond Va 23219 - Realtorcom

1 W Main St Richmond Va 23220 Realtorcom

307 N 31st St Richmond Va 23223 - Realtorcom

3224 Patterson Ave Richmond Va 23221 - Realtorcom

Zi2gskkmmqsyrm

Why Richmond Virginia Is The Underground Music City Everyone Needs To Visit

4004 Park Ave Richmond Va 23221 - Realtorcom

8 Canterbury Rd Richmond Va 23221 - Realtorcom

Sppup1jikcqccm