Greenville County Property Tax Rate

This is the total of state and county sales tax rates. All other sales tax rates are maintained at the 6 percent rate.

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property tax rates by county, 2015.

Greenville county property tax rate. Get a paid property tax receipt for scdnr registration. The median property tax on a $148,100.00 house is $977.46 in greenville county the median property tax on a $148,100.00 house is $740.50 in south carolina the median property tax on a $148,100.00 house is $1,555.05 in the united states Greenville only has a local option sales tax on prepared food for recreational improvements.

Property tax rates by county, 2017. Property tax rates by county, 2014. An application must be filed with the assessor before the first penalty date (generally january 15th) for taxes due.

Find greenville county residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. Millage rate tax amount ; Greenville county, sc sales tax rate.

The county’s average effective rate is 0.69%. The 2018 united states supreme court decision in south dakota v. The minimum combined 2021 sales tax rate for greenville county, south carolina is.

The information provided for each county is listed below in the order that it is Property taxes (no mortgage) $53,634,300: , sc sales tax rate.

Property tax rates by county, 2016. Property tax rates by county, 2019. The december 2020 total local sales tax rate was also 6.000%.

Budget divided by assessments equals millage rate The south carolina state sales tax rate is currently %. The greenville county sales tax rate is %.

The millage rate is then applied back to each property to generate a tax bill. The current total local sales tax rate in greenville county, sc is 6.000%. Millage rates vary among the 136 tax districts within greenville county.

If you have documents to send, you can fax them to. Greenville county auditor 301 university ridge suite 800 greenville, sc 29601; Yearly median tax in greenville county.

The respective budgets for each entity (school, county, municipality, etc) are divided by their appropriate assessments to establish a millage rate. If you are a resident of greenville county and the home you own and occupy is your primary legal residence, you may be eligible to file for a special assessment ratio that will reduce your taxes. Property tax rates by county, 2020.

What this means is that, if the market/appraisal value of your property is $180,000, the assessed value is $7,200, if you live in the home as your primary residence, and $10,800, if you use the property as a rental or vacation home or something else. To determine an estimate of tax assessed on your property, please visit the vehicle tax estimator or the real estate estimator. Each entity sets their budget and millage.

When contacting greenville county about your property taxes, make sure that you are contacting the correct office. If paying by mail, please make your check payable to “greenville county tax collector”, and mail to: Greenville county property tax collections (total) greenville county south carolina;

Property tax rates by county, 2018. The median property tax (also known as real estate tax) in greenville county is $971.00 per year, based on a median home value of $148,100.00 and a median effective property tax rate of 0.66% of property value. You can pay your property tax bill at the tax collector’s department.

South carolina is ranked 1523rd of the 3143 counties. Property tax appraisals the greenville county tax assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features of the property and the fair market value of comparable properties in the same neighbourhood. Greenville county collects, on average, 0.66% of a property's assessed fair market value as property tax.

We appreciate the contributions of county auditors from each of the 46 counties. M obile homes also qualify. You can also pay online.

For an owner of a $100,000 home, this change represents an increase of about. Only search using 1 of the boxes below. The annual south carolina property tax rates report by county details millage rates for every jurisdiction that levies property taxes in the state.

Remember to have your property's tax id number or parcel number available when you call! Located in northwest south carolina, along the border with north carolina, greenville county is the most populous county in the state and has property tax rates higher than the state average. The median property tax in greenville county, south carolina is $971 per year for a home worth the median value of $148,100.

Property tax rates by county, 2013. The greenville county assessor's office can help you with many of your property tax related issues, including:

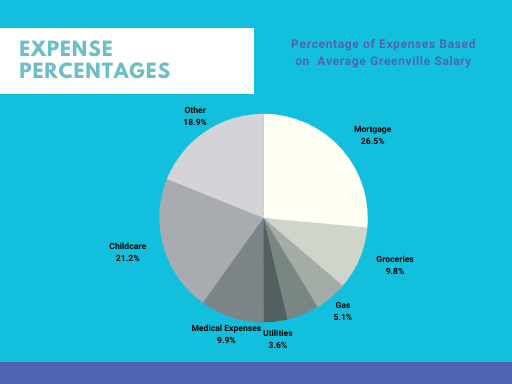

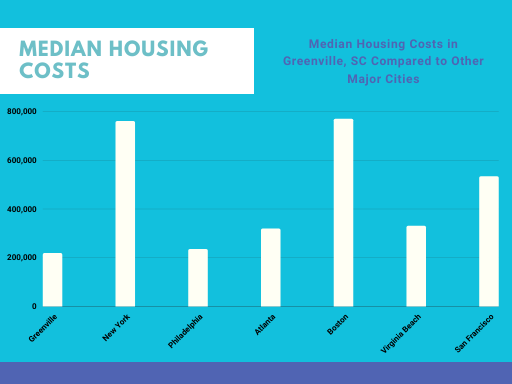

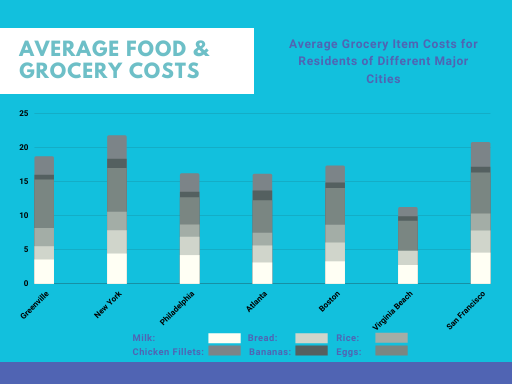

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Greenville Overlook Luxury New Homes In Wilmington De Delaware Homes For Sale Luxury Homes Pretty House

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Update Greenville County Schools Release Plan For In-person Class Instruction - Greenville Journal

Home Departments A Air Quality Alcohol And Drug Abuse Commission Animal Care Animal Control Answer Book Auditor B Birth Certificates Budget Building Safety C Cares Act Circuit Solicitors Office Clerk Of Court Code Compliance Coroners Office

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Why Land Values Are Rising In Greenville County South Carolina

Want To Rent Your House Well Youre Going To Have To Pay Up - Greenville Journal

Redistricting Population Explosion Means Some Greenville County District Lines Will Shift - Greenville Journal

45 Eye-catching Master Bedroom Ideas Photo Gallery Modern Bedroom Living Room Design Modern Girl Bedroom Designs

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Greenville Maps

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Greenville Maps

Greenville Sc Cost Of Living Is Greenville Affordable Data

2021 Best Places To Live In Greenville County Sc - Niche

Taxes Greenville Area Development Corporation