Tax Return Rejected Dependent Ssn Already Used

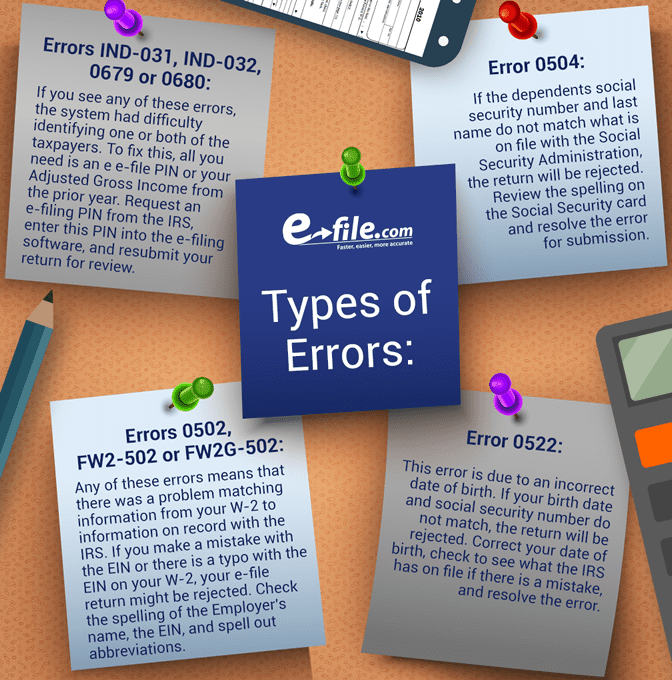

A case of fat fingers, digits transposed, a small error can result in an electronic filing error. Spouse ssn in the return must not be equal to a dependent ssn on this tax return or on another tax return.

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name - Dont Mess With Taxes

I submitted a client return with their dependent daughter.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Tax return rejected dependent ssn already used. For instructions on how to correct and refile your return, select your version of turbotax: I also file the daughter's taxes and i made sure i clicked she is a dependent of someone else such as parent. when i send the parent's taxes, it is rejected because of the previously used social security number. Only one return with the same ssn will be accepted.

Dependent rejection if your tax return is being rejected because the listed dependent's social security number is being used on another tax return, and you have verified that the information you have supplied is correct with the social security administration, you will need to file a paper return for this filing season. You entered the wrong ssn on your tax return: Online tax return with deduction tips & friendly live support.

Let’s assume it was not your mistake. Check that you have entered every ssn number correctly. By filling out this form and submitting it with your return, you are alerting the irs that your return was rejected for efiling because of a duplicate social security number.

Ad do your secure online tax return, in minutes. Ssn has been used on a previously accepted return. Verify that the name and ssn are correct for your qualifying child.

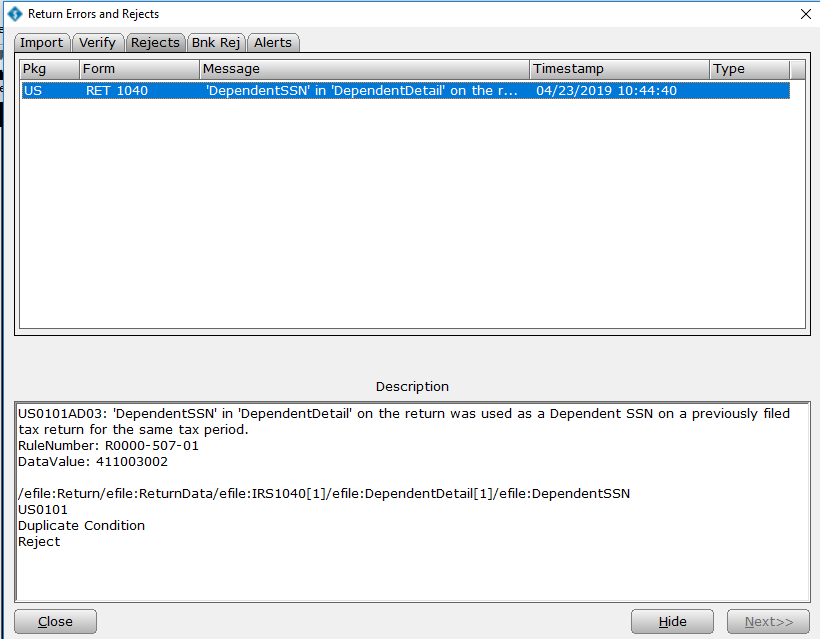

I know i have not filed previously this year. If your return was rejected due to your dependent's ssn being used on another return, the first thing to do is to verify that you entered the ssn correctly in the return. The reject code is sent when the irs has already accepted a tax return with the social security number (ssn) that has been seen as your dependent.

If it is incorrect, that means that someone did indeed use your dependent's ssn on a return. Online tax return with deduction tips & friendly live support. The ssn in question also appears as the filer, spouse, or dependent on another tax return for this same year.

Australia's #1 online tax service. Explaining why you can't efile (lacerte give a nice diagnostic to remind me of that) The ssn in question also appears as the filer, spouse, or dependent on another tax return for this same year.

If it is incorrect, fix it and resubmit it. The dependent claimed on your return has already been claimed for the indicated tax year on a different accepted tax return. When you receive a message saying that your tax return was rejected because an ssn has already been used, a few things might have gone wrong.

When this reject occurs, the return cannot be electronically filed with this dependent on it and a paper return will be required in order to claim the dependent on the tax return. If you check your return and the ssn is correct, you’ll need to paper file your return. The first thing to do:

I called the irs and the guy didn’t seem to give a crap and just said to paper file it. To make certain that you entered your social security number correctly, select basic information from the left side of your screen followed by personal information>>>general information. Rejected due to ssn already used.

Ad do your secure online tax return, in minutes. Potential reasons why your ssn has already been used: Once the irs receives your return and form 14039, they will send you an acknowledgment letter.

Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependent's ssn, the irs has security measures in place to ensure the accuracy of returns submitted. This is an internal error code. Australia's #1 online tax service.

The issue is that the death (& her ssn) has been reported to ssa & irs. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependent's ssn, the irs has security measures in place to ensure the accuracy of returns submitted. “a dependent on your return has already been claimed (or claimed themselves) on another return.” assuming you entered your dependent’s information correctly, it.

The irs is stating they have already processed and accepted a tax return for this year with the social security number listed on the return.

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support

Ssn Already Used By Someone Else On A Tax Return - Crossborder Planner

Dont Make These Mistakes On Your Tax Return Taxact Blog

1040 2020 Internal Revenue Service

Formulir Pemerintah Yang Digunakan Untuk Pajak Ditolak Foto Stok - Unduh Gambar Sekarang - Istock

How To Fix Error 512 Your Dependents Social Security Number Ssn Cannot Be Used To Claim An Exemption On Two Separate Tax Returns - Your Dependents Social Security Number Ssn Cannot Be

/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

Non-filers Form Initially Rejected Rstimuluscheck

Rejected Tax Return Common Reasons And How To Fix

Non-filers Form Initially Rejected Rstimuluscheck

Is Your Tax Return Rejected Follow These Steps To Correct It

My Images For Just-lisa-now- - Intuit Accountants Community

Solved If Reject Code Is R0000-507-01 With Multiple Depen - Intuit Accountants Community

Instructions For Form W-7 092020 Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

2

How To Correct An E-file Rejection E-filecom

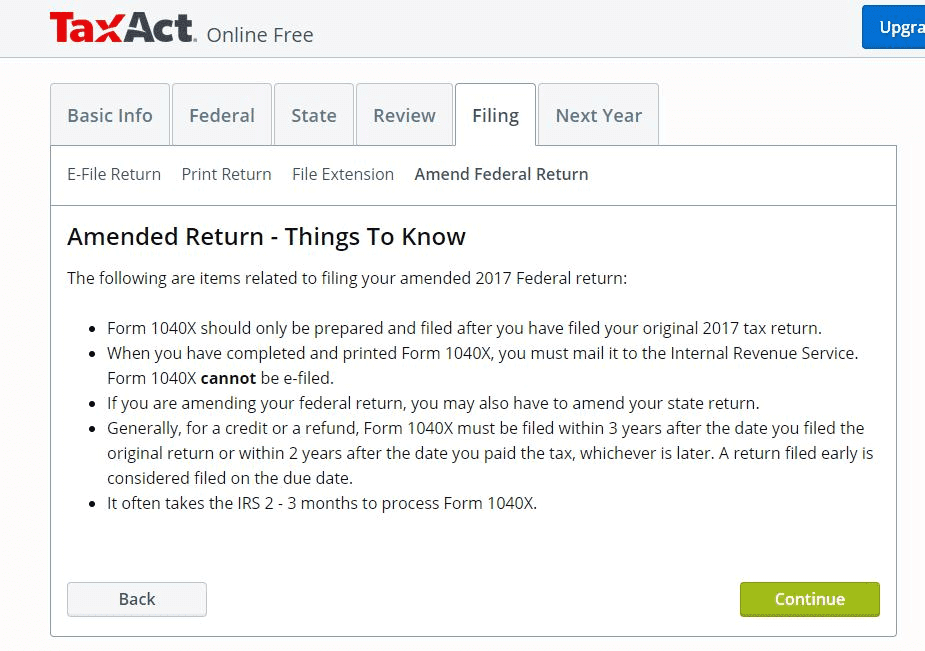

Tips For Filing An Amended Tax Return 1040x Taxact

What To Do When Your Tax Return Is Rejected Credit Karma Tax