Oregon Wbf Tax Rate

The purpose of the tax is to help fund programs in oregon to help injured workers and their families. 14.0 percent decrease premium assessment* state regulatory costs to administer workers’ compensation and

Oregongov

For agency information, please see oregon workers' compensation division website.

Oregon wbf tax rate. Under state law, employers that knowingly attempt to manipulate businesses to get a lower tax rate are liable for serious penalties. The oregon income tax has four tax brackets, with a maximum marginal income tax of 9.90% as of 2021. The annual total sui tax rate is based on a range of rates.

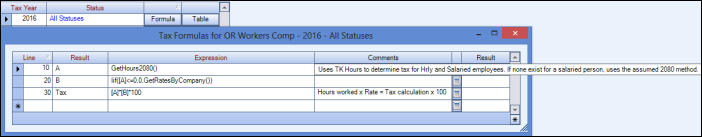

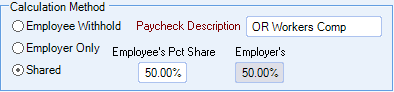

(trimet) tax rate is 0.007137. Detailed oregon state income tax rates and brackets are available on this page. Employers and employees split the cost.

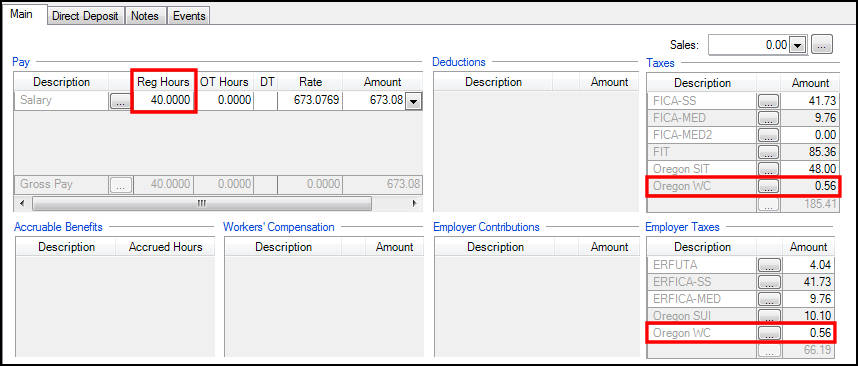

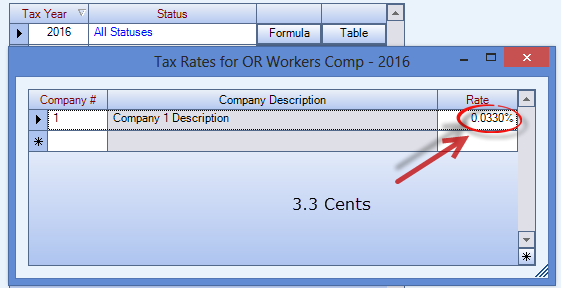

The oregon workers’ compensation payroll assessment rate is not to change in 2021, the state department of consumer and business services said. What is the wbf assessment rate in oregon? For calendar year 2016 the rate is 3.3 cents per hour (this rate has not changed for several years).

The wbf assessment rate (which varies from year to year) is x.xx cents for each hour or partial hour worked. What is the oregon wbf tax? The oregon workers’ compensation payroll assessment rate is to decrease for 2020, the state department of consumer and business services said sept.

Employers report and pay the wbf assessment directly to the state with other state payroll taxes. For 2022, our analysts recommend no change in the current assessment, which means it would remain at 2.2 cents per hour worked. Tax rate notices were issued to employers on november 13, 2020.

The workers’ benefit •fund (wbf) assessment rate is. 1, 2020, the tax rate is to be 2.2 cents an hour or part of an hour worked by each employee, down from 2.4 cents an hour in 2019, the department said on its website. • statewide transit tax rate is 0.001.

Oregon income tax brackets and other information. 1, the tax rate is to be 2.2 cents an hour or part of an hour worked by an employee, which is the same as the 2020 rate, the department said on its website. It will remain 0.028 through the first quarter of 2013.

Departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. Effective april 1, 2013, the department raised the wbf assessment rate from 2.8 cents per hour to 3.3 cents per hour. A table on the department's website shows the breakdown of changes in employers' sui tax.

The state income tax system in oregon is a progressive tax system. 2.8 cents per hour combined employer & employee rate 1.4 cents per hour employer rate, 1.4 cents per hour employee rate You are responsible for any necessary changes to this rate.

The department of consumer and business services has set the wbf assessment rate for calendar year 2019 at 2.4 cents per hour. This tax rate is the same for all employers, and is. Tax rates • the workers’ benefit fund (wbf) assessment rate is 0.022.

Wbf assessment rate change the wbf assessment rate is changing for the first time since 2007. Mailing of this booklet and forms The tax brackets are different depending on your filing status.

The oregon 2021 state unemployment insurance (sui) tax rates range from 1.2% to 5.4% on rate schedule iv, up from 0.7% to 5.4% on rate schedule ii for 2020 and 0.9% to 5.4% on rate schedule iii for 2019. Employers can deduct 1.1 cents per hour from employees if they choose to have employees pay a portion of the 2.2 cents per hour employer tax. The method for determining the workers’ benefit fund (wbf) assessment for an individual employee sometimes results in amounts of less than a cent being owed.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. The 3.3 cents per hour rate is the employer. • lane transit district (ltd) tax rate is 0.0076.

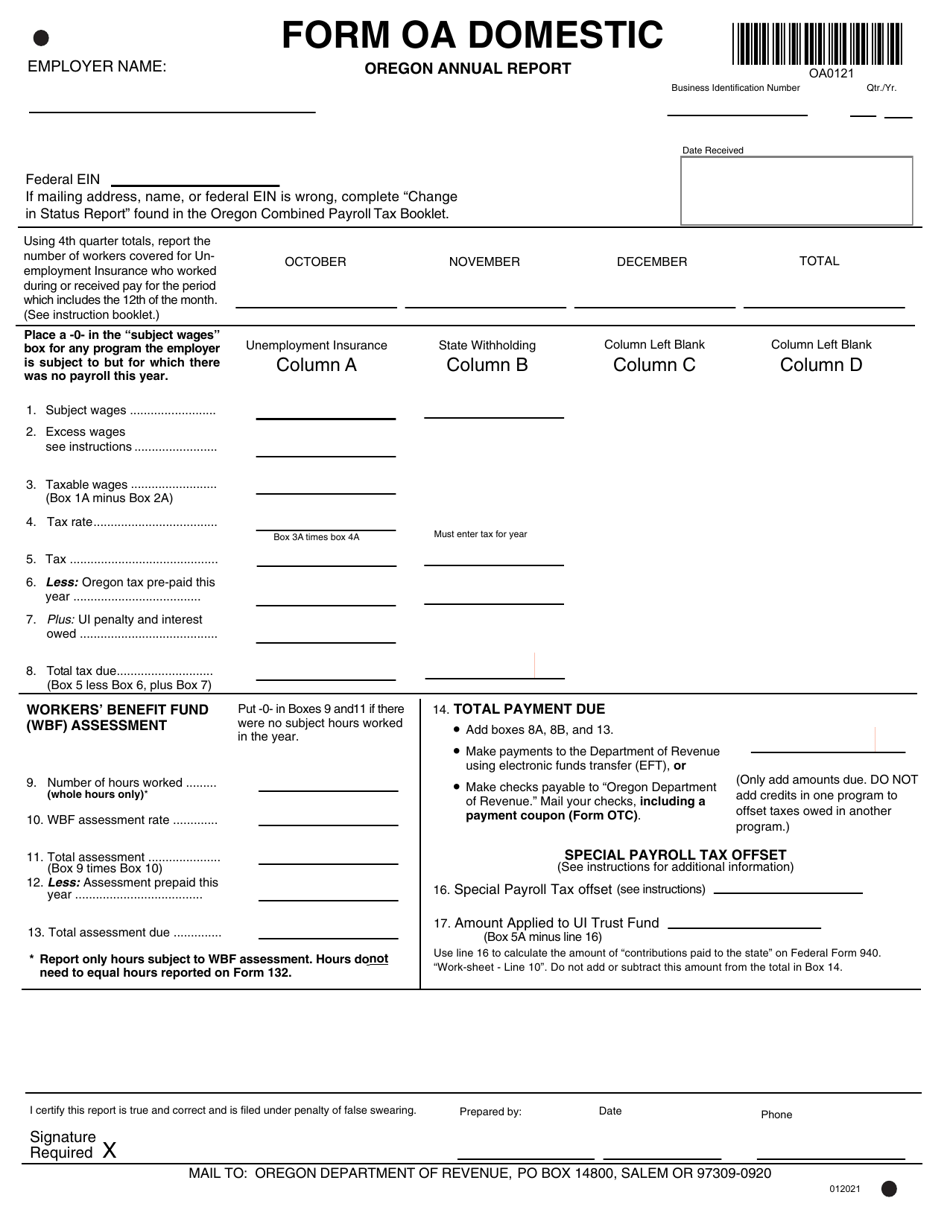

If you are an oregon employer and carry workers’ compensation insurance, you must pay a payroll tax called the workers’ benefit fund (wbf) assessment for each employee covered under workers’ comp. Average 5.8 percent decrease from 2021. • lane transit district (ltd) tax rate is 0.0069.

Standard 2015 new employer rate 2.9% voluntary contribution permitted no unemployment insurance employee deduction none disability insurance minimum wage $9.25 minimum cash wage $9.25 maximum tip credit none for 2015, the workers’ benefit fund (wbf) assessment rate is 3.3 cents per hour. Workers' benefit fund (wbf) 2018 assessment rates: In 2021, this assessment is 2.2 cents per hour worked.

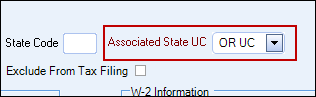

If the oregon worker benefit fund (or wbf) tax rate is changing in january (any year.) Recent rate history pure premium medical costs and benefits for lost wages. Excludes insurer expenses and profit.

Enter the tax formula and table rate information. • the taxable wage base for unemployment insurance (ui) is $43,800. Starting april 1, 2013 the rate will increase to 0.033 for the second through fourth quarters of 2013.

Oregon Workers Benefit Fund Wbf Assessment

Oregon Workers Benefit Fund Payroll Tax

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

2

2

2

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Transit Tax Update Available Now Datatech

Oregon Domestic Combined Payroll Tax Report - Pdf Free Download

2

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Workers Benefit Fund Payroll Tax

2

Oregon Workers Benefit Fund Payroll Tax

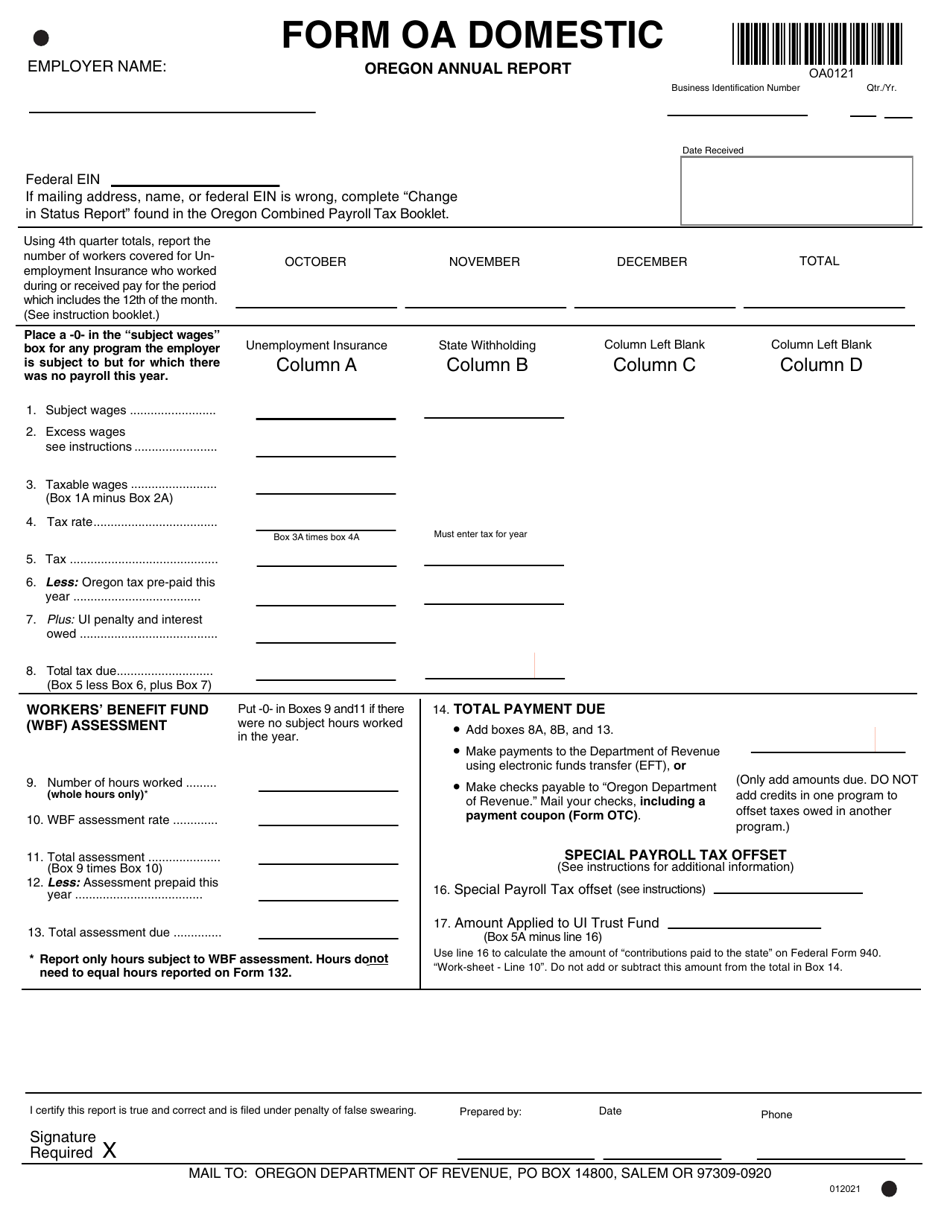

Form Oa Domestic Download Fillable Pdf Or Fill Online Oregon Annual Report Oregon Templateroller

Oregon Workers Benefit Fund Payroll Tax

Oregon Wbf

Oregon Workers Benefit Fund Payroll Tax

Fillable Online Oregon Workers Benefit Fund Wbf Assessment Workers Benefit Fund Wbf Assessment Table Of Contents Background 2 Subjectivity 3 Assessment Rate 5 Determining Hours Worked - Oregon Fax Email Print - Pdffiller