Lincoln Ne Sales Tax Increase

General introductory information on sales/use tax in spanish. Lincoln is the capital city of the u.s.

2

Lincoln to raise sales tax rate.

Lincoln ne sales tax increase. For 2021, the overall blended rate of the three agencies is 5.3%, with lincoln’s portion is only 2.17% on your overall tax bill. Detailed nebraska state income tax rates and brackets are available on this page. The corporate tax rate for the first $100,000 of nebraska taxable income remains 5.58%.

The current state sales and use tax rate is 5.5 percent, so the total sales and use tax rate will increase from 7 percent to 7.25 percent. This is the total of state, county and city sales tax rates. The december 2020 total local sales tax rate was also 7.250%.

, ne sales tax rate. Corporations (domestic and foreign), limited liability partnerships, and limited liability companies are required to submit a tax report or annual report due no later than april 15 of each required reporting year. The minimum combined 2021 sales tax rate for bellevue, nebraska is.

If there were no state tax increases, state general fund spending would need to be reduced one third. The bellevue sales tax rate is %. The nebraska state sales and use tax rate is 5.5% (.055).

Over the past year, there have been seventeen local sales tax rate changes in nebraska. November 18, 2020 (lincoln, neb.) — tax commissioner tony fulton announced that effective january 1, 2021, the local sales and use tax rates for gordon, greeley and juniata will each increase from 1% Lincoln voters approved a limited sales tax increase tuesday that would raise $34.5 million to replace the city's aging emergency radio system and build four new fire stations to match city growth.

Therefore, household impact is based on all three agencies & your property assessment (overseen by mpac). If there were no spending cuts, sales and income taxes would increase by 33%. The county sales tax rate is %.

If a schedule is not signed and filed on or before may 1st a 10% penalty will be added to the tax bill. 1, the village of orchard will start a 1.5% local sales and use tax. Foreign and domestic corporations filing llc/llp filings.

This also includes an alphabetical list of nevada cities and counties, to help you determine the correct tax rate. This table lists each changed tax jurisdiction, the amount of the change, and the towns and cities in which the modified tax rates apply. , notification to permitholders of changes in local sales and use tax rates effective april 1, 2022 updated 12/02/2021 effective april 1, 2022, the city of arapahoe will increase its rate from 1% to 1.5%.

Lincoln county from 1/1/2001 through 6/30/2009, and lyon &. If i pay sales tax do i still have to pay personal property tax? The additional tax rate will begin in october, because of the timelines set by the state, and will bring the city sales tax to 1.75 percent for the next six years.

This page will be updated monthly as new sales tax rates are released. These include plumbing repairs, work to fix ac units and furnaces, and basic veterinary care. If nebraska lawmakers cut state spending $750 million and increased state sales and income taxes $750 million, the state tax increase would be 17%.

Rates and codes for sales, use, and lodging tax. 2021 nebraska sales tax changes. The nebraska sales tax rate is currently %.

1912 bristow 4% to 5% sales and use increase july 1, 2021 5805 commerce 4% to 3% sales and use decrease july 1, 2021 3304 east duke 2% to 3.5% sales and use increase july 1, 2021 5507 edmond 4% lodging new july 1, 2021 2419 lahoma 4% to 4.5% sales and use increase july 1, 2021 The current total local sales tax rate in lincoln, ne is 7.250%. The nebraska income tax has four tax brackets, with a maximum marginal income tax of 6.84% as of 2021.

More information for consumers, retailers and others who hold sales and use tax permits is available at lincoln.ne.gov (keyword: If a schedule is not signed and filed on or before july 31st, on august 1st a schedule will be prepared by our office for you and a 25% penalty will be added to the tax bill.

2

Nebraska Extending State Tax Filing Deadline To May 17 Klin - Newstalk 1400

City Hall Neighbors Decide Not To Fight For Perpendicular Parking Local Government Journalstarcom

Todays Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Instagram Prints Mostly Sunny

Pin On Nma Driving In America

Ttr Puerto Puerto Rico San Juan Puerto Rico

Cyndi Lamm - Home Facebook

Nebraska Real Estate Transfer Taxes An In-depth Guide For 2021

City Council Approves Ordinance Changes Police Hope Will Help Combat Catalytic Converter Thefts Local Government Journalstarcom

Lincolnnegov City Of Lincoln And Lancaster County Coronavirus Covid-19 Business Resources

Window Replacement In Omaha Ne Lincoln Ne

Charles Apple

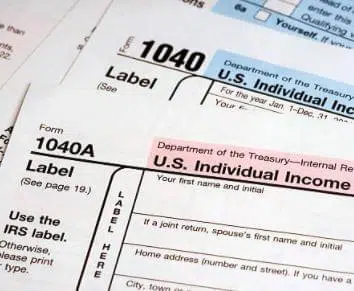

History - Board Of Educational Lands And Funds

2

Hm6t6gvrj43ywm

Voted Have You Thank You Realtors Association Of Lincoln For The Stickers Governmental Affairs Realtors Association

How To Get A Resale Certificate In Nebraska - Startingyourbusinesscom

Window Replacement In Omaha Ne Lincoln Ne

Nebraska Sales Tax Rates By City County 2021