Coweta County Property Tax Due Date

There is a $60,000 per transaction limit when paying with an echeck. In some counties property tax returns are filed with the county tax commissioner, and in other counties, returns are filed with the county board of tax assessors.

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

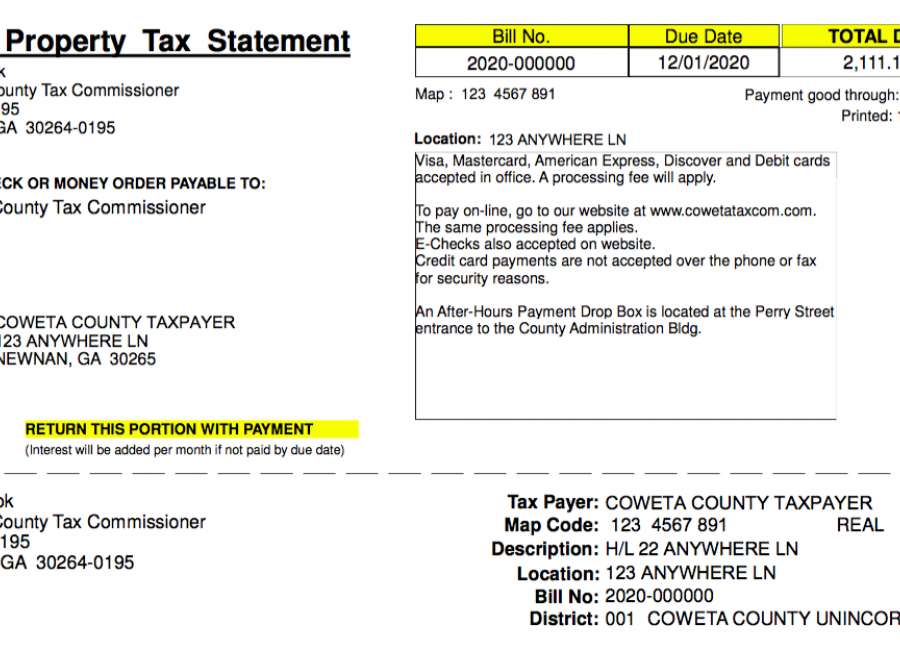

Coweta property tax bills were sent out last week, and most coweta property owners should have now received their bills for real property.

Coweta county property tax due date. Now all coweta county residents and businesses receive one tax bill, due and payable by december 1st to the coweta county tax commissioner. The city of newnan will no longer bill and collect city taxes seperately. Questions answered every 9 seconds.

Property tax appeals and reassessments; Bills may be paid using cash, check, mastercard, or visa. Property taxes for the last few years i have tried to keep up with how laurens county taxes compare to surrounding counties and others around the state.

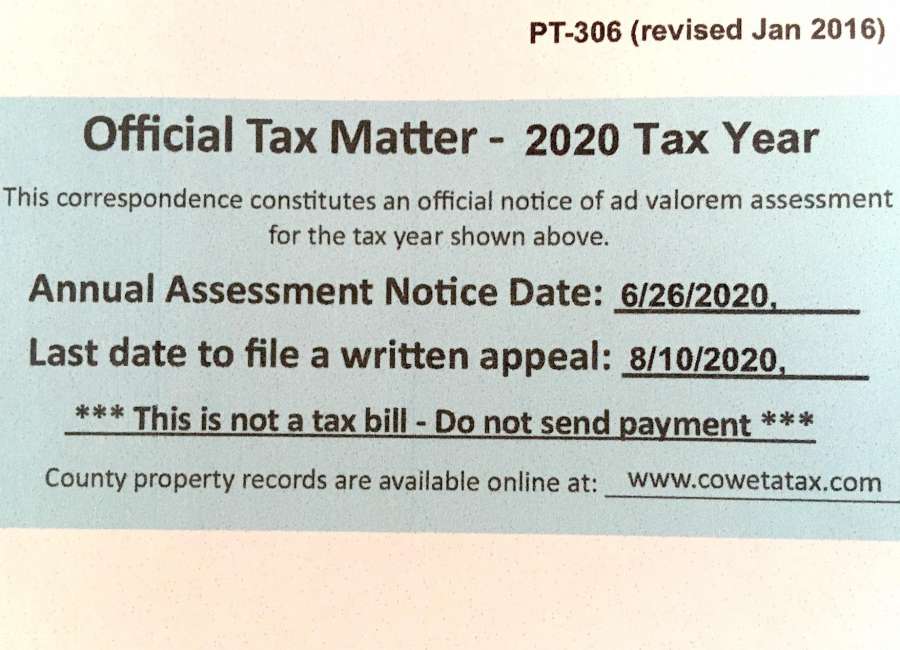

Property tax returns must be filed with the county tax office between january 1 and april 1 of each year. Coweta county, ga property tax assessments; Property owners may contact the assessment office for questions about:

Property tax rates and tax roll; Coweta county collects, on average, 0.81% of a property's assessed fair market value as property tax. The filing deadline cannot be extended.

The median property tax in coweta county, georgia is $1,442 per year for a home worth the median value of $177,900. When/how can homeowners apply for the homestead exemption? Basic exemption extended to $7,000.

Paying property tax bills and due dates; The median property tax on a $177,900.00 house is $1,440.99 in coweta county. Coweta county gis maps, property.

Beginning in 2015, all coweta county residents will receive one tax bill annually, due and payable to the coweta county tax commissioner by december 1st. Ad a tax advisor will answer you now! The deadline for filing an application for the freeport exemption with the coweta county board of tax assessors is april 1 st in order to receive the maximum exemption on quality inventory.

I have tweaked my model over the years in an attempt to capture not only the raw numbers but to compare the main factors i believe affect the millage rate: You should check with your county tax. Questions answered every 9 seconds.

Bills can also be paid using a bank draft which automatically deducts the amount from your bank. Property taxes are due dec. Checking the coweta county property tax due date

Secured property tax bills are sent out in october. The basic exemption for this county is $2,000 on state and school and $5,000 on county and fire. Each year, property tax returns must be filed by april 1.

When are property taxes due in georgia county coweta? Yearly median tax in coweta county. The exemption provided for herein shall be for a period not exceeding twelve (12) months from the date such property is stored in this state.

You may pay your bill any of our offices which are located in newnan, fayetteville and palmetto, or you may simply mail in your payment. You can contact the coweta county assessor for: If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the coweta county tax appraiser's office.

The payment for secured property is due in two installments. Appealing your property tax appraisal; Property tax bills are based on the calendar year in which they are issued.

Is there are any options for online payment of property taxes in georgia county coweta? The coweta county assessor is responsible for appraising real estate and assessing a property tax on properties located in coweta county, georgia. Property tax returns must be filed with the county tax office between january 1 and april 1 of each year.

The information should be used for informational use only and does not constitute a legal document for the description of these properties. Property assessments performed by the assessor are used to determine the coweta county property taxes owed by individual taxpayers. Tax commissioner robi brook has announced property tax bills for 2021 have been mailed to taxpayers and are due wednesday, december 1,.

Ad a tax advisor will answer you now! Tax commissioner robi brook has announced property tax bills for 2021 have been mailed to taxpayers and are due wednesday, december 1,. Georgia is ranked 841st of the 3143 counties in the united states, in order of the median amount.

Property Tax Bills On Their Way - The Newnan Times-herald

Property Tax Bills Sent Due Dec 1 - The Newnan Times-herald

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Property Values Skyrocket But Taxes Havent Been Set - The Newnan Times-herald

Coweta Tag Office Closed Due To Covid-19 Winters Media

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Lgs Local Property Tax Facts For The County - Georgia Department

The Shopper August 12 2020 Issue By The Coweta Shopper - Issuu

The Shopper July 24 2019 Issue By The Coweta Shopper - Issuu

Property Tax Deadline Is - Coweta County Government Facebook

Articles By Tag Coweta County - Lindseys Inc Realtors - Lindseys Realtors Blog

Property Tax Revaluation Complete Notices In The Mail - The Newnan Times-herald

2

2

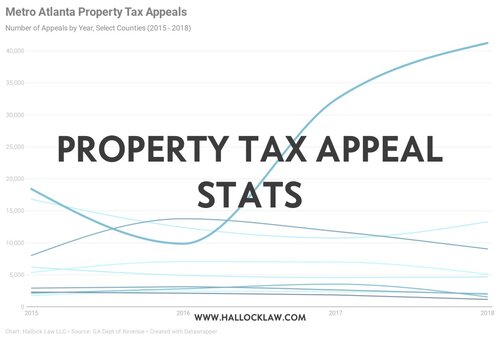

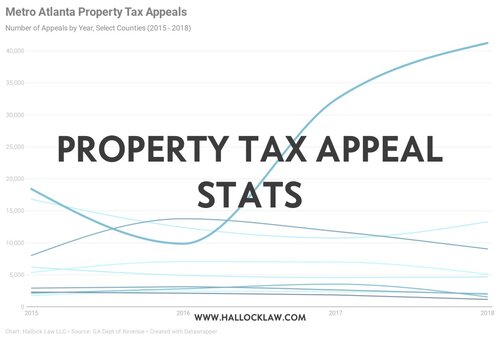

Coweta County Ga Hallock Law Llc Property Tax Appeals

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Pattys-cakescom

Property Tax Deadline Is - Coweta County Government Facebook

Property Tax Deadline Is Tuesday - The Newnan Times-herald