Tax Per Mile Pa

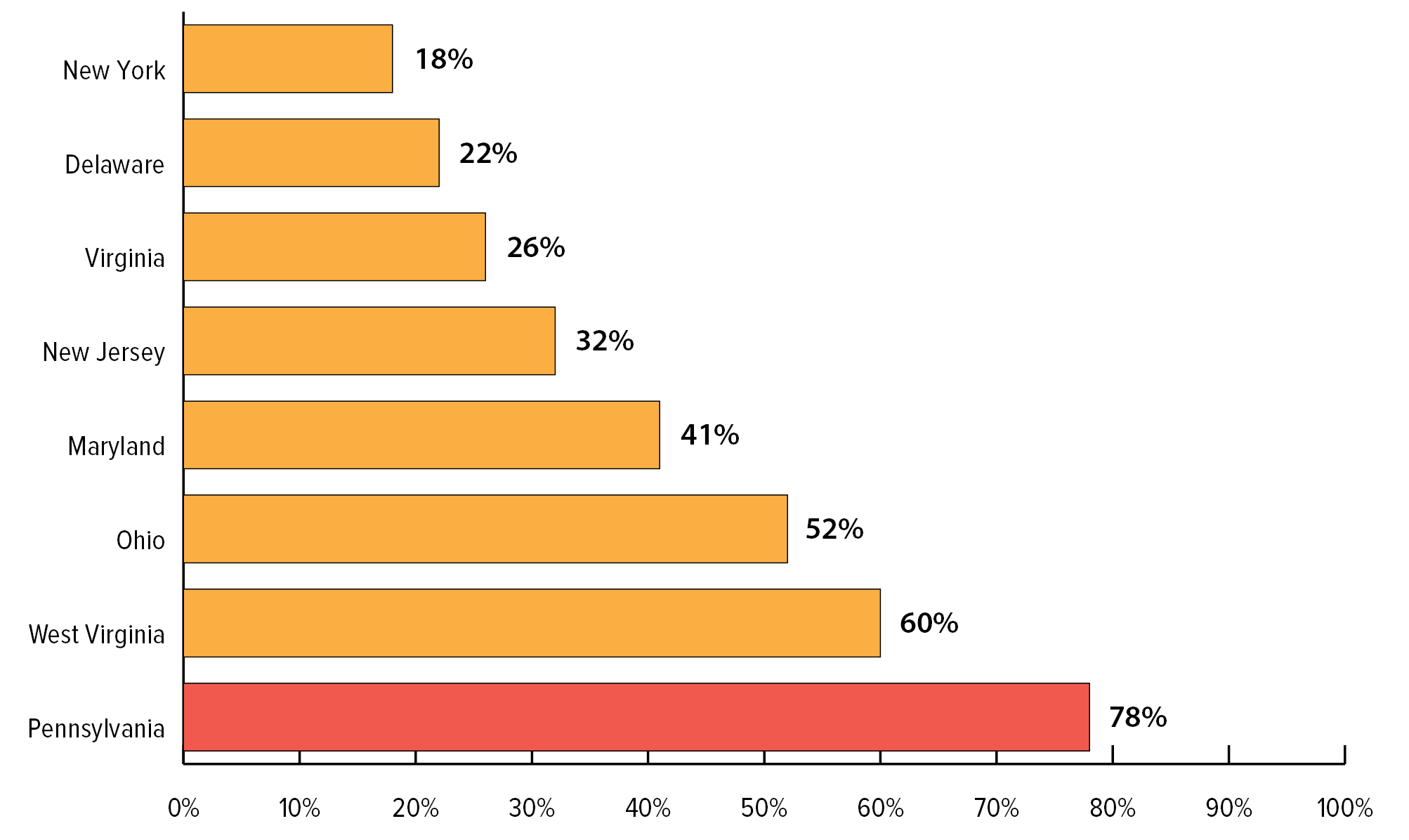

That puts pennsylvania just behind california (66.9) and illinois (59.56). Fuel tax is due on the last day of each month for the previous month.

Revenuepagov

According to the pennsylvania motor truck association, that could be a huge savings for truckers.

Tax per mile pa. Pennsylvania motorists are now paying 58.7 cents per gallon in state gas, on top of the federal gas tax of 18.4 cents per gallon. According to the american institute of petroleum, pennsylvania has the highest gas tax in the nation, at 77 cents per gallon. “charging two cents a mile, drive 10,000.

Pennsylvania’s tax on gasoline is 58.7 cents per gallon (75.2 for diesel fuel). A yearly average of 7,500 driving miles would cost $605.50 with a per mile cost. Pennsylvania has the highest tax on gas in the continental united states.

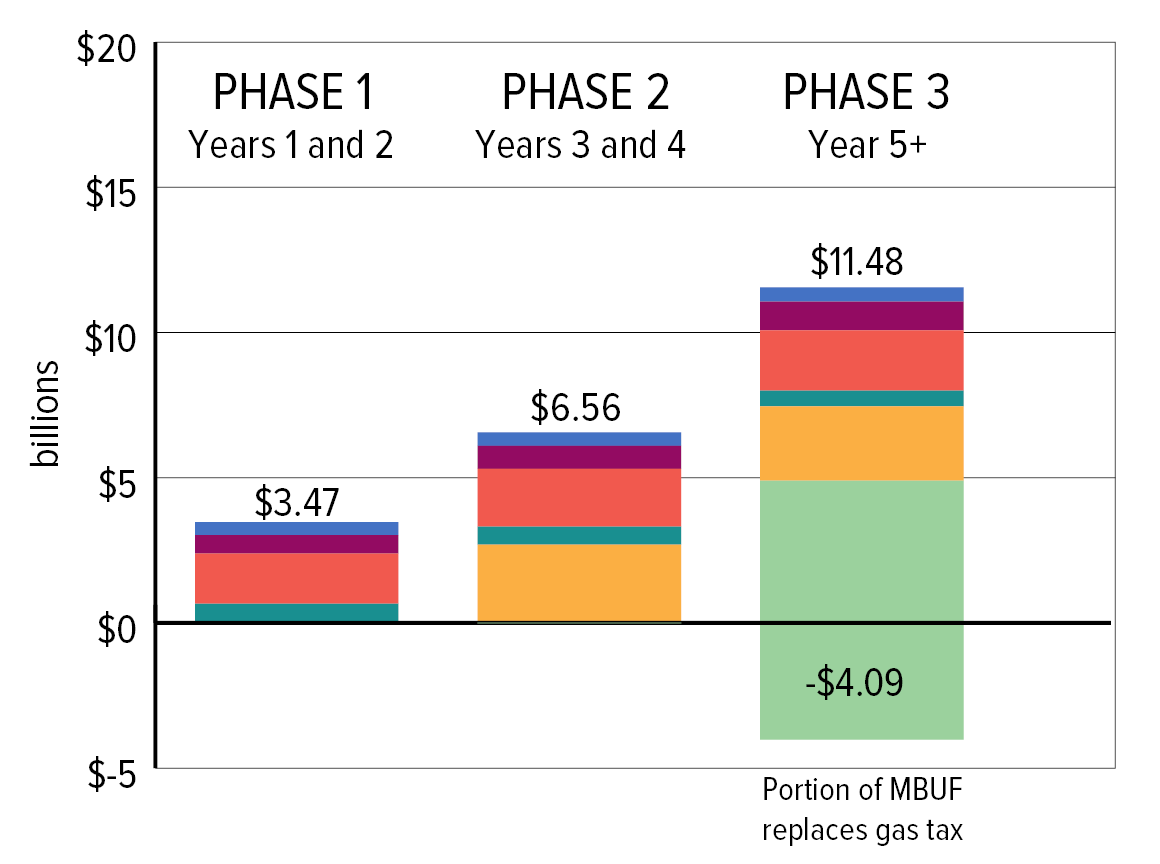

The eastern transportation coalition is advocating using a mileage counter on each vehicle. The commission proposes charging drivers 8.1 cents per mile for traveling on the roads in pennsylvania in five to 10 years, according to the final draft of the proposal. Those paying mileage tax receive credit on their bills for fuel taxes they pay at gas stations.

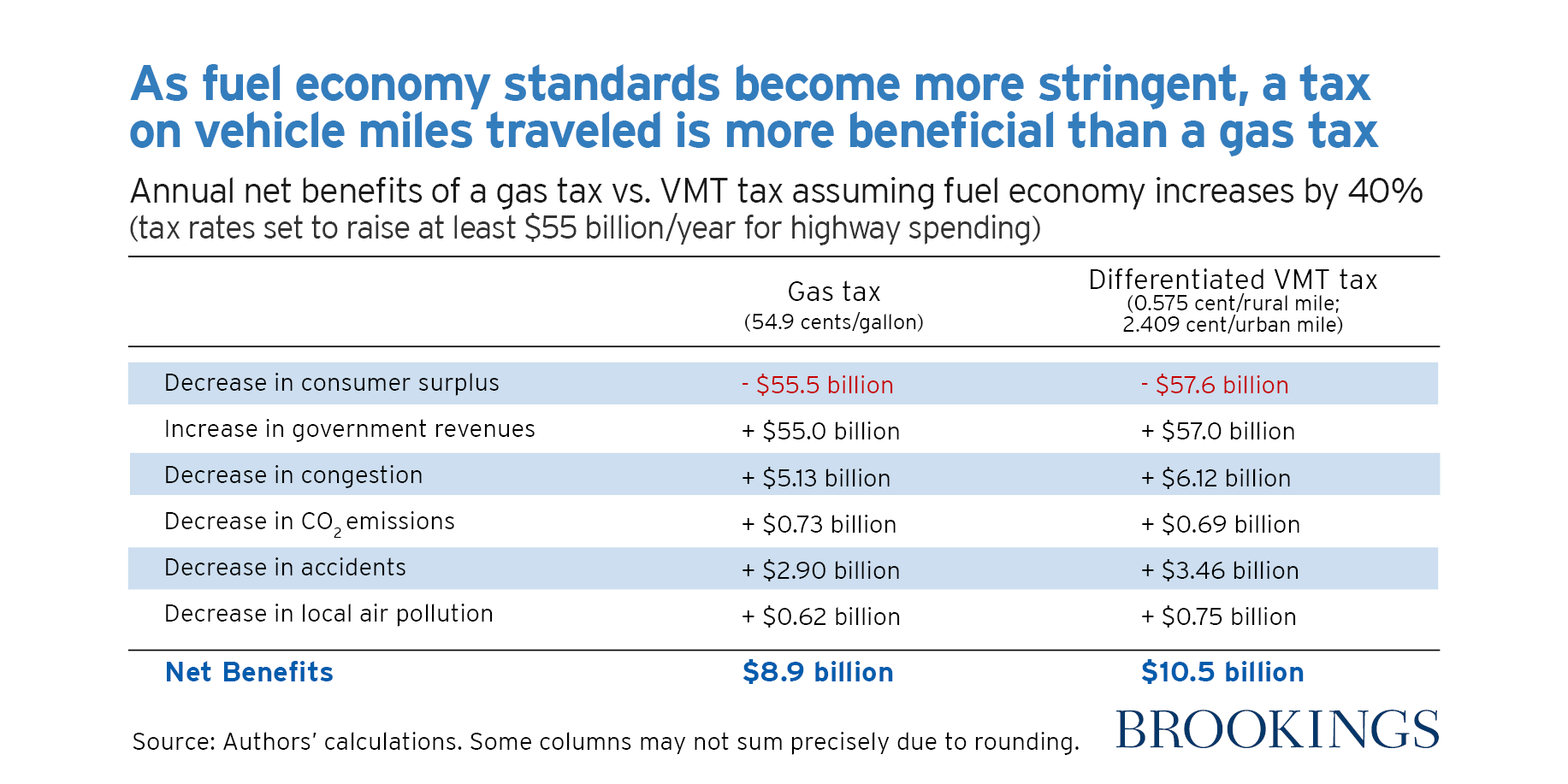

Taxpayers can log miles in various ways (handwritten logs, gps device or apps) the plans and rates in other states are still in the planning stages. A vmt tax would, if we assume a flat rate, need to be levied at 8 cents per mile to raise $8.4 billion. Pennsylvania — pennsylvania is one of 17 states considering replacing its gas taxes with a mileage fee.

Boesen noted that a proposal floated in pennsylvania suggests using a tax of 8.1 cents for each mile traveled, among other changes, and phasing out the state’s gas tax. Click the button below to view details on 0 pa fuel tax reports. This average fee would, as mentioned above, have to be adjusted based on weight per axle.

This tax may be as high as 8.1 cents per mile which is to compensate for lost revenue in fuel taxes. This will double state vehicle registration fees, sales tax increases on vehicle purchases, electric vehicle charges, and more. The rate is 1.5 cents per mile.

Additionally, motorists nationwide pay a federal excise tax of 18.4 cents per gallon of gasoline, a rate that has not changed since october of 1993. Fuel producers and vendors in pennsylvania have to pay fuel excise taxes, and are responsible for filing various fuel tax reports to the pennsylvania government. This is part of ap’s effort to address widely shared misinformation, including work with outside companies and organizations to add factual context to misleading content that is circulating.

Wolf has tasked his commission with a difficult job, but he is right to consider the future of transportation funding. But, the oregon program could be a framework for how other states. Boesen noted that a proposal floated in pennsylvania suggests using a tax of 8.1 cents for each mile traveled, among other changes, and phasing out the state’s gas tax.

Under the plan, motorists would pay 8.1 cents per mile of travel. A mileage tax around the 4.5 cents per mile and repealing the pa gasoline tax would still increase highway maintenance revenues and not be overly oppressive. A carnegie mellon university study of this fee found on average that most pennsylvanians drive around 10,000 miles each year and pay $200 in gas taxes.

Pa Commission Proposes Adding And Increasing Fees Axing Gas Tax To Fund Transportation Needs Pittsburgh Post-gazette

How Should The Government Tax Drivers To Maintain Roads Procon

States With Highest And Lowest Sales Tax Rates

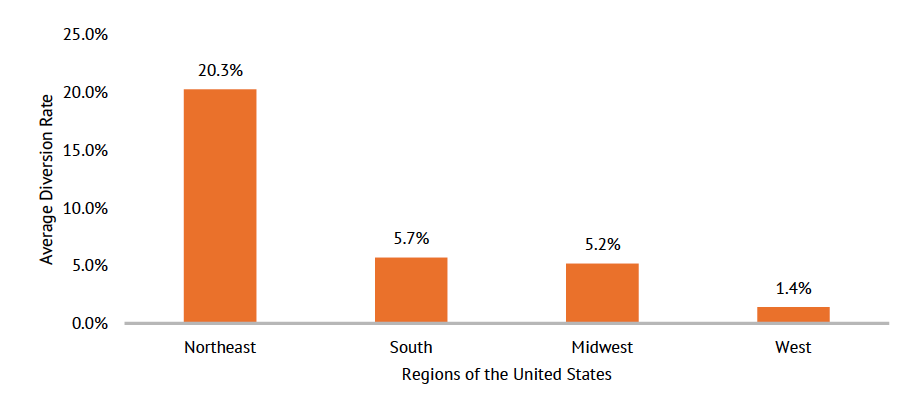

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

Report Transportation Revenue Options Commission

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

Highway And Road Expenditures Urban Institute

A Guide To Company Car Tax For Electric Cars - Clm

How Should The Government Tax Drivers To Maintain Roads Procon

Revenuepagov

19 Ltd Companies Directors Expenses You Should Claim 2021

Infrastructure Bill Proposes Voluntary Pilot Program For Per-mile Vehicle Fee Not Driving Tax - Factcheckorg

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Infrastructure Bill Proposes Voluntary Pilot Program For Per-mile Vehicle Fee Not Driving Tax - Factcheckorg

Us States With Highest Gas Tax 2021 Statista

Report Transportation Revenue Options Commission

Vehicle Miles Traveled Tax Vmt Legislation Update And Outlook - Dmgs

Pas Transportation Funding Pitch Faces A Rough Road Pittsburgh Post-gazette

Panel Says Pa Could Eliminate Gas Tax By Charging Drivers Fee Per Mile News Sharonheraldcom