Tax Shield Formula Excel

Mari kita perhatikan contoh perusahaan xyz ltd, yang bergerak dalam bisnis pembuatan karet sintetis. Lakukan pengiraan tax shield yang dinikmati oleh syarikat.

Download 10 Gst Invoice Templates In Excel - Exceldatapro Invoice Format Invoice Format In Excel Invoice Template

Tax shield = deduction x tax rate more free templates for more resources, check out our business templates library to download numerous free excel modeling, powerpoint presentation, and word document templates.

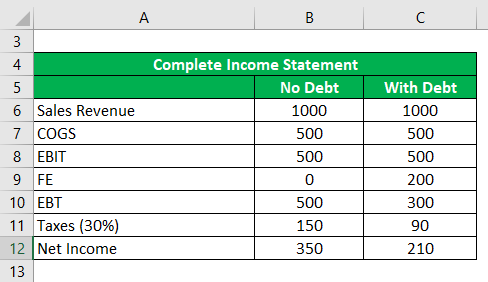

Tax shield formula excel. The effect of a tax shield can be determined using a formula. In the line for the initial cost. The precise relationship between levered beta βe and unlevered beta βu determines cost of equity capital r e and in the same time uniquely determines the value of tax shield e s.

Berikut adalah jumlah perbelanjaan yang boleh ditolak, oleh itu, pengiraan tax shield adalah seperti berikut, formula perisai cukai = ($ 10,000 + $ 18,000 + $ 2,000) * 40%; The chosen relationship or interdependent particular tax shield definition influences the value of an asset or npv in capital. The most important financing side effect is the interest tax shield (its).

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. How to calculate after tax salvage value.correction: Tax shield formula tax shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.

How to calculate tax shield due to depreciation. Interest tax shield formula = average debt * cost of debt * tax rate. C = net initial investment t = corporate tax rate k = discount rate or time value of money d = maximum rate of capital cost allowance 2.

Multiply your tax rate by the deductible expense to calculate the size of your tax shield. Can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest expense and depreciation expense in the case. For example, suppose you can depreciate the $30,000 backhoe by $1,500 a year for 20 years.

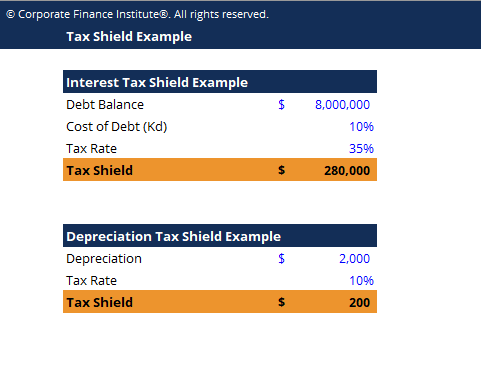

Modigliani formula for a tax shield. Interest tax shield = interest expense x tax rate This is simply to bring the pv of tax

Tax shield = deduction x tax rate examples of tax shield formula (with excel template) The difference in taxes represents the interest tax shield of company b, but we can also manually calculate it with the formula below: Where the effect of the tax shield can be determined by the formula as such:

Sesuai laporan laba rugi xyz ltd terbaru untuk tahun buku yang berakhir pada tanggal 31 maret 2018, tersedia informasi berikut. Interest tax shield = interest expense deduction x effective tax rate; To learn more, launch our free accounting and finance courses!

Tax shield = deduction x tax rate. The calculation of depreciation tax shield depreciation tax shield the depreciation tax shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. Present value of tax shield for amortizable assets present value of total tax shield from cca for a new asset acquired after november 20, 2018 𝐶𝑑𝑇1 +1.5𝑘 = ( ) (𝑑+𝑘) 1+𝑘 notation for above formula:

Interest tax shield = $4m x 21% = $840k For individuals.tax rate is primarily used for interest expense and depreciation expense in the case of a company. A tax shield is the future tax saving attribute of tax by determining the firm’s present value and helps to predict the deductibility of a particular expenditure in the profit & loss account.

About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.tax shield can be claimed for a charitable contribution, medical expenditure etc. The tax shield formula is simple:

In other words, y ou will lose $35,000 (which is salvage value, s) from the capital base. Interest tax shield formula the interest tax shield can be calculated by multiplying the interest amount by the tax rate. Berdasarkan maklumat tersebut, lakukan pengiraan perisai cukai yang dinikmati oleh syarikat.

This is usually the deduction multiplied by the tax rate.

Pin On Custom Essay Writing

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Example Template - Download Free Excel Template

Download 12 Month Cash Flow Statement Cash Flow Statement Flow Chart Template Cash Flow

Summary Of Transactions Tabular Analysis In Bangla Basic Accounting Analysis Accounting Basic

Tax Shield Formula Step By Step Calculation With Examples

Cash Flow After Deprecition And Tax - 2 Depreciation Tax Shield - Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculation - Wall Street Prep

How To Calculate Sales Tax In Excel

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Sales Tax In Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Pin On Solutions Manual

Free Donation Form Templates In Word Excel Pdf With Fundraising Pledge Card Template - 10 Professional T Donation Form Sponsorship Form Template Card Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example