Fremont Ca Sales Tax Calculator

The current total local sales tax rate in fremont, ca is 10.250%. Remember that zip code boundaries don't always match up with political boundaries (like fremont or newaygo county ), so you shouldn't always rely on something as imprecise as zip.

How To Use A California Car Sales Tax Calculator

The combined rate used in this calculator (8.25%) is the result of the california state rate (6%), the 94583's county rate (0.25%), and in some case, special rate (2%).

Fremont ca sales tax calculator. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. Mysql_fetch_array() expects parameter 1 to be resource, boolean given in /homepages/32/d512681860/htdocs/salestaxstates/pages_functions.php on line 51. Method to calculate fremont sales tax in 2021.

The county sales tax rate is 0.25%. The alameda county, california sales tax is 9.25%, consisting of 6.00% california state sales tax and 3.25% alameda county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 3.00% special district sales tax (used to fund transportation districts, local attractions, etc). California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated.

Fyi, on a $50,000 car, the fees in ventura county are $4,194 vs los angeles county where they are $5,321. That's the difference between the 7.25% sales tax vs. Try it now & grow your business!

The current total local sales tax rate in fremont, ne is 7.000%.the december 2020 total local sales tax rate was also 7.000%. Fremont, ne sales tax rate. The december 2020 total local sales tax rate was 9.250%.

The fremont sales tax rate is 0%. The minimum combined 2021 sales tax rate for fremont, california is 10.25%. With local taxes, the total sales tax rate is between 7.250% and 10.750%.

There is no city sale tax for fremont. For tax rates in other cities, see california sales taxes by city and county. The fremont, california, general sales tax rate is 6%.

Hereof, what is fremont tax? 101 rows how 2021 sales taxes are calculated for zip code 94538. As part of the mental health services act, this tax provides funding for mental health programs in the state.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. The average sales tax rate in california is 8.551%. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage.

The california sales tax rate is currently 6%. You can simply select one rate or multiple rate for a maximum total equivalent to the combined.simply press one rate and then press and maintain alt + select the other rate(s). The sales tax rate is always 9.25% every 2020 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (3%.

There is no applicable city tax. The 94583, san ramon, california, general sales tax rate is 8.25%. Calculation of the general sales taxes of 94555, fremont, california for 2021.

The 10.25% sales tax rate in fremont consists of 6% california state sales tax, 0.25% alameda county sales tax and 4% special tax. Use the dmv calculator above. Create your own online store and start selling today.

California (ca) sales tax rates by city (f) the state sales tax rate in california is 7.250%. Technically, tax brackets end at 12.3% and there is a 1% tax on personal income over $1 million. The fremont, michigan sales tax rate of 6% applies to the following two zip codes:

Look up the current sales and use tax rate by address Create your own online store and start selling today. The alameda county sales tax is collected by the merchant on all qualifying sales made within.

The fremont, california, general sales tax rate is 6%.the sales tax rate is always 9.25% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (3%). The california sales tax rate is currently 6%. The fremont county, wyoming sales tax is 5.00%, consisting of 4.00% wyoming state sales tax and 1.00% fremont county local sales taxes.the local sales tax consists of a 1.00% county sales tax.

The fremont county sales tax is collected by the merchant on all qualifying sales made within fremont county; In all, there are 10 official income tax brackets in california, with rates ranging from as low as 1% up to 13.3%. How 2021 sales taxes are calculated for zip code 94583.

This is the total of state, county and city sales tax rates. Groceries are exempt from the fremont county and wyoming state sales taxes Try it now & grow your business!

There are approximately 9,387 people living in the fremont area. How 2021 sales taxes are calculated in fremont. You can print a 10.25% sales tax table here.

, ca sales tax rate.

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Mka7r8ijnvvd2m

Property Tax Calculator

Calculate Import Duties Taxes To United States Easyship

Food And Sales Tax 2020 In California Heather

Missouri Sales Tax Rates By City County 2021

California Sales Tax Rates By City County 2021

Wyoming Sales And Use Tax Rates Lookup By City Zip2tax Llc

Nebraska Sales Tax - Small Business Guide Truic

Food And Sales Tax 2020 In California Heather

Mka7r8ijnvvd2m

How Much Is A 160000year Salary After Taxes In California - Quora

How To Calculate Cannabis Taxes At Your Dispensary

Wyoming Income Tax Calculator - Smartasset

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Colorado Sales Tax Rates By City County 2021

How To Calculate Cannabis Taxes At Your Dispensary

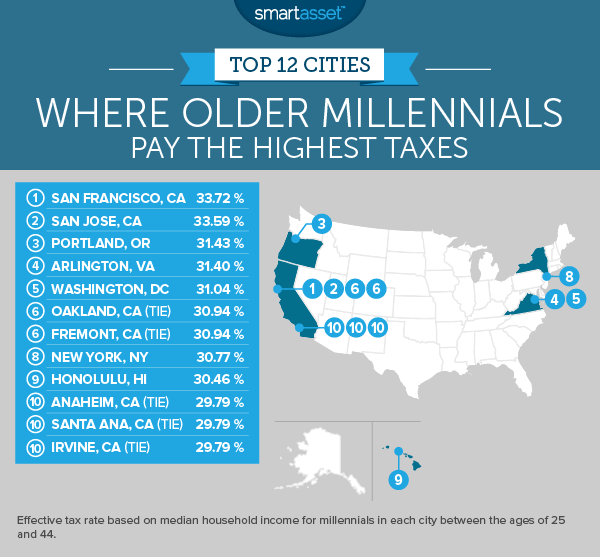

Where Millennials Pay The Highest Taxes - 2017 Edition - Smartasset

Food And Sales Tax 2020 In California Heather