Jersey City Property Tax Online Payment

Ach direct debits do not incur a fee. Click here to make your tax payments online.

City Of Jersey City Jerseycity Twitter

A fee of 2.95% will be applied for all credit card and debit card transactions.

Jersey city property tax online payment. Website disclaimer| government websites by civicplus ®. Landlord license payments can be made via check or money order to: This resolution extends the grace period for the may 2020 property tax quarter.

Click here to view the service fees. Box 2025 jersey city nj 07303. A fee of $1.95 will be charged for payments made via electronic check.

Post mark dates are not acceptable per new jersey statutes. You may make your payment in person or by mail. Recycling & garbage collection view schedule & more;

Click here to visit the site. Housing & social services assistance in referrals & resources; Each quarterly payment has a ten day grace period that includes the due date.

Look up property assessments / tax assessment post cards. You can access your property tax information and payment status online. Please call the tax office if your payment is overdue, interest accrues daily.

There is a fee charged by the service providers. You can pay your jersey city property taxes using one of the following methods: Pay online, no registration required.

To see all personnel at the tax collector’s office, click here. City of jersey city p.o. To proceed with your online payment to the city, please click on the appropriate payment link.

City of jersey city p.o. There are two programs offered by state of new jersey: 51 rows jersey city, nj 07302 deductions:

Simply go to www.ci.orange.nj.us, click on the online bill pay button, and fill in the required information on the webpage to make a payment. With any questions, please contact the tax collector’s office. Annual year income statement for qualifying seniors (pd 65)

Public library access website for online resources; The township does not receive or store account or card numbers. Request for 200’ property owners list & miscellaneous payments.

Parking commuter & residential parking; This useful tool provides a user friendly description of what: Harborside marina reserve marina slips;

This web based service allows residents of the city to inquire about their property taxes and to pay their bills safely online: Interest is calculated at 8% for balances up to $1500.00 and 18% for delinquencies over $1500.00. Property tax reimbursement (senior freeze):

Payments pay a ticket, water bill & taxes; 8 springfield avenue cranford, nj 07016. If you are mailing your payments, please note that payments are processed based on the date received.

Welcome to our easy online tool to find out more information about paying various fees, taxes and/or fines. Department of inspections 319 e state street trenton, nj 08608 Documents required, prices associated, qualifications, approval process and other relevant data.

Recreation for children, youth & adults Instructions on how to appeal your property value. Official website of cranford new jersey.

Coronavirus Jersey City - Cases Updates And More December 2021 - Jersey City Upfront

Township Of Teaneck New Jersey - Tax Collector

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

![]()

Once A Modern Marvel Beacon Of Jersey City Sold After Hitting Rough Times - Njcom

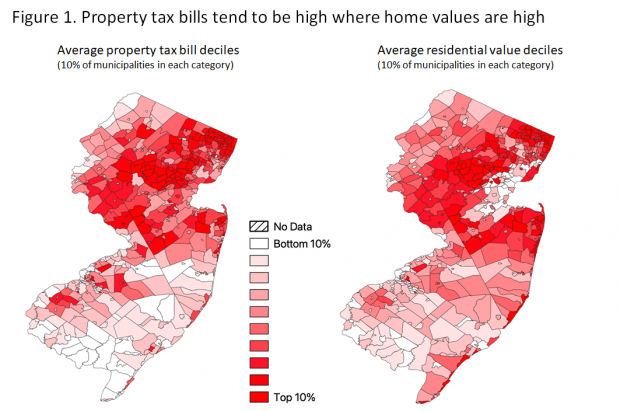

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Mayor Fulop Expands Covid Rental Assistance - City Of Jersey City

2

City Of Jersey City Online Payment System

Pavonia Branch - Jersey City Free Public Library

2

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Tax Assessor Paterson New Jersey

City Of Cape May Nj - Home

New Jersey Companies Education Workforce Profile Choose Nj

Liberty State Park Advocates Backlash Over Budget Language May Help Case For Protection

Why Do New Jersey Residents Pay The Highest Taxes - Mansion Global

2

Jersey Citys Property Tax Rate Finalized At 148 Jersey Digs

New Jersey State Taxes Forbes Advisor