Colorado Estate Tax Exemption 2021

Notably, the elimination of the. Application for property tax exemption.

2020 Estate Planning Update

For coloradans with an estate plan in place, this may affect them.

Colorado estate tax exemption 2021. However, colorado residents still need to understand federal estate tax laws. 2021 colorado state salary comparison calculator; Section 3 of the bill lowers the maximum amount to $0 for all property tax years beginning on and after january 1, 2020, which has the.

The exemption is, in fact, indexed annually for inflation, so it does increase over time. The district of columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to 11.2 percent. When it comes to federal tax law, unless an estate is worth more than $5,450,000, no estate tax is collected.

The federal estate tax exemption for 2021 is $11,700,000.00, an increase of $120,000.00 from 2020. The exemption is subtracted from the value of estate assets, with the result being subject to the estate. For 2021, the federal estate, gift and gst applicable exclusion amounts are $11.7 million.

The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023. Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately eliminated it, effectively eliminating the colorado estate tax for individuals who die after december 31, 2004. Among the tactics being discussed are a considerable reduction in the 2022 federal gift and estate tax exemption, currently estimated to be worth $12 million per person, and increased tax rates on.

Fifty percent of the first $200,000 in actual property value is exempt from property taxation. Senator sanders’ bill aims to reduce the estate tax exemption from $11,700,000 to $3,500,000. The maximum rate for federal estate, gift and gst taxes is 40 percent.

This is per irs’s basic exemption of $5 million indexed for inflation in 2017. Note, however, that the estate tax is only applied when assets exceed a given threshold. Seniors and/or surviving spouses who qualify for the property tax exemption must submit an application to their county assessors between january 1st and july 15th of the year you qualify.

The state is required to reimburse local governments for the lost revenue as a result of the increased exemption. Federal estate taxes only apply to individuals with estates valued at over $11.7 million (the current estate tax exemption amount), or $23.4 million for married couples in 2021. For 2022, the federal estate, gift and gst applicable exclusion amounts will be $12.06 million.

Then, the gift and estate tax exemption is lowered from $11.7 million to $6 million with the gift and estate tax rate increased from 40% to 45%, all effective january 1, 2022. For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020). Married couples can exempt up to $23.16 million.

2021 colorado state sales tax rates the list below details the localities in colorado with differing sales tax rates, click on the location to access a supporting sales tax calculator. This means that when you pass away, the value of your estate is calculated and any. The exemption is adjusted for inflation thereafter.

Us citizen unlimited marital spouse: From 2023 through 2025, the state credit would go up to 25% before reverting back to 20% in 2026. However, not many states have an estate tax.

3 if federal law is changed to reinstate the state death tax credit, a colorado estate tax may be collected on estates in future years. The act increases the exemption for business personal property tax from $7,700 to $50,000 for tax years beginning jan. Assets that spouses inherit are not subject to federal estate tax.

The irs also does not collect an. There is no estate or inheritance tax collected by the state. As of 2021, the federal estate tax exemption is $11.4 million.

For 2021, this amount is $11.7 million (or $23.4 million for married couples). Only the very wealthy have to worry about estate taxes, though the right estate planning lawyer can help those who might be taxed plan ahead to minimize or eliminate their estate tax liability. No estate tax or inheritance tax connecticut:

2021 colorado state salary examples; Funding colorado’s child tax credit for the first time for single filers making less than $75,000 and joint filers making less than $85,000 The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold:

Expanding colorado’s earned income tax credit to 20% of the federal eitc, up from 15%, starting in 2022. The state of colorado, for example, does not levy its own estate tax. The state constitution authorizes the general assembly to lower the maximum amount of the actual residential value of residential real property that is subject to the senior property tax exemption (exemption).

If the decedent’s taxable estate exceeds this amount, the excess will be taxed at a flat rate of 40%. The exemption for married couples can total $23,400,000.00 because of the “portability” option which can be used at the first death […] Us resident (green card holder) to:

The annual gift exemption is $15,000. Estate tax can be applied at both the federal and state level. While this bill has not been passed yet, it is important for coloradans to contact their estate planning attorneys and get ahead of the curve in case it does.

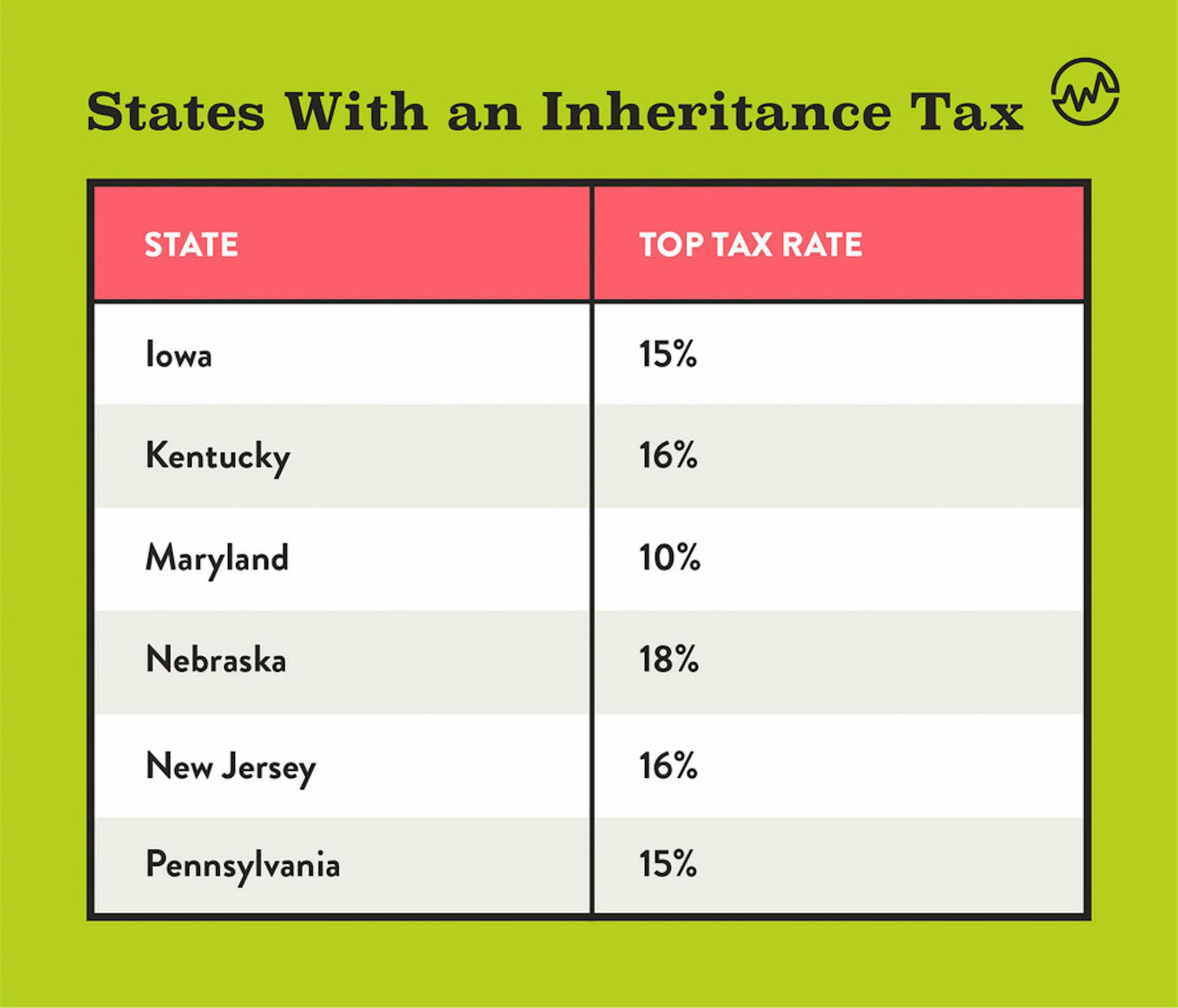

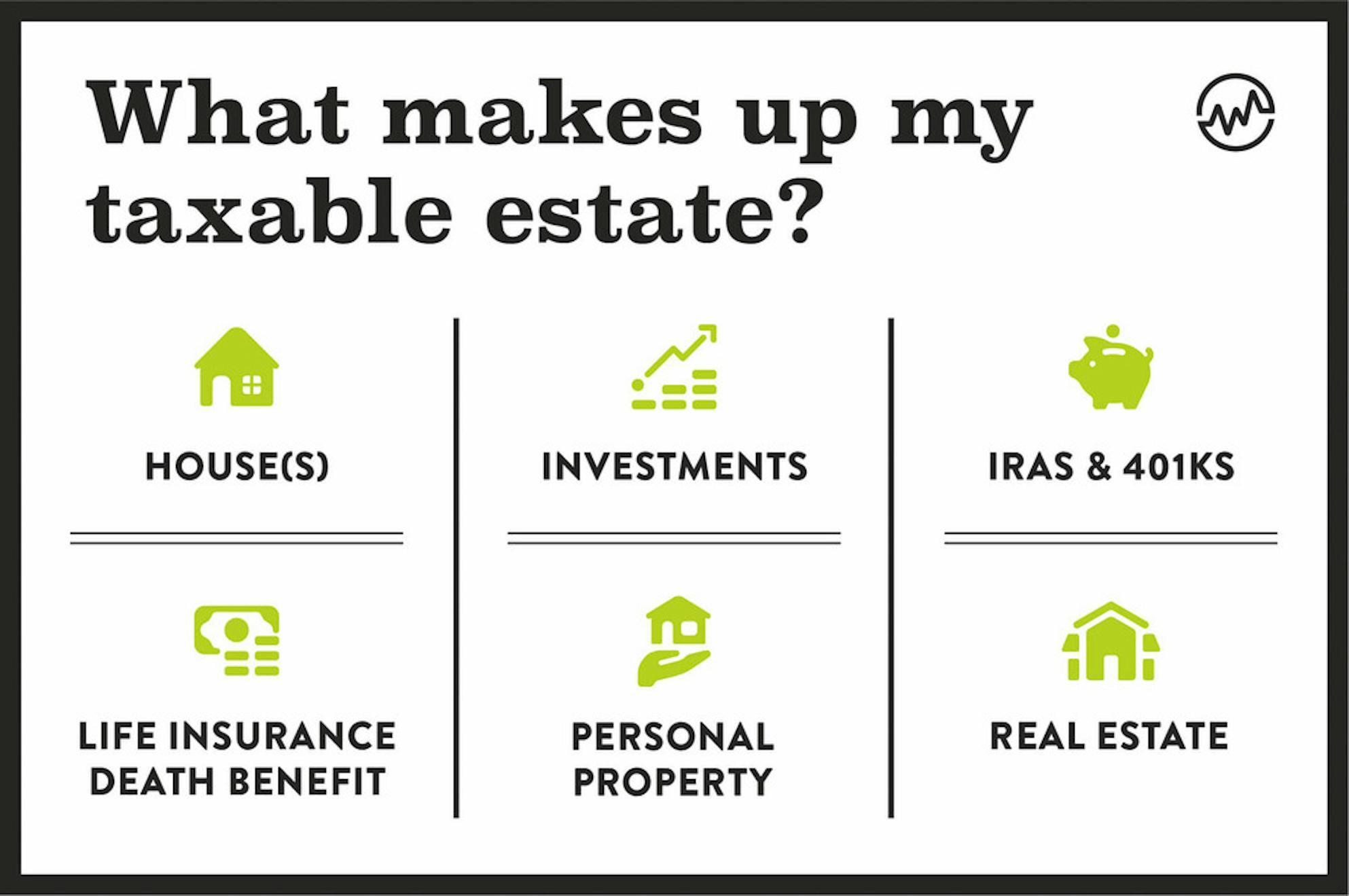

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

How To Avoid Estate Taxes With A Trust

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Colorado Estate Tax Do I Need To Worry - Brestel Bucar

Recent Changes To Estate Tax Law Whats New For 2019

Colorado Estate Tax Do I Need To Worry - Brestel Bucar

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax Exemption 2021 - Amount Goes Up Union Bank

A New Era In Death And Estate Taxes

Recent Changes To Estate Tax Law Whats New For 2019

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A New Era In Death And Estate Taxes

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

House Estate Tax Proposal Requires Immediate Action

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wyoming Tax Benefits - Jackson Hole Real Estate - Ken Gangwer