Nebraska Car Sales Tax Form

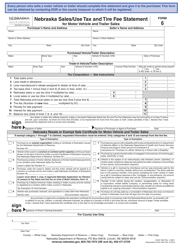

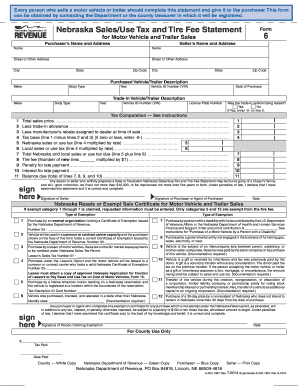

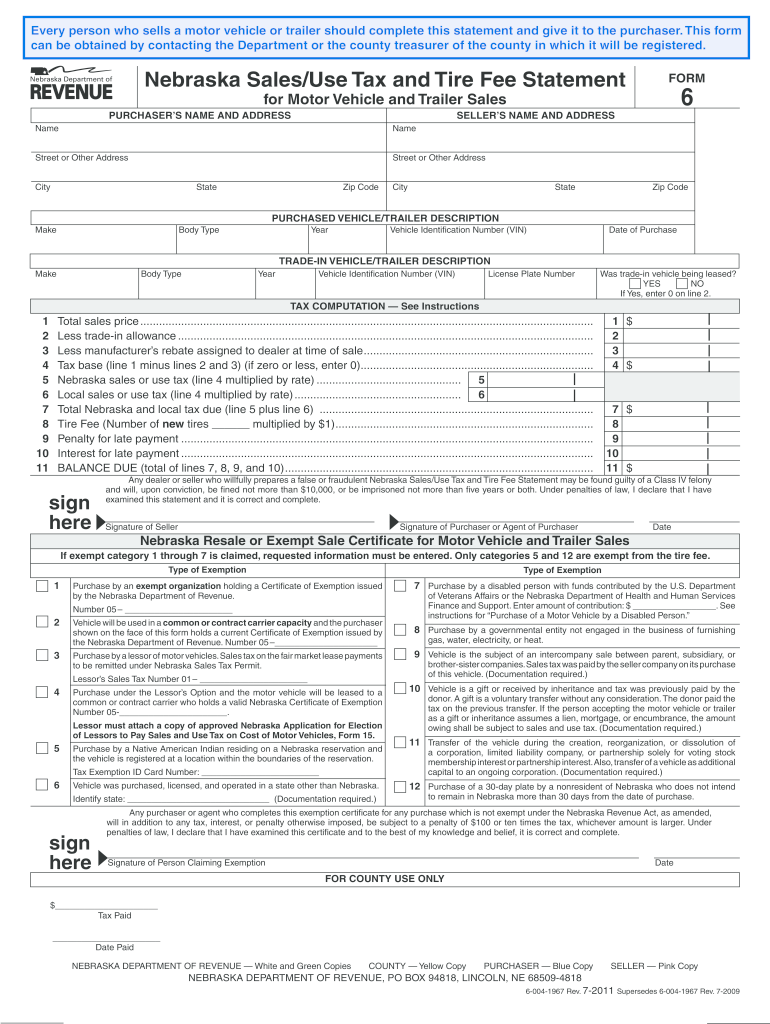

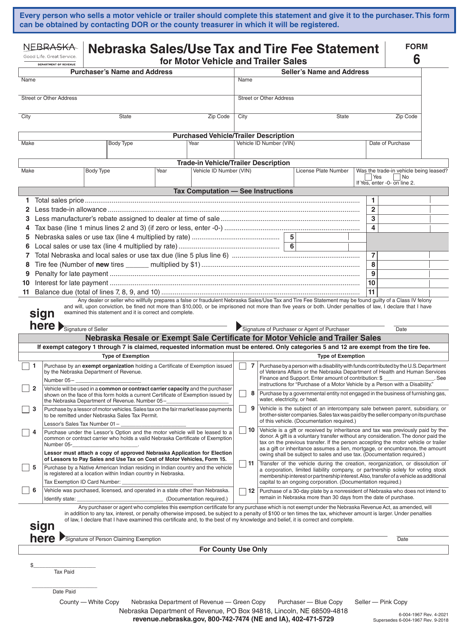

Form 6mb, nebraska sales and use tax statement for motorboat sales; A form 6 is the nebraska sales tax and use form.

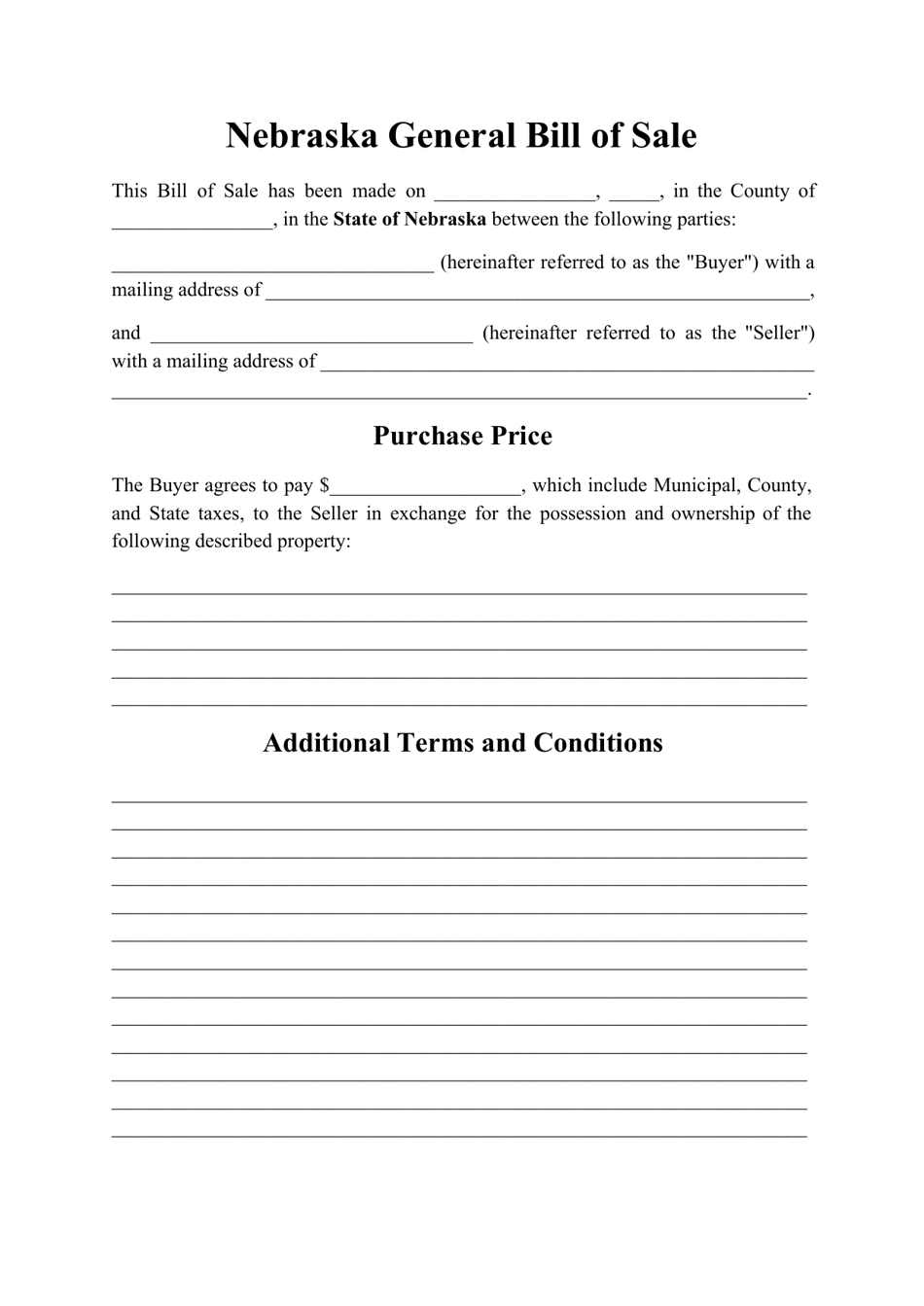

23 Printable Bill Of Sale - Nebraska Dmv Forms And Templates - Fillable Samples In Pdf Word To Download Pdffiller

If you purchase something from a licensed nebraska dealer they are required by the state to provide you with this form so that you can register your vehicle in whatever county you reside.

Nebraska car sales tax form. Notification to permitholders of changes in local sales and use tax rates effective january 1, 2022. The library is open by appointment only at 9:00 a.m. You can find these fees further down on the page.

Food and ingredients that are generally for. Or form 6xmb, amended nebraska sales and use tax statement for motorboat sales. In addition to taxes, car purchases in nebraska may be subject to other fees like registration, title, and plate fees.

Dakota county levies an additional 0.5% county sales tax. If the tax district is not in a city or village 40% is allocated to the county and; Nebraska has a state sales and use tax of 5.5%.

How to obtain a permit. The nebraska state sales and use tax rate is 5.5% (.055). The lessor must collect and remit the nebraska and local sales tax on the recurring periodic payments at the primary property location of the lessee in nebraska.

Must be ordered from the nebraska department of revenue. Any retailer filing monthly returns and engaged in business at more than one location selling property or providing services subject to sales and use tax may make application to file a combined monthly nebraska and local sales and use tax return, form 10. (if you are familiar with the location of the courthouse, the library is across the street to the south.

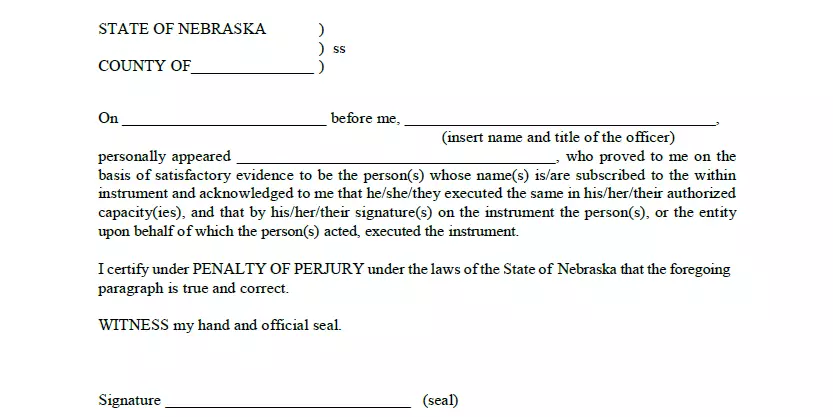

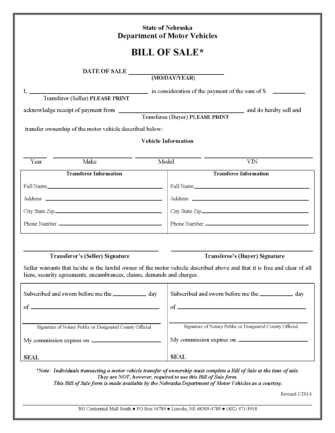

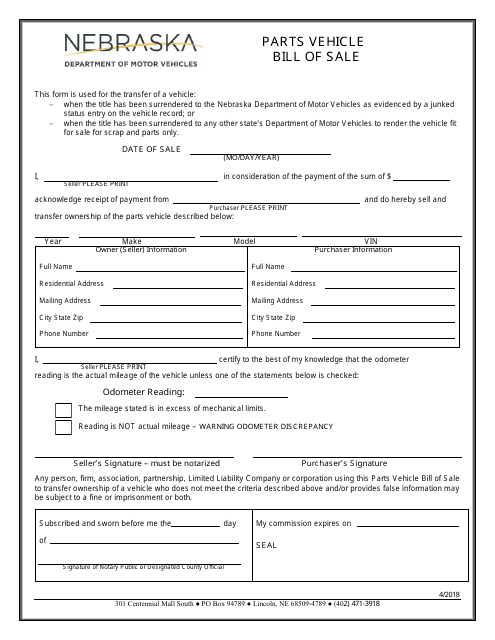

The state does not require a bill of sale , but does allow its official use in certain circumstances related to transferring the title on a vehicle. The 2021 annual tax sale is monday, march 1, 2021. Nebraska sales tax permit and must file a nebraska and local sales and use tax return, form 10, on or before the due date.

Or (ii) in lieu of a copy of the permit, obtain the following: And (ii) the name and address of the purchaser; (i) a copy of the purchaser’s sales tax permit;

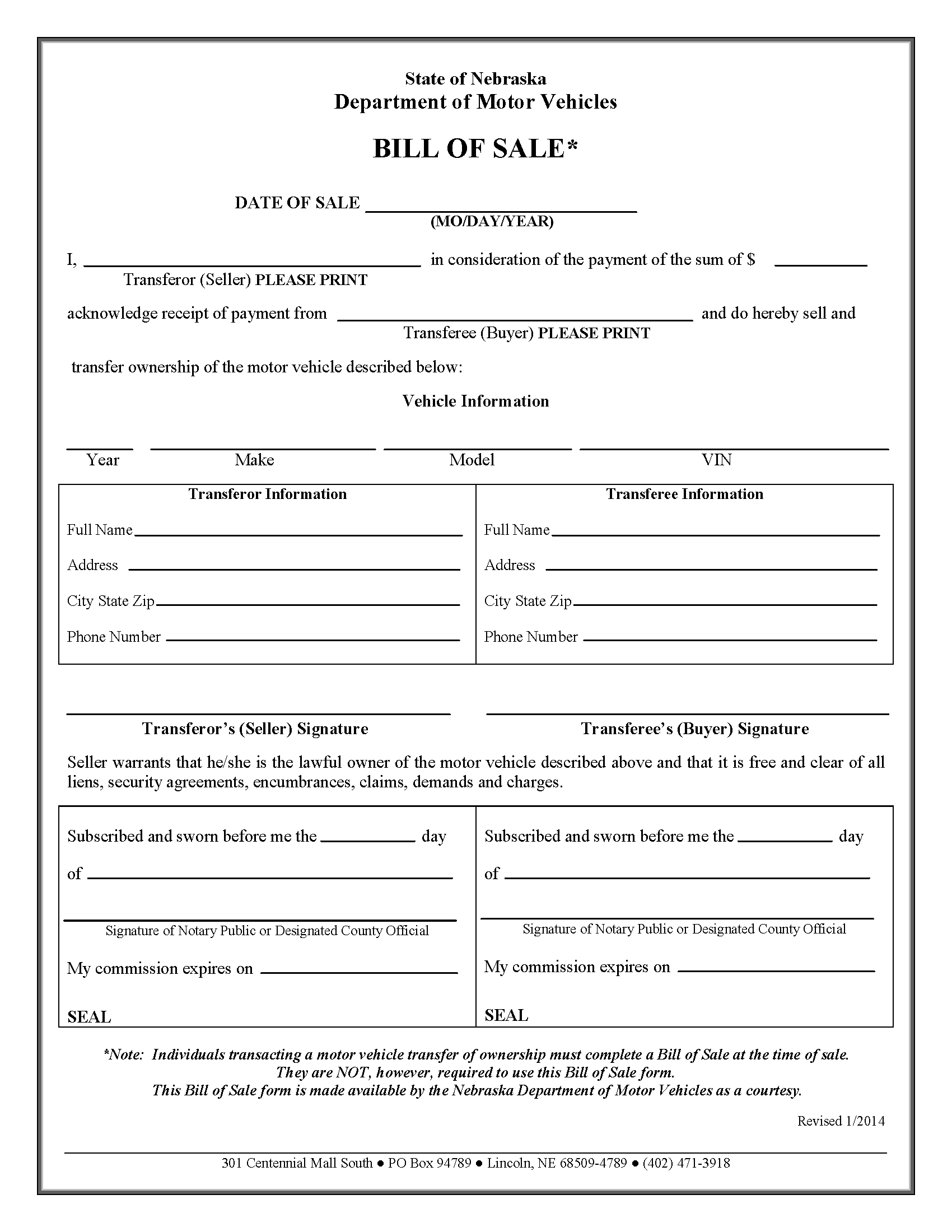

You must complete a nebraska tax application, form 20 , to apply for a sales tax permit. Hastings public library (2nd floor) 314 n. Bill of sale* date of sale (mo/day/year) i, in consideration of the payment of the sum of $ transferor (seller) please print.

Retailers should only report nebraska sales on this return. As a courtesy, the nebraska department of motor vehicles has created a bill of sale form that you may use for your motor vehicle transactions. B) a statement that the purchaser is engaged in.

The county, purchaser, and seller must keep a copy of the signed form 6. Form 1040n is the general income tax return for nebraska residents. In addition to the state tax, some nebraska cities assess a city sales and use tax, in 0.5% increments, up to a maximum of 1.5%.

You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of revenue. A) sales tax permit information may consist of: 002.09 persons who are not required to hold a sales tax permit, but who are liable for use tax, must

Purchasing agent appointment and delegation of authority for sales and use tax, form 17, i hereby certify that purchases of building materials, and fixtures are exempt from nebraska sales tax. Sales/use tax and tire fee statement for motor vehicle and trailer sales submit this form to disclose the amount of sales tax and tire fees paid on a vehicle or trailer you purchased. 18% is allocated to the city or village, except that:

The states with the highest car sales tax rates are: After the application has been processed, you will receive your nebraska sales tax id number printed on the. There are no changes to local sales and use tax rates that are effective january 1, 2022.

Nebraska resale or exempt sale certificate for motor vehicle and trailer sales. Nebraska collects a 5.5% state sales tax rate on the purchase of all vehicles. Unfortunately, if you live close to a state with a lower or no car sales tax, such as if you live near delaware, you cannot buy a car in that state to avoid sales tax.

Form 6xn, amended nebraska sales/use tax and tire fee statement for motor vehicle and trailer sales; (i) sales tax permit number; Each sales location must hold a sales tax permit, and all licensed locations must be subject to common ownership (the same person or persons.

Nebraska department of revenue form 6 is not available for download from the department of motor vehicles website. The nebraska dmv bill of sale is a form to be used when selling a vehicle to another person in return for trade or monetary funds. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:

In counties containing a city of the metropolitan class, 18% is allocated to the county and 22% to the city or village. 002.08 persons holding a sales tax permit may report and pay all use tax due on the nebraska and local sales and use tax return, form 10, or a nebraska and local business use tax return, form 2.

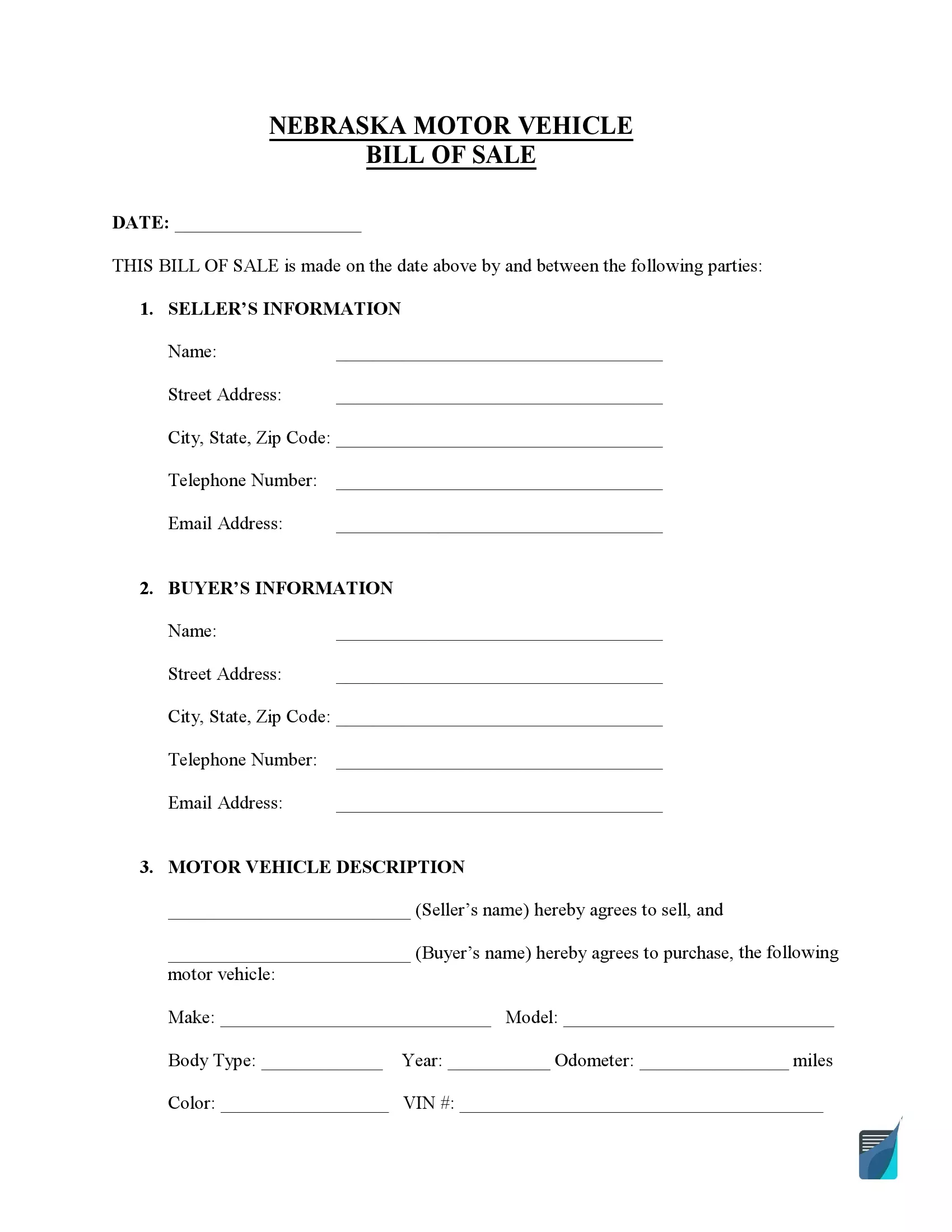

Free Nebraska Motor Vehicle Bill Of Sale Form - Pdf Word

How To Get A Resale Certificate In Nebraska - Startingyourbusinesscom

Form 6 Download Printable Pdf Or Fill Online Nebraska Salesuse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Vehicle And Boat Registration Renewal Nebraska Dmv

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

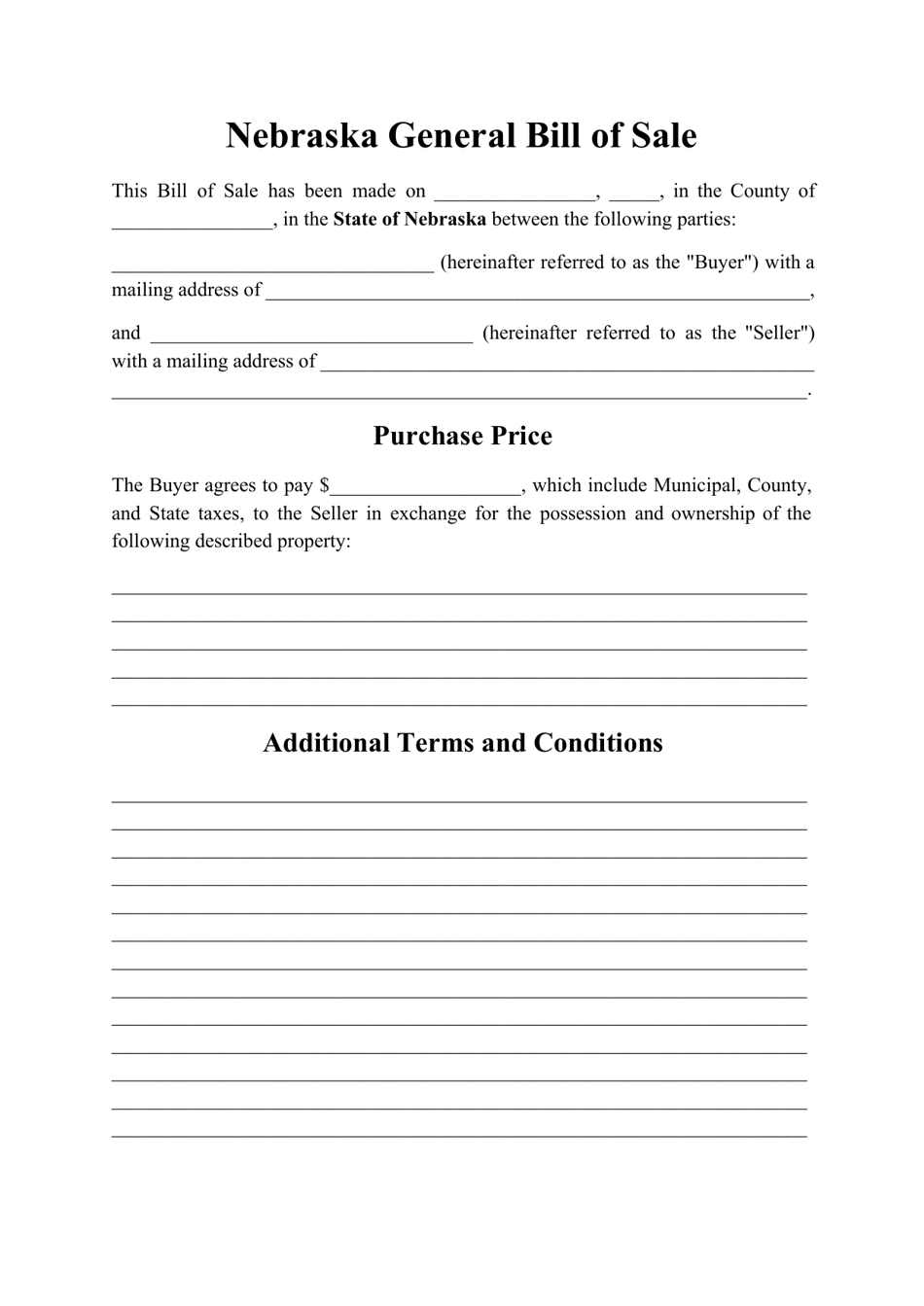

Nebraska Generic Bill Of Sale Download Printable Pdf Templateroller

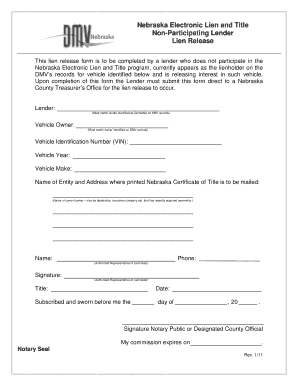

Nebraska Lien Release - Fill Online Printable Fillable Blank Pdffiller

2018-2021 Ne Dor Form 6 Fill Online Printable Fillable Blank - Pdffiller

Free Nebraska Vehicle Bill Of Sale Form Pdf Formspal

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Nebraska Form 6 - Fill Out And Sign Printable Pdf Template Signnow

Nebraska Bill Of Sale - Fill Out And Sign Printable Pdf Template Signnow

2018-2021 Ne Dor Form 6 Fill Online Printable Fillable Blank - Pdffiller

Free Nebraska Motor Vehicle Bill Of Sale Form - Pdf Word

Form 6 Download Printable Pdf Or Fill Online Nebraska Salesuse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Free Nebraska Vehicle Bill Of Sale Form Pdf Formspal

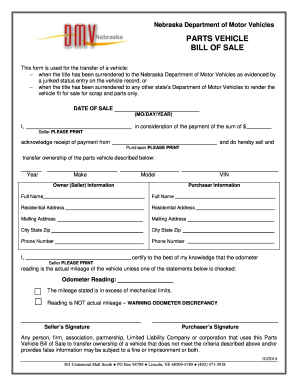

Nebraska Parts Vehicle Bill Of Sale Download Fillable Pdf Templateroller

Form 6 Download Printable Pdf Or Fill Online Nebraska Salesuse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller