California Mileage Tax Bill

But opponents are concerned the legislation is laying the groundwork. Could be revenue generating for service companies.

Did The House Vote On The Infrastructure Bill 9newscom

California is the second state to test mileage fees in recent years, joining oregon, which launched a pilot program of its own in 2014.

California mileage tax bill. Install a mileage recorder or do like what they do with kelly’s blue book. The money so collected is used for the repair and maintenance of roads and highways in the state. When business raise prices on goods to cover the cost of a mileage tax the state collects more sales tax revenue.

If california adds on another mileage tax, more of the middle class will leave and the rest will drive less. The california mileage tax proposal would require tracking every driver’s mileage and charging them four cents per mile they drive. California’s annual gas tax collection has fallen since 2006 by 7.1 percent from $2.8 billion to $2.6 billion, because the average miles driven by state residents fell by 8.3 percent, from 13,300 to 12,200, during the same period.

The bill would require that the pilot program not affect funding levels for a program or purpose supported by state fuel tax and electric vehicle fee revenues. California has announced its intention to overhaul its gas tax system. Tags gas tax highway bill vehicle miles traveled tax fuel.

California has funded its state and local roads with a gas tax since 1923. Gavin newsom has signed into law a bill to extend the state’s mileage tax pilot program. Under the $ 163 billion plan, drivers will be charged a few cents for every mile they drive locally as a way to fund road and transportation improvements.

A new bill going through sacramento would tax drivers for every mile they are on the road. Since 2015, the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Those that are driving electric cars, which the government is pushing, will no longer be skirting road taxes you will.

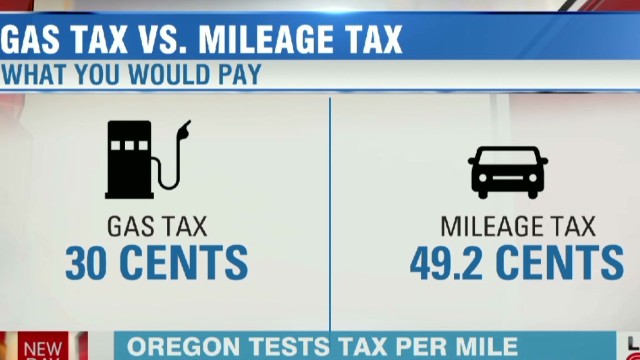

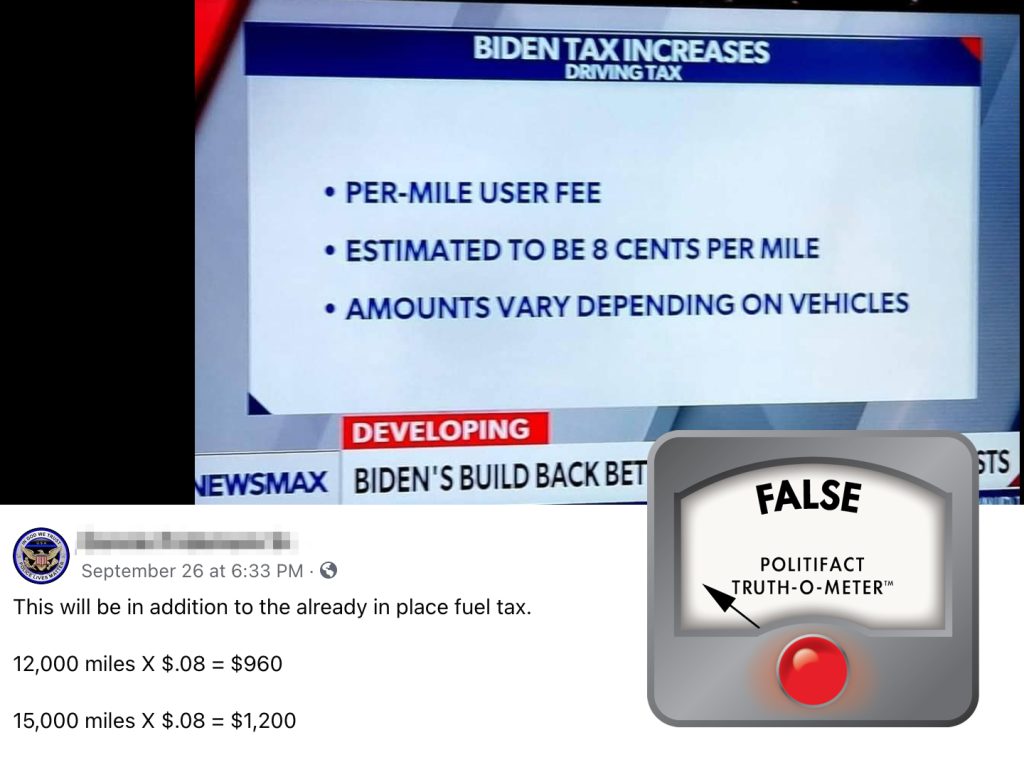

The state gasoline tax of 52.9 cents per gallon could be replaced with a miles driven fee of $0.05. Users are expressing concerns about the cost of driving and incorrectly stating that it would cost drivers 8 cents a mile, per a usa today story. Look up the table with average mileage data for year and make of model, maybe adjust for condition and region of the county, goose the numbers ten percent, and bill accordingly like the auto excise tax.

Traditionally states have been levying a gas tax. Gavin newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases. The newest 3.5 trillion dollar infrastructure bill includes a “by the mile tax”.

But that state tax, now 36 cents a gallon, hasn’t been increased since 1994 due to political opposition. California expands road mileage tax pilot program traffic flows past construction work on eastbound highway 50 in sacramento, california. This means that they levy a tax on every gallon of fuel sold.

Service vehicles will charge based on mileage from their office to your location. The california road charge pilot program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. In 2022 and 2028, a tax of 4 cents per mile and two half cents of local excise tax are planned.

If actual mileage is lower, get the mileage gismo installed. This is accomplished by more taxation and other user fees. Instead of paying at the pump when purchasing fuel, a mileage tax system determines a driver’s vehicle miles.

The california legislature passed a bill extending a road usage charge pilot program.

San Diego Driving Tax Locals Torn Over Per-mile Road Usage Tax Discussed By Sandag

Californias Road Usage Charge Pilot Program Stirs Controversy - The Coast News Group

Could You Be Taxed Per Mile - Cnn Video

Vehicle Miles Traveled Tax Proposed

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeaglecom

How Should The Government Tax Drivers To Maintain Roads Procon

Town Hall Organized To Fight Against Sandags Mileage Tax Hikes Cbs8com

How To Pay Your Taxes With A Credit Card In 2021 Forbes Advisor

What Are The Mileage Deduction Rules Hr Block

Secured Property Taxes Treasurer Tax Collector

Politifact Biden Infrastructure Plan Wouldnt Establish A Per-mile Driving Tax Nbc 6 South Florida

Us California Exploring Vehicle-miles-traveled User Fee To Replace Gas Tax

Town Hall Organized To Fight Against Sandags Mileage Tax Hikes Cbs8com

Proposed Sandag Plan Will Charge San Diegans For Every Mile Traveled Increase Sales Tax -

Sandags Proposed Road Charge Would Piggyback On Californias Plans For A Per-mile Driver Fee - The San Diego Union-tribune

Sandag Considers Mileage Tax For San Diego Drivers Nbc 7 San Diego

Oregonlegislaturegov

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Us California Exploring Vehicle-miles-traveled User Fee To Replace Gas Tax