Yellen Retroactive Capital Gains Tax

Still another would make the change to capital gains tax retroactive, with a start date of april 2021. Treasury secretary janet yellen told cnn’s jake tapper on sunday that senate democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest americans.

Oaktrees Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Treasury secretary janet yellen suggested in remarks before a senate panel that if congress were to pass a capital.

Yellen retroactive capital gains tax. With everything else uncertain, those who have had or could potentially gain even marginally above that threshold in 2021—including. Yellen argues capital gains hike from april 2021 not retroactive. Yellen made the remarks in response to a question from tapper about whether a wealth tax should be part of how democrats look to pay for biden’s $3.5.

At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan. Echoing his 2020 campaign plan, the president has proposed a raft of tax hikes that include raising the top corporate rate to 28% from 21%, raising the top personal rate to. At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan.

June 16, 2021 | blog. The phrase “unrealized capital gains” has been trending on social media and forums during the last 24 hours after the u.s. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more.

“i don’t see a prospective change in rules pertaining to the taxation of future realization of capital gains as being a retroactive. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. Treasury secretary janet yellen on wednesday suggested a proposed tax increase on investments that was included in president joe biden's budget request will not have a retroactive effective date if it become law.

Still another would make the change. Treasury secretary janet yellen suggests capital gains tax may not be retrocative. If you sell shares that you own in a company and make a profit when you sell them, you pay a tax on the.

Yellen floats idea of capital gains hike dated to two months ago. What’s clear is that a capital gains tax hike is almost certainly on its way. Janet yellen discusses unrealized capital gains tax proposal, house speaker pelosi approves.

Capital gains tax is a tax on the profit that investors realise on the sale of their assets. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. Us treasury secretary janet yellen has proposed a hike in capital gains tax, as well as taxing unrealised capital gains.

Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. Secretary of the treasury janet yellen discussed the subject on cnn’s “state of the union.” yellen explained the concept, which aims to tax. Yellen had first proposed the tax on unrealised capital gains in february 2021.

The biden administration is looking to raise its tax revenue to fund a $3.5 trillion spending plan over ten years. As marketwatch points out, the change primarily affects those households with income of $1 million or more. Treasury secretary janet yellen suggested in remarks before a senate panel that if congress were to pass a.

Still another would make the change to capital gains tax retroactive, with a start date of april 2021. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. Yellen argues capital gains hike from april 2021 not retroactive.

Still another would make the change to capital gains tax retroactive, with a start date of april 2021. If not retroactively, then likely by january 1, 2022. Stocks snap lower as biden budget suggests retroactive capital gains tax hike from zerohedge.com us equity markets hit a vacuum to the downside briefly this morning shortly after headlines that the $6 trillion biden budget malarkey includes the assumption that a retroactive capital gains tax hike would be included (which would have started in april).

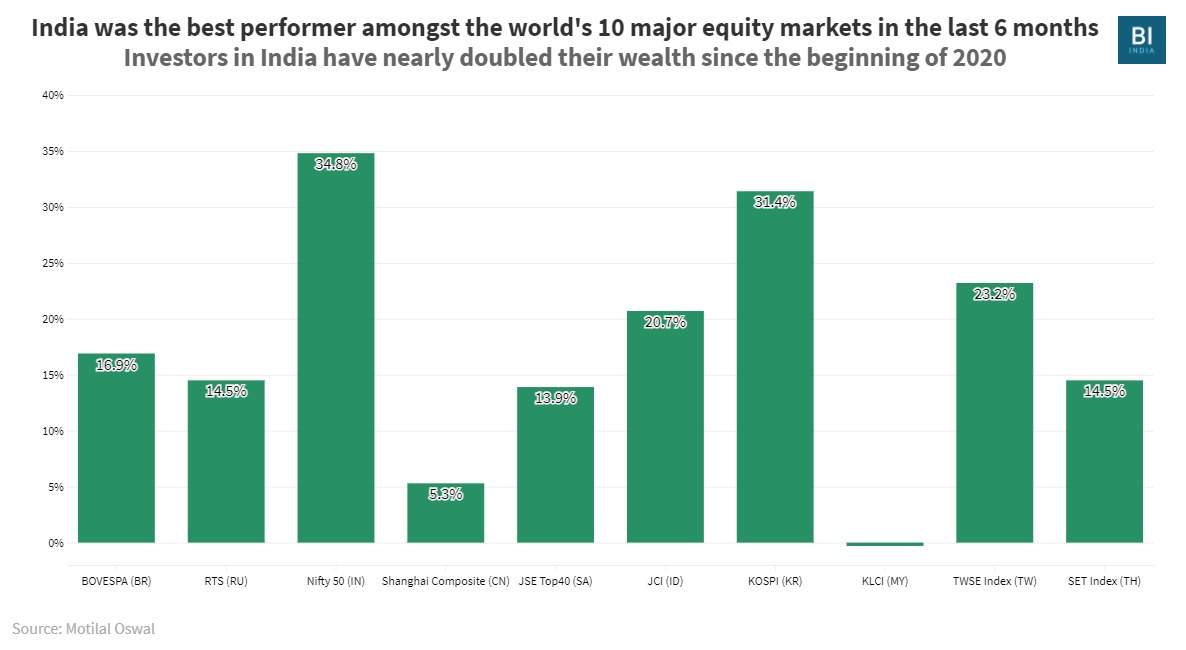

Wealth managers believe this could spook investors in the us and that could move money towards emerging economies, which includes markets like india. Still another would make the change to capital gains tax retroactive, with a start date of april 2021. One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.[9] president biden’s budget proposal suggested raising the rate on such capital gains to 43.4 percent for households with income over $1 million, effective for all.

Janet yellen, the treasury secretary in the joe biden administration, has proposed a tax on unrealised capital gains. At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more.

No Us Wont Tax Your Unrealized Capital Gains Alexandria

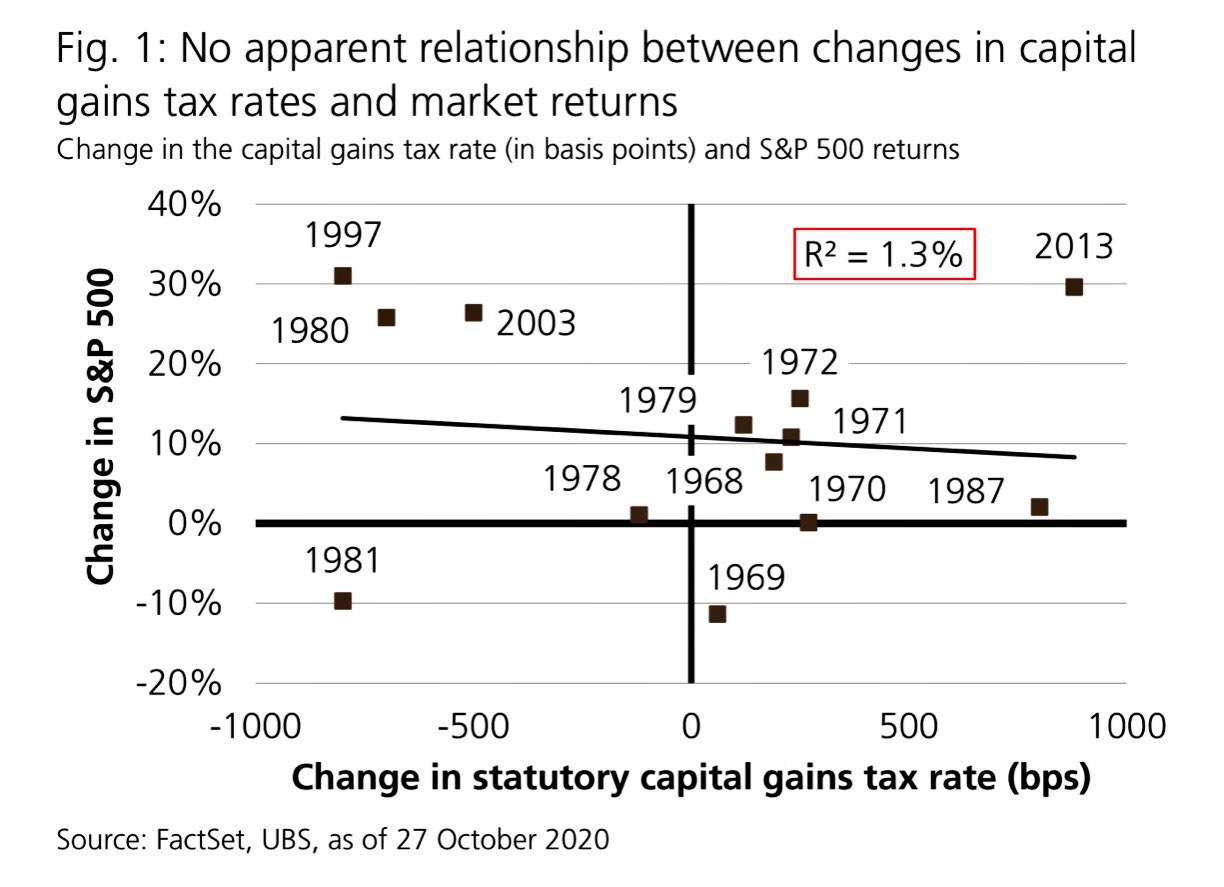

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Sp 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Janet Yellens Preposterous Tax Plan Stock Investor

Yellen No New Taxes Unless Youre Rich - Thestreet

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive - Bloomberg

Janet Yellens Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Biden Budget Said To Assume Capital-gains Tax Rate Increase Started In Late April - Wsj

An Act Of War Against The Middle-class Americans Criticize Janet Yellens Idea To Tax Unrealized Capital Gains Taxes Bitcoin News

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive By Bloomberg - Techregister

Yellen Floats Idea Of Capital Gains Hike Dated To Two Months Ago

Yellen Describes How Proposed Billionaire Tax Would Work Barrons

Janet Yellen Testimony On Economic Recovery 2022 Budget Transcript - Rev

Proposed Impactful Tax Law Changes And What You Can Do Now - Johnson Pope Bokor Ruppel Burns Llp

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Bidens Budget Assumes A Massive Retroactive Capital Gains Tax - Mish Talk - Global Economic Trend Analysis

Janet Yellens Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen Not Planning A Wealth Tax But Could Do Capital Gains Tax

Janet Yellens Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India