Portability Estate Tax Definition

On the real estate tax bill or use the parcel record search. The answer is that portability allows the first spouse to die to transfer his/her unused estate tax applicable exclusion amount to the surviving spouse, who can then use it.

A Guide To Estate Planning - Family And Matrimonial - United States

If you moved to hillsborough county from another florida county, provide the most complete address you can and be sure to include the name of the county.

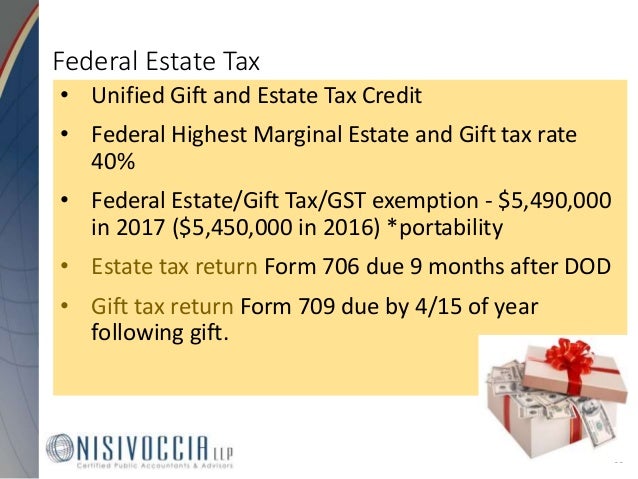

Portability estate tax definition. There are three distinct but related federal transfer taxes: On that tax return, they have a portability election. As of january 1, 2018, the estate tax exemption for individuals is $11.2 million, adjusted for inflation.

Estate and gift taxes are affected by the principles of portability, and they are a part of a group of taxes known as federal transfer taxes. Definition of portability of the estate tax exemption so what does “portability” of the estate tax exemption mean? You sell your current florida homestead that has an assessed value of $200,000 and a just (market) value of $350,000.

What is estate tax portability? The election to transfer a dsue amount to a surviving spouse is known as the portability election. Since in 2015 the federal estate tax exemption is $5.43 million per person (the exemption changes every year since it is indexed for inflation), this means that a married couple can potentially pass on $10.68 million to their heirs free from federal estate taxes.

Refer to some nonresidents with u.s. The 2012 american taxpayer relief act (“the act”) made permanent the concept of “portability,” which allows a surviving spouse 1 to apply, or “port,” his or her deceased spouse’s unused federal unified gift and estate tax exemption 2 to the surviving spouse to use against future gift or estate taxes. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her $5,000,000 (in 2011, or $5,120,000 in 2012, $5,250,000 in 2013, $5,340,000 in 2014, and $5,430,000 in 2015) federal estate tax exemption, then the surviving spouse can make an election to pick up the.

In other words, if your assets are worth $11.2 million or less at the time of your death (and you have not used any of your combined estate and gift tax exemption), your estate owes no estate tax. Historically, any applicable exclusion unused at death was thereafter lost. Whether the federal estate tax basic exclusion amount reverts in 2026 to $5,000,000 as adjusted for inflation under current law, or recent proposed law changes are enacted that reduce the basic exclusion amount to $3,500,000, ensuring that the unused exclusion of the first spouse to die can be used by the.

Portability is a concept that says that if i die today and my wife, through you, her cpa, files an estate tax return, she is going to be able to capture my $5 million exemption, giving her a $10 million exemption. An estate tax return may need to be filed for a decedent who was a nonresident and not a u.s. In simple terms, portability of the federal estate tax exemption between married couples comes into play if the first spouse dies and the value of the estate does not require the use of all of the deceased spouse’s federal exemption from estate taxes.

Assets must file estate tax returns to learn more. The 2010 tax act 1 has made it possible, under specified circumstances, for the estate of a surviving spouse to make use of the unused estate tax exemption of his or her predeceased spouse, a concept referred to as portability of the applicable exemption amount. It is based on the maximum credit for state death taxes allowable under § 2011 of the

The portability amendment literally made that tax savings “portable” so you can now transfer up to $500,000 of your accrued save our homes benefit to your new home. Portability allows a second dying spouse to use the unused estate tax exemption amount (referred to under the law as the applicable exclusion amount) of the predeceased spouse, in many cases leading to substantial estate tax savings. The portability law and the irs have made it very simple, when someone passes away they file what is called an estate tax return.

Starting january 1, 2021, property owners with a homestead exemption will have 3 years (instead of the original 2 years) to transfer their “save our homes” tax benefit to a new property. All of these taxes impact the amount of money passed to an individual’s. The maryland estate tax is a transfer tax imposed on the transfer of assets from an estate.

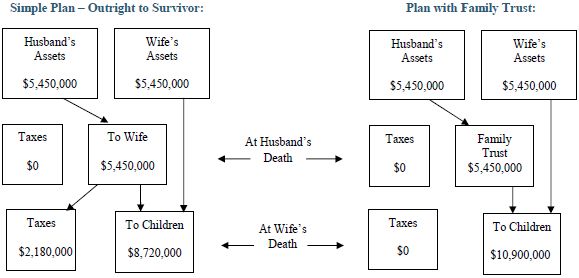

Some estate planners have suggested that portability makes it unnecessary to. What does portability of the estate tax exemption mean? While the estate tax has been in force for many years, most estates have remained exempt from the tax due to an “applicable exclusion amount” that shelters a certain amount of a person’s assets from estate taxation (currently, $5 million).

The excess of (a) the applicable exclusion amount of the last deceased spouse of the surviving spouse, over (b) the amount with respect to which the tentative tax. The basic exclusion amount, or. The only way you don’t get the portability election.

Prior to portability, living trusts 3 were constructed in such a way. “a homeowner must have a homestead exemption in place on their current residence to qualify for portability,” the city of jacksonville said. To properly make the portability election, the surviving spouse must timely file a federal estate tax return,.

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Estate Tax Introduction Video Taxes Khan Academy

Exploring The Estate Tax Part 2 - Journal Of Accountancy

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/senior-couple-outdoors-together-557921553-578501e63df78c1e1f3fc024.jpg)

The Portability Of The Estate Tax Exemption

Deceased Spousal Unused Exclusion Dsue Portability

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Exploring The Estate Tax Part 1 - Journal Of Accountancy

Exploring The Estate Tax Part 1 - Journal Of Accountancy

Nj Estate And Inheritance Tax 2017

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

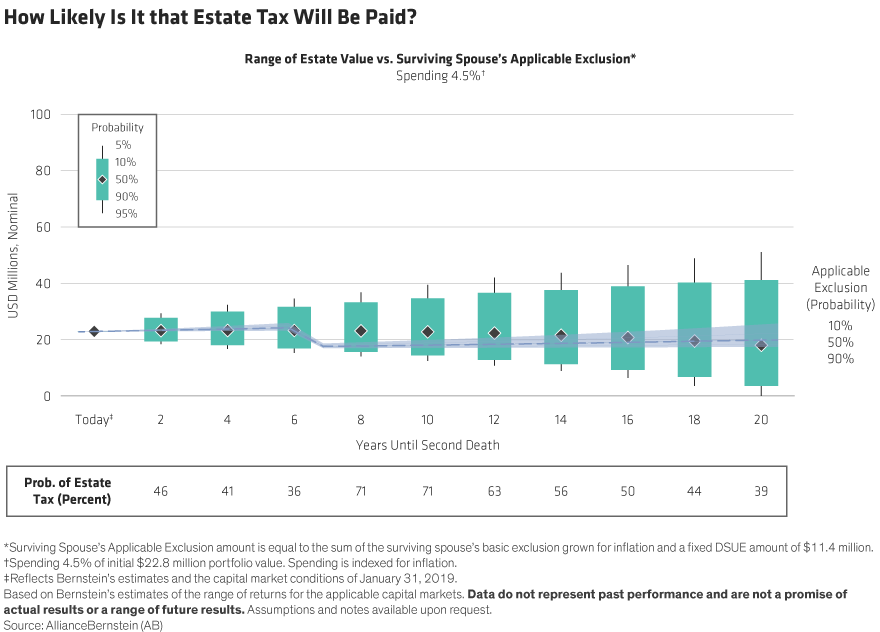

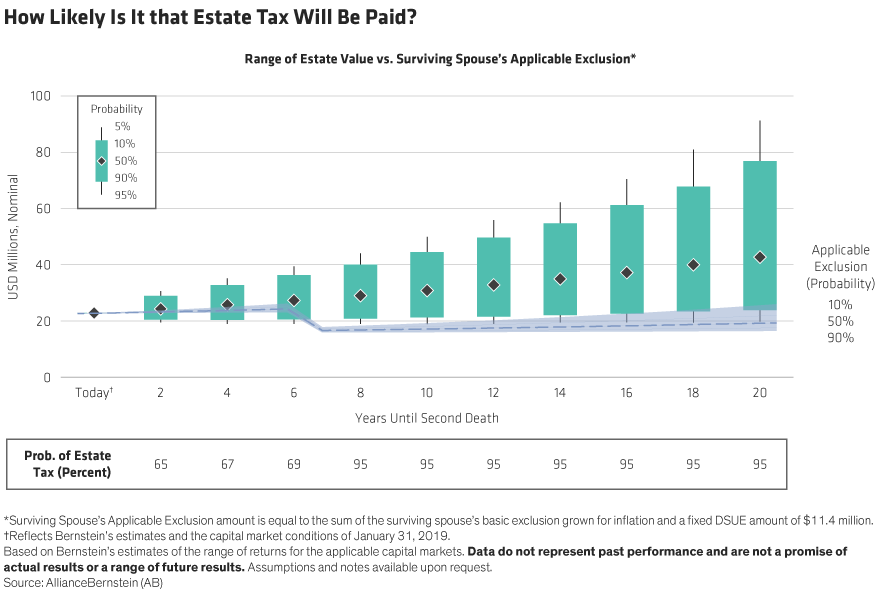

Will Your Estate Be Taxable In The Future - Context Ab

Portability - How It Works For Estate Tax - Batson Nolan

Exploring The Estate Tax Part 1 - Journal Of Accountancy

The Portability Of The Estate Tax Exemption

An Overview Of Estate Tax Portability Provisions - Aicpa Insights

Will Your Estate Be Taxable In The Future - Context Ab

Understanding Qualified Domestic Trusts And Portability

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Estate Tax Exemption Portability Law Video