Does Draftkings Provide Tax Forms

If you win any bet with super longshot odds, where winnings are 300x more than the wager, and you win $600 or more, your winnings are reported to your home state’s tax office and to the irs. The best place to put this 1099 is under ''other common income''.

Gambling Winnings How Playing Fantasy Sports Affects Your Taxes

The draftkings promo code for december is a $50 free bet (exclusive) plus a $1,000 deposit bonus.

Does draftkings provide tax forms. In more and more states across the us, daily fantasy sports sites are licensed and subject to regulation. Here is the full email that some draftkings players are sending players: On april 23, 2021, florida governor ron desantis signed a new gaming compact with the seminole tribe that granted the indian tribe essentially a monopoly over mobile sports betting.in return, the seminole tribe will guarantee florida $2.5 billion in tax revenue over the next five years.

If it turns out to be your […] and if you really bring home the bacon, earning at least $5,000 for sports betting, this definitely goes on. The site does not restrict the use of a third party credit card to deposit money. Those sites should also send both you and the irs a tax form if your winnings are $600 or more.

Entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and forms of identification including but not limited to a driver's license, proof of residence, and/or any information relating to payment/deposit accounts as reasonably requested by draftkings in order to complete the withdrawal of prizes. A majority of companies issue tax forms by january 31st every year as required by law. Draftkings w9 email to players.

On the next screen, click 'this was prize winnings'. Any attempt to try to evade paying. Joseph steven murray, insider at draftkings (nasdaq:dkng), made a large insider buy on november 19, according to a new sec filing.

To get the full $1,000, you must deposit $5,000 when signing up. On sunday my girlfriend gifted me $25 to deposit on draftkings. You may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and forms of identification, including but not limited to a driver's license, proof of residence, and/or any information relating to payment/deposit accounts as reasonably requested by draftkings in order to complete the withdrawal of deposits.

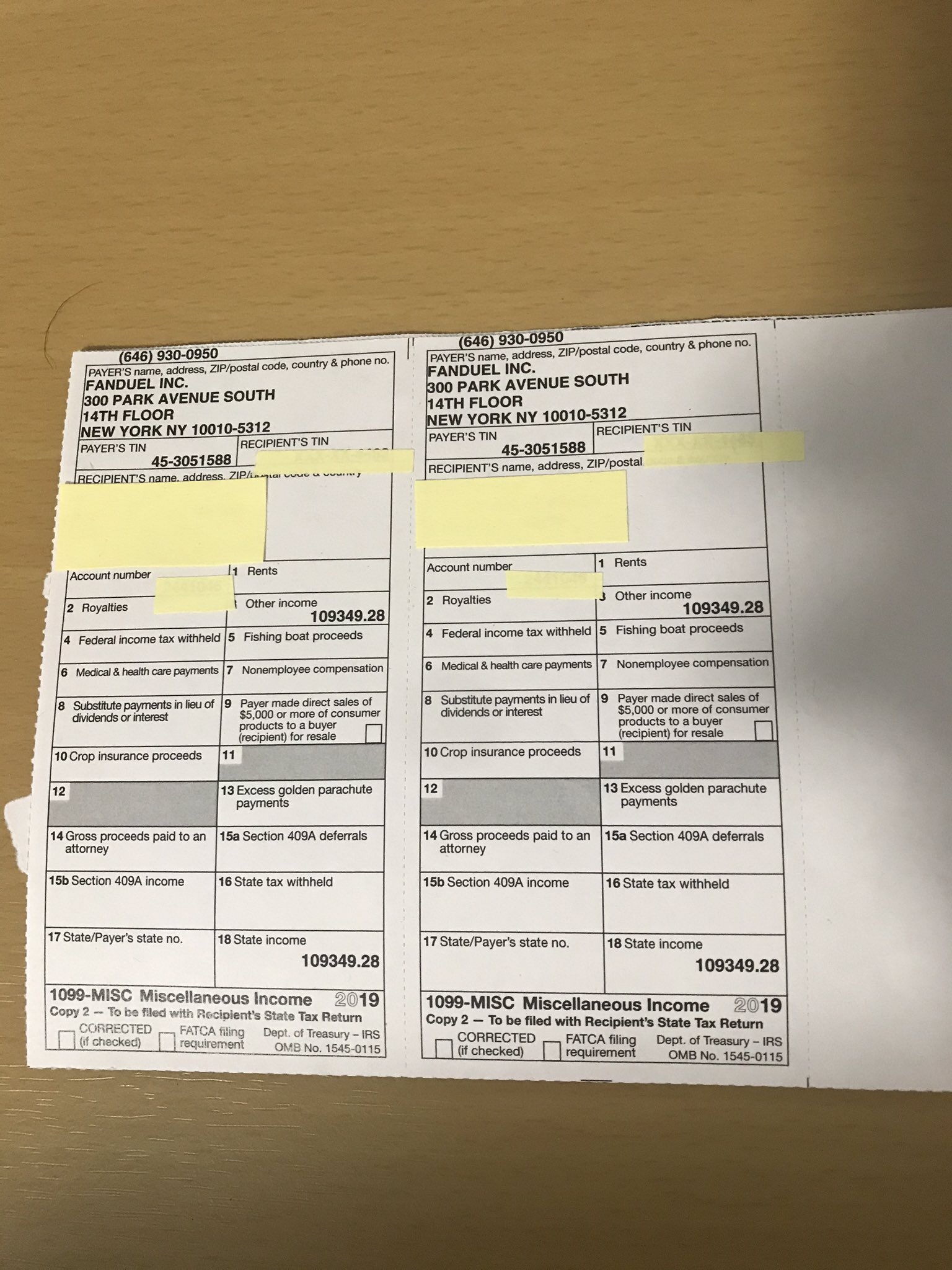

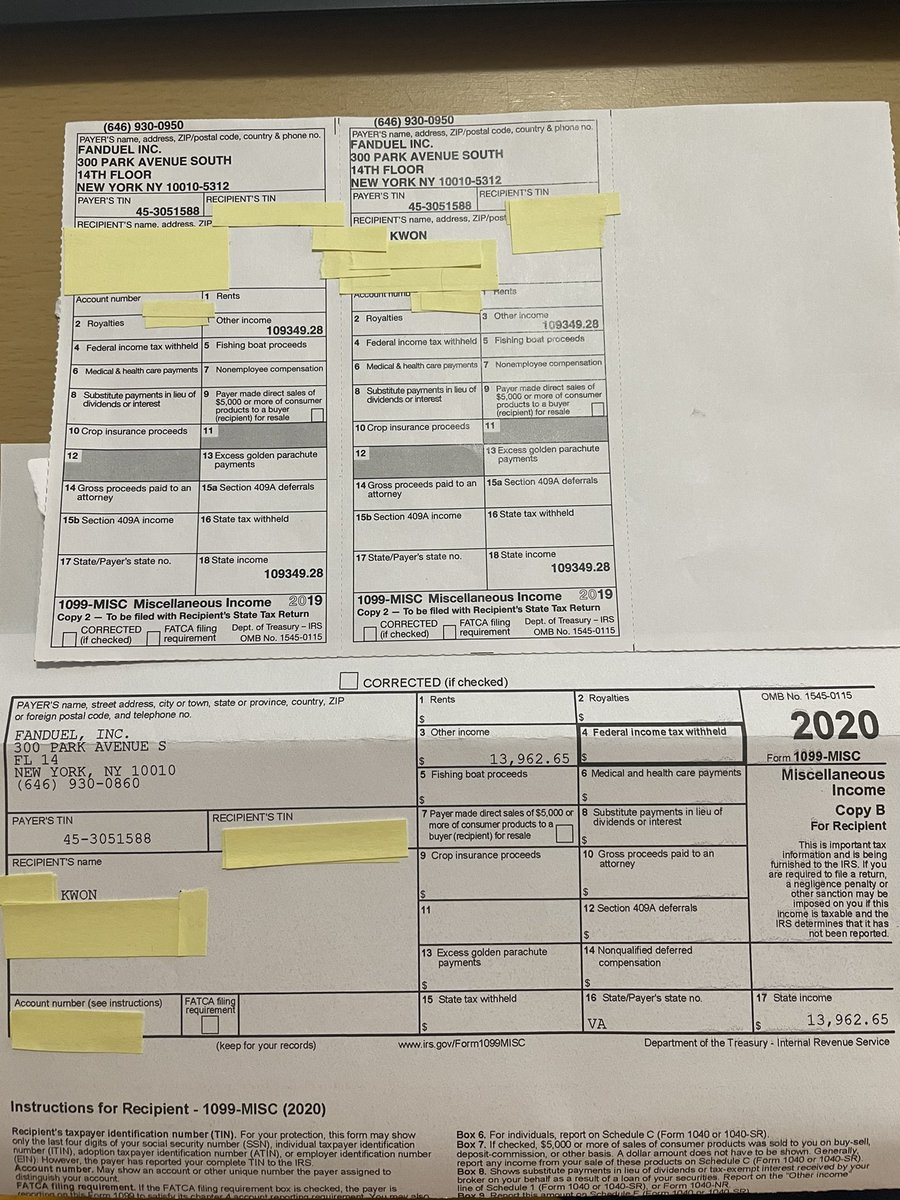

The 1099 tax forms report your winnings to the taxing authorities and also gives you notice of the amount you must report on your taxes. However, the income will still be subjected to federal income tax and you will be required to report it on your tax form. Entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and forms of identification including but not limited to a driver's license, proof of residence, and/or any information relating to payment/deposit accounts as reasonably requested by draftkings in order to complete the withdrawal of prizes.

Does draftkings send tax forms. Does draftkings report to irs. Draftkings seems to think that since they have the option to file for an extension, they should do that most years because they can’t do things in a timely fashion.

As long as you are playing with a legal and reputable site such as fanduel or draftkings and you’re in a state where dfs is legal. Even if you played and won and did not receive any tax forms, there still may be an obligation to report and pay taxes on winnings. Entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and forms of identification including, but not limited to, a driver's license, proof of residence, and/or any information relating to payment/deposit accounts as reasonably requested by draftkings in order to complete the withdrawal of winnings/prizes.

Yes, winnings will be taxed. Even if you don't receive a 1099 form, you must still report the net profits on your federal and state income tax returns. The answer is yes, your cumulative net profit is taxed, and draftkings is contractually required to send a 1099 tax form to any player that nets of $600 in profit in a calendar year.

You get both the $50 free bet and $1,000 deposit match on your first deposit. Fillable form 1040 2018 income tax return irs tax forms irs taxes. It can be found in the wages & income section, and i have attached a screenshot.

Just click through any of our links, and the bonus will automatically. This is standard operating procedure for daily and traditional sports betting sites, and is one of the requirements for draftkings, and sites like it, to stay in business. The deposit bonus is pretty simple:

To fill out sufficient tax forms. Then if you win $1,200 or more from a slot game, your winnings are also reported to the same people. They'll match 20% of your first deposit up to $1,000.

Reporting taxes from dfs play in 2015 is not straightforward for players. For example, let’s say i won $10,285 in total winnings while entering $3,948 and then earning $400 in bonuses. If you win any prize worth more than $600, the sweepstakes' sponsor is required to send you a 1099 form for it.

Fanduel Draftkings Could Cost You Liberty Tax Service

Draftkings Review

Will You Be Taxed For Winning Dfs

Nft And Dfs Cpa On Twitter Posting This For A Few Reasons -fanduel Sent Out 1099s Lets Do Some Tax Planning Link In Bio Or Dms -through Hard Work- Financial Dfs Goals

Daily Fantasy Sports Tax Reporting

Do You Owe Daily Fantasy Taxes

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Heres How To Find Your Draftkings 1099 Form Online

Draftkings Tax Form 1099 Where To Find It How To Fill

Dbarlow2 - Dfs Army

Has Anyone Received Their Draftkings 1099 Yet Thanks Rdfsports

Play Draftkings Or Fanduel The Irs Wants To Know About Your Winnings Nasdaq

Draftkings Tax Form 1099 Where To Find It How To Fill

Printingbenjamins Gtwwy Twitter

When And How Do You To Submit A Fanduel W9 Form

How To Pay Taxes On Sports Betting Winnings Bookiescom

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

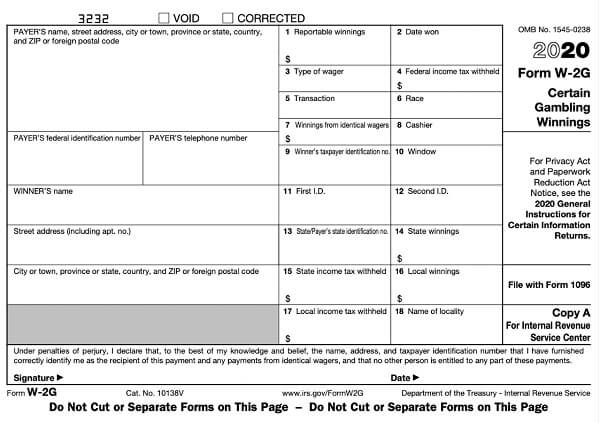

Form W-2g Certain Gambling Winnings Definition

Daily Fantasy Sports Tax Reporting

What To Do When Receiving A Draftkings W9 Form Request