Betterment Tax Loss Harvesting Wash Sale

By realizing, or harvesting a loss, you can: Betterment sold almost all of my shares of vanguard vti and reinvested into schwab’s schb u.s.

Tax Loss Harvesting Methodology

What is a wash sale?

Betterment tax loss harvesting wash sale. What securities do you use? The sold asset is replaced by a similar one, helping to maintain your risk level and your expected returns. If this is true, then these services pay for themselves and i might as well take advantage of.

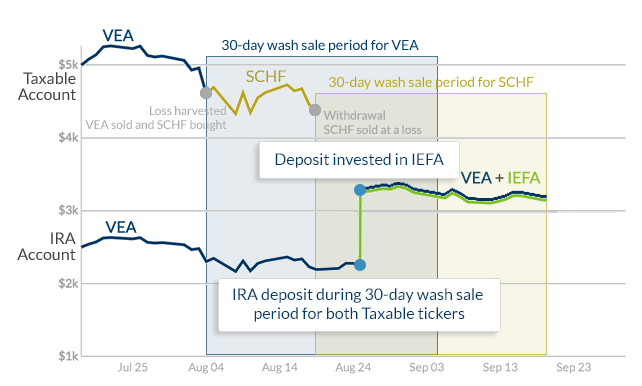

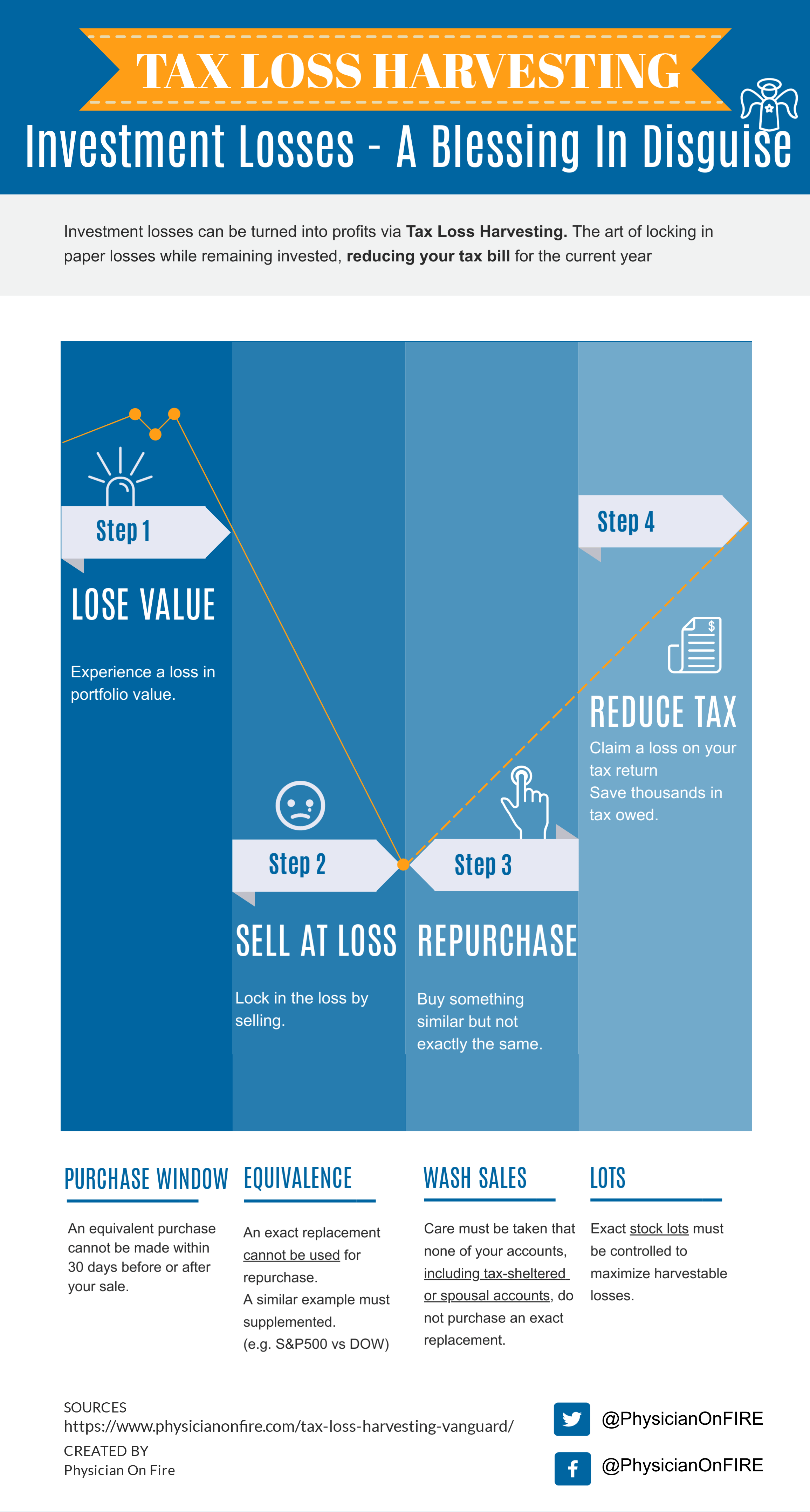

A wash sale occurs when you sell securities at a loss and, within 30 days (before or after) buy substantially identical assets. You can use harvested losses to offset taxes on any capital gains as well as to reduce taxable income by up to $3,000 per year. Betterment offers automatic tax loss harvesting but it cannot sync with external accounts (schwab and fidelity) and we would like to avoid wash sale issues.

Will there be any commissions? This is why when an etf is sold, it is replaced with a similar investment, but not similar enough so that the irs could state it as a wash sale. It is important to be aware of something called a wash sale when dealing with an investment loss.

A wash sale could also occur where securities in an account held outside betterment are sold at a loss and used to fund a betterment account. Is tax loss harvesting legal? Using betterment or other similar programs increase the risk you will have a wash sale.

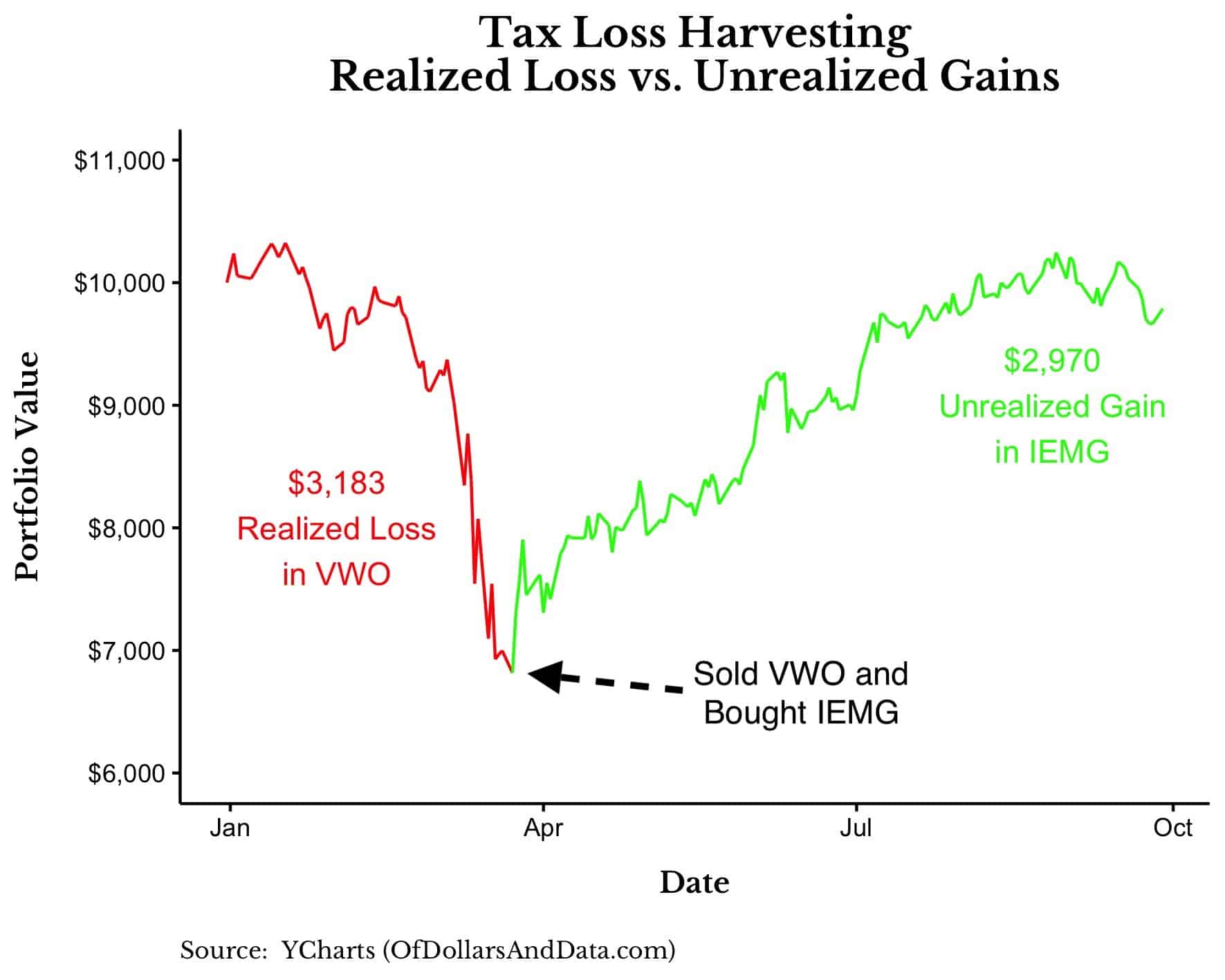

Will you automatically return to the primary etfs? Tax loss harvesting is the practice of selling an asset that has experienced a loss. Existing strategies and their limitations every tax loss harvesting strategy shares the same basic goal:

What is tax loss harvesting; Tax loss harvesting with betterment. For example, you can't sell the stock in your taxable account and then turn around and repurchase it in your ira — or even in your spouse's ira.

This helpful feature efficiently makes use of capital losses to set your mind at ease so you won't ever have to purposefully incur losses to reduce your tax burden. One suggestion betterment has made is to invest exclusively in target date funds in 401ks. Reduce tax liability by reducing your income.

What are the upsides and downsides? What's an example of a wash sale? The betterment tax loss harvesting program does take into consideration the wash sale rule.

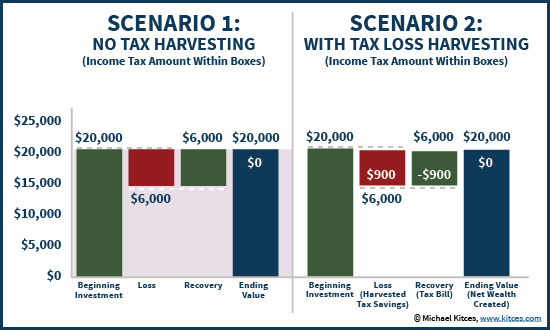

How will tlh affect my allocations? So, if you had $10,000 in capital gains (from a taxable account) and were in the 15% capital gains tax bracket, you would owe the irs $1,500. This is where tax loss harvesting comes in.

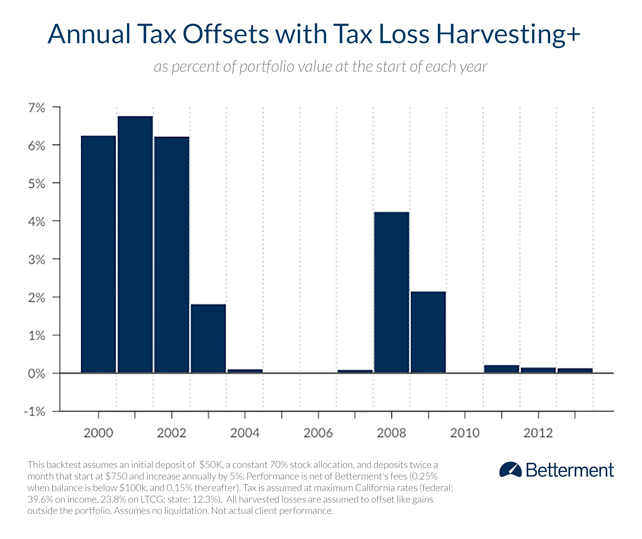

Back in 2018 when we saw a pretty significant market dip, betterment did its thing and harvested some tax losses for me in my taxable account. Say you bought 1000 shares of vtsax (vanguard total stock market index) for $43 and then a few months later the price dropped to $40. Wash sales in a traditional ira are lost forever!

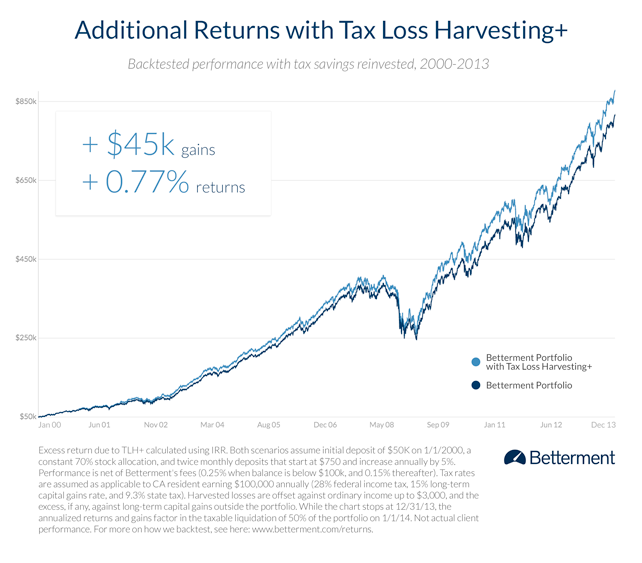

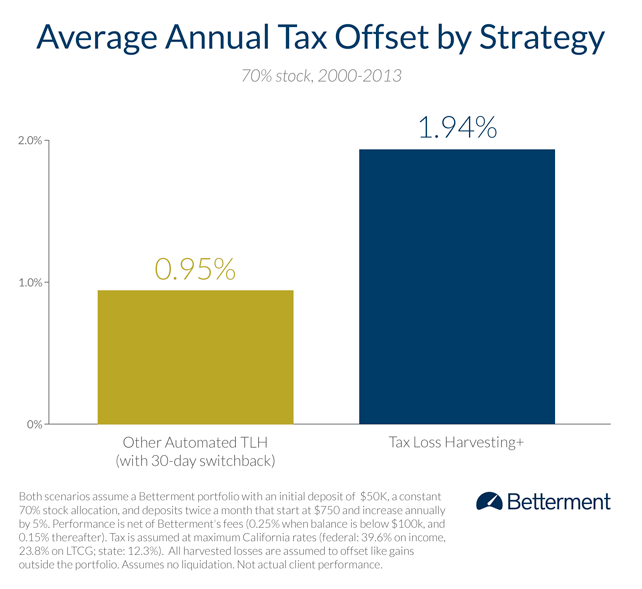

Wash sales where the replacement security is purchased in an ira account are particularly worth avoiding. Betterment wrote a white paper on tlh+, which presents data that suggests their algorithm, with very reasonable assumptions on marginal tax rates given an attending physician audience, will produce gains of about twice that of simpler automated tax loss harvesting algorithms extant. I don’t claim to be an expert on taxes or the wash sale rule by any means.

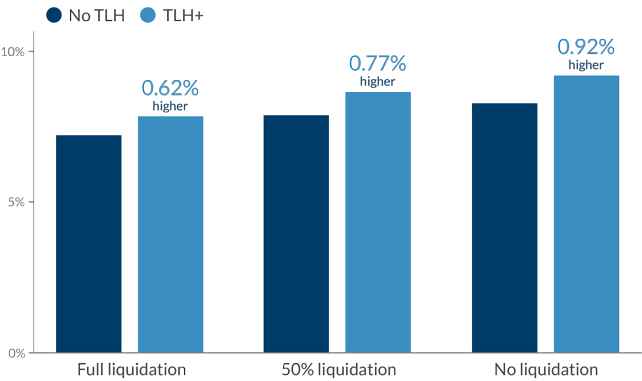

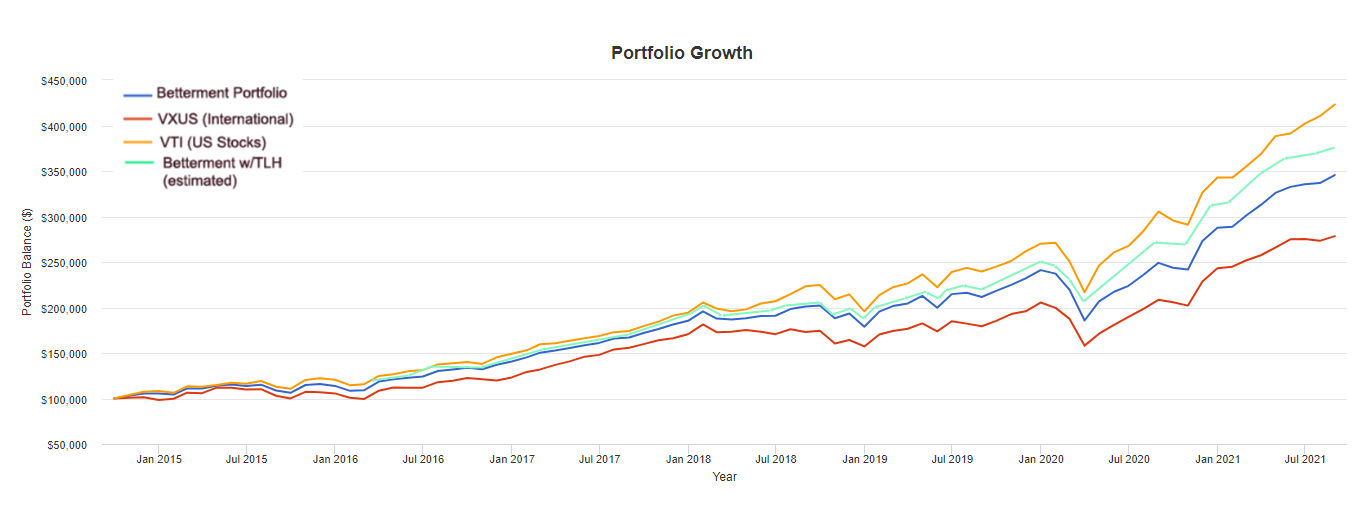

Betterment and wealthfront claim that tax loss harvesting gives an extra.77% vs 1% respectively which would more than offset their.15% and.25% respective fees. When betterment sells a security at a loss and you buy a substantially identical security in your ira unwittingly, the wash sale loss is disallowed forever. How often will you harvest losses?

Approaches to tax loss harvesting differ primarily in how they handle the proceeds of the harvest to avoid a wash sale. Offset taxes on realized capital gains. The error messaging you are seeing with regard to the wash sale entries is a result of automatic rounding of the number imported from your broker or typed in by you.

For the cynics, these predicted gains are.

Tax Loss Harvesting Methodology

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Why Betterment Has Zero Of Our Dollars - Go Curry Cracker

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting

The Definitive Guide To Tax-loss Harvesting And Avoiding Wash - Minafi

Tax Loss Harvesting Methodology

Tax Loss Harvesting Methodology

Tax Loss Harvesting Methodology

The Definitive Guide To Tax-loss Harvesting And Avoiding Wash - Minafi

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Tax Loss Harvesting Methodology

The Definitive Guide To Tax-loss Harvesting And Avoiding Wash - Minafi

Tax-loss Harvesting Is Killing Your Nest Egg - The Wealthy Accountant

Tax Loss Harvesting Methodology

The Betterment Experiment Results Mr Money Mustache

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Top 5 Tax Loss Harvesting Tips - Physician On Fire