Mark Ladd Republic Tax Relief

The norwegian tax system has two bases of income. The tax on ordinary income is 22 percent for 2021.

Republic Tax Relief We Fix Taxes

The relief is available under section 1020 tca for married couples and section 1031g tca for civil partners.

Mark ladd republic tax relief. In addition, we have the personal income base. More than just a fighting force, the defense department delivers health care, disaster relief and other support to people around the world in humanitarian missions every day. With around 3,800 partners and staff in the uk and access to more than 43,000 people in 120 countries across the rsm network, we can meet our clients’ needs wherever in.

Previously, mark was the manager, operations at natio. Income from dividends and interest are taxed at 26.375%, including surcharge relief of 50% of the with a possibility of tax relief of up to 40% for nonresident companies. Foreign source income of australian residents;

Republic tax relief | 21 followers on linkedin. In places where there are no aab, file the monthly vat declaration, together with the required attachments and pay the vat due with the revenue collection officer (rco) Also during the current legislative session and prior to the passage of the act, georgia’s house of representatives passed a bill that raises the standard deduction, which would provide georgians with an estimated $140 million in state income tax relief that largely benefits those of lower to middle incomes.

You claim a treaty exemption that reduces or modifies the taxation of income from dependent personal services, pensions, annuities, social security and other public pensions, or income of artists, athletes, students, trainees, or teachers. Comprised of tax professionals with over 25 years of experience, optima tax relief is a full service tax resolution firm that can handle almost any irs or state tax issue. Tax relief costs range from $750 to $10,000 or more, depending on your tax debt circumstances.

The tax reliefs to expatriates seconded to the republic of albania are implemented under specific conditions. 255 e rincon st ste 225. Relief for foreign taxes where income has been subject to tax twice (in republic of albania and a foreign jurisdiction) relief can be granted by the albanian general tax directory in accordance with signed double taxation treaties.

Additional information relating to tax treaties includes: The aab receiving the tax return shall stamp mark the word received on the return and machine validate the return as proof of filing the return and payment of the tax. Our team is on hand to provide answers for clients impacted by garnishments, bank.

Whether, in relation to the profits and gains derived by the indian company from its business of developing a special economic zone in india, p ltd is eligible for a tax sparing credit under regulation 9 (1) of the income tax (foreign tax credit) regulations 1996 in respect of indian profits tax which would otherwise have been payable but for the exemption effectively given as. Let ellis and ellis, the nation’s top irs and state tax specialists, guide you through your journey to gaining financial control over your taxes. Under marginal relief the tax liability would be calculated as follows.

€36,000 gives €4,000 as the amount by which the income exceeds the limit. The ordinary income base is a net base. Linkedin is the world’s largest business network, helping professionals like.

This is a gross base for taxation. Had been jointly assessed to tax throughout the year (see paragraph 4.2 for further details on joint assessment). The bracket tax and the social security contributions for employees are based on this.

Residency status and tax relief; Central repayments office (cro) tax relief schemes for persons with disabilities including relief on vehicles, fuel and appliances, vrt export refund scheme, marine diesel rebates. €40,000 minus low income exemption limit:

Marginal relief restricts the tax payable to 40% of this. Tax relief tax relief is calculated using the formula: Ellis & ellis, llc offers combined flat rate price and no obligation consultation.

4,000 x 40% = €1,600. Rates may be reduced under a tax treaty. On average, tax relief costs between $1,000 and $7,000.

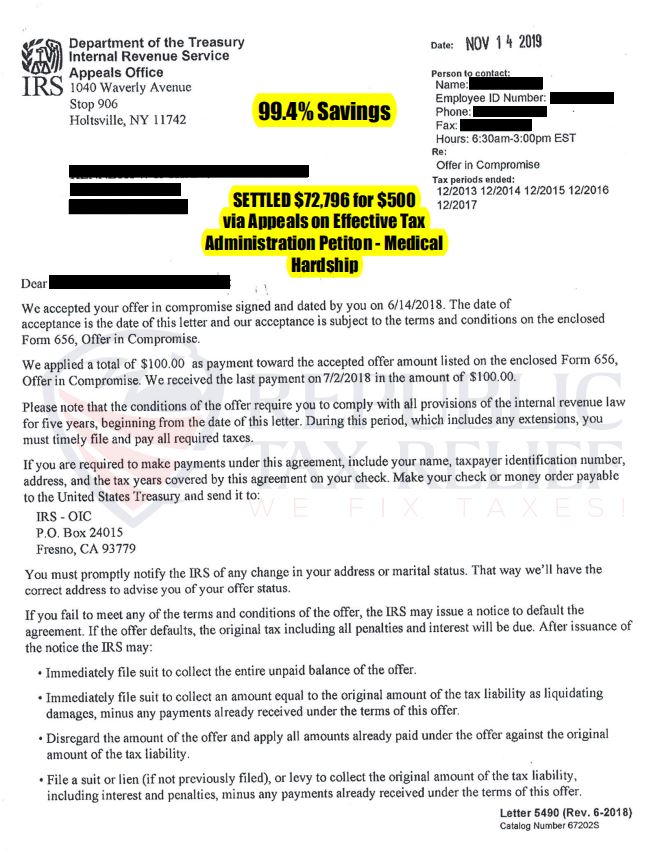

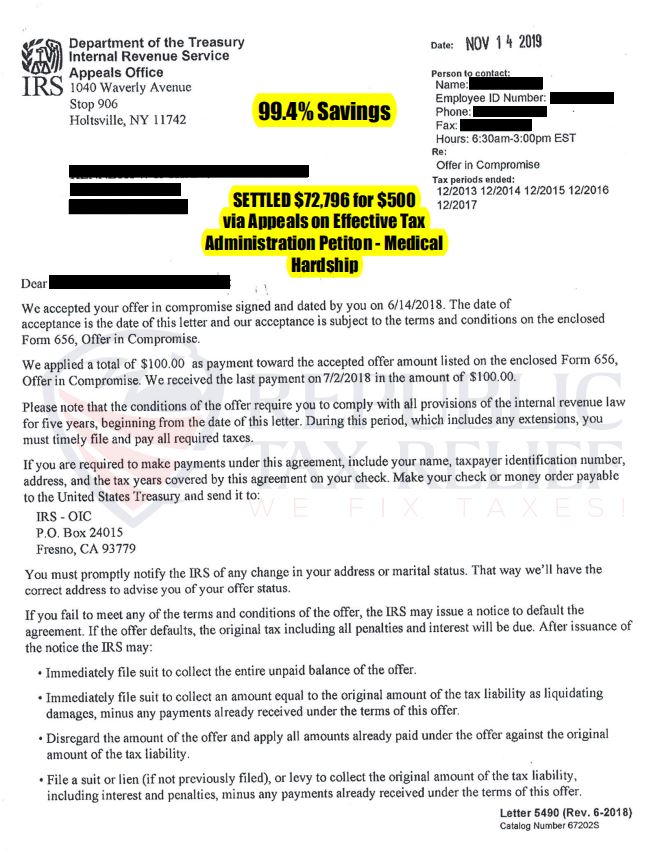

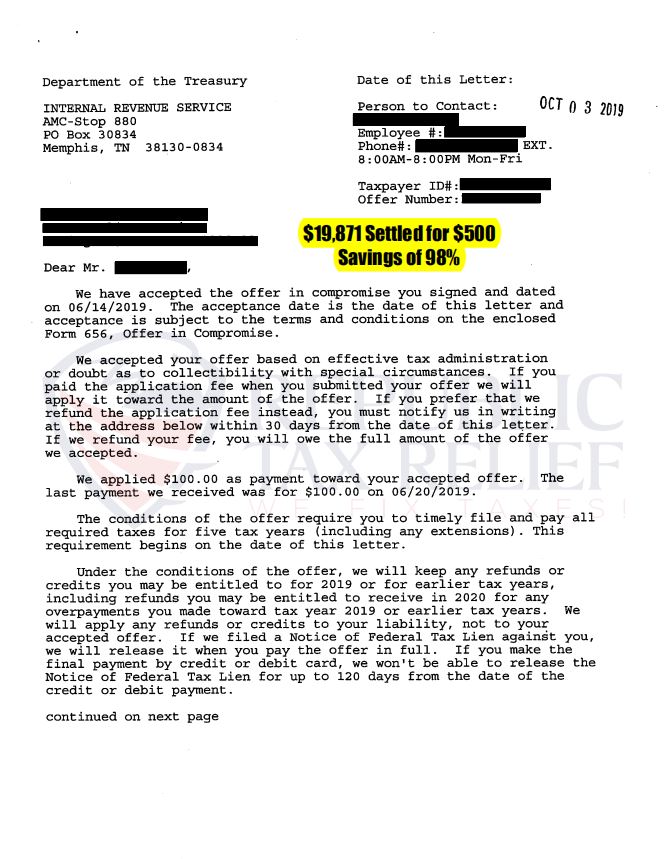

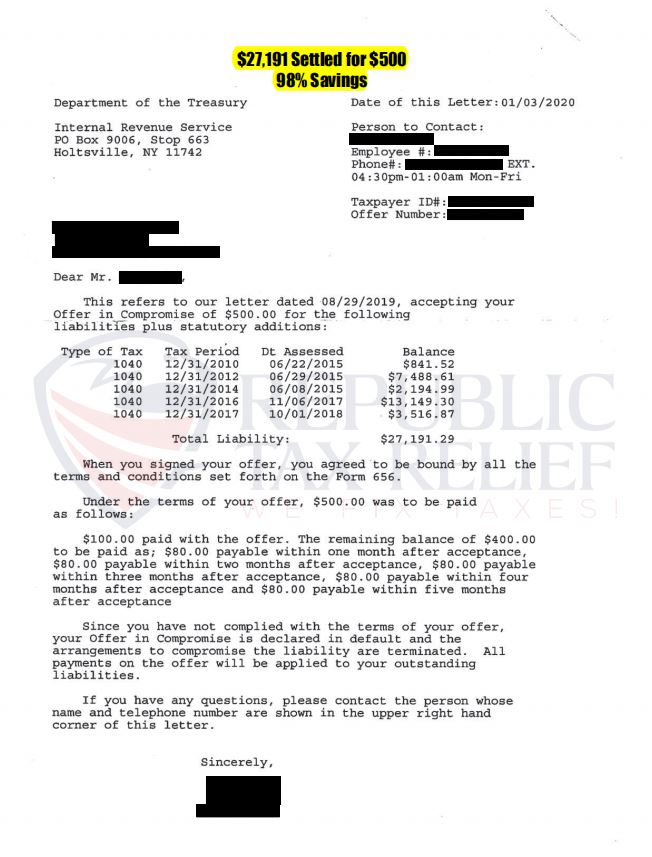

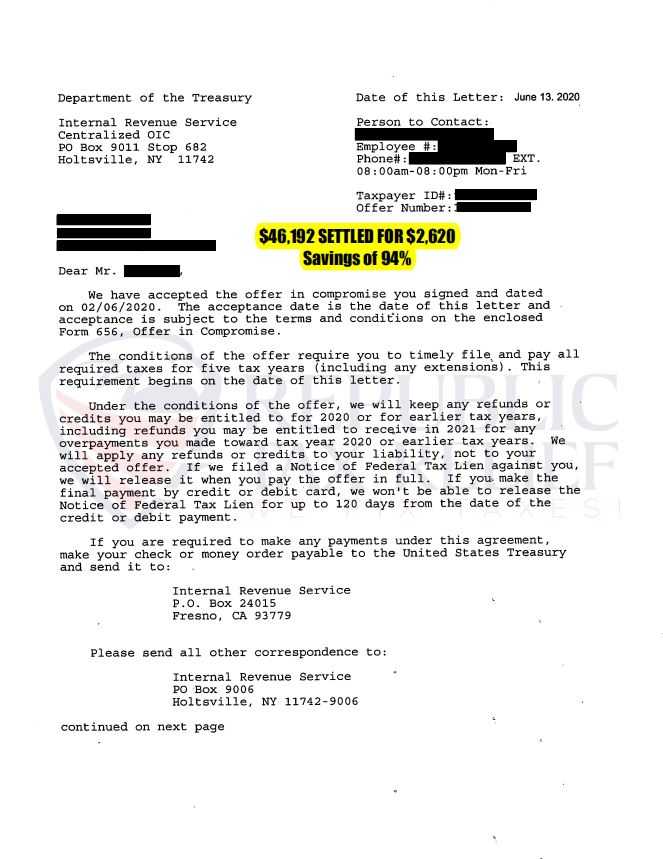

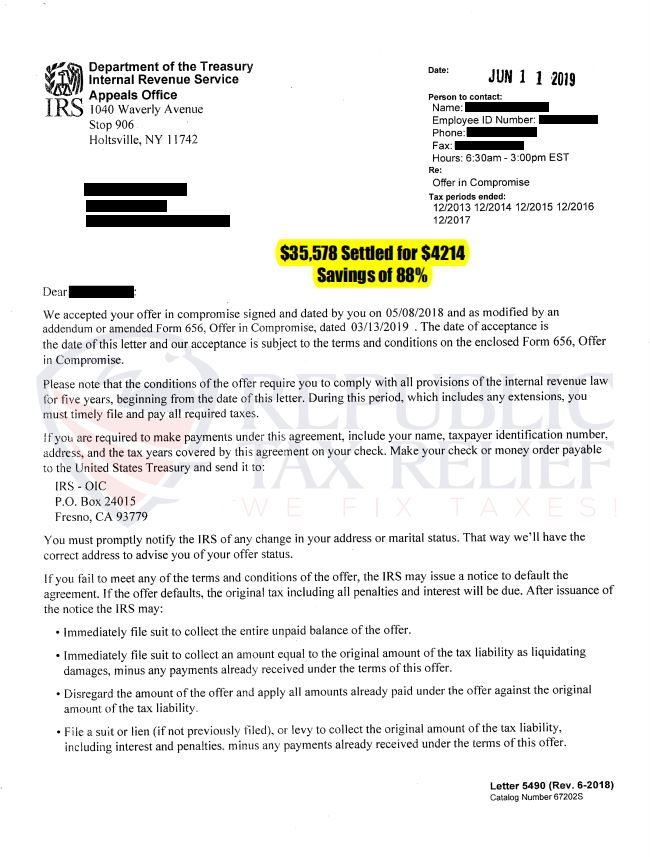

Vehicle registration tax (vrt) for enquiries about transfer of residence (tor) applications, inheritance or temporary exemptions, and vrt second stage appeals only. Australian income of foreign residents; From humble beginnings to one of the largest and most respected tax relief companies in the nation, republic tax relief is still centered on its core values and is veteran owned and operated.

A x b 12 where: Rsm is a leading provider of audit, tax and consulting services to middle market leaders, globally. View mark ladd’s professional profile on linkedin.

Mark ladd is the chief executive officer at republic tax relief based in corona, california. Chief executive officer at republic tax relief.

Republic Tax Relief We Fix Taxes

Republic Tax Relief We Fix Taxes

2

Republic Tax Relief We Fix Taxes

![]()

Mark Ladd Corona Ca Usa Startup

Careers And Employment At Republic Tax Indeedcom

Republic Tax Relief Better Business Bureau Profile

Wiseintro Portfolio

Republic Tax Relief We Fix Taxes

Poverty Reduction Strategy Papers - Detailed Analysis Of Progress In Implementation In Policy Papers Volume 2003 Issue 045 2003

Republic Tax Relief Ranks 783 On The 2020 Inc 5000 List Of Americas Fastest Growing Companies

Pdf International Experience In Developing The Financial Resources Of Universities

Republic Tax Relief We Fix Taxes

Republic Tax Relief Ranks 783 On The 2020 Inc 5000 List Of Americas Fastest Growing Companies

Mark Ladd Corona Ca Usa Startup

Mark Ladd

2

2

Mark Ladd