San Francisco Gross Receipts Tax Pay Online

It is due annually on february 28 and must be filed online. The city’s gross receipts tax, which remains a stealth payroll tax for most companies, will become especially confounding as remote work grows.

Annual Business Tax Return Treasurer Tax Collector

The rate of the grt is dependent upon the type of business activities and the amount of gross receipts.

San francisco gross receipts tax pay online. For registration years after june 30, 2015, annual fees are determined by gross receipts from the prior year and fees can range from $90 to a maximum of $35,000 for companies with gross receipts over $200m in the prior year. Due on april 30, 2020, are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of $10,000,000 or less. Apportionment for this section is 50% real, personal, tangible and intangible property and 50% based on payroll (section 953.5(c)) san francisco gross receipts may be reduced by amounts paid in the tax year to a subcontractor possessing a valid business registration certificate with the city to the extent those amounts were included in the amount your business allocated to the.

About gross receipts tax and payroll expense tax. The progressive tax rate ranges between 0.1% to 0.6% and is assessed on gross receipts sourced to san francisco as determined for gross receipts tax purposes. The san francisco gross receipts, homelessness gross receipts, commercial rents, and/or payroll expense tax.

San franciso's annual business tax return filing should be completed on its online 2020 tax portal (available at gross receipts tax (gr) | treasurer & tax collector (sftreasurer.org)). These quar terly estimated tax liabilities must instead be paid along with annual tax payments for tax year 2020, which will generally be due by march 1, 2 021. Determining the gross receipts tax.

The grt is based on a taxpayer’s city receipts for each calendar year, regardless of the taxpayer’s fiscal year end. Gross receipts tax and payroll expense tax. The tax will be imposed at a rate between 0.175 percent and 0.69 percent of san francisco gross receipts over $50 million, depending on the type of business, and an additional 1.5 percent of the payroll expense in san francisco for businesses that pay.

Lean more on how to submit these installments online to comply with the city's business and tax regulation. Therefore, for 2018, both payroll expense tax and grt are payable by san francisco businesses. Work with your accountant to determine if you need to file this;

Gross receipts refers to the total amount of money received from doing business in san francisco and includes amounts derived from sales, services, dealings in property, interest, rent, royalties, dividends,. Additionally, businesses may be subject to up to four local san francisco taxes: The most recent tax rates can be found on the ttx website.

The business tax and fee payment portal provides a summary of unpaid tax, license and fee obligations. San francisco businesses are also subject to annual registration fees based on san francisco gross receipts for the immediately preceding tax year. Payment of displayed obligations may not constitute payment in full of all tax, license or fee liabilities.

Gross receipts tax and payroll expense tax. The fees range from $15,000 to $35,000 for companies with payroll expenses over $20m. You may pay online through this portal, or you may print a stub and mail it with your payment.

You may file your gross receipts and payroll expense taxes online with ttx. All persons interested in the matter of proposition c As of the date of this tax alert, san francisco's 2020 tax portal has not yet appeared on its website.

Under the general rule, the registration fee is $90 for businesses with less than $100,000 in receipts, which increases to $35,000 for businesses with more than $200 million in gross. Sf annual gross receipts tax for 2020 filing & payment deadline. San francisco (in california) has a gross receipts tax on businesses with more than $1,170,000 in combined taxable san francisco gross receipts or more than $320,000 in taxable san francisco payroll expenses.

Pay online the payroll expense tax and gross receipts tax quarterly installments. Pay online the payroll expense tax and gross receipts tax quarterly installments. The hgrt is an additional tax imposed on businesses that are currently paying a san francisco gross receipts tax.

5 businesses conducting business both within and outside san francisco must apportion their gross receipts to determine gross. Most business taxes require you to file your tax return before you will see an obligation in the payment portal. The limits are quite low so many funded startups will need to file.

Make a payment please note the following: First enacted in 2014, the gross receipts tax (grt) is imposed on the amount of a taxpayer’s gross receipts that are sourced to san francisco. Lean more on how to submit these installments online to comply with the city's business and tax regulation.

You may pay online through this portal, or you may print a stub and mail it with your payment. Welcome to the san francisco office of the treasurer & tax collector's business tax and fee payment portal.

7 Easy Payroll Remittance Form Sample In 2021 Payroll Payroll Taxes Form

Software Requirements Document Template Check More At Httpsnationalgriefawarenessdaycom44156software-requirements-document-template

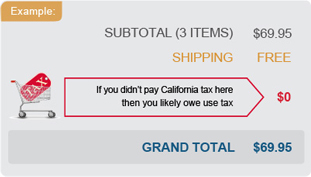

California Use Tax Information

Pin On Desktop

Loaner Car Agreement Template Free Printable Templates Printable Free Payroll Template Agreement

Quickbooks Online Vs Quickbooks Self Employed Quickbooks Online Quickbooks Self

Construction Billing Invoice Templates Construction Invoice Templates Construction Invoice Templates Invoice Template Invoice Template Word Invoice Layout

Annual Business Tax Returns 2020 Treasurer Tax Collector

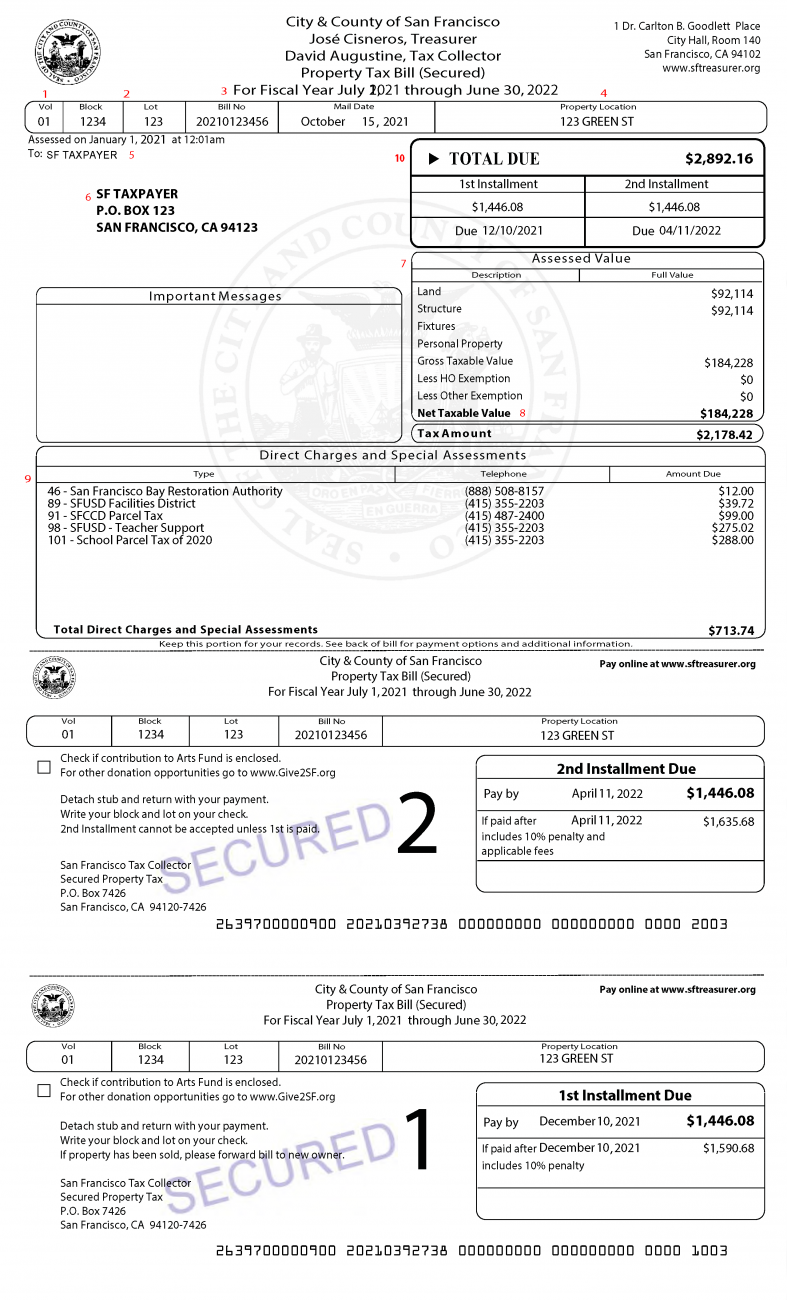

Secured Property Taxes Treasurer Tax Collector

Real Estate Bookkeeping Services Nomersbiz Bookkeeping Services Bookkeeping Online Bookkeeping

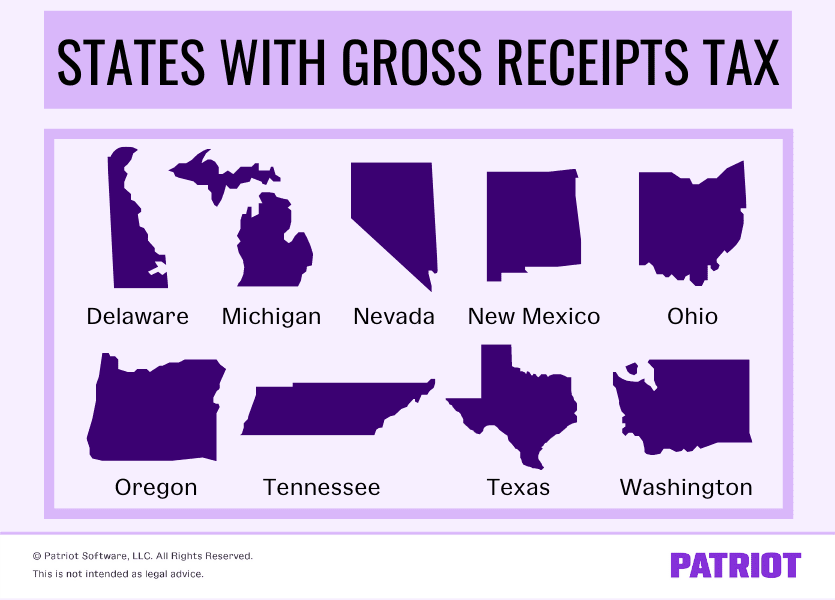

What Is Gross Receipts Tax Overview States With Grt More

We Make You A Customized Fake Receipt For Online Or In-store Purchases Or A Personal Or Business Invoic Receipt Template Free Receipt Template Money Template

Annual Business Tax Returns 2019 Treasurer Tax Collector

Self Employed Builder Invoice Templates Work Invoice Template Reading About Details Of Work Invoice Templa Invoice Template Invoice Template Word Templates

Usa California Pge Pacific Gas And Electric Company In 2021 Bill Template Templates Document Templates

Secured Property Taxes Treasurer Tax Collector

Deluxe Paystub Paycheck Statement Template Doctors Note

Payroll_mobile Best Email Triggered Email Payroll

Accountancy Web Design Web Design Simple Website Design Simple Website