Nh Meals Tax Form

Anyone who sells meals that are subject to sales tax in massachusetts is a meals tax vendor. if a liquor license holder operates a restaurant where meals are served, the holder of the license is presumed to be the meals tax vendor, whether the meals are served by the license holder or a concessionaire. Tax exempt meals and rental receipts 21 mail to:

Pin On Welcome New Neighbor Inc

If applicable, tax is applied at a flat 0.75 percent on the portion of the tax base apportioned to new hampshire in 2015.

Nh meals tax form. Municipality has until july 1 following the notice of tax to grant or deny the abatement application. Motor vehicle fees, other than the motor vehicle rental tax, are administered by the nh department of safety (rsa 261). Learn about different types of sales and use tax from meals to telecommunications and much more.

The state of new hampshire does not issue meals & rentals tax exempt certificates. The tax is assessed upon patrons of hotels (or any facility with sleeping accommodations) and restaurants, as well as on motor vehicle rentals. This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it is made available by the new hampshire government.

Enter your total tax excluded receipts on line 1 (excluded means that the tax is separately stated on the customer receipt or check). Meals & rooms (rentals) tax data. Provided on the employer’s business premises and furnished solely for the employer’s benefit.

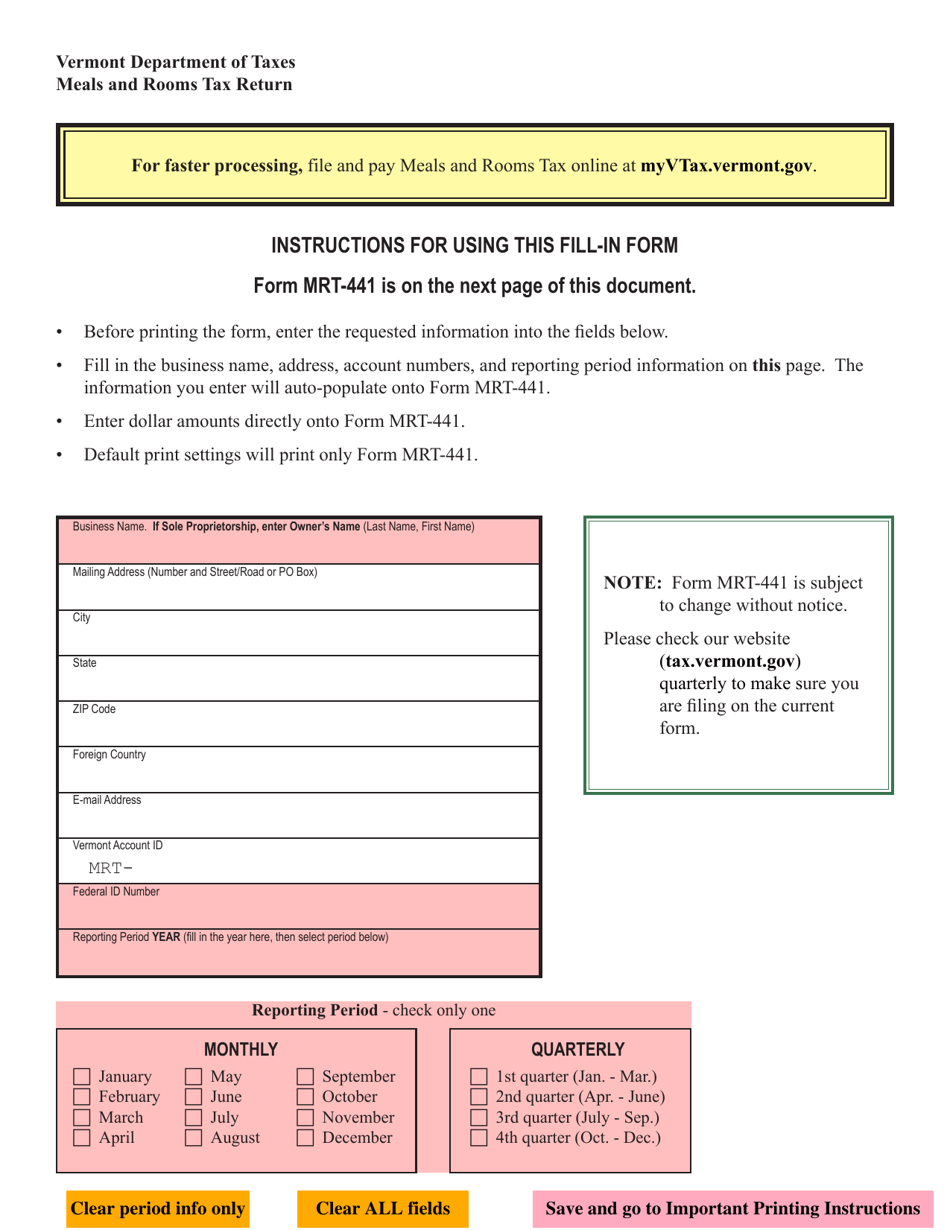

If you have a single location and cannot file and pay through myvtax, you may still use the paper forms. Is clothing subject to sales tax and why is a use tax is due on that new computer you just purchased in new hampshire. Taxpayer must file the abatement application with the municipality by march 1 following the notice of tax.

If you must file for multiple locations, or if your total meals and rooms tax remitted for the year exceeds $100,000, the commissioner of taxes has mandated that you use myvtax. How to use sales tax exemption certificates in new hampshire. In the tam, the irs answered a question about an employer’s policy for providing free meals on site.

10 meals for the new hampshire food bank ($10/month) nhpr is partnering with the new hampshire food bank. The meals and rentals (m&r) tax was enacted in 1967. A 9% tax is also assessed on motor vehicle rentals.

Tax obligations, business licenses & permits. Choose this option and 10 meals will be donated to families facing hunger right now. Generally, for meals to be excluded from workers’ income, two situations must apply, as listed in internal revenue code sec.

Make checks payable to state of new hampshire 20 21. Treasury meals & rooms tax distribution reports; The meals tax rate is 6.25%.

Multiply this amount by.09 (9%) and enter the result on line 2. Rcci lunch menu & meal county record [12] (32k xls) rcci meal pattern exception request form [34] (61k doc) rcci sbp menu & meal count record [58] (40k xls) resource management daily income worksheet [3] (73k xls) daily meal count worksheet [2] (51k xls) financial workbooks and instructions [171] (431k xls) special milk programs The m&r tax is paid by the consumer and is collected and remitted to the state on the 15th of each month by operators.

The rate dropped to 0.72 percent for. Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%. You can register online, and once you’ve registered, you’ll receive a meals and rooms (rentals) tax license as well as instructions on filing your lodging taxes.

3213 Individual Income Tax Returns Internal Revenue Service

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Irs Explains Which Meals Qualify For Temporary 100 Expense Deduction - Journal Of Accountancy In 2021 Tax Deadline Loan Forgiveness Payroll Taxes

Certification Request Form

Fillable Form 1040 Schedule C 2019 In 2021 Irs Tax Forms Credit Card Statement Tax Forms

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040i1040tt By Legibus Inc - Issuu

Form St-100311new York State And Local Quarterly Sales And

Contract For Catering Services Template Awesome Catering Contract Template Free Documents For Contract Template Templates Pop Up Card Templates

How To Fill Out A W-4 A Complete Guide Gobankingrates

Bank Wire Transfer Form Bank Wire Form Bank Personal Information Personal Info On Form Marketing Graphics Bank Of America Bank

Vt Form Mrt-441 Download Fillable Pdf Or Fill Online Meals And Rooms Tax Return Vermont Templateroller

3213 Individual Income Tax Returns Internal Revenue Service

3113 Individual Income Tax Returns Internal Revenue Service

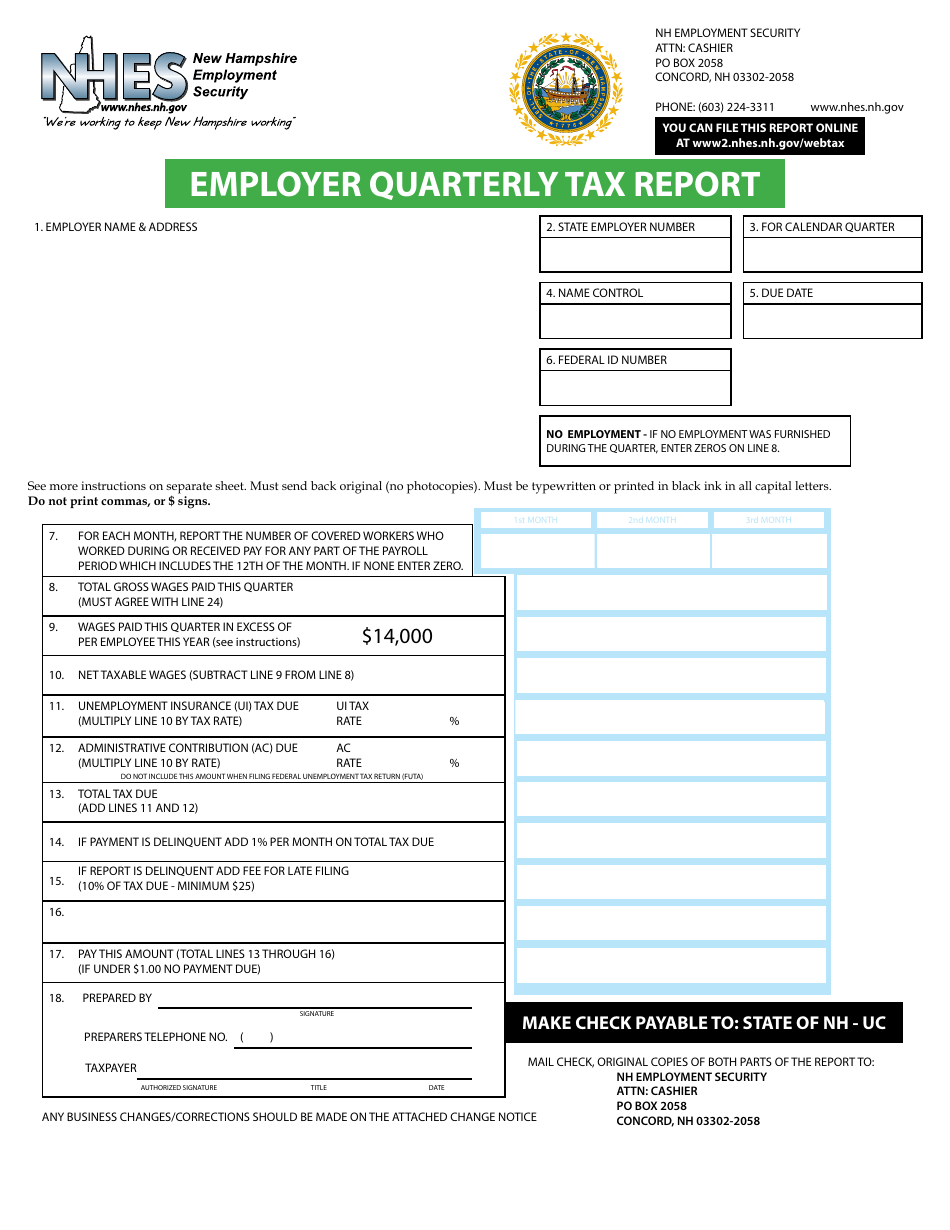

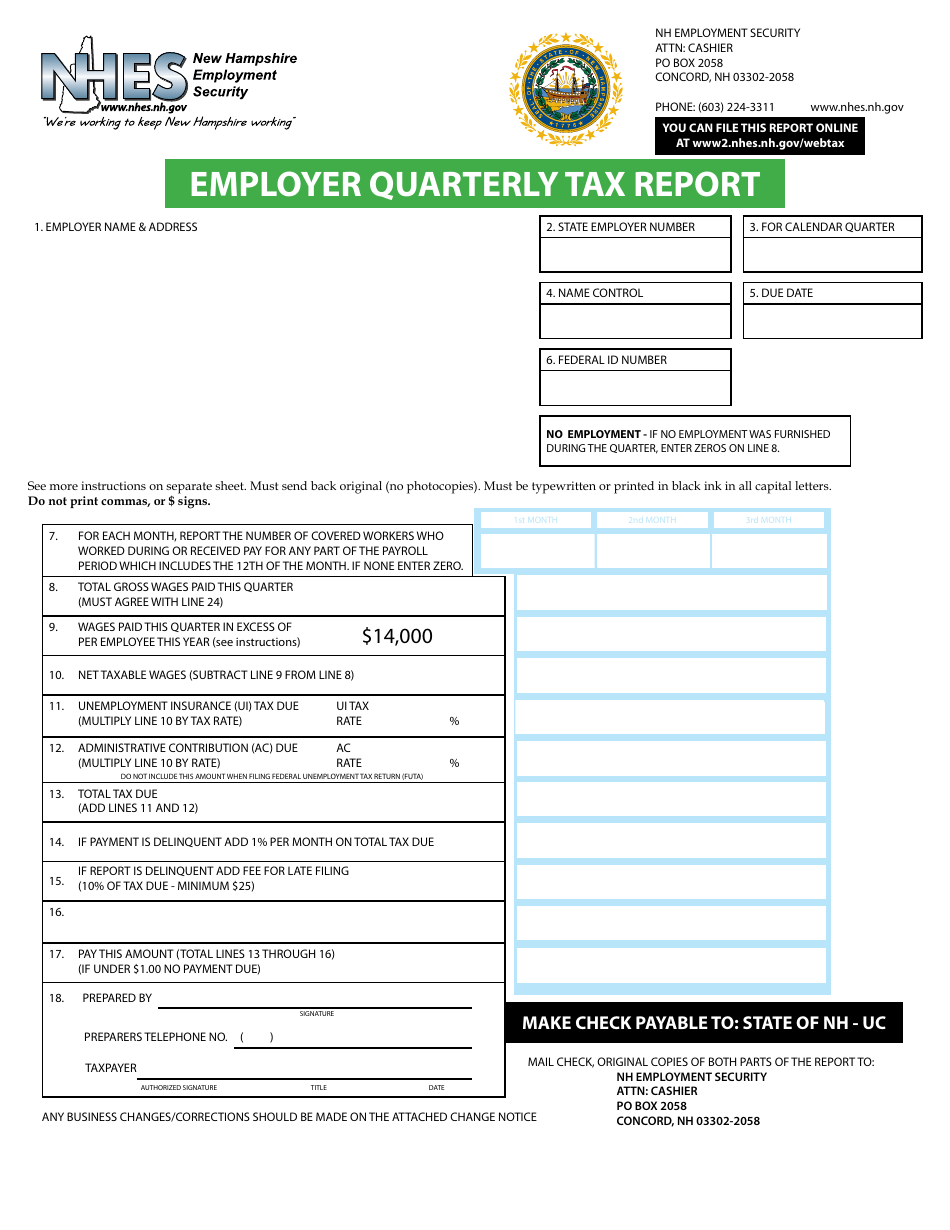

New Hampshire Employer Quarterly Tax Report Download Fillable Pdf Templateroller

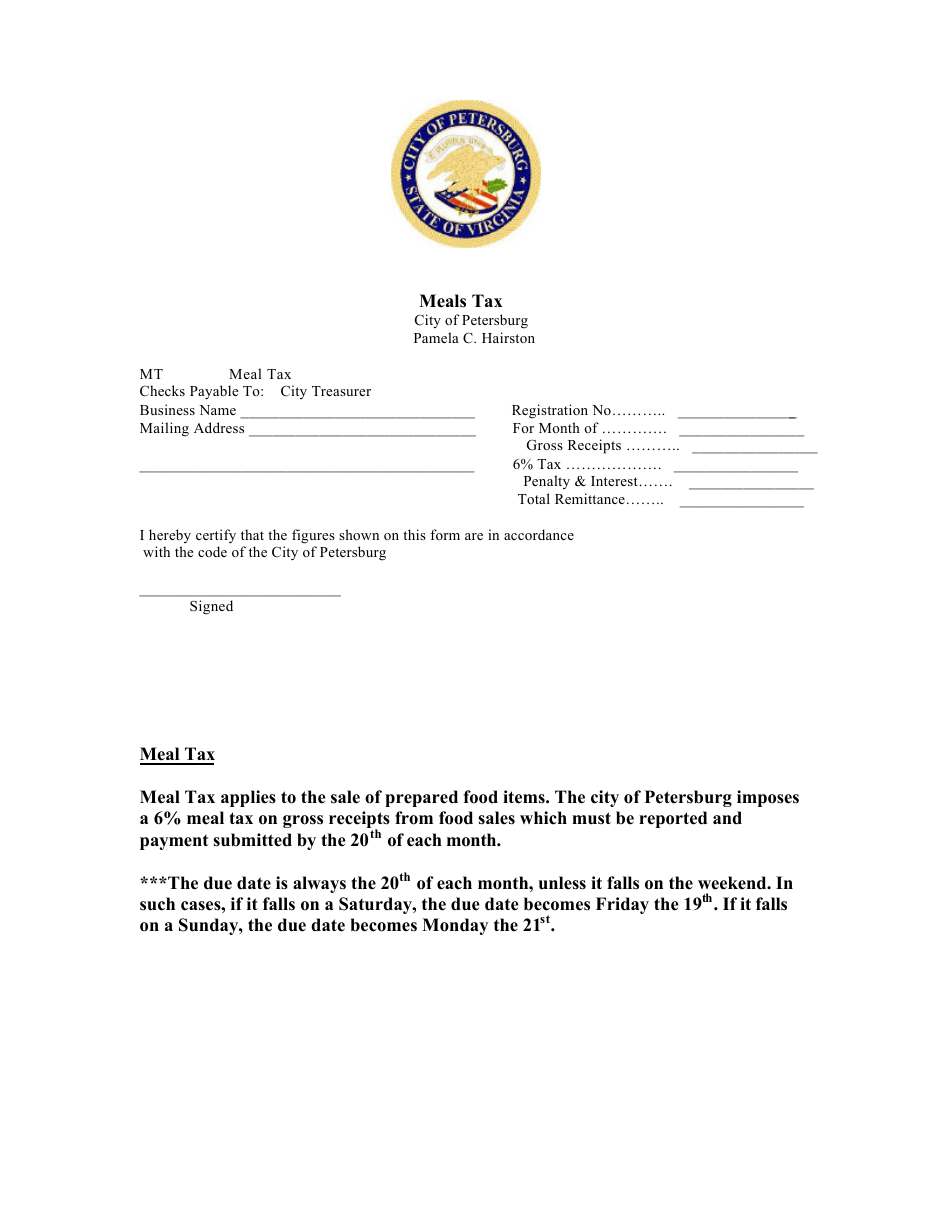

Petersburg Virginia Meals Tax Form Download Printable Pdf Templateroller

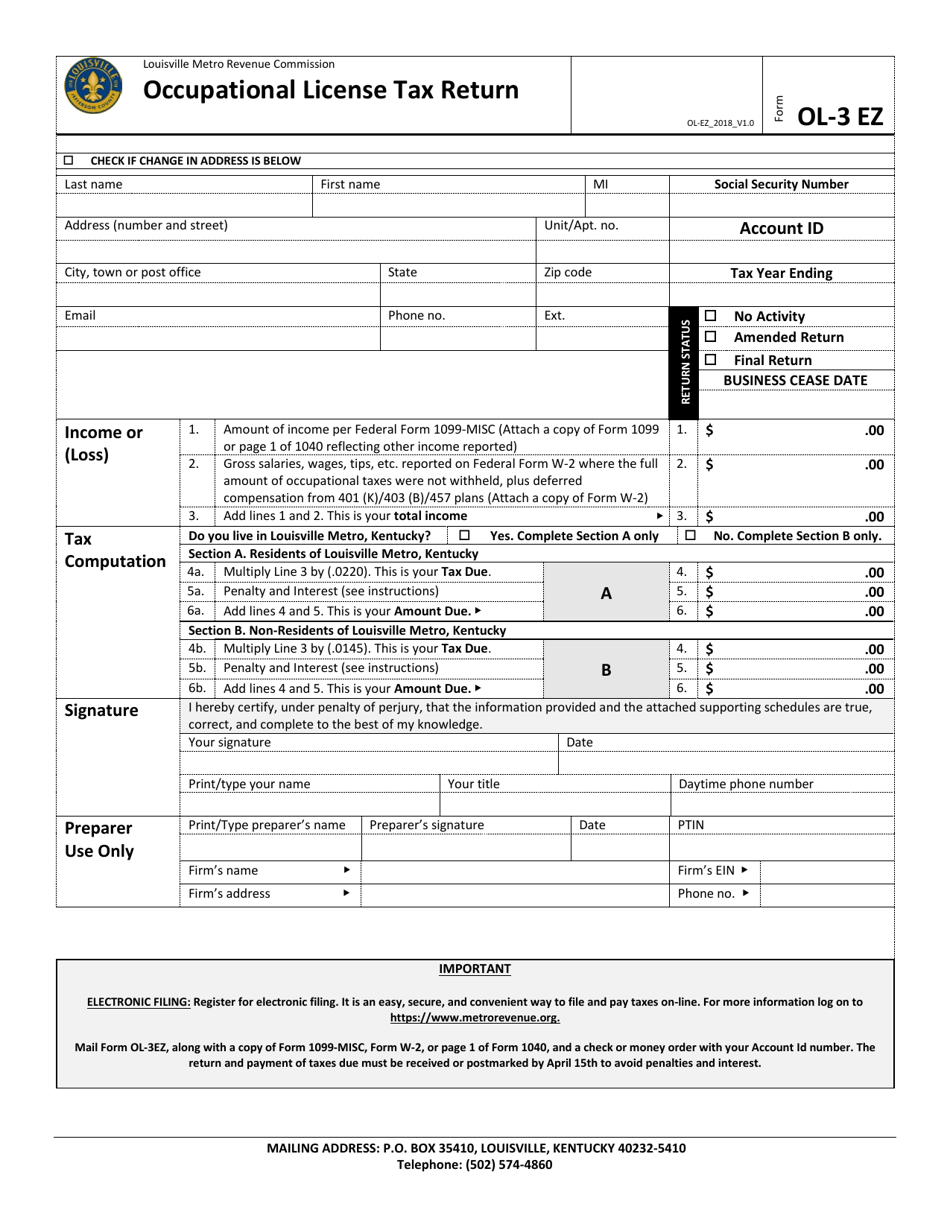

Form Ol-3 Ez Download Printable Pdf Or Fill Online Occupational License Tax Return Louisville Metro Kentucky Templateroller

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

2

Tax Return Form Hmrc High Resolution Stock Photography And Images - Alamy