Hotel Tax Calculator Illinois

The following local taxes, which the department collects, may be imposed. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code.

How To Charge Your Customers The Correct Sales Tax Rates

If you have any questions about how to use our illinois payroll calculator, you can always find definitions and more detailed information in our guide to the payroll process.and keep in mind that we offer easy and affordable online payroll services if you ever want any outside help.

Hotel tax calculator illinois. But instead of increasing taxes on local residents (property taxes for example), state and local. A monthly return is due on or before the last day of the month following the month for which the return is filed. Overview of illinois taxes illinois has a flat income tax of 4.95%, which means everyone’s income in illinois is taxed at the same rate by the state.

Metropolitan pier and exposition authority hotel tax. Write us at illinois department of revenue, miscellaneous taxes division p.o. Illinois has a 6.25% statewide sales tax rate , but also has 897.

The cigarette excise tax in illinois is $2.98 per pack of 20. It winds up being a little less than 15% + $3.50 per day. If filing a tax period prior to april 2011 call 217 785 6606 to obtain the correct form.

The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. The chicago, illinois, general sales tax rate is 6.25%.depending on the zipcode, the sales tax rate of chicago may vary from 6.3% to 10.25% You might also encounter this tax as hotel lodging tax, tourist tax, room tax or sales tax.

See all additional local taxes & fees. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Illinois alcohol and tobacco tax.

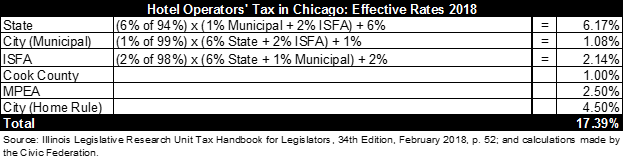

Illinois sports facilities hotel tax. Hotel tax matrix city of chicago hotel room revenue revenue taxable description furnished by hotels y/n tax type comments this matrix addresses only those city of chicago taxes that are administered by the chicago department of revenue. The matrix does not address the city of chicago taxes that are enforced by the illinois department of revenue.

A hotel occupancy tax is a tax placed on each nights’ stay at a hotel. The tax, as all other taxes, was created as a way to increase government revenues. As a reminder, the surcharge rate is 6% as of 12/1/18.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The city of chicago levies taxes on both hotel operations and occupancy. It is not a substitute for the advice of an accountant or other tax professional.

The hotel accommodations tax remains 4.5%. [4] specific sales tax levied on accommodations. [3] state levied lodging tax varies.

The original 4.0% home share tax was implemented in 2016 to fund supportive services related to housing for the. Depending on local municipalities, the total tax rate can be as high as 11%. Beer will generally be subject to a rate of 23 cents per gallon while liquor is subject to a rate of $8.55 per gallon.

State has no general sales tax. The illinois (il) state sales tax rate is currently 6.25%. How 2021 sales taxes are calculated in chicago.

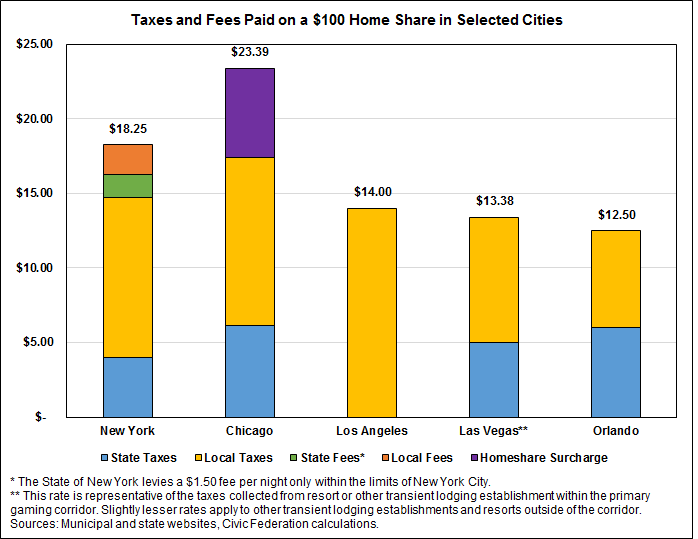

The city charges a 4.5% hotel accommodations tax and a 6.0% additional home share tax on rentals through companies such as airbnb, as well as a 1.0% hotel operators tax. The new form mirrors the 7520 tax return, but the tax and the surcharge should be paid and reported separately beginning with the december 2018 payment due 1/15/19. The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for illinois residents only.

Except as noted on their respective pages, the preprinted rate on the return will include any locally imposed taxes.

Personal Vision Statement Examples For Life In 2021 Vision Statement Examples Vision Statement Essay Prompts

Eb-5 Process Timeline This Timeline Is For General Informational Purposes Only The Actual Time Required To Complete Timeline Informative Capital Partners

Ryan Wiley Business Card - Burlington On Mortgage Brokers Mortgage Brokers Mortgage Home Mortgage

Have You Ever Asked What Are The Various Types Of Retirement Accounts Beinvestmentsmart And Join Us To Financial Seminar Money Smart Week Financial Literacy

Taxes City Of Fort St John

Explaining The Difference Between A Home Inspection Vs A Home Appraisal Homeinspection Homeappraisal Rel Real Estate Articles Home Inspector Home Appraisal

Property Tax - City Of Decatur Il

Httpannapolispropertyservicescomlooking-to-rentproperty-search-advanced-map-searchingviewc Rental Property Investment Rental Property Property For Rent

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Bookkeeping Payroll

Taxes City Of Fort St John

.png)

Taxes Fees

Law Firm Website Design Paperstreet Law Firm Website Law Firm Website Design Law Firm

How Do Chicagos Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Pin By Minosta4u Official On Great Usa Home Loans Mortgage Loans Mortgage Lenders

Pin By Joelle Massincaud On Resumes Pinterest Nursing Resume Registered Nurse Resume Rn Resume

How Do Chicagos Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Our Chicago Accountant Look At Whats The Best Tax Planning For You Consult With You To Ensure We Uphold Your Vision Ht Tax Preparation Tax Services Tax Prep

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Wisconsin Sales Tax - Small Business Guide Truic