How To Pay Late Excise Tax Online

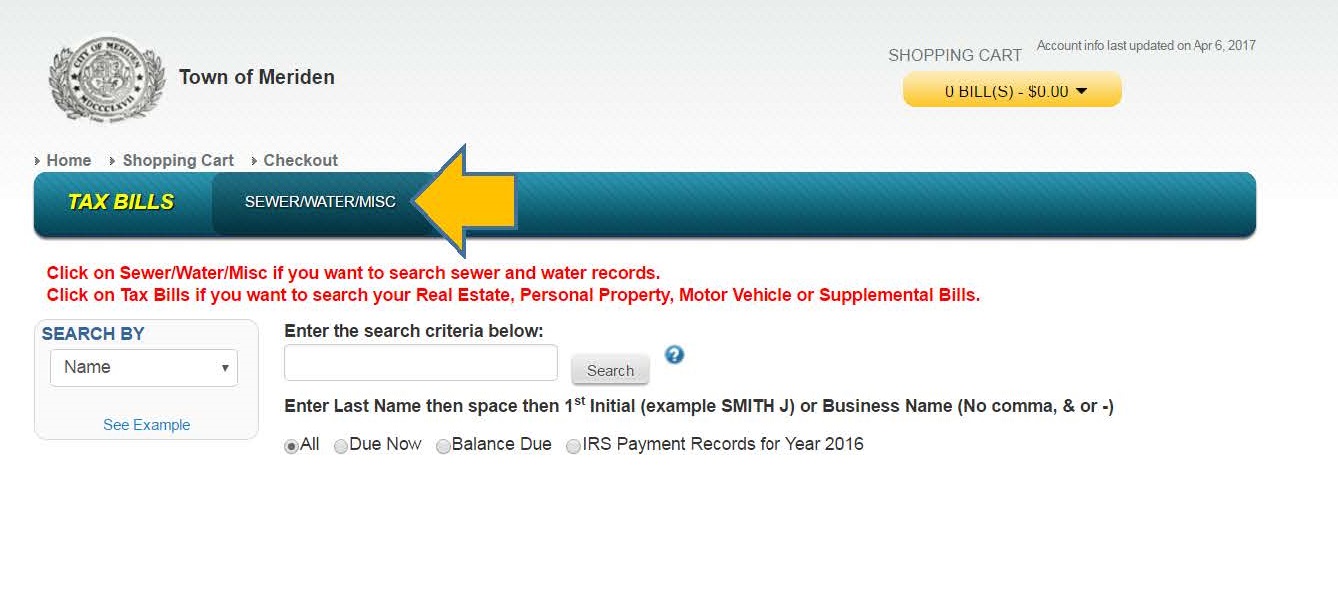

You need to enter your last name and license plate number to find your bill. Thirty days after issue, date varies upon registration of vehicle.

How To Pay Vehicle Token Tax Via Epay Punjab App - Phoneworld

Once a vehicle reaches the 5th year, that vehicle will remain at 10% of the original msrp for the life of the vehicle.

How to pay late excise tax online. If you have to pay excise duty but don't have an excise licence, psp or movement permission, you’ll need to: Payment by credit card or electronic check may be made online through invoice cloud. You can pay your excise tax through our online payment system.

All owners of motor vehicles must pay an excise tax; The charge for the demand is $30. You can make your payment free of charge at your financial institution in canada.

Do not ignore an excise bill for a. If payment is due, you can mail a cashier’s check, money order or company check payable to the texas comptroller of public accounts along with the report. For excise tax purposes, price paid and condition are not considered.

Motor vehicle excise tax bills are issued each calendar year to each owner of a vehicle registered in massachusetts. Once completed, click the next button within the option you choose. Tax information for income tax purposes must be requested in writing.

If an excise is not paid within 30 days from the date of issue, a demand will be sent. Go to our online system What are the requirements for abatements?

It’s now easier to view and pay your bills online. On unpaid excise tax bills, an owner risks incurring late fees and penalties if an abatement is not granted. The postmark date will serve as proof of timely filing.

Once you enter your name, please click one of the options below to continue entering specific information. Your obligation as a taxpayer will depend on your circumstances and business type. How to make a payment.

If your excise tax return is late, you must pay a penalty based on the amount of taxes you owe. You can find the bank account details in mytax. If javascript is disabled in your browser, please.

You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis, when you lodge your excise return. Excise bill abatement if an owner of a motor vehicle feels that they are entitled to an adjustment of their excise bill, it is strongly recommended that they pay the bill in full, then contact the board of assessors for an application for abatement. You must have an original voucher from the canada revenue agency (cra) for your financial institution to accept the payment.

It appears that your browser does not support javascript, or you have it disabled. Stay current with filing frequencies and operational reports, excise tax, and export due dates by subscribing to receive automated reminders when it is time to file. The legislature also authorized county governments.

If you pay excise duty in your online bank, please note that you must pay your taxes to the tax administration’s danske bank or nordea account. Interest accrues on the overdue bill from the day after the due date until the date of payment at an annual rate of 12 percent. Bring a lawsuit against you (within 6 years of the date the excise is due and payable)

The assessor’s office must receive abatement applications within 3 years after the excise. Online payments (taxes, water, sewer, trash) pay delinquent excise & parking tickets; The tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale services, and use tax on imports for resale, and 4% for all others.

Present your remittance voucher with your payment to the teller. The bills are prepared from the records of the massachusetts registry of motor vehicles. Therefore, it is the responsibility of the owner to contact the local assessor if he/she has not received a bill.

We will then present bills found matching the options you provided. If your excise tax payment is late, you must pay additional penalties and interest based on the amount of taxes you owe. In all situations, payment of excise duty is due at the same time as lodgment of your excise return.

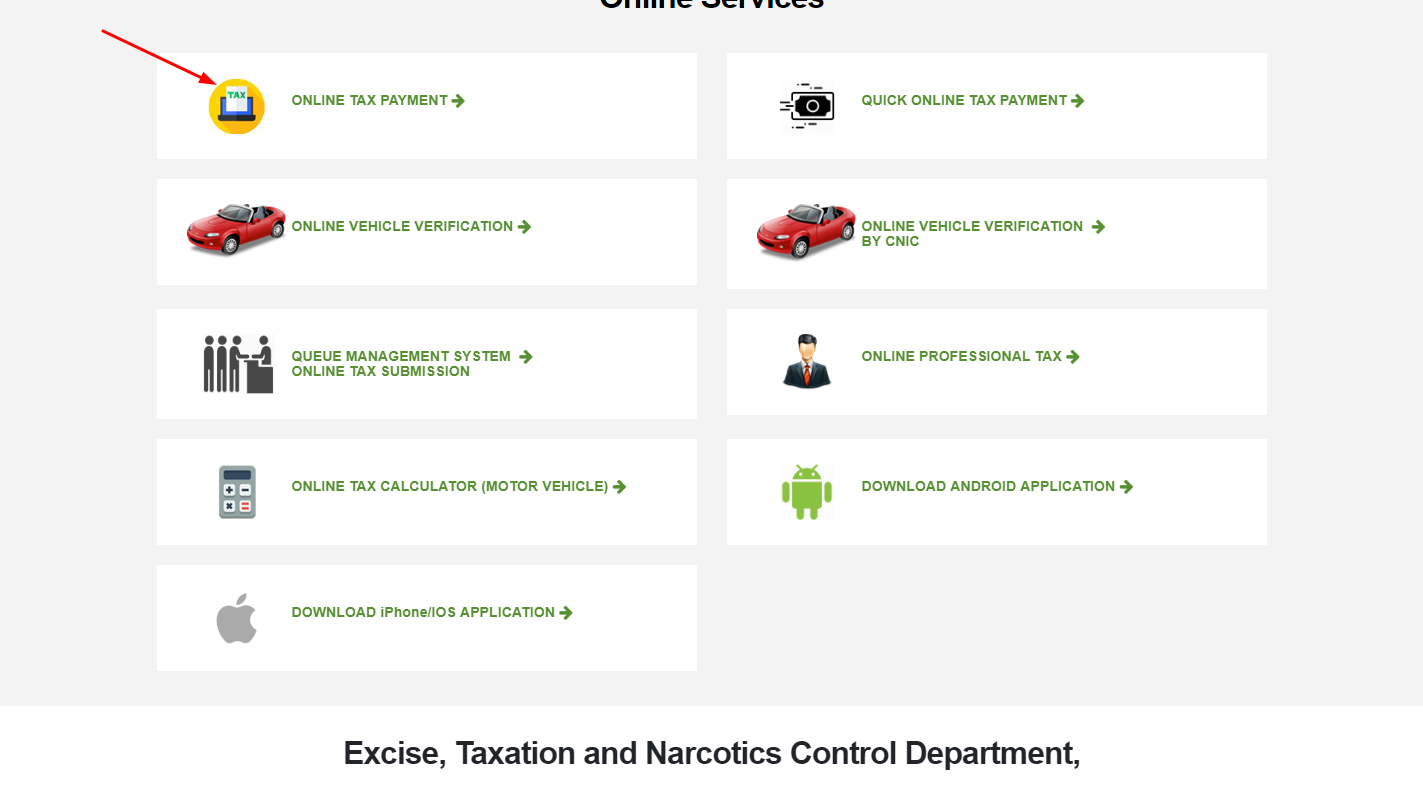

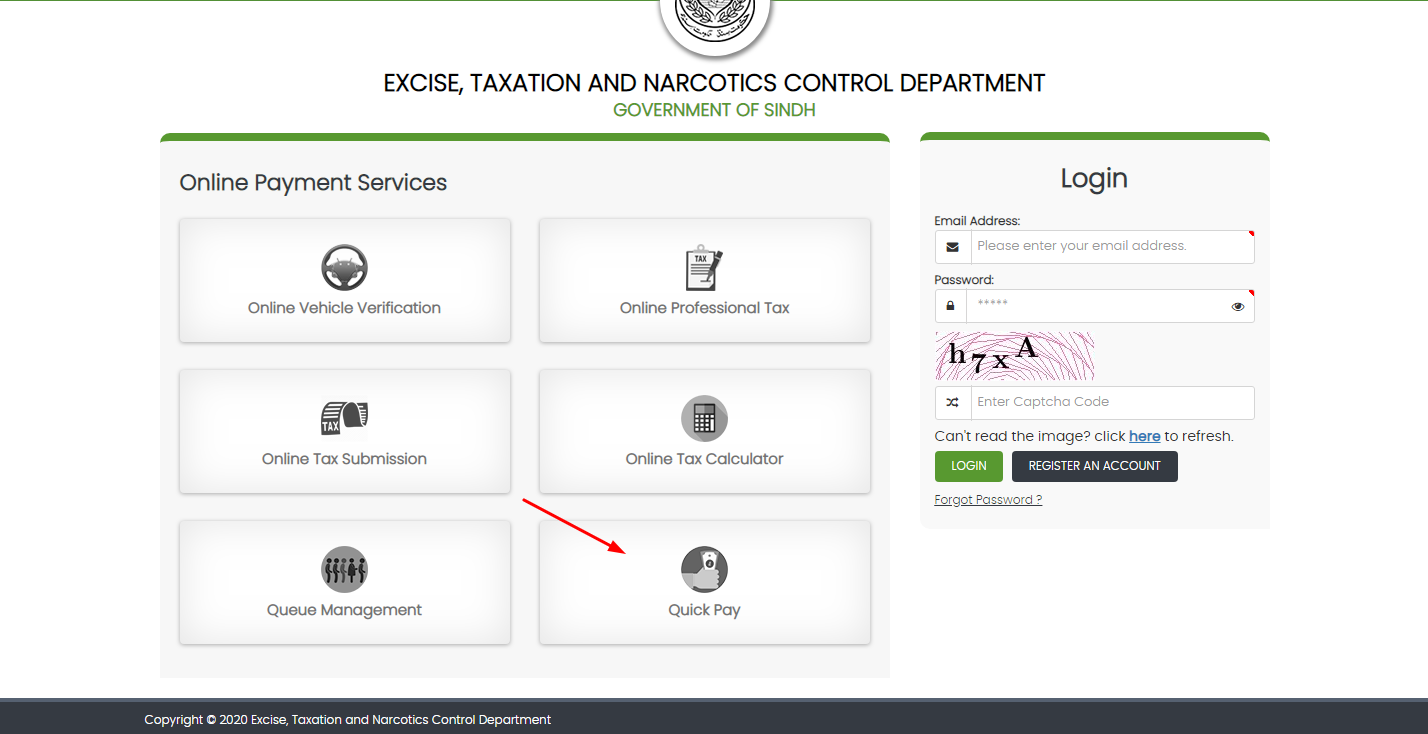

Excise, taxation and narcotics control department government of sindh. Payment by check or money order may. Click on the button below to make a payment.

Make sure to use the correct account number when you pay. The teller will return the top part to you as a receipt. The town of tewksbury offers residents an easy and secure way to view, print and pay their real estate tax, personal property tax, vehicle excise tax, and water & sewer bills online.

Your ttb specialist will assist you in calculating the penalties and interest. Majority of bills are due in late march or early april. Excise bills are prorated by the month, thus the owner is responsible for the excise accrued through the month in which the car was last registered to.

Complete a registration for excise. For vehicles on the road january 1 that have paid an excise tax in the prior year those bills are generally issued by february 15. Pay excise tax demands online.

What Is Transmittal Form 1096 Irs Forms Irs Tax Forms

Eway Bill Registration Procedure For Gst Registered Taxpayer Complete Step By Step Registration Procedure To Register On Ewa Bills Registration Latest Updates

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

How To Pay Online Motor Vehicle Taxtoken Tax In Sindh

Online Road Tax Payment - Best Ppt Template Download

Tech Giants Have Hijacked The Web Its Time For A Reboot Led Light Mask Reboot Latest Technology Updates

View Or Pay Your Taxesutility Bill Online

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

If 1099 Employee Wont Provide An Ssn For Your 1099 Tax Form 1099 Tax Form Tax Forms Irs

The Real Deadline For Depositing 401k Deferrals And What To Do If Youre Late Wwwpatriotsoftwarecom Deposit Payroll Software Employment

How To Pay Online Motor Vehicle Taxtoken Tax In Sindh

Federal Form 1099 Misc Deadline Irs Irs Forms Form

Online Road Tax Payment - Best Ppt Template Download

Online Road Tax Payment - Best Ppt Template Download

How To Pay Your Vehicle Tax Online In Sindh Zameen Blog

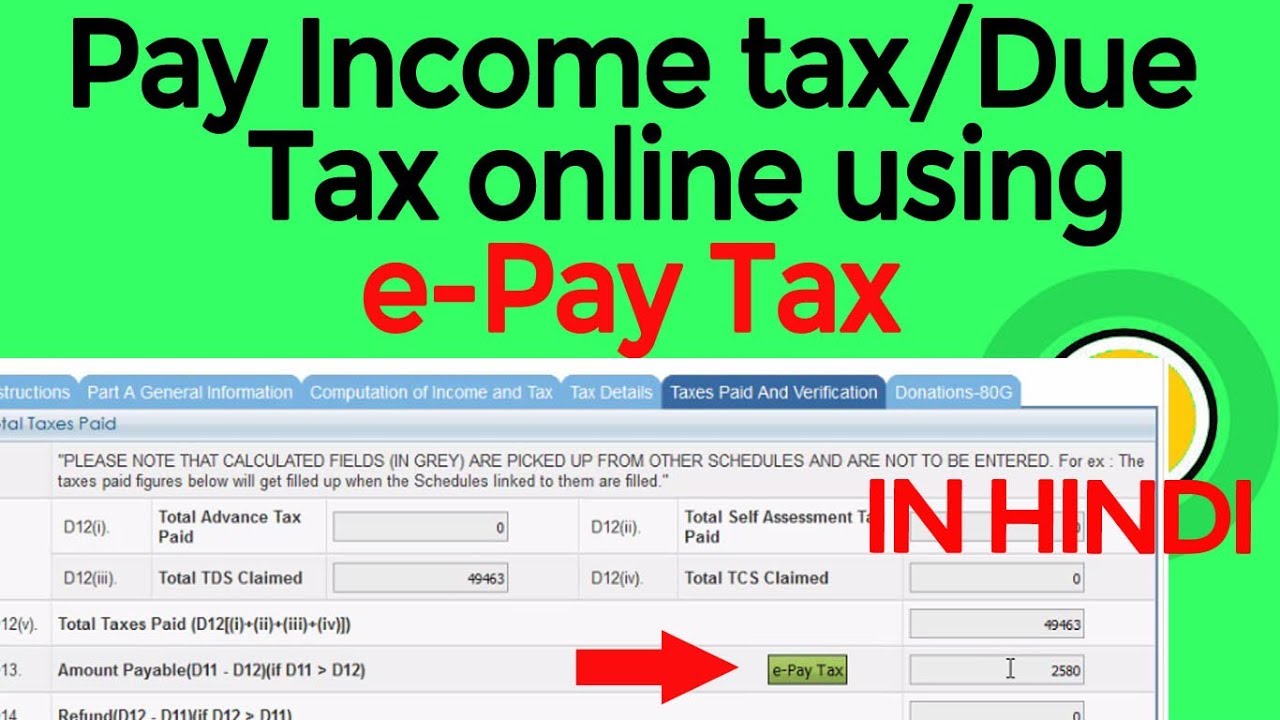

Steps To Pay Due Income Tax Via Online

How To Pay Income Tax Online Through E Pay Using Atm Card Or Online Banking - Youtube

Gst Migration Registration For Existing Assessee Registration Consent Letter Patent Registration

New Gst Registration Procedure Gst Number Blog Tools Confirmation Letter Registration