Reit Dividend Tax South Africa

The definition of a reit in the income tax act refers to a company which is south african tax resident and whose shares are listed on the jse as shares in a reit as defined in terms of the jse listings requirements. A south african tax resident natural person investing in a reit will be subject to income tax on dividends received by or accrued from a reit at a maximum rate of 40%.

Google Image Result For Httpsbookstoregpogovsitesdefaultfilesstylesproduct_page_imagepubliccoversf1040sd Tax Forms Capital Gain Capital Gains Tax

A reit and a controlled company must also consider dividends tax, transfer duty, securities transfer tax and vat.

Reit dividend tax south africa. The definition of a reit in the income tax act refers to a company that is a south african tax resident whose shares are listed on the jse as shares in a reit, as defined in the jse limited listing requirements. Reit dividends received by south african tax residents must be included in their gross income and will not be exempt from income tax (in terms of the exclusion to the general dividend exemption, contained in paragraph (aa) of section 10(1)(k)(i) of the income tax act) because they are dividends distributed by a reit. South african residents that earn foreign dividends generally have to pay tax on those foreign dividends and declare them when submitting their south african tax return.

A proposal included in the draft taxation laws amendment bill for 2020 would exclude real estate investment trusts (reits) from application of the participation exemption rules. In turn this may result in the reit or cc not being able to claim the dividend as a qualifying distribution deduction and ultimately the reit or cc may be in a taxable income position. South african resident shareholders are generally subject to income tax (section 10(1)(k)(i)(aa)) and exempt from the dividends tax;

General taxation principles the general taxing principle of a reit is the flow through principle so However, where the company paying the cash dividend is a reit (as defined in section 1 of the act), cash dividends paid to: Put simply, a reit may deduct for income tax purposes distributions made to its shareholders.

Investor is subject to normal tax on distributions derived from a reit or controlled company. Reits are therefore effectively allowed to operate on a tax neutral basis. The real estate investment trust (reit) tax regime in south africa was addressed for general review in annexure c.

Albeit that the reit is a sa tax resident company and jse listed, it may also raise funds abroad, as tradable units, as explained later. Annexurec also referred to the implementation of the financial sector regulation act, no9 of 2017 and the establishment of the financial sector conduct authority (fsca) which provide for the regulation of unlisted reits, as it is proposed that. In south africa, a reit receives special tax considerations and offers investors exposure to real estate through shares listed on the johannesburg stock exchange (jse).

The dividend recipient, however, will not be taxed on dividends. The tax policy decision was to tighten controls and take advantage of the growth in the reit investment market for south african property companies and the development of industrial and commercial property. A reduced dividend withholding rate, in terms of the

Tax on dividends received by or accrued from a reit will be imposed on natural persons who are south african residents. Note that dwt is payable only on dividends paid out by the companies, and is payable after the company has already paid 28% corporate tax on its net profits. Foreign shareholders of sa reits are levied a dividend withholding post tax at the current rate of 20%, but this can be reduced in terms of the rates set by the applicable double tax agreement between south africa and the domiciled country of the investor.

Proposed change to taxation of foreign dividends and gains by reits. Reit tax legislation was introduced into the south african income tax act in 2012 in order to create a unified system for both the put and pls regimes. Real estate investment trusts (reits) are subject to a special tax regime in south africa.

As of 1 january 2014 the sa dividend withholding tax at 15% or the treaty governed rate where the investor is resident in a treaty country, will apply to nonresident investors. The purpose of the reit tax legislation was to provide investors with tax certainty in order to incentivise the use of property investment companies, in line with international principles. Moreover, it must be noted that a reit is not subject to capital gains tax in respect of properties that it disposed of, and dividends declared by a reit to south african shareholders are not exempt, but are in fact part of the shareholders’ taxable income.

A real estate investment trust (reit) is a company that derives income from the ownership, trading, and development of income producing real estate assets. Such person will, however, be exempt from dividends tax in respect of such dividend.

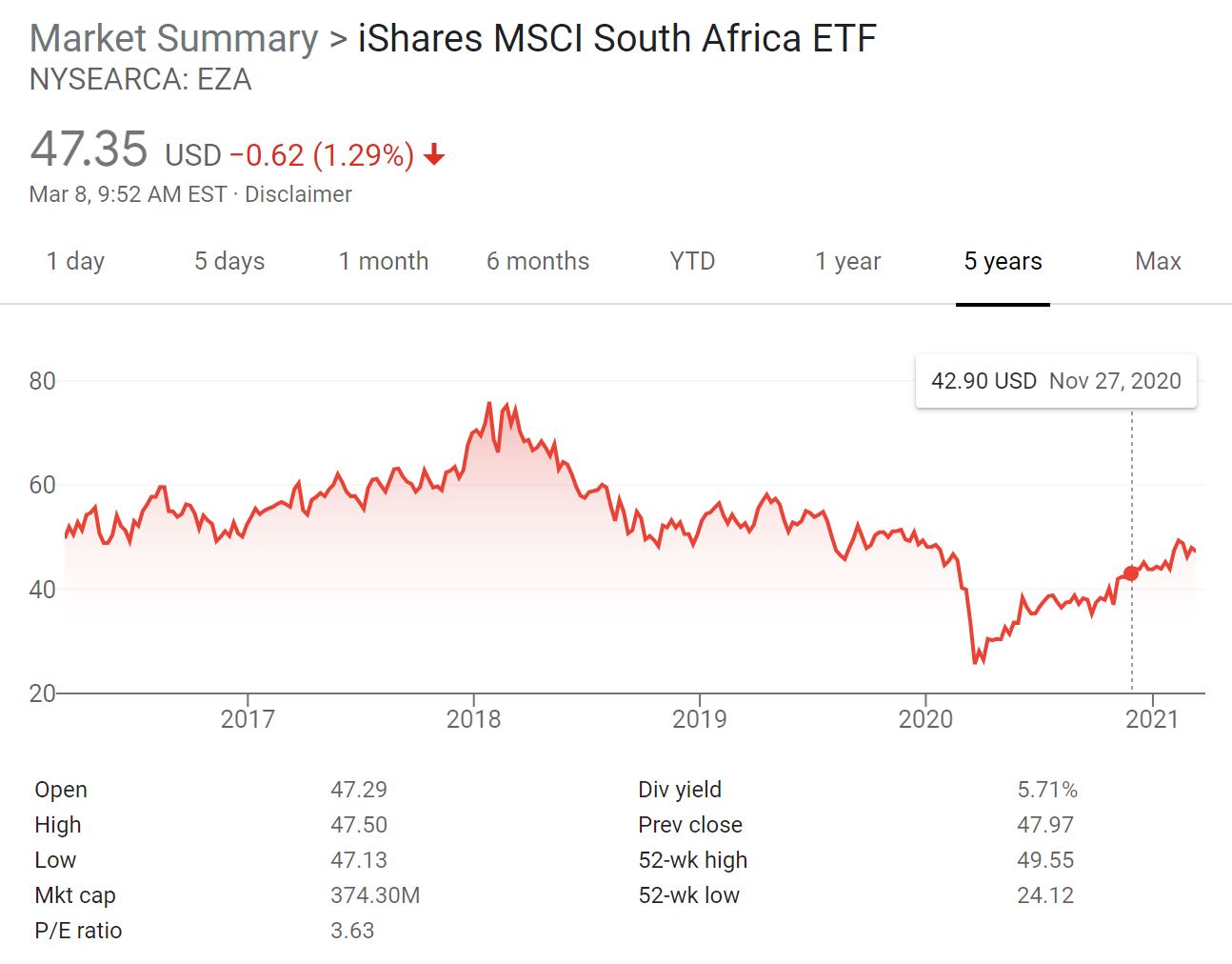

Best Etf South Africa - Compare Top Etfs For 2021

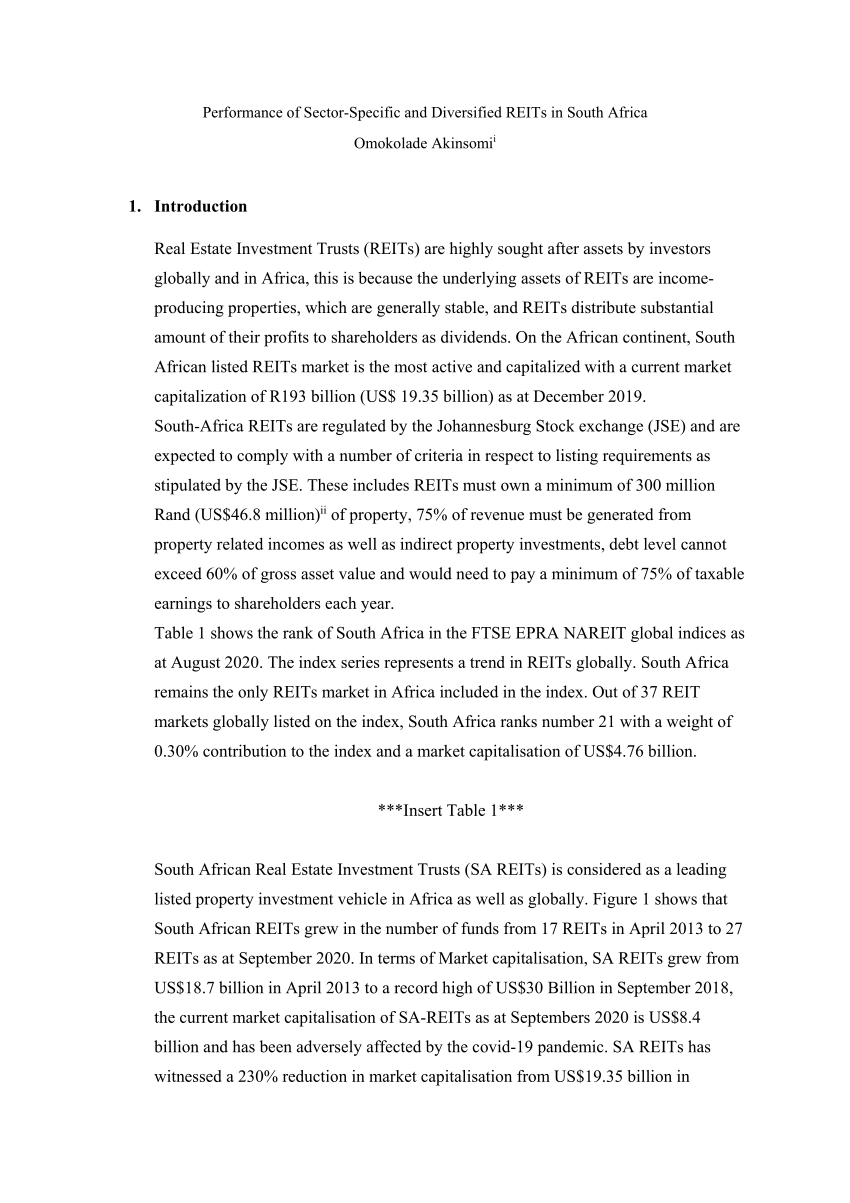

Pdf Performance Of Sector-specific And Diversified Reits In South Africa Omokolade Akinsomi

South Africa Rate Hike Could Signal End Of Cheap Money In Region - Bnn Bloomberg

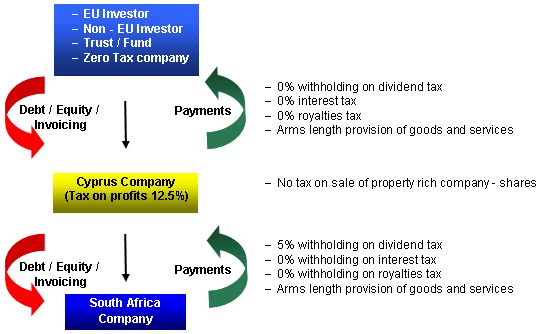

Structuring Investments In From South Africa Through Cyprus - Tax - Cyprus

How Reit Regimes Are Doing In 2018 Ey Slovakia

The Zero Rate Conundrum - Does It Really Make Sense - Ishares 20 Year Treasury Bond Etf Nasdaqtlt Seeking Alph Advanced Economy Developed Economy Nasdaq

South Africa Reits Investing Offshore International Tax Review

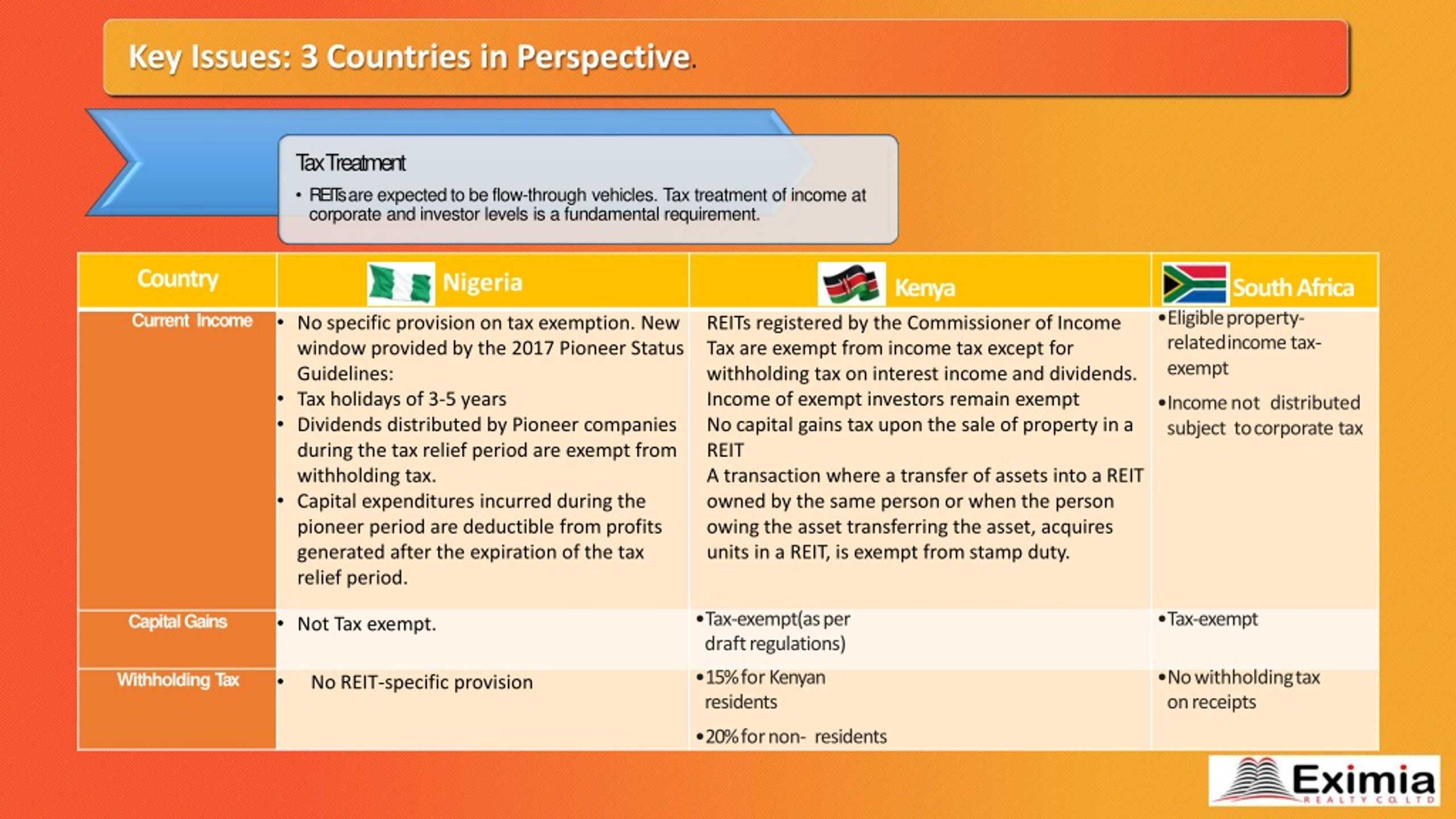

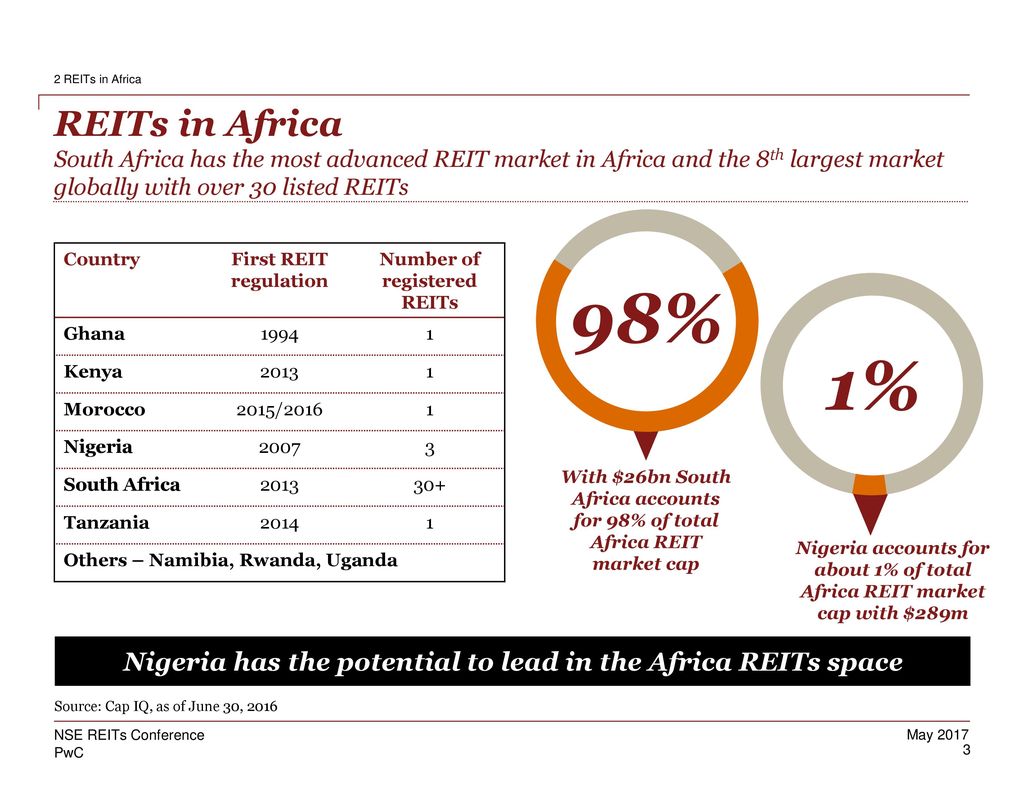

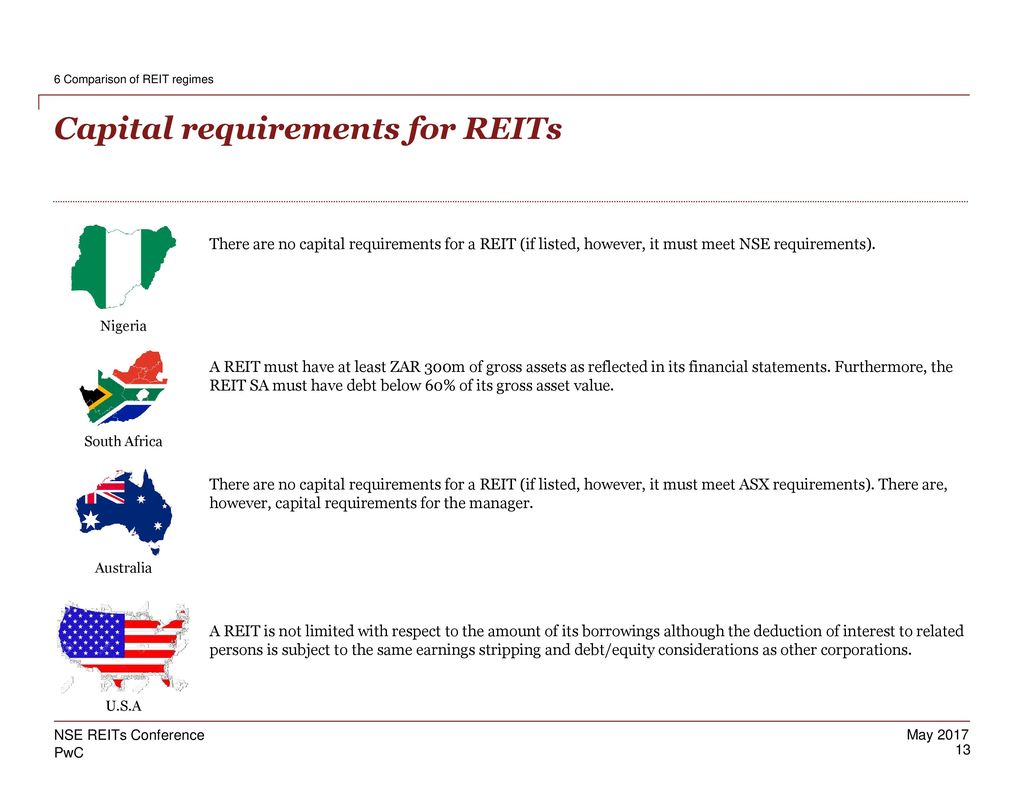

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub-sahara Africa Taiwo Oyedele Pwc West - Ppt Download

South Africa Reits Investing Offshore International Tax Review

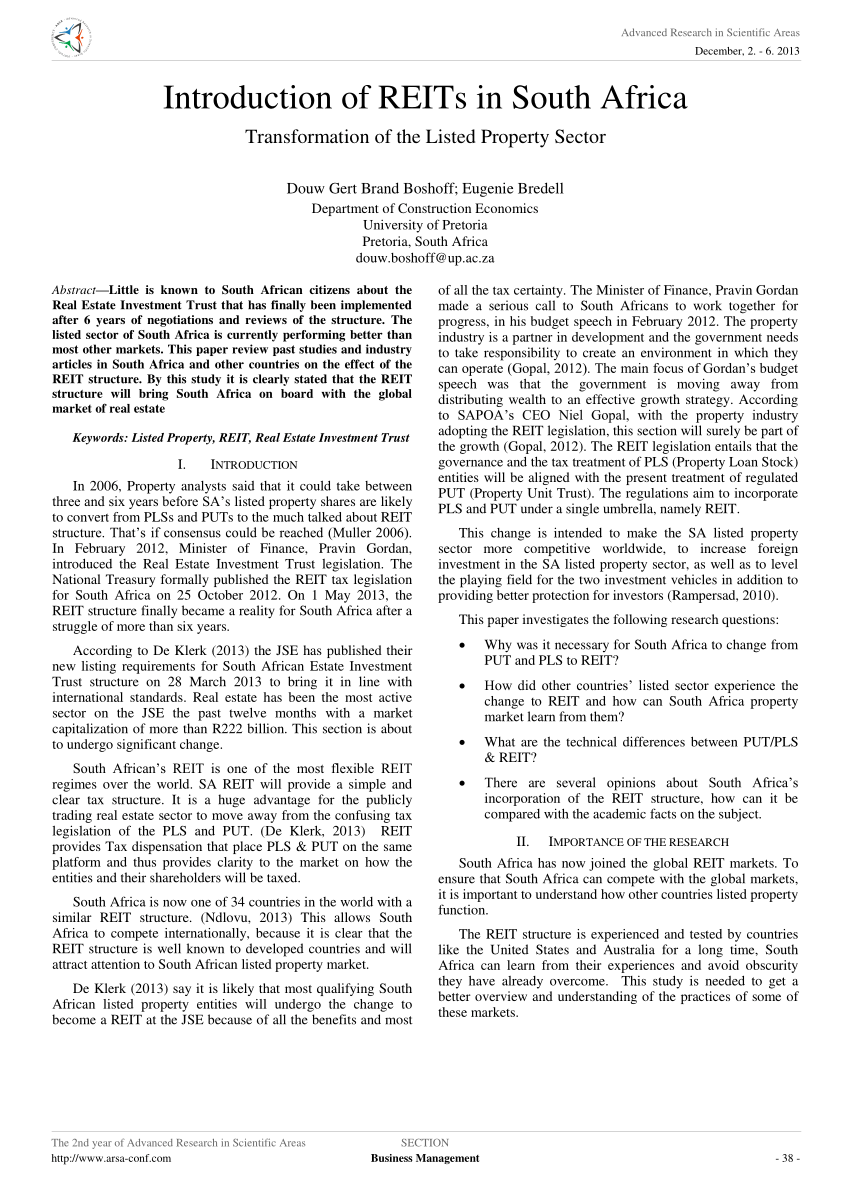

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

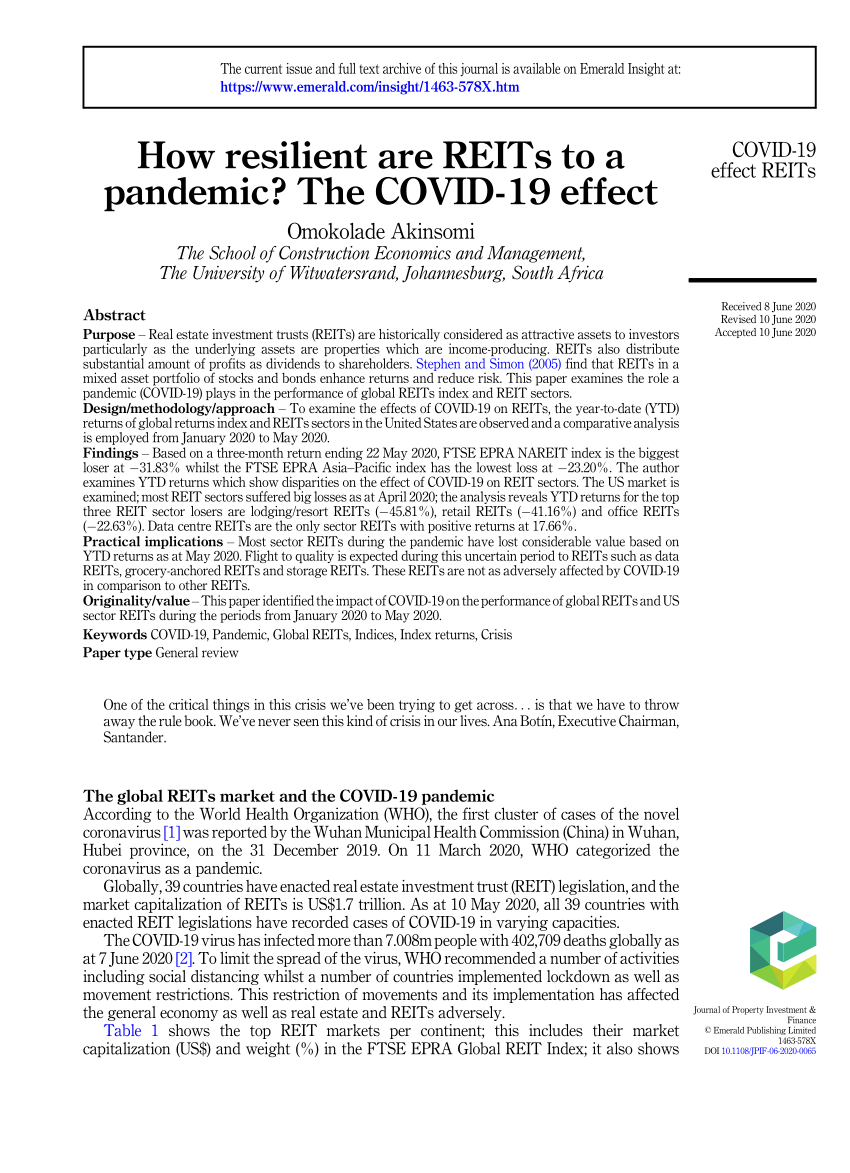

Pdf How Resilient Are Reits To A Pandemic The Covid-19 Effect

Pdf Comparison Of Reit Dividend Performance In Nigeria And Malaysia

Real Estate Investors Face Dividend Drought

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub-sahara Africa Taiwo Oyedele Pwc West - Ppt Download

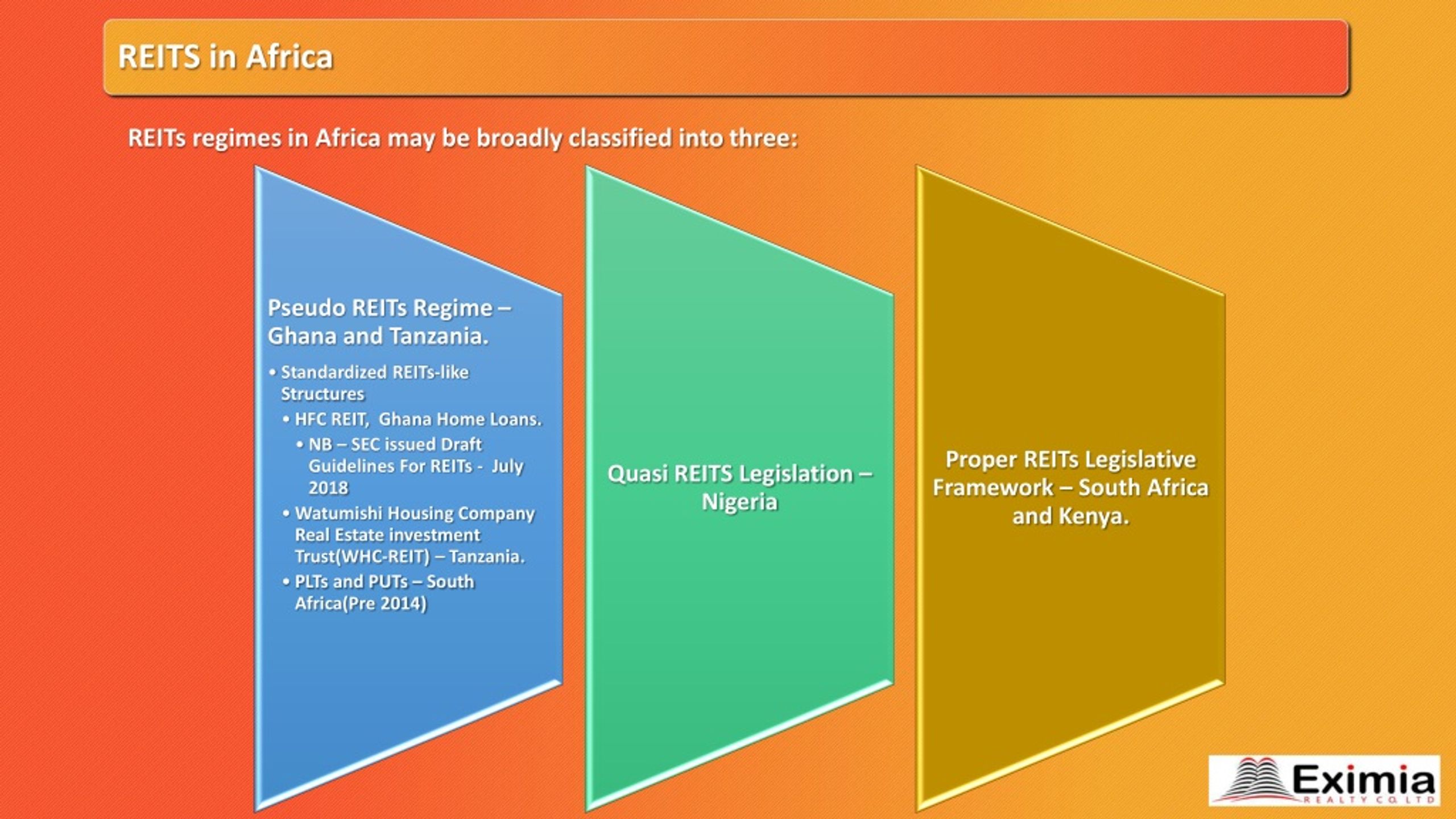

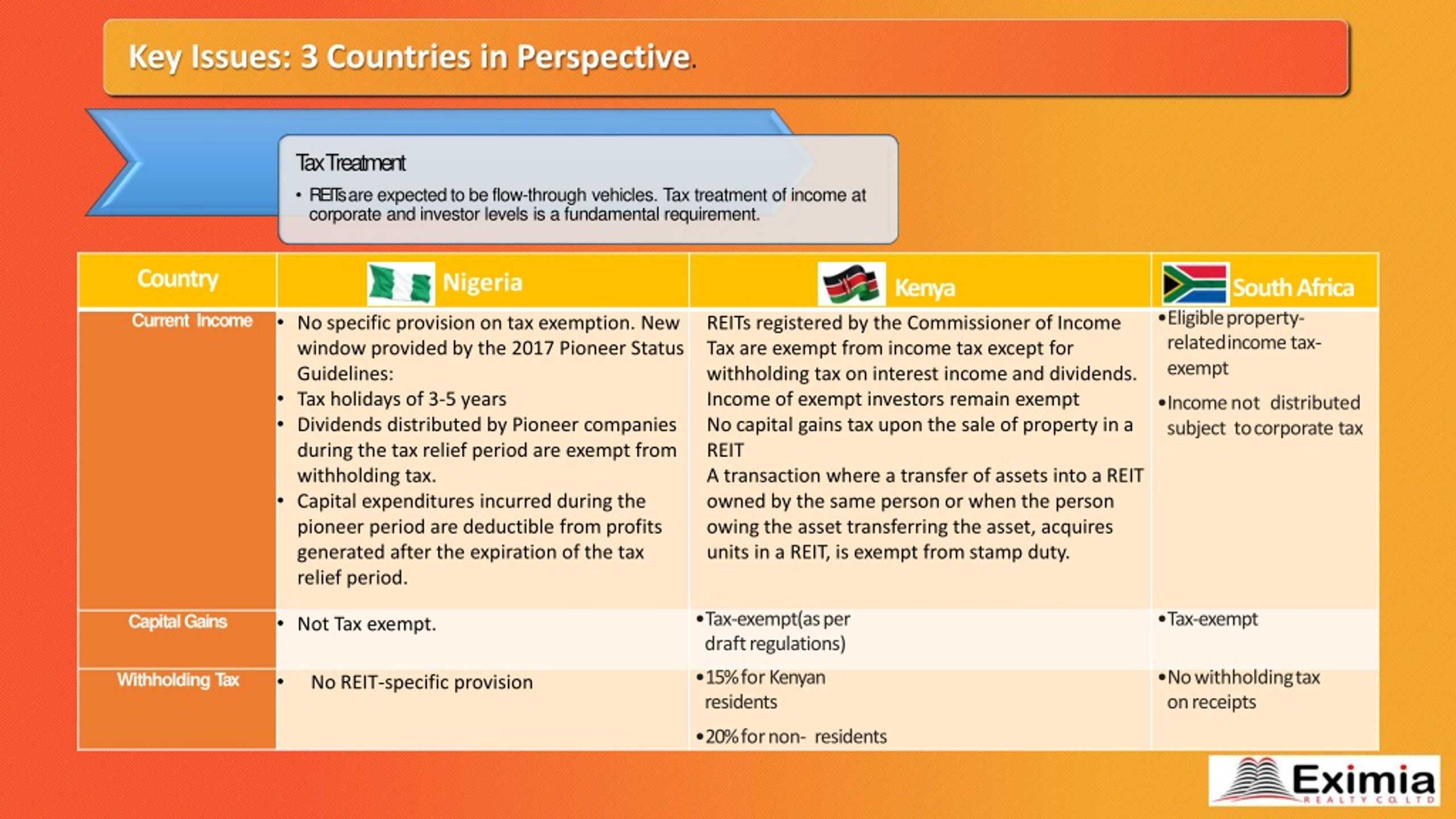

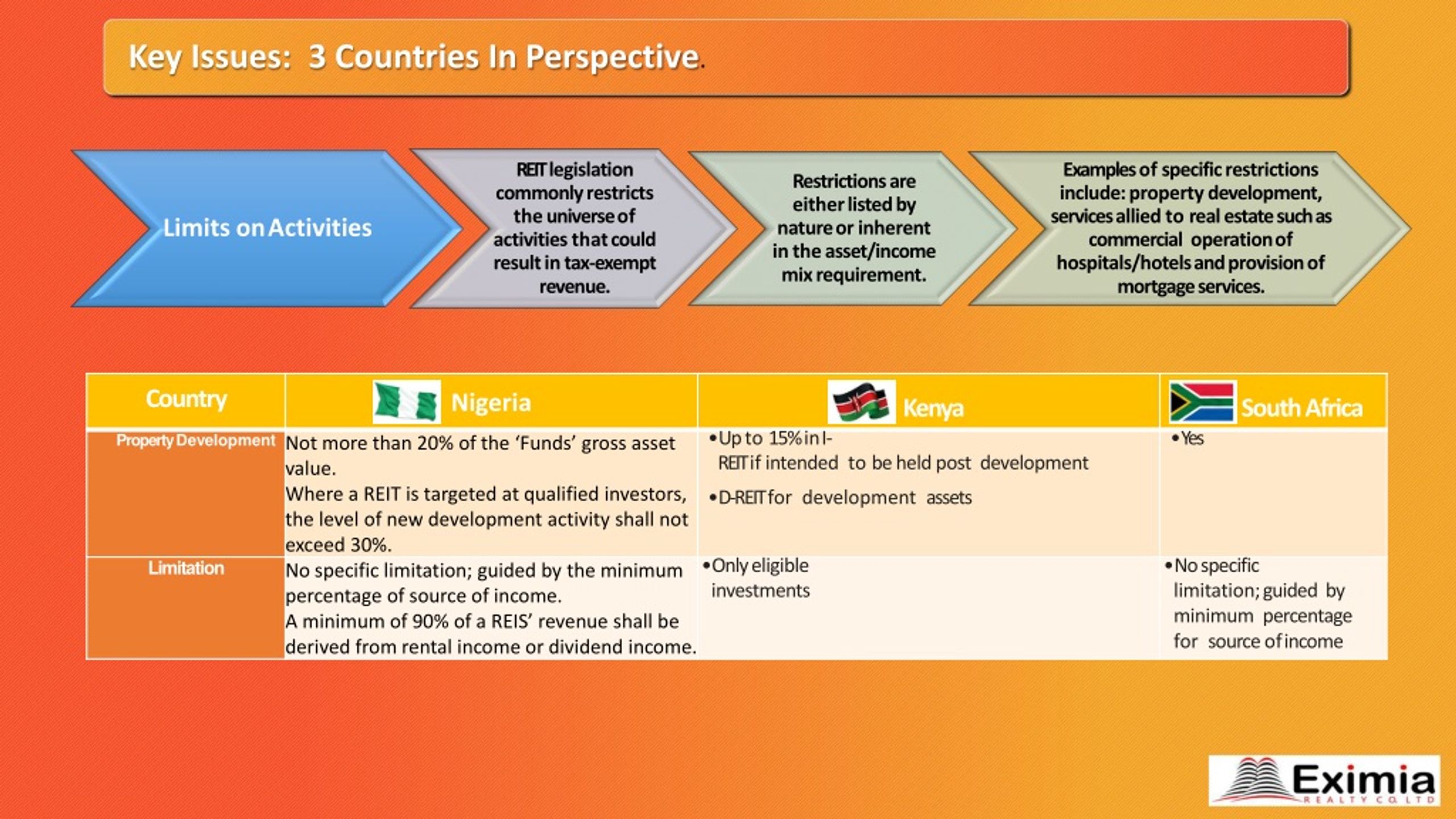

Ppt - Reits - An African Perspective Powerpoint Presentation Free Download - Id8160924

Pdf The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

Taxes Like Fees Can Eat Into Your Investment Returns

Ppt - Reits - An African Perspective Powerpoint Presentation Free Download - Id8160924

Ppt - Reits - An African Perspective Powerpoint Presentation Free Download - Id8160924