Owe State Taxes Illinois

If your business collects sales tax and makes sales tax payments to the illinois state government, you must have a valid sales tax business certificate. Taxpayers who owe delinquent income taxes to the state of illinois have four standard options available to reach a reasonable resolution.

Illinois Income Tax Rate And Brackets 2019

Republican candidates for governor say they can right the ship.

Owe state taxes illinois. You must pay tax to illinois on any income you earn there if you work there and live in any other state except wisconsin, iowa, kentucky, or michigan. The state of illinois tax laws are not representative of other states’ statutes. But tax years 2018 and 2019 were different.

Filing returns and paying taxes on time will save you from the headache of having to pay interest, penalties, and fees that stem from being delinquent on your taxes. I owe illinois money, how do i pay the state? When combining state and local public retiree obligations, government finance watchdog wirepoints shows the total unfunded.

General illinois tax information 800 877 8078. Filing $190,000.00 of earnings will result in $ of your earnings being taxed as state tax (calculation based on 2021 illinois state tax tables). The estate tax rate for illinois is graduated and the top rate is 16%.

You can avoid state back taxes by filing and paying any taxes you owe by the dates specified by your state revenue service. In addition to some of the same options the irs has, states can revoke, suspend, or not renew specific licenses granted to taxpayers who owe state taxes. You can learn more about how the illinois income tax compares to other states' income taxes by visiting our map of income taxes by state.

Remember that in illinois, you pay taxes on the entire estate if it is above the $4 million threshold. Previously, the tax rate was raised from 3% to 5% in early 2011 as part of a statewide plan to reduce deficits. I owe illinois money, how do i pay the state?

The income tax rate in illinois is 4.95%, after an increase from 3.75% in 2017. The state of illinois has a flat income tax, which means that everyone, regardless of income, is taxed at the same rate. Owe more than $5,000 and you will be required to submit financial information.

You owe illinois use tax if you purchase an item. Why do i owe state taxes. Owe less than $5,000 and you may or may not be required to submit.

Usually, if you got a refund the previous year, you should be able to have another one this year as long as you have the same situation. This results in roughly $ of your earnings being taxed in total, although depending on your situation there may be some other smaller taxes added on. If you expect to owe $500 or more on april 15th, you must pay your income.

The illinois income tax was lowered from 5% to 3.75% in 2015. On which sales tax would normally be collected if you bought it from a retailer in illinois. States can assess penalties and take enforcement collection actions against taxpayers who have not filed a required tax return or paid state taxes owed.

Like most tax questions, the answer is, it depends. Federal and state tax laws and regulations are not the same. Most states want to be paid by check or money order or by credit/debit card on the state's tax web site.

State income tax can also be individual or corporate. May 31, 2019 5:37 pm. The state of illinois generally allows up to 24 months to pay your back taxes in equal monthly payments, but they prefer 12 months.

This process is expected to take several months. We may request a hearing to revoke your sales tax business certificate if you owe the illinois state government past due sales tax or have not filed your sales tax returns. Did you pay your state tax due when you filed the return?

I owe illinois money, how do i pay the state? If you did not pay the state tax due, and have bank/credit card records to prove it, then you still owe. Find your taxable estate bracket in the chart below.

Do i owe illinois use tax? It is impossible to pay a state tax due from a federal refund, so hope you did not expect that. It is possible to owe illinois taxes and get a refund from your federal return in the same year.

Questions answered every 9 seconds. Questions answered every 9 seconds. May 31, 2019 5:37 pm.

The second column, base taxes paid, shows what you owe on money that falls below your bracket. The best way to avoid back taxes is to stay current on your taxes. Generally speaking, compensation received because of a judgment or settlement in illinois is not taxable as gross income.

Taxes you owe income tax illinois state illinois. $5,000 is typically the cutoff for submitting financial information. Ad a tax advisor will answer you now!

Ad a tax advisor will answer you now! Below are a few negative consequences of unfiled and unpaid state taxes. That makes it relatively easy to predict the income tax you will have to pay.

The state's personal income tax rate is 4.95% as of the 2020 tax year. You might owe state taxes because you have a different personal tax situation.

Freelance Financial Consulting Services For Hire Online Fiverr Tax Help Irs Taxes Tax Debt

Irs Has More Than 11 Billion In Unclaimed Tax Refunds Tax Refund Irs Tax

Authorculture Tax Deductions For Authors--updated Tax Services Tax Help Tax Deductions

Incometax2020 Itr Income Tax Tax Refund Income Tax Return

Instructions For Tax Deductions Cars For Madd Tax Attorney Tax Lawyer Tax Deductions

A Working Relationship With Fincen Is Also Imperative Luckily A Lawyer And Specifically A Tax Attorney Illinois C Tax Attorney Irs Taxes Debt Relief Programs

Pin On Real Estate Is My Passion

Millions Of Tax Dollars Improperly Refunded To Unauthorized Workers As Irs Insists Its Getting Better It Gets Better Irs Worker

Free Trust God With Taxes Ecard - Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

Piecing Together Factors Affecting Your Credit Score Credit Card Infographic Credit Card Credit Score

Illinois Corrections Owes Chester 12 Million In Utilities Illinois Department Of Corrections Chester

Authorculture Tax Deductions For Authors--updated Tax Services Tax Help Tax Deductions

Pin On Irs Tax Resolution

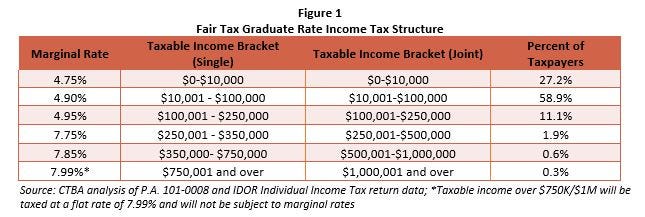

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

1893 Garnishee For Taxes Receipt For Fleming County Kentucky James Campbell And Elija Skeens Vintage Collecta James Campbell Little Blonde Girl Fifty Cent

Johnson City Tn Irs Cnc Ssgarnishments Wwwmmfinancialorg Irs Taxes Tax Debt Debt Help

Illinois Farms And The Fair Tax How Will The Farming Industry Be Impacted By Ctba Ctbas Budget Blog

Best 10 Custom Writing Websites Hire A Professional Paper Writer Online And Writing A Term Paper For A Demand Writing A Term Paper Bills Bill Of Sale Template

10 Euros Offert En Bitcoin Sur Coinbase