How Are Rsus Taxed In Canada

I believe this is the correct form. • income tax and cpp must be withheld at source and remitted to the cra.

Rsa Vs Rsu All You Need To Know Eqvista

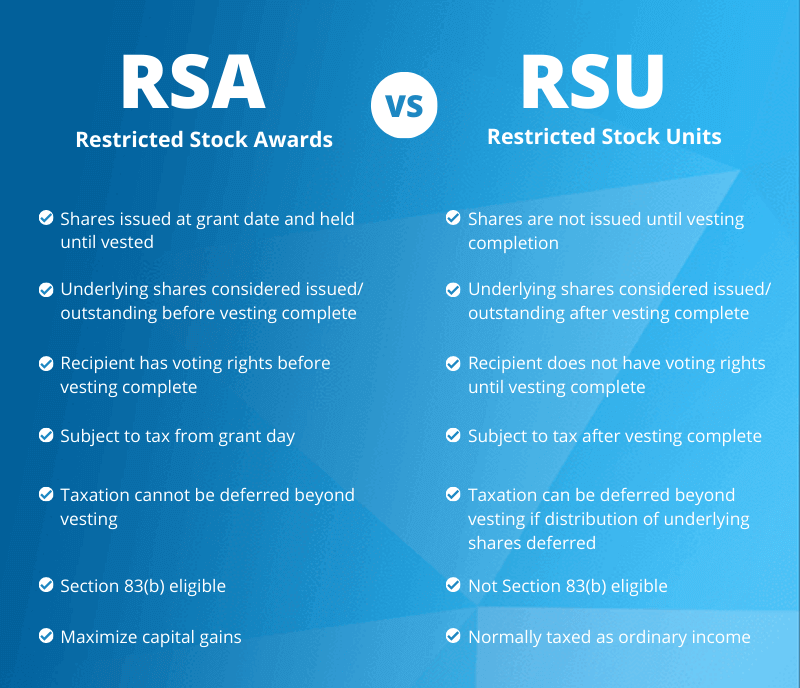

When the rsu’s vest (when you’re able to sell them), you’ll receive a taxable benefit equal to the value of the shares received or cash received.

How are rsus taxed in canada. These are connected to an etrade account that the company arranged for me. The cra believes it is “important and necessary” to determine where the employment giving rise to the rsu benefits was exercised, and that canada may give up its rights to taxation under domestic law (under an applicable income tax treaty) if it is determined the benefit does not relate to canadian employment or that certain thresholds are met. If the share sale results in a capital loss, 50% of that capital loss can be deducted from taxable capital gains in that year, subject to the detailed rules set out in the income tax act (canada).

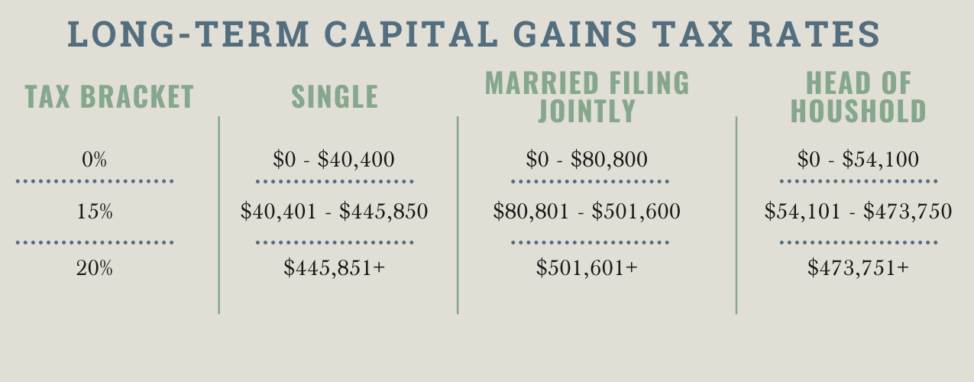

A few years ago, the cra ruled that rsus could be converted into dsus without infringing the sda rules. Cra could alter the historic tax treatment of rsus in canada and could accelerate the tax point of these awards. 50% of any capital gains are included in the employee's income and taxed at his applicable marginal rate.

This is different from incentive stock options , which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. The tax treatment of equity based compensation can vary widely depending on the treatment in canada, the u.s. • when canadian employees exercise options, stock option benefit must be computed by the employer.

To avoid immediate taxation, these types of awards must be designed to. Rsu’s are effectively deferred employee bonuses. Ordinary tax on current share value.

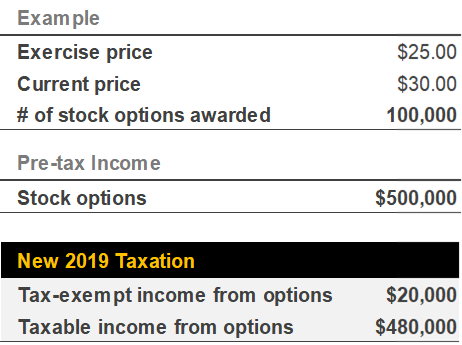

On november 30, 2020, in its fall economic statement, the federal government announced that it will move ahead with new rules for the taxation of employee stock options, which will be effective for stock options granted after june 30, 2021. This amount should be reported on your t4 from your employer. Instead of paying something like 28% amt, you will have nearly 54% taxes.

If you sell your rsus on vest date. What you do when they vest will determine.if capital gains comes into play. The day your rsus vest you will be taxed on them as regular income.

To avoid immediate taxation, these types of awards must be designed to. Or whether the employee is subject to the tax rules of both countries (such as a u.s. Rsus are taxed at the ordinary income rate and tax liability is triggered once they vest.

Restricted stock and rsus are taxed upon delivery and subject to progressive income tax up to 56 percent. Rsus generate taxes at a couple of different milestones: If you hold on to the stock for a day or more after vest.

If they all vest while you are in canada you will be bummed. Because there is no actual stock issued at grant, no section 83(b) election is permitted. Canadian tax & legal alert cra issues new views on rsu taxation in canada april 21, 2021 contacts:

Income taxation of qualified stock options (a)what is a qualified stock option? I work in canada for a company that trades in the us. The taxation of rsus is a bit simpler than for standard restricted stock plans.

One of the benefits i get from my job is that i get restricted stock units (rsus) once a year. Citizen in canada, or a resident of canada working in the u.s.) 1.02 u.s. If you are awarded rsus, each unit represents one share of stock that you will be given when the units vest.

If you have a large number of stocks, moving to canada may burn you financially. However, in canada, the taxation of rsus is not as favourable as the taxation of stock options for employees since the income from rsus is treated as employment income at the date the unit vests whereas the proceeds from stock options are taxed as capital gains when the option is exercised. As a result, both rsus and stock options continue to.

For employees that have been granted rsus that can either be settled in cash or shares, or a combination of both, this change in position How are restricted stock taxed? Here’s the tax summary for rsus:

The gain from the sale of shares is subject to tax as capital income at 30 percent up to eur30,000 and 34 percent for the exceeding part. You just pay full income tax on the value at vest. Nearly all will treated like income on vesting, and there will be no long term exception or amt carry forward for future.

Employee share purchase (esp) plan Once when you take ownership of the shares (usually when they vest) and again (in. This would apply to local canadian employees as well as any internationally mobile employees who are currently in canada or have been in the past.

The Blunt Bean Counter Punitive Income Tax Provisions

Taxation Of Stock Options For Employees In Canada - Madan Ca

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation - Flow Financial Planning

Ca Hybrid Methodology For Sourcing Certain Rsus - Kpmg Global

Rsus Can Set You Up For Long-term Financial Success

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Taxation Of Stock Options For Employees In Canada - Madan Ca

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu And Taxes Restricted Stock Tax Implications

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsus - A Tech Employees Guide To Restricted Stock Units

Taxation Of Stock Options For Employees In Canada - Madan Ca

.jpg?width=920&name=GTN_Canada%20(1).jpg)

New Canada Revenue Agency Position On Restricted Stock Units

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen