Child Tax Credit Portal Not Working

You can no longer renew your tax credits online for the 2020 to 2021 tax year. If you don’t, you won’t be able to get a tax refund this year.

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

We’ll make the first advance payment on july 15, 2021.

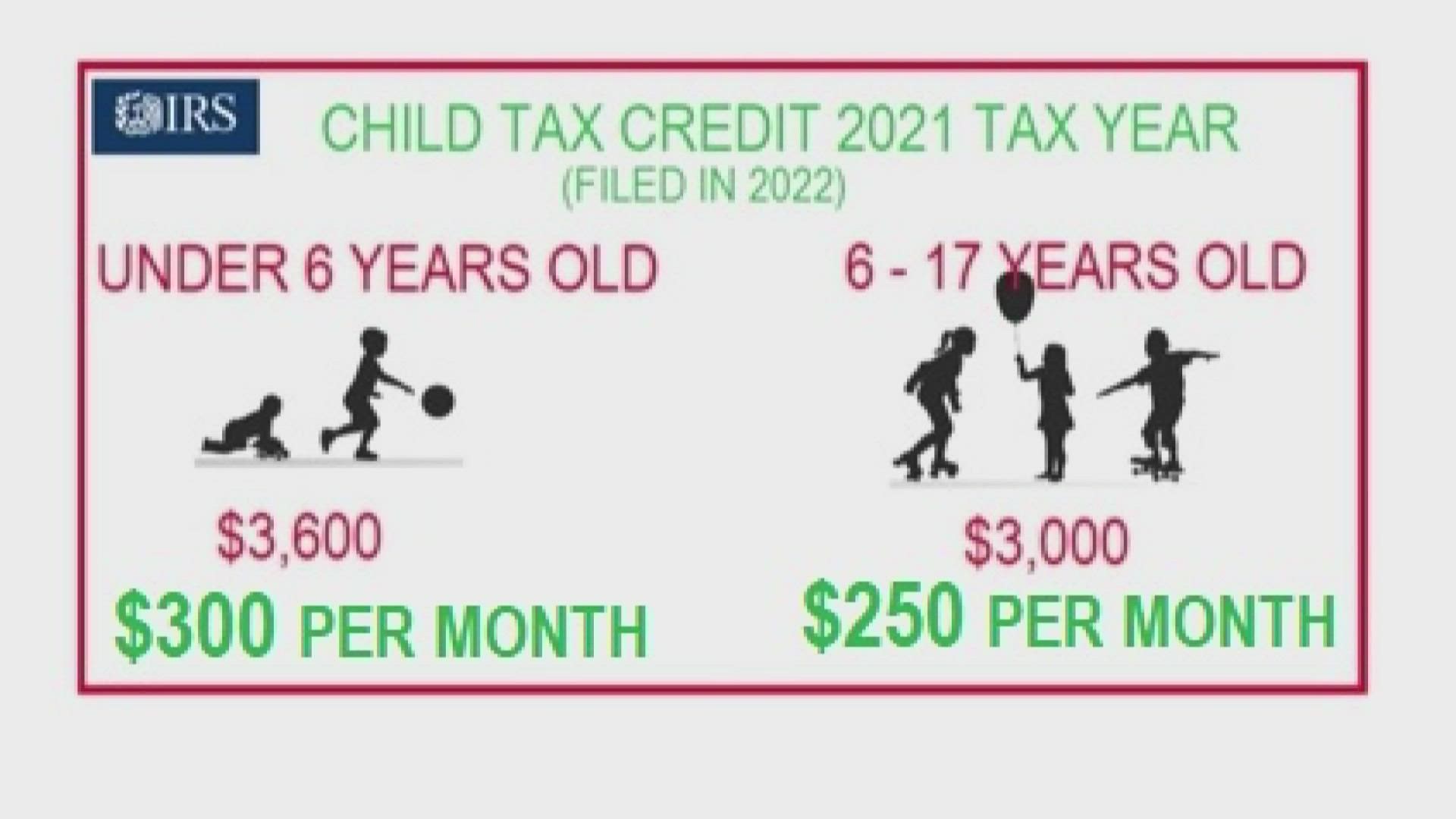

Child tax credit portal not working. Up to $3,600 ($300 monthly) per qualifying dependent child under 6. If the irs has invalid bank. For 2021, the maximum child tax credit is $3,600 per child age five or younger and $3,000 per child between the ages of six and 17.

You will claim the other half when you file your 2021 income tax return. Parents take to twitter (again) about shortages in october’s child tax credit payment. Eastern time on november 29, 2021.

Firstly, do not use this tool if you: My child tax credit monthly refund says that my eligibility is pending. The child tax credit portal — which will also allow you to opt out of the periodic payments and take the money as a lump sum next year — is supposed to be available by july 1.

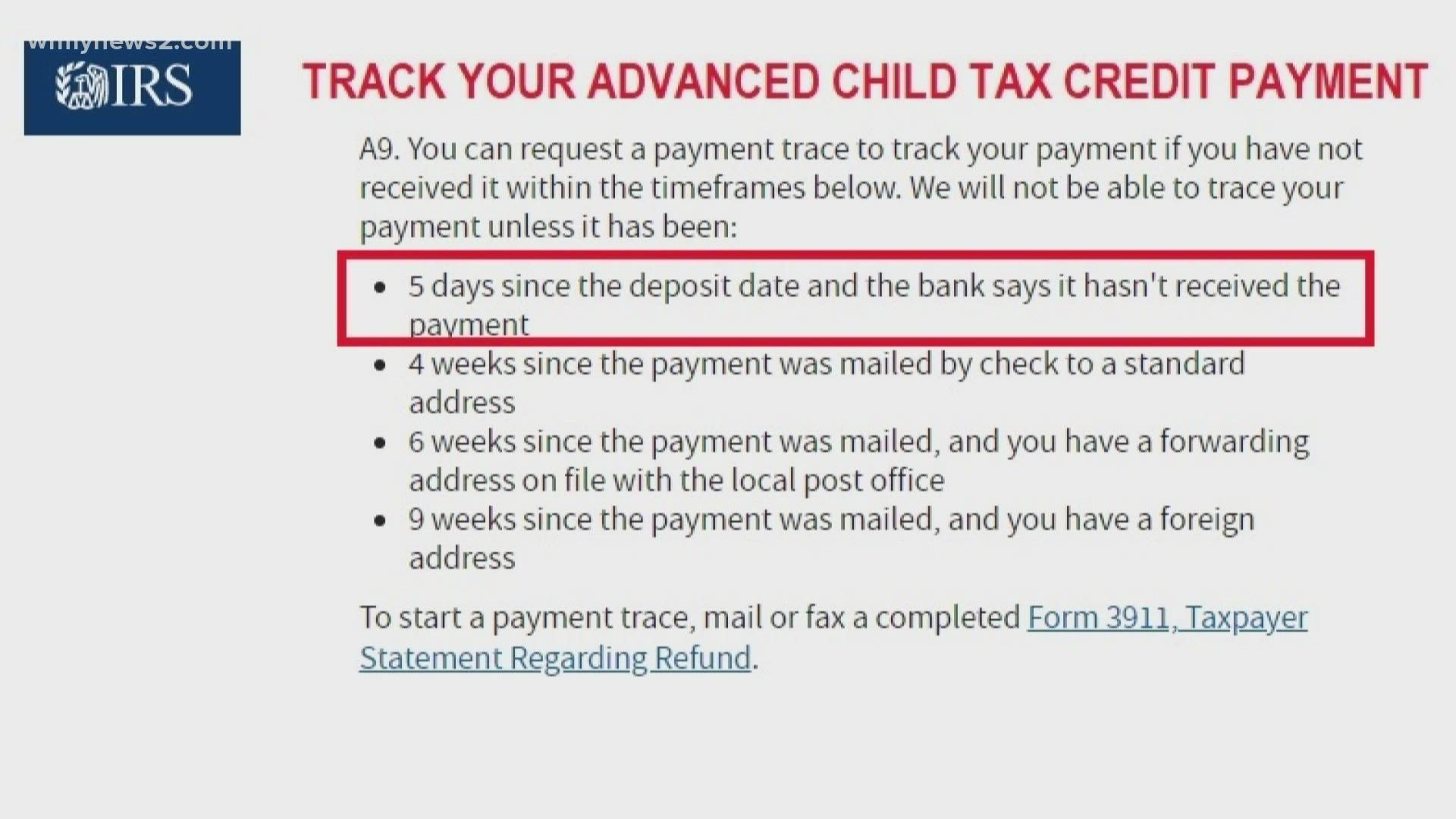

Using the child tax credit update portal, you can view your payment history and add your direct deposit information if the irs doesn't have it from a recent tax return. The amount you can get depends on how many children you’ve got and whether you’re: If your banking information is listed on the child tax credit update portal, we recommend choosing the direct deposit box.

According to the irs, you can use the child tax credit update portal to see your processed monthly payment history. Who should not use the new child tax credit portal tool. Still waiting on ctc.portal still saying pending.

If all else fails, you can plan to claim the child tax credit when you file your 2021 taxes next year. The third child tax credit check is here. The irs will pay half the total credit amount in advance monthly payments.

The irs has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit (ctc). Making a new claim for child tax credit. There are a number of changes to the ctc in 2021 because of the american rescue plan act of 2021, which president biden signed into law on march 11, 2021.

For this year only, the child tax credit has increased from $2,000 per child to $3,000 per child. The child tax credit (ctc) is also limited to your tax liability. Important changes to the child tax credit are helping many families get advance payments of the credit:

If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit, there can be a couple of things wrong. Contact hmrc by phone or post if: Another reason could be that the irs is missing information it needs to process your child tax credit.

Child tax credit will not affect. The new “child tax credit update portal” allows parents to view their eligibility, view their expected ctc advance payments, and, if they wish to do so, unenroll from receiving advance payments (i.e., to opt out). If all else fails, you can plan to claim the child tax credit when you file your 2021 taxes.

In this situation, it’s worth filing taxes as the refund will result in thousands of dollars for just a few hours of work. You'll need to mail the form where you would usually send a paper tax. In order to sign in to any of the portals, you will need to first verify your identity through id.me.

The problem is that if you want to claim a refundable tax credit, you will need to fill out form 1040 and certain other tax forms. Filed or plan to file a 2020 tax return; In addition to missing out on monthly child tax credit payments in 2021, a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed.

Already claiming child tax credit. What i’m about to say may offend some ppl. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021.

But, if you have more than $2500 of earned income, some or all of it is usually given back to you thru the additional child tax credit. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. It could set back biden's agenda.

Increased to $3,600 from $1,400 thanks to the american rescue plan ($3,600 for their child under age 6). Up to $3,000 ($250 monthly) per qualifying dependent child 17 or younger on dec. In 2021, the child tax credit offers:

The irs won't send you any monthly payments until it can confirm your status. Use the child tax credit update portal to set up direct deposit if you need to add or update your banking details with the irs, you can do so. But i hate hearing the excuse that most of us didn’t get ours because “there is a government shutdown coming” or.

Parents of children under age 6 would be. If the child tax credit update portal returns a pending eligibility status, it means the irs is still trying to determine whether you qualify.

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Scam Alert Child Tax Credit Is Automatic No Need To Apply - Oregonlivecom

The Child Tax Credit Toolkit The White House

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tvcom

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Where Is My September Child Tax Credit 13newsnowcom

Late Child Tax Credit Payments From Irs Arriving Now - Fingerlakes1com

Childctc - The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Child Tax Credit Income Tool How To Report Income Adjustments Marca

Child Tax Credit Update November 15 Sign-up Deadline Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out - Cbs News

Politifact Advance Child Tax Credit Payments Wont Usually Require Repayment