What Is The Inheritance Tax Rate In Virginia

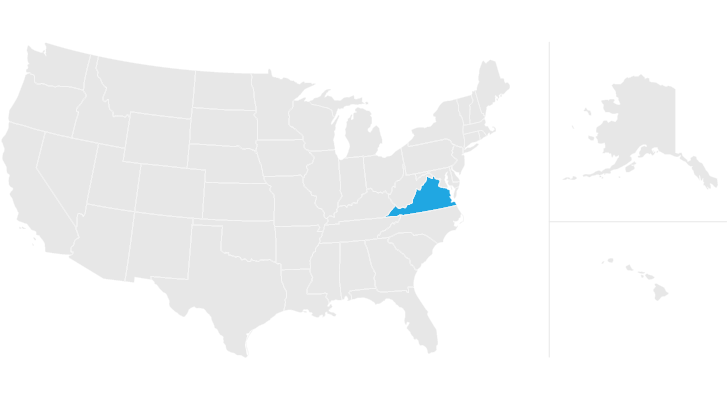

Virginia does not have an inheritance tax. If you inherit property of any kind from a decedent who was a resident of another state, you might receive an inheritance tax bill from the state where the decedent lived.

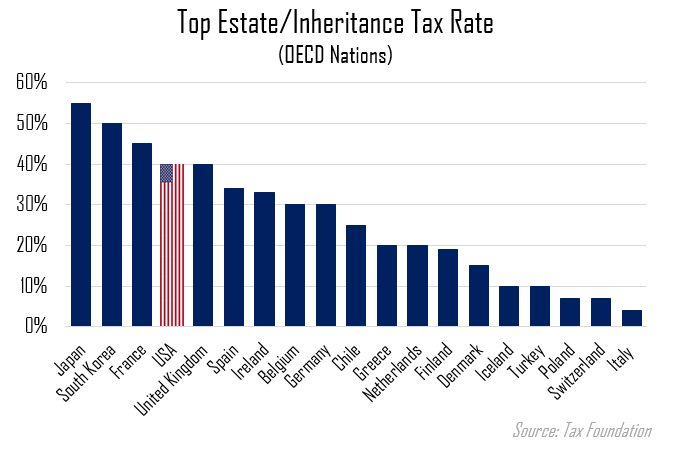

Should The Estate Tax Be Increased Or Abolished Seeking Alpha

The top estate tax rate is 16 percent (exemption threshold:

What is the inheritance tax rate in virginia. If you were born on january 1,. Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question. The median property tax in virginia is $1,862.00 per year for a home worth the median value of $252,600.00.

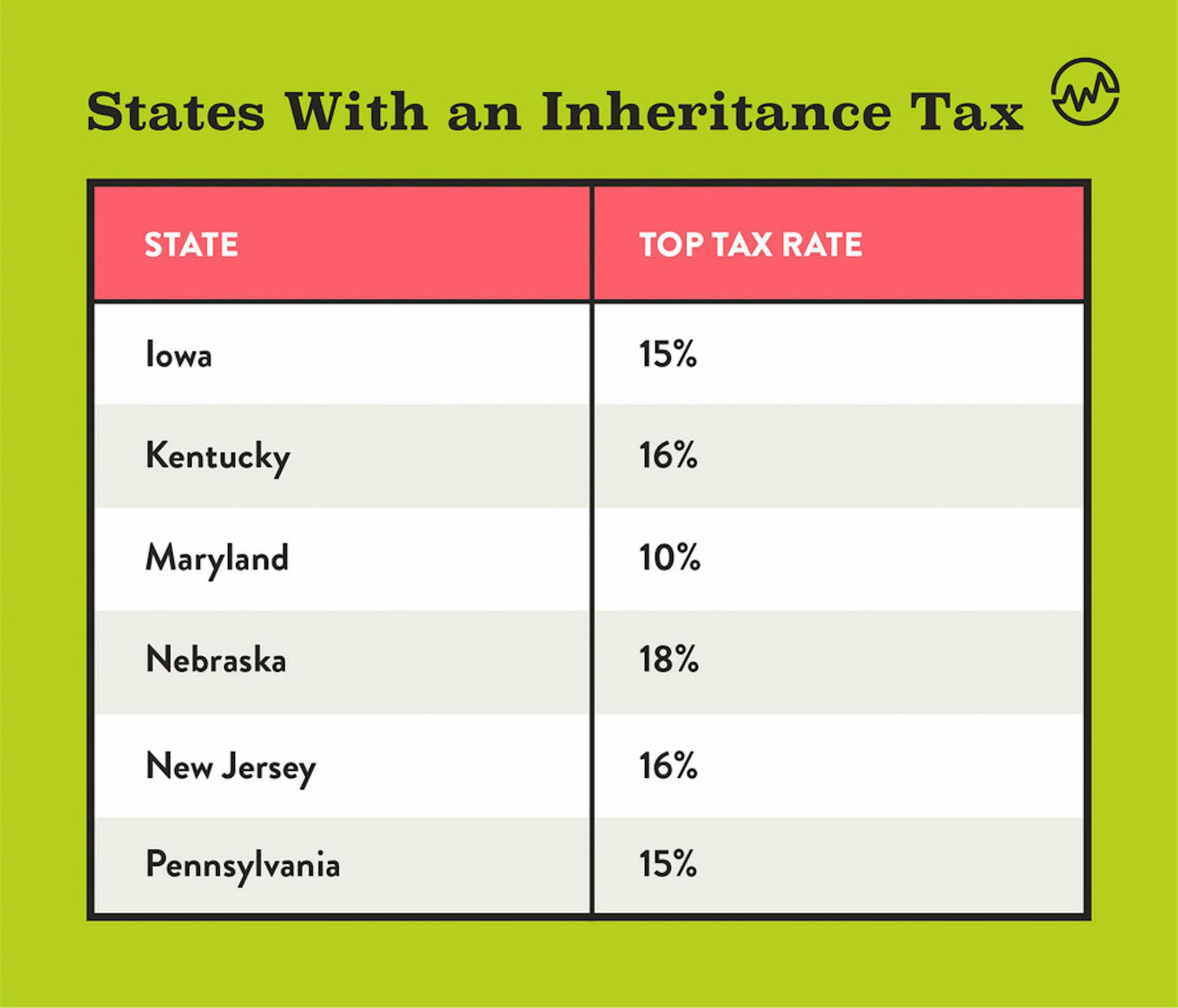

However, as the exemption increases, the minimum tax rate also increases. The fiscal year (july 1st to june 30th) real estate tax is billed in two parts by the office of the city treasurer. Pennsylvania has an inheritance tax ranging from 4.5% to 15%.

The top estate tax rate is 20 percent (exemption threshold: With the elimination of the federal credit, the virginia estate tax was effectively repealed. Most purchases in virginia are subject to this 5.3% sales tax while some localities in northern virginia and hampton roads charge 6% due to the 0.7% additional tax imposed in those areas.

Unlike the federal income tax, virginia's state income tax does not provide couples filing jointly with expanded income tax brackets. For example, indiana once had an inheritance tax, but it was removed from state law in 2013. Virginia estate and inheritance taxes prior to january 1, 1980, virginia imposed an inheritance tax on property that beneficiaries received from decedents.

The federal gift tax kicks in for gifts of $14,000 for 2017 and $15,000 for 2018. 1% tax on the clear value of property passing to a child or other lineal descendant, spouse, parent or grandparent. Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to virginia income tax:

No estate tax or inheritance tax No estate tax or inheritance tax. Some food items are subject to sales tax but at a reduced base rate.

No estate tax or inheritance tax. Today, virginia no longer has an estate tax* or inheritance tax. It is still a good idea to consult a probate attorney to minimize federal taxes.

Tax rates for decedents who died before july 1, 1999: Form 92a200, 92a202, or 92a205: However, certain remainder interests are still subject to the inheritance tax.

A tax is hereby imposed upon every generation skipping transfer, where the original transferor is a resident of the commonwealth of virginia at the date of original transfer, in an amount equal to the amount allowable as credit for state legacy taxes under § 2604 of the internal revenue code, to the extent such credit exceeds the aggregate amount of all taxes on the same transfer actually paid. Another state’s inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. As with all other tax brackets the government only taxes the amount which exceeds this minimum threshold, meaning that if your estate is worth $11,700,001, the government will levy taxes on $1.

**the rate threshold is the point at which the marginal estate tax rate kicks in. No estate tax or inheritance tax washington: Virginia's maximum marginal income tax rate is the 1st highest in the united states, ranking directly below virginia's %.

However, very few states impose an inheritance tax. Here’s a breakdown of each state’s inheritance tax rate ranges: Virginia collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets.

2021 tax rate tax form due date; Most often, this is a $1 state tax and $0.33 local tax for every $1,000 within the estate. Rates and tax laws can change from one year to the next.

The remainder passes tax free. Virginia currently does not levy an inheritance tax. Inheritance tax rates depend on the beneficiary's relationship to the decedent.

Although there is no wv inheritance tax, that does not mean that you might not be subject to an inheritance tax from another state. Last day of ninth month after death: Virginia inheritance and gift tax.

10% on property passing to siblings or other individuals. Connecticut’s estate tax will have a flat rate of 12 percent by 2023. In 2020, rates started at 10 percent, while the lowest rate in 2021 is 10.8 percent.

Prior to july 1, 2007, virginia had an estate tax that was equal to the federal credit for state death taxes. Virginia’s general sales and use tax rate is 4.3% with a 1% additional local sales tax. $2.193 million) washington dc (district of columbia):

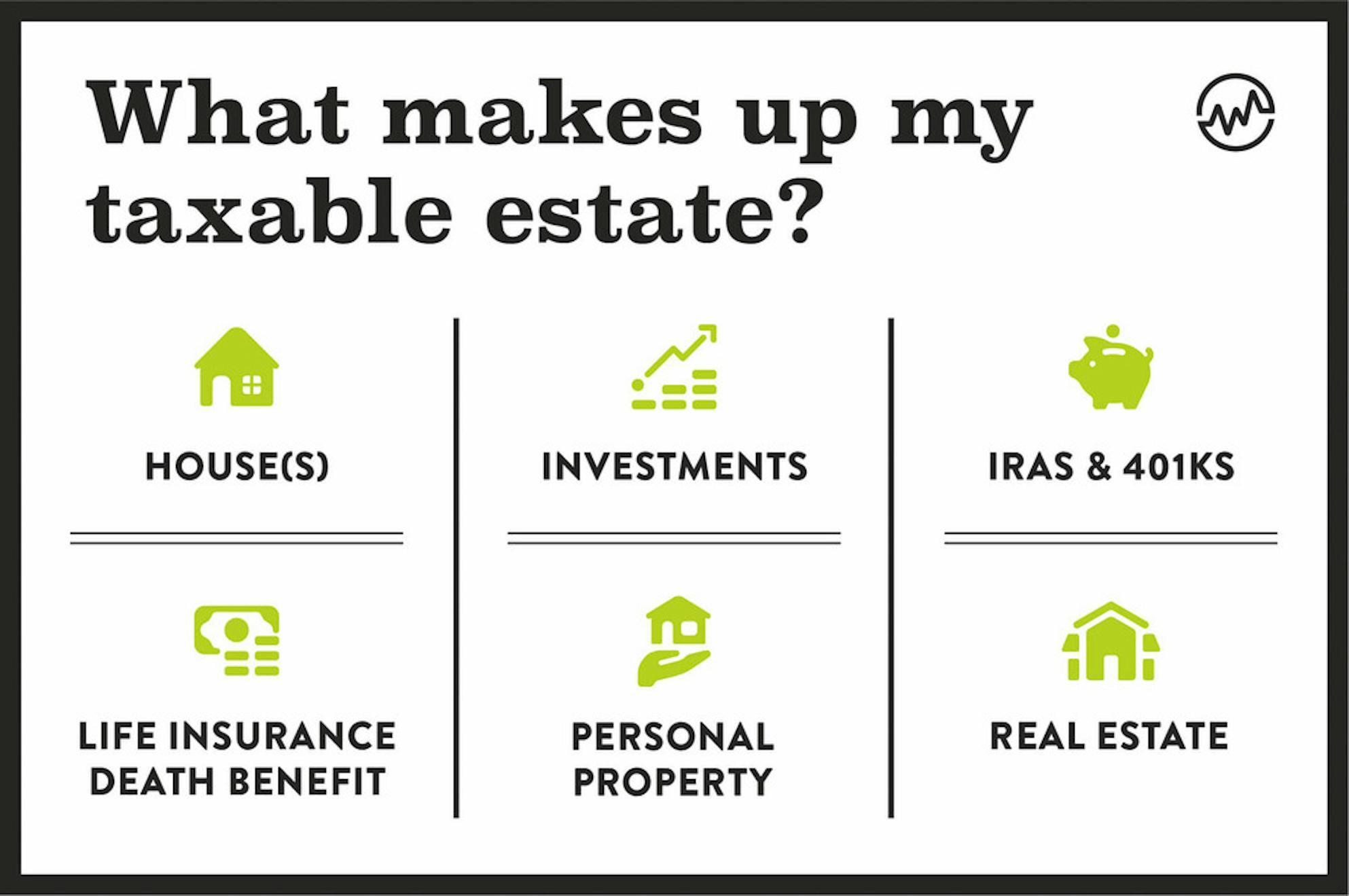

An inheritance or estate tax is a tax levied on the assets of an individual at the time of his death, with a higher tax rate typically charged on. There’s also no gift tax in virginia. No federal inheritance and estate taxes.

Only 11 states do have one in place. West virginia does not have an inheritance or an estate tax.

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Virginia Estate Tax Everything You Need To Know - Smartasset

Virginia Estate Tax Everything You Need To Know - Smartasset

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

States With An Inheritance Tax Recently Updated For 2020

Avail Arlington Va Tax Service At Most Competitive Prices In Virginia Tax Services Inheritance Tax Tax Deductions

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Estate Tax - Quora

States With An Inheritance Tax Recently Updated For 2020

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

The Death Tax Taxes On Death - American Legislative Exchange Council

Recent Changes To Estate Tax Law Whats New For 2019