Indiana Estate Tax Id Number

Pay personal property judgments online; Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business.

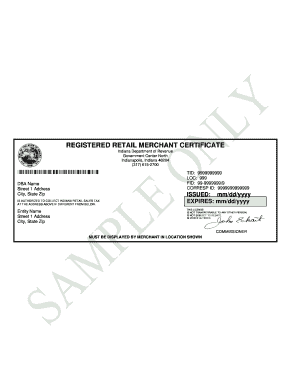

Indiana Resale Certificate - Fill Out And Sign Printable Pdf Template Signnow

Indiana sellers of touchable items need a sellers tax id number and a business tax registration id number.

Indiana estate tax id number. The state treasurer does not manage property tax. Tax bill 101, how to understand your bill; In the event that someone dies and leaves behind money, property, or other assets, the administrator, or executor of the estate, will need to obtain what is known as an employer identification number (ein), also called a federal tax id number.

No matter what the entity, whether it be an estate of a deceased individual, a trust tax id, or another, filing for an ein is needed. An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity. An ein, also known as an employer identification number or tax id number, is used to identify a business entity, trust, estate, and various other entity types.

Here’s how to get one: Generally, all indiana businesses need an ein. But ein’s are also used by corporations, partnerships and other business entities.

Listings and history records were updated. They let your small business pay state and federal taxes. It is assigned by the united states internal revenue service.

The decedent and their estate are separate taxable entities. A ein is usually required for licensing and permitting as well as opening a. The property tax id number also might be located on the deed to the house and on some of the closing documents you received when you bought your house.

Indiana sole proprietor / individual A state employer id number. You may need a federal tax id number and a state employer id number if you are an employer.

Getting an indiana tax id number, a trust tax id number, or any other entity, requires going through the irs. This is a unique, identifying number for your business, but is distinct from your federal tax id (also called an employer identification number, or ein). The state number is the indiana taxpayer identification number, or tin;

Carrico, martin county treasurer 129 main st / po box 359 shoals, in 47581 p: It's free and takes just a few minutes. Ein stands for employer identification number, which is another name for a federal tax id.

Indiana employer identification number (ein) is also known as a federal tax identification number in indiana, and is used to identify a business entity. A business tax registration id. You can get a printable version of this form from the irs’ website and then fill out all the required lines.

Citizen’s guide to property tax; Please contact your county treasurer's office. You may apply for it online via the state's website.

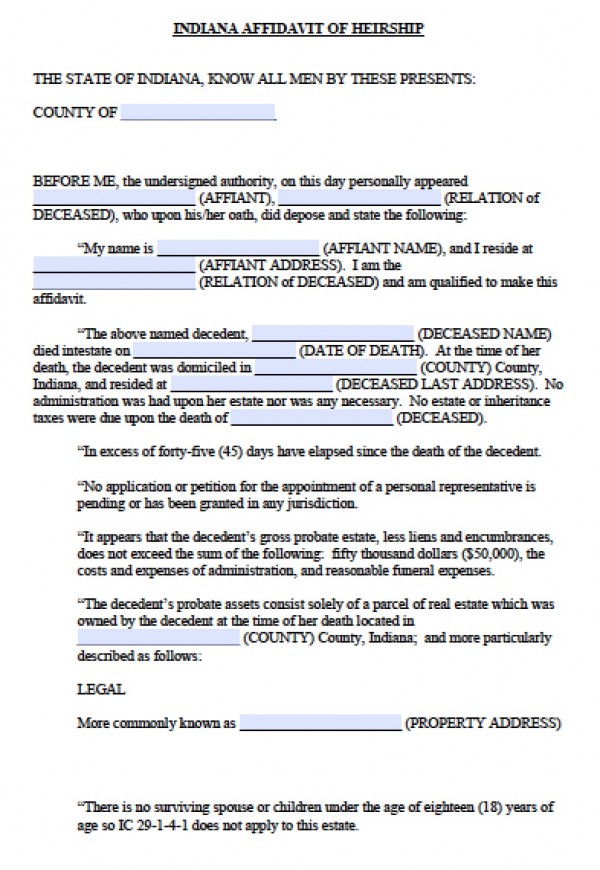

All businesses in general need a ein, according to the irs. A state sales tax id number. An estate (or decedent estate) or succession is a legal entity created as a result of a person's death.

Apply for tax id number online indiana apply for your indiana federal tax id number online right here. The internal revenue service (irs). Irs ein tax id number | estate of deceased individual application.

Before filing form 1041, you will need to obtain a tax id number for the estate. The information provided in these databases is public record and available through public information requests. An indiana taxpayer identification number is required for any business that operates in this state, including nonprofit organizations.

As you may already know, dealing with the irs can be frustrating. Cut through the red tape. The estate consists of the real estate and/or personal property of the deceased person.

A federal tax id number (ein) &. Federal ein numbers apply to many different groups. This legal identification, which is also called an employer identification number (ein), allows startups to open business bank accounts, apply for loans and other essential tasks.

As of last week, the last of the counties (hamilton, hendricks, marion, morgan and shelby counties) have been converted to use the state parcel number. There are 4 tax id numbers. Generally, businesses need an ein to operate.

Yes, estates are required to obtain a tax id: Where tax dollars are spent in indiana; Expect to receive your tax id number within six weeks.

Type of entity in indiana that need a tax id number: Since the information displayed appears exactly as it is. It is assigned by the indiana department of revenue.

The federal number is the employer identification number or ein; Is a tax id required for estates?

Kvachkoff Law Offices - Tax Sales

Dor Stages Of Collection

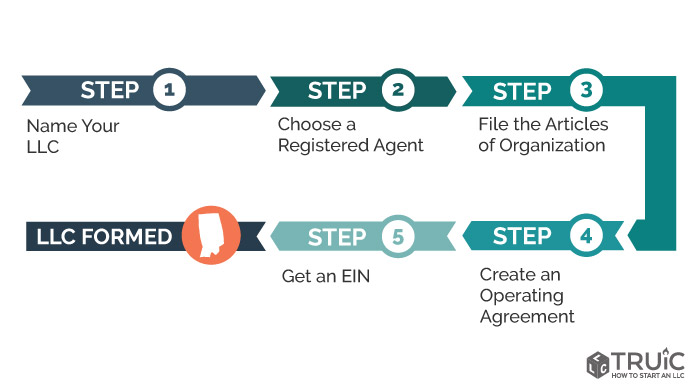

Llc Indiana - How To Start An Llc In Indiana Truic

2

Pay Property Taxes Online

2

The New Age In Indiana Property Tax Assessment

Indiana Veterans Benefits Military Benefits

Free Indiana Affidavit Of Heirship Form Pdf - Word

Indiana State Tax Information Support

The New Age In Indiana Property Tax Assessment

Llc Indiana - How To Start An Llc In Indiana Truic

The New Age In Indiana Property Tax Assessment

Judicial Branch - Indiana Government And State Documents - Research Guides At Indiana University

Wheres My State Refund Track Your Refund In Every State

2

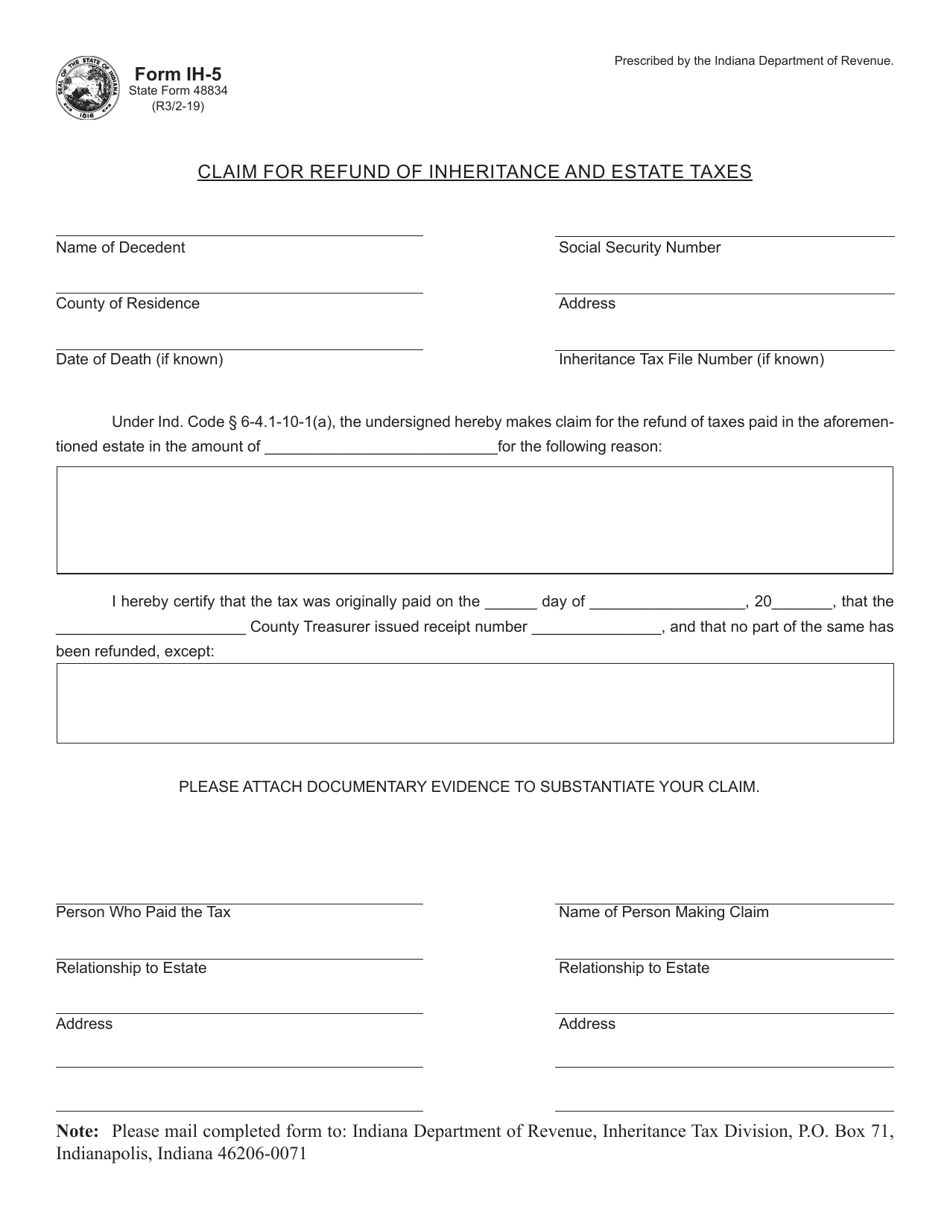

Form Ih-5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Tax Claim - Indiana County Pennsylvania

2