Michigan Sales Tax Exemption Number

This rab addresses exemption claims based on the status of the purchaser (e.g., exempt entities) and exemption claims based on the use of the acquired property or specified service (e.g., Their sales tax license number must be included in the blank provided on the exemption claim.

Michigan - Attwiki

Unavailable on friday, march 26th from 5:00.

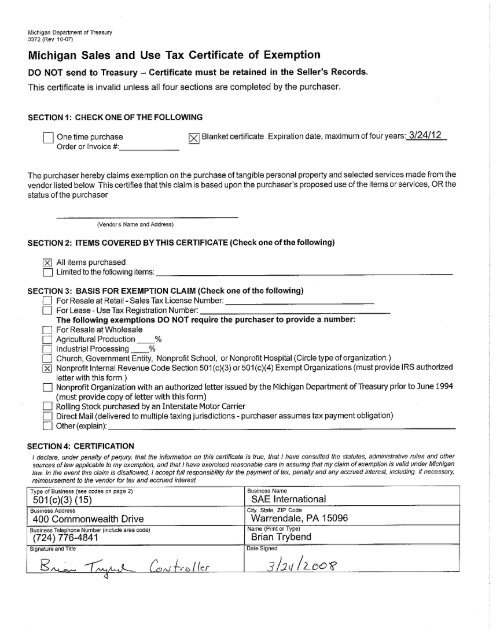

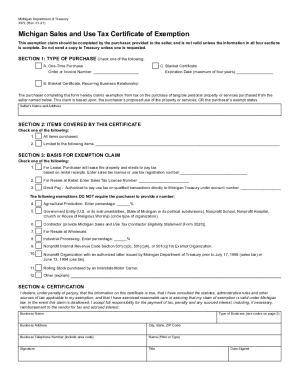

Michigan sales tax exemption number. This certificate is invalid unless all four sections are completed by the purchaser. The buyer must present the seller with a completed form at the time of purchase. You should never use your social security number for retail purchases.

Michigan sales and use tax contractor eligibility statement for qualified nonprofit hospitals, nonprofit housing, church sanctuaries, and pollution control facilities exemptions: Several examples of exemptions to the state's sales tax are vehicles which have been sold to a relative of the seller, certain types of equipment which is used in the agricultural business, or some types of industrial machinery. Penalty and interest waived for 33 days for certain sales, use, and withholding taxpayers with returns due january 20, 2021.

It is the purchaser's responsibility to ensure the eligibility of the exemption being claimed. Sellers are also responsible for examining the certificate and evaluating whether the goods sold are reasonably consistent with the purchaser’s line of business. // livonia, mi // 48150.

May use this form to claim exemption from michigan sales and use tax on qualified transactions. Sales tax exemptions in michigan. Tax exemption certificate for donated motor vehicle:

Sellers are required to maintain proper records of exempt sales, including exemption forms or the same information in another. Other documentation that sellers in the state of michigan may accept are the uniform sales and use tax certicate approved by the Obtain a michigan sales tax license.

Type of purchase i i a. Records may be kept electronically. Michigan does not issue “tax exempt numbers” and a seller may not rely on a number for substitution of an exemption certicate.

All claims are subject to audit. Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers. Once you have that, you are eligible to issue a resale certificate.

Michigan department of treasury lansing michigan 48922 local phone (sales tax department): Do not send to the department of treasury. Instead of providing an employer with a social security number, an individual can provide their michigan tax id number, indicating their professionalism and their ability to fulfill work requirements.

There is no such thing as a “sales tax exemption number” for agriculture; Certificate must be retained in the seller's records. Michigan does not issue “tax exempt numbers” and a seller is not permitted to rely on a number in lieu of a valid exemption claim.

The michigan department of treasury does not issue tax exempt numbers. How to use sales tax exemption certificates in michigan. When amazon stores your products in one of its fulfillment centers in any state, including michigan, this.

Sales tax return for special events: Fill out the michigan 3372 tax exemption certificate form. Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number.

There are certain tax exemptions for people who own farms and work in agricultural production, but to claim the exemption you. The undersigned promises to reimburse the seller for the amount of the tax involved or will pay said amount in tax direct to the state of michigan. It is the purchaser’s responsibility to ensure the.

Michigan department of treasury 3372 (rev. For resale at retail in section 3, basis for exemption claim. Farms are defined as “any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the census year.

This is relevant if you sell your products on amazon or are recognized as an amazon fba (fulfillment by amazon) seller. Anyone interested in receiving the benefits of a tax id number should seek advice from. Michigan sales and use tax certificate of exemption:

Tax exempt from director of contracting & purchasing services 08/09/17: 1 toll free phone (sales tax department): Signed sales and use tax form.pdf signed:

A michigan tax id number can make your business feel more professional. How do i obtain a tax exempt number to claim an exemption from sales or use tax? Form 3372, michigan sales and use tax certificate of exemption, is used to claim exemption from michigan sales and use tax.

3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Sales tax is set at 6 percent in the state of michigan for all taxable retail sales, with some concessions, however.

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

2

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

2

Michigan Sales Tax Exemption - Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form - Fill Online Printable Fillable Blank Pdffiller

Sales Tax License Michigan - Fill Online Printable Fillable Blank Pdffiller

2

2

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury - Utoledo Fax Email Print - Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption - Students - Sae

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

State Paperwork Examples

How To Register For A Sales Tax Permit In Michigan Taxvalet

Michigan Sales Tax - Small Business Guide Truic

Resalesales Tax License Agron Llc

Michigan Resale Certificate - Fill Out And Sign Printable Pdf Template Signnow

How To Get A Certificate Of Exemption In Michigan - Startingyourbusinesscom