Dekalb County Tax Assessor Pay Online

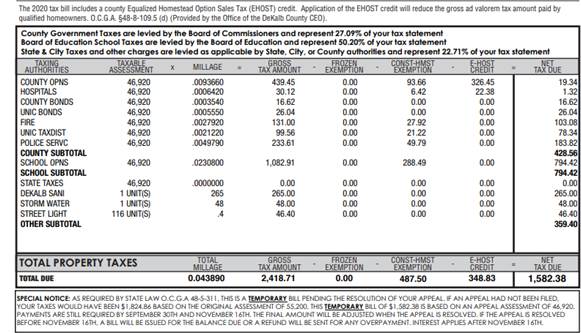

At this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead exemption, make address changes, view tax sale information, apply for. For more information about property tax bills, select tax bill information under property tax from the services menu.

Payments Dekalb Tax Commissioner

Another way to reduce your taxes is to ensure that the assessed value of your property is correct.

Dekalb county tax assessor pay online. You may search by entering in parcel number, (located in the upper right hand corner of tax bill), or search by last name. Instructions for using the online real estate tax payment link. The dekalb county office of assessments assumes no responsibility for errors or omissions.

If this page is not populated, contact your township assessor for the information. The tax payment methods page has information about how you can. Real estate = 12 123 12 123:

To continue, select pay now. The convenience of paying from your home, work, or anywhere that you have access to the internet. Personal property = 1234567 address:

The information regarding assessments, sketches, and square footage is for general information purposes only and is submitted to our office by the specific township assessors. This gives you the ability to pay your property taxes at your convenience, anytime day or night; Welcome to the dekalb county online tax payment portal.

Quickly search, submit, and confirm payment through the. For the best experience, it recommended that you use the latest versions of chrome, edge, or safari. For more information on dekalb county property information and tax payments, please visit one of these county departments:

The dekalb county trustee's office continually strives to find and offer new services to benefit our taxpayers. *** only one item needed for search *** parcel id: Homestead exemption is a savings allowed for those property owners who own and live at their primary residence.

Property taxes are collected for. Due to volume, payments received by mail during payment season could take up to a week or longer to post once received. Search for the property record and click the link underneath the “pay now” button.

Dekalb county residents can sign up to receive property tax statements by email. We believe another choice for paying. This takes you to wedge, the dekalb county online property tax inquiry and payment portal.

Welcome to dekalb county's most recent, improved, efficient, and convenient way to pay property taxes.online! Please contact the treasurer’s office if you have any questions. Address = 123 main (no st., dr., rd.,etc.)

Under the picture, click on the box with the red letters that says “pay my property taxes”.

Payments Dekalb Tax Commissioner

Dekalb Property Tax Final Installment Deadline Nov 15 Dekalb Tax Commissioner

Dekalb Ga Property Records - Mo5mlcom

Payments Dekalb Tax Commissioner

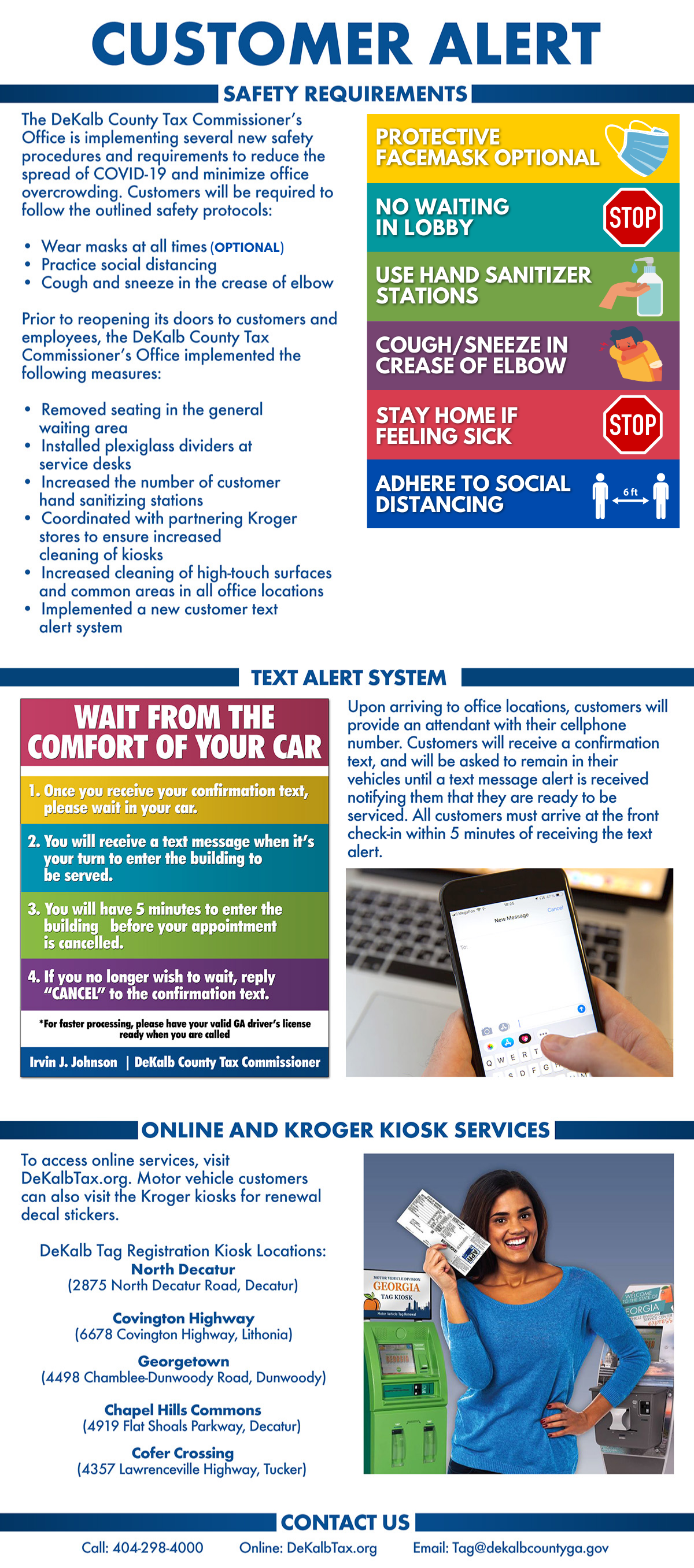

Covid-19 Customer Alert Dekalb Tax Commissioner

Dekalb County Tax Commissioner Announces Payment Options For 2020 Tax Bills - On Common Ground News - 247 Local News

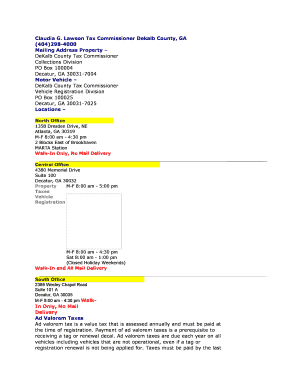

Dekalb County Tax Assessor - Fill Online Printable Fillable Blank Pdffiller

Payment Information Dekalb County Ga

Payments Dekalb Tax Commissioner

Online Payment Service By Vps

General Tax Bill Payment Information Dekalb Tax Commissioner

Payments Dekalb Tax Commissioner

Click2skip Dekalb Tax Commissioner

Dekalb County Tax Commissioners Office To Mail Annual Property Tax Bills In Mid-august - On Common Ground News - 247 Local News

Online Payments

Brookhavengagov

Ehost Dekalb County Ga

Payments Dekalb Tax Commissioner

Payments Dekalb Tax Commissioner