Steamboat Springs Colorado Sales Tax Rate

You can find more tax rates and allowances for steamboat springs and. Steamboat springs in colorado has a tax rate of 8.4% for 2022, this includes the colorado sales tax rate of 2.9% and local sales tax rates in steamboat springs totaling 5.5%.

Steamboat Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Represent about 8% of annual collections.

Steamboat springs colorado sales tax rate. What is the total sales tax rate i should charge in the city of steamboat springs? Click here for a larger sales tax map, or here for a sales tax table. Combined with the state sales tax, the highest sales tax rate in colorado is 11.2% in the city of.

The county sales tax rate is %. The us average is 7.3%. The sales tax rate is always 8.4% the sales tax rate is always 8.4% every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1%), the colorado cities rate (4.5%).

Collected by the colorado department of revenue: Still, city finance director kim weber said the costs of labor and supplies has required the city to make cuts in services. The colorado sales tax rate is currently %.

Colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to 8%.there are a total of 223 local tax jurisdictions across the state, collecting an average local tax of 3.374%. The state general sales tax rate of colorado is 2.9%. If steamboat springs city council members agree on the rate carr proposed, residents will pay 2% more each year, eventually reaching $106.25 per month, while businesses will eventually reach $290.47.

The minimum combined 2021 sales tax rate for steamboat springs, colorado is. Sales tax rates in routt county are determined by four different tax jurisdictions, routt county, yampa, steamboat springs and steamboat springs local marketing district. For the past 5 years, august collections.

This is the total of state, county and city sales tax rates. An alternative sales tax rate of 8.4% applies in the tax region steamboat springs , which appertains to. That’s what we tried to encourage,” carr said.

The steamboat springs sales tax rate is %. The steamboat springs, colorado, general sales tax rate is 2.9%. Chaser within the city limits.

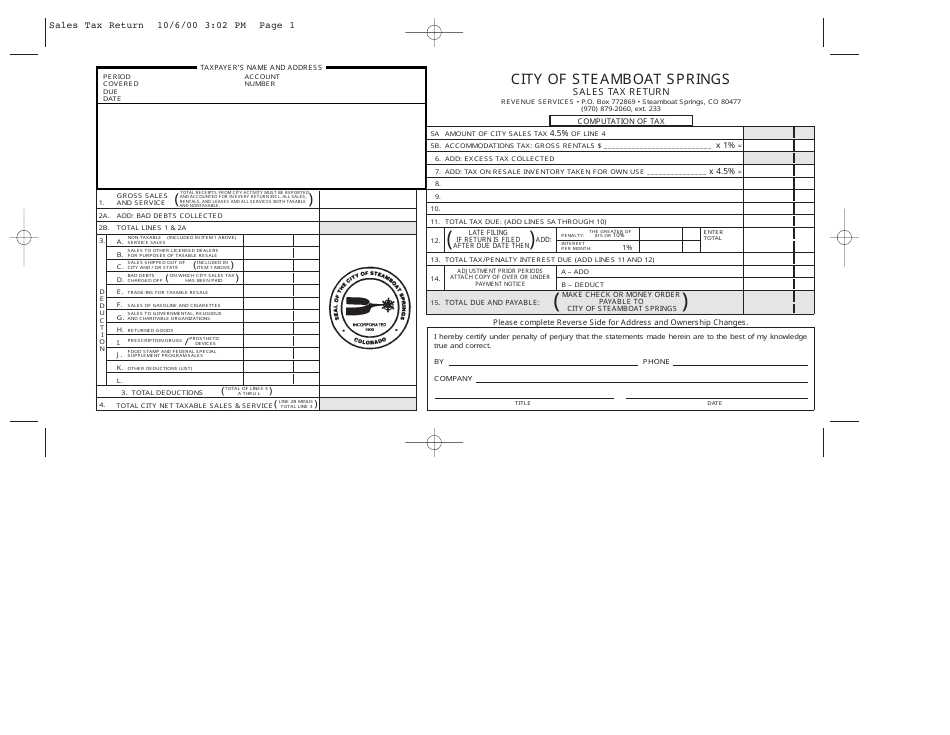

Routt county, colorado has a maximum sales tax rate of 8.4% and an approximate population of 16,637. As of 1/1/17 8.4% (4.5% city, 2.9% state and 1% county). Excise tax is levied at a rate of 1.2% of the construction value and is collected through the building permit process.

Please contact us for additional information regarding sales taxes on lodging. August 2020 collections or an increase of $383,910. Steamboat springs' sales tax is levied on tangible personal property and taxable services that are purchased, sold, leased or rented within the city of steamboat springs.

The steamboat springs, colorado sales tax rate of 8.4% applies in the zip code 80477. What is the sales tax rate in steamboat springs, colorado? Cities and/or municipalities of colorado are allowed to collect their own rate that can get up to 7% in city sales tax.

The august 2021 sales taxes for the city of steamboat springs are 16.66% higher compared to the. The us average is 7.3%. Steamboat springs’ excise tax on construction helps defray the costs of capital improvements and infrastructure.

State of colorado, el paso county, and pprta. The steamboat springs, colorado sales tax is 8.40%, consisting of 2.90% colorado state sales tax and 5.50% steamboat springs local sales taxes.the local sales tax consists of a 1.00% county sales tax and a 4.50% city sales tax. The city of steamboat springs is a home rule municipality with its own municipal code, collecting its own sales tax.

The current total local sales tax rate in steamboat springs, co is 8.400%. “this is to encourage conversation practices by setting the base rate and then having tiers of usage; Every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (0% to 6.5%), the colorado cities rate (0% to 7%), and in some case.

Who needs a sales tax license? Effective january 1, 2016 through december 31, 2020, the city of colorado springs sales and use tax rate is 3.12% for all transactions occurring during this date range.

Municipal Tax Steamboat Springs Co - Official Website

City Of Steamboat Sees Increase In September Sales Tax Steamboattodaycom

Steamboat City Sales Tax Collections Continue Rebound In April Steamboattodaycom

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Artfestivalcom

Steamboat Liquor Marijuana Stores See Sales Tax Collection Decrease In September Steamboattodaycom

Sales Tax Chart And Fees Routt County Co - Official Website

2

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinewscom

Timeshare Exchange Taxes Proposed In Steamboat Springs Co Voc

442 And 428 Pine St Steamboat Springs Co 80487 Realtorcom

Steamboat Sales Tax Rebounds In June After Soft May Thanks To Spike In Construction Home Improvement Steamboattodaycom

Sales Tax Chart And Fees Routt County Co - Official Website

Economy In Steamboat Springs Colorado

2

2

Municipal Tax Steamboat Springs Co - Official Website

City Of Steamboat Springs Colorado Sales Tax Return Form Download Printable Pdf Templateroller

2